By: Jordan Tussy, Hunter Hamilton and William Teague, CFA

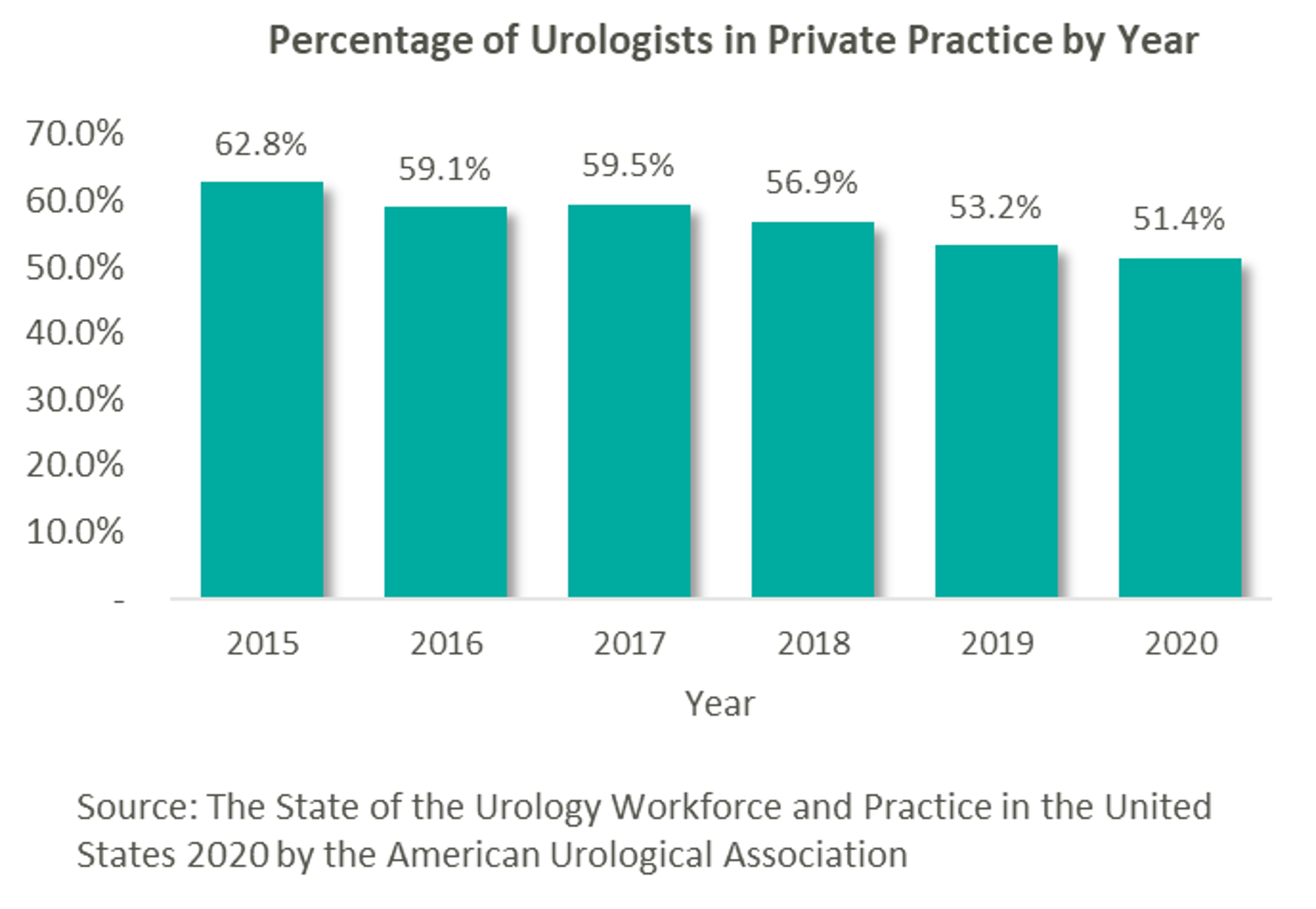

As many physician specialties begin to mature (e.g., gastroenterology, dermatology and ophthalmology), funds have started to flow into the urology space from private equity (“PE”) firms still eyeing platform acquisitions. “Competition for quality assets in this segment is still pretty light. There are a number of independent urology groups of scale with good management teams and back-office infrastructure,” stated Jeanne Proia of Cross Keys Capital in an interview with Mergermarket. [1] Growth prospects for urology practices are also particularly strong due to increases in life expectancy that have led to increases in demand for urologic services. Additionally, an expected shortage of urologists estimated to exceed 3,600 by 2025 will only further amplify the situation. [2] Urology’s several sources of ancillary revenue such as lab & pathology services, lithotripsy, radiation oncology, and ambulatory surgery make the specialty particularly attractive to platforms seeking to execute a roll-up strategy. With over 13,000 urology providers, 51.4% of whom work in private practice, this fragmented market offers PE firms the opportunity to facilitate consolidation. [3]

This prospect, paired with the strong demand for urologic services, has led to significant investment interest in the space, which can trace its roots back to August 2016 with Audax Private Equity’s partnership with Chesapeake Urology and the resulting formation of United Urology Group (“UUG”).

United Urology Group

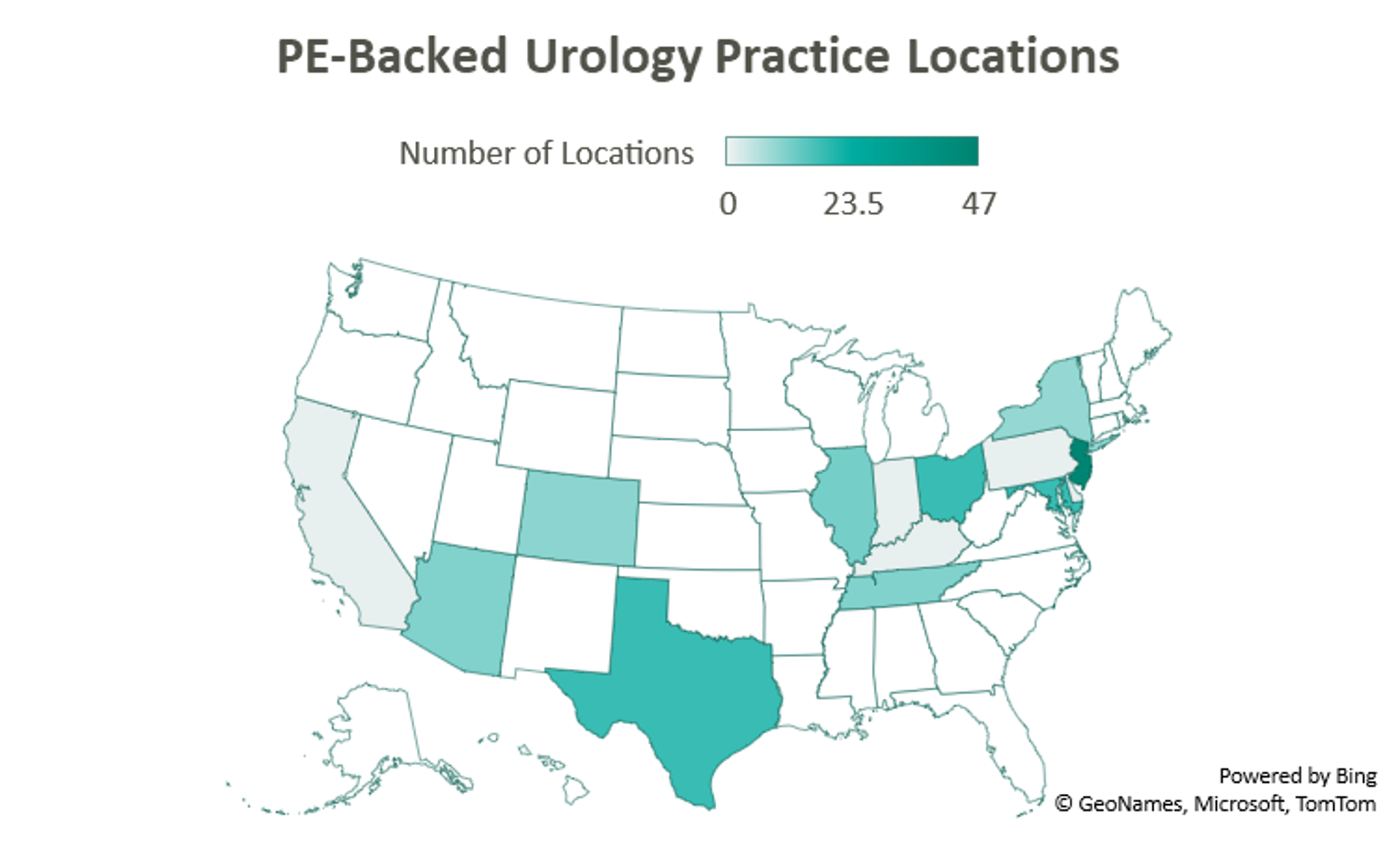

Since acquiring Maryland’s Chesapeake Urology, Audax Private Equity’s UUG has further expanded its footprint both locally in Maryland, as well as nationally. Most recently, UUG has entered Arizona markets through its partnership with Arizona Urology Specialists in late 2019 and additional affiliations with Arizona Institute of Urology and Urological Associates of Southern Arizona in January of this year. Through this most recent partnership, UUG now operates out of 25 offices in Delaware and Maryland, 11 facilities in Tennessee, 10 offices in Colorado, and 23 locations in Arizona. With these locations and over 220 physicians, UUG remains committed to providing accessible care. [4]

Urology Management Associates

Prospect Hill Growth Partners (formerly known as J.W. Childs Associates) partnered with New Jersey Urology (“NJU”), a practice comprised of 96 providers in 46 New Jersey locations, to form Urology Management Associates (“UMA”) in September 2018. [5] NJU, having previously merged with Delaware Valley Urology in April 2018, represented the largest group of urologists in the United States at the time. Since then, UMA has expanded through a partnership with Premier Urology Group in September 2019 and Urology Care Alliance in December 2019. This latest affiliation expanded the platform’s presence in New Jersey and established its stake in Pennsylvania. UMA currently has over 150 providers and operates out of 64 locations, including 6 cancer treatment centers. [6]

U.S. Urology Partners

A 2018 strategic investment by NMS Capital in Central Ohio Urology Group launched US Urology Partners as an employment alternative for practices wanting to maintain their independence. As of August 2019, the hope of the organization’s CEO Mark Cherney was to grow US Urology Partners’ roughly $50M in revenue 10x in the next 3-5 years. Cherney also indicated that urology may be the next physician specialty to see significant consolidation, stating that “while the other physician specialties such as dermatology, dental and ophthalmology have seen heavy M&A activity in recent years, urology has remained relatively untapped for sponsor investment.” [7] Cherney cites shrinking rates of reimbursement, growing administrative costs, a complex regulatory environment, and a lack of independence as deterrents to hospital employment, while a national platform partnership on the other hand can provide “greater management support and financial strength.” [8] The group most recently partnered with Associated Medical Professionals of New York, a nearly 30-physician practice operating out of 9 locations throughout the Central New York region. Ancillary services offered by the practice include radiation oncology, pathology, imaging, lithotripsy services, as well as clinical research. [9]

Solaris Health

Another big presence in the space is Lee Equity Partners, who in June 2020 acquired and merged Integrated Medical Professionals and The Urology Group to form Solaris Health. The goal of Solaris “is to build a national platform that attracts leading independent urological partners who are committed to providing quality and value in healthcare.” [10] The platform has since expanded from its origins in New York, Ohio, Kentucky, and Indiana into Pennsylvania through a partnership with MidLantic Urology and, most recently, into Illinois through an affiliation with Chicago’s Associated Urological Specialists in March of this year. With more than 262 providers, Solaris now operates out of more than 11 sites in six states. [11]

Urology America

With its formal acquisition of Texas-based Urology Austin in October 2020, Gauge Capital established Urology America, a fully integrated urology network providing comprehensive urologic care. The largest urology practice in the metro Austin area, Urology Austin brought 18 locations and over 50 providers to the platform. Also included in the transaction were Urology Austin’s clinical research department, patient navigation programs, pelvic floor physical therapy, the Austin Center for Radiation Oncology, as well as a nationally accredited in-house pharmacy and pathology laboratory. Urology America is currently seeking to partner with urology practices nationally recognized as innovators and leaders in the field. [12]

Urology Partners of America

New to the space is Triton Pacific Capital Partners. This May, the Los Angeles private equity firm partnered with Genesis Healthcare Partners (“GHP”), a Southern California urology group with 48 providers and 15 locations, to establish Urology Partners of America (“UPA”). At the time of the transaction, GHP represented the largest independent urology group on the West Coast. With a current focus on further expansion across the Western States, the platform has a long-term goal, according to UPA CEO, Marshal Salomon, of building “the business to 200+ physicians within the next few years.” [13]

Future of the Field

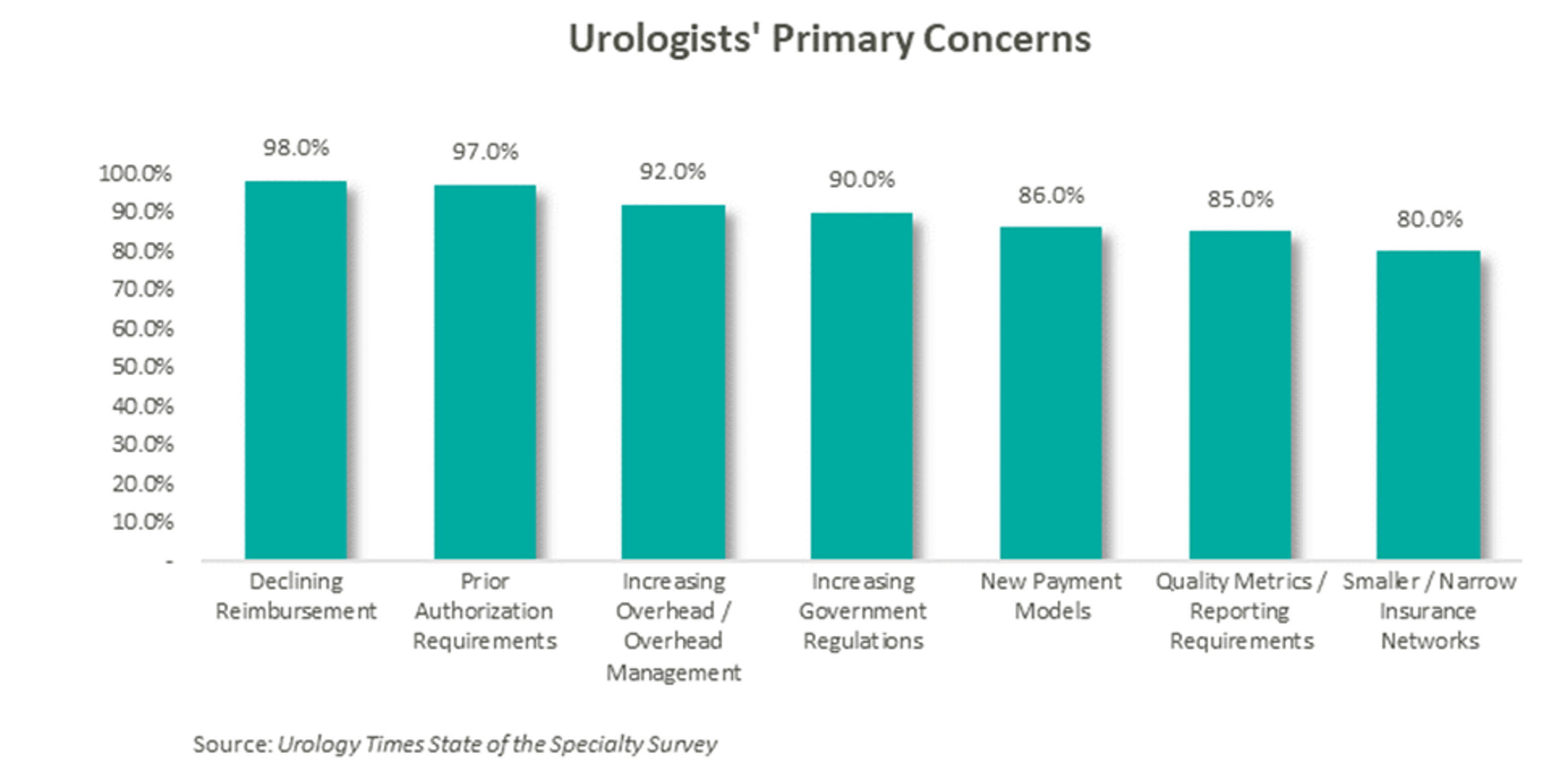

According to data compiled by Urology Times, over 90% of urologists surveyed are concerned about declining reimbursement trends, growing regulation, and increasing overhead costs. [14] Furthermore, a study published in the July 2021 Issue of The Journal of Urology revealed that the average rate of reimbursement per urologic procedure decreased by an average of 0.4% per year from 2000 to 2020 before adjusting for inflation. [15]

As a result of these pressures, independent physicians are seeking alternative employment structures to private practice. PE firms are an attractive option due to their ability to alleviate some of the administrative burden, strengthen payor negotiations though scale, provide access to additional capital and allow the providers to focus on their clinical services. With this model, physicians receive upfront compensation from the acquisition and may retain an equity position in the new entity. They often agree to a reduction in their historical compensation as a trade-off for the promise of future equity returns and current liquidity. The success of the model depends on the ability of the PE firm to provide both operational and financial value to the practice and deliver on earnings repair. Otherwise, shareholder physicians may not continue to perform at historical levels, and non-shareholder physicians may begin to reconsider private practice.

Since the formation of United Urology Group, there has been a trend of PE-backed urology practice consolidation over the past 5 years. Given that most urology visits are with patients over the age of 65 and that nearly 20% of the population is expected to be 65 or older by 2030, demand for urologic services is only expected to increase. [16] With increasing demand, fragmentation, and a complex regulatory environment, continued consolidation should be expected in the urology space. The ability to deliver on earnings recapture through the successful implementation of economies of scale will ultimately determine the outcome of these platforms, as the value of the model hinges on the loyalty of the urologists.

Sources:

[1] https://us-uro.com/wp-content/uploads/2019/09/mergermarket-urology-private-equity.pdf

[2] https://solarishealthpartners.com/wp-content/uploads/2021/04/Private_Equity_and_Urology_-Urol_Clin_N_Am_48_2021_233%E2%80%93244.pdf

[3] https://www.auanet.org/research/research-resources/aua-census/census-results

[4] https://www.unitedurology.com/news/

[5] https://njurology.com/j-w-childs-associates-forms-urology-management-associates-with-new-jersey-urology/

[6] https://njurology.com/about-us/news/

[7] https://us-uro.com/wp-content/uploads/2019/08/us-urology-in-mergermarket.pdf

[8] https://us-uro.com/2019/08/27/u-s-urology-partners-supports-growth-of-independent-practices/

[9] https://us-uro.com/2020/11/23/u-s-urology-partners-announces-partnership-with-associated-medical-professionals-of-new-york/

[10] https://solarishealthpartners.com/wp-content/uploads/2020/09/LEE-EQUITY-INTEGRATED-MEDICAL-PROFESSIONALS-AND-THE-UROLOGY-GROUP-FORM-SOLARIS-HEALTH.pdf

[11] https://solarishealthpartners.com/news/

[12] https://www.urologyamerica.com/october-2020-2/

[13] https://www.mygenesishealth.com/about-genesis/news/2021/05/triton-pacific-announces-partnership-with-genesis-healthcare-partners.html

[14] https://www.urologytimes.com/view/state-specialty-survey-top-pain-points-are-revenue-drop-prior-auth?page=2

[15] https://www.auajournals.org/doi/pdf/10.1097/JU.0000000000001655

[16] https://www.merritthawkins.com/uploadedFiles/Merritt-Hawkins-urology-trends-white-paper-2021.pdf