Written by Greg Henderson & Samuel Betsill

Diagnostic imaging in the United States is estimated to generate over $100 billion annually, with outpatient, non-hospital-based imaging accounting for approximately 40% of the total market. Since Congress passed the Deficit Reduction Act of 2005, significant reimbursement rate cuts have been made to the diagnostic imaging business. Since 2010, the Center for Medicare Services (“CMS”) has further reduced reimbursement for imaging procedures by revising the methodology used to determine relative value units (“RVUs”) under the Medicare Physician Fee Schedule (“MPFS”). These cuts have impacted all imaging modalities, but some more than others due to perceived over-utilization. These rate cuts will result in increased pressure on independent freestanding operators to pursue affiliations with larger platform imaging center operators.

Medicare pays for non-hospital-based imaging services under the MPFS. On December 27, 2020 CMS passed the revised MPFS that cut reimbursement primarily for the professional component of radiology procedures. The charts below detail the CMS reimbursement rate by imaging modality.

Note: Payment calculated based on evenly weighted average of all CPT codes within each modality on a national average payment basis. Actual reimbursement may vary depending upon geography.

These reimbursement rate cuts will likely affect certain operators more than others. Single site operators (“SSOs”), in contrast to multi-platform operators (“MPOs”) are expected to face greater challenges due to the 2021 MPFS rate cuts.

Single Site Operators

The single site operator, defined as freestanding and in-office, will face the most severe impact from the 2021 MPFS rate cuts if they rely heavily on government payors.

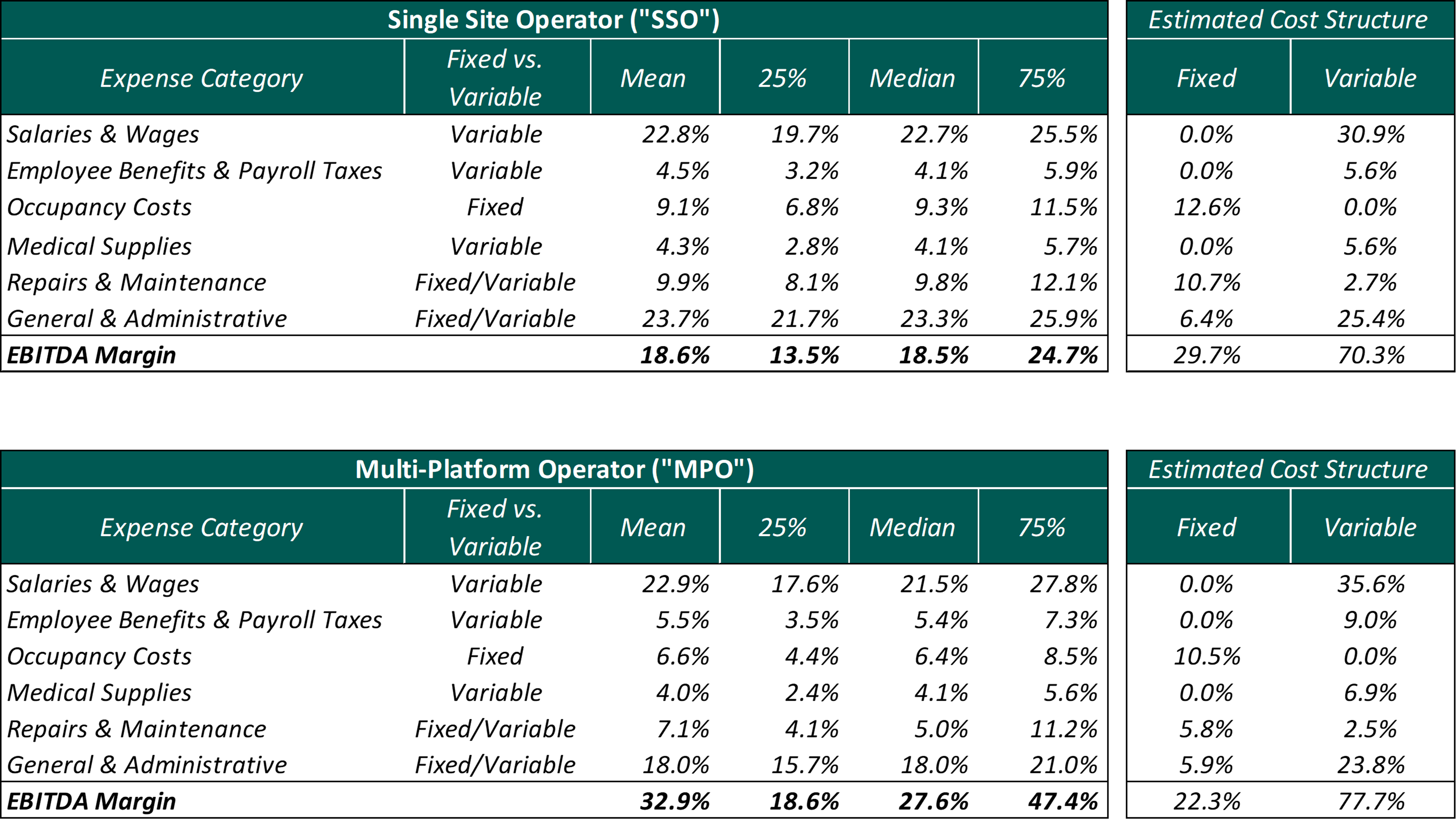

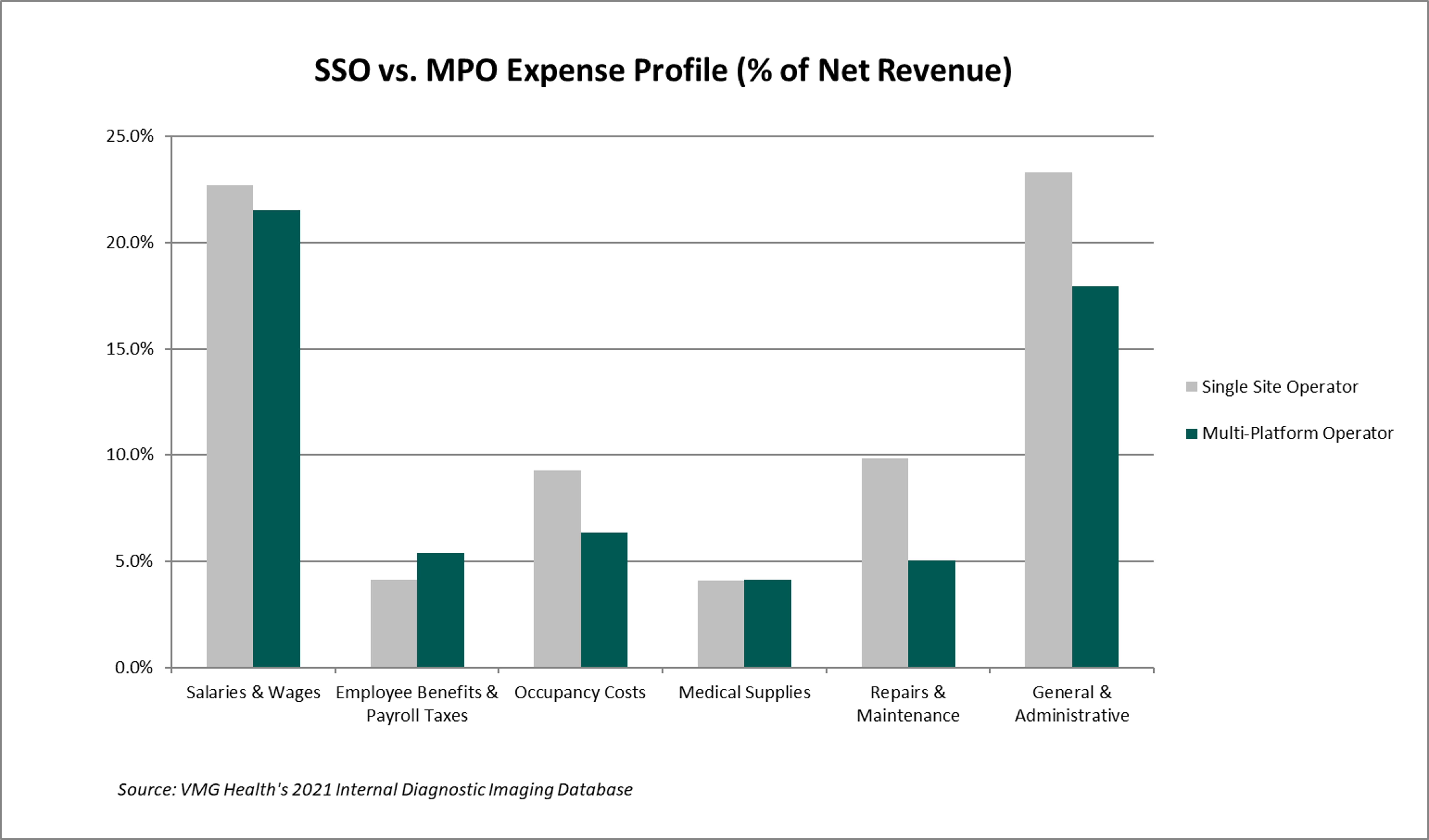

Based on VMG’s internal diagnostic imaging database, the median EBITDA margin for SSOs is approximately 18.5% with approximately 29.7% of operating expenses designated as fixed. Conversely, the MPO has a median EBITDA margin of approximately 27.6% with approximately 22.3% of operating expenses designated as fixed. Please note, these percentages are comprised from a limited sample size and not necessarily representative of all imaging centers.

These dynamics expose SSOs to more operating risk. Compared to a reduction in scan volume, where variable expenses trend more closely with volume, reimbursement rate cuts have a direct negative impact to the bottom line. Due to the high fixed cost nature of a diagnostic imaging business (predominantly repairs & maintenance and occupancy costs), future capital requirements and the access to said capital, any variance in an SSO’s business model can create significant impacts to underlying earnings and the value of the business. Additionally, centers with a large percentage of government payors will experience a more severe impact.

The SSO has two potential options to combat reimbursement pressure: invest more heavily in advertisement and marketing or renegotiate rates with commercial payors. The former would require higher short-term investments, but if implemented correctly, could drive higher scan volume, and increase revenue to mitigate reimbursement cuts. However, this option might require increased spending on advertising and marketing that the SSO may not have the margin to sustain.

Alternatively, given commercial payor’s increasing interest in consumer driven health plans, SSOs could attempt to negotiate increases in reimbursement rates. This is made possible by the lower cost structure of freestanding and office-based imaging centers as compared to a hospital-based provider. However, many smaller SSOs may not have the leverage to renegotiate with large payors. Ultimately, SSOs that have sufficient cash flow to invest in advertisement and marketing, or SSOs that have the leverage to negotiate more favorable rates with commercial payors will succeed more in mitigating decreases in operating revenue caused by reimbursement rate pressure.

Multi-Platform Operators

Multi-platform operators (“MPOs”) are characterized as diagnostic imaging centers with multiple locations, providing multiple imaging modalities at each location. The MPO and the SSO alike will be affected by the 2021 Medicare rate cuts, but given greater access to capital, operational efficiencies, economies of scale, and more sustainable profit margins, the MPO is likely to be be more favorably positioned to withstand the effects.

As illustrated below, operational efficiencies and economies of scale can be realized in multiple areas of the MPO business. Due to multiple locations, general and administrative costs, such as billing expenses and management oversight, can be allocated across many centers. Additionally, operational staffing efficiencies may be leveraged as MPOs have the benefit of utilizing shared staff across multiple centers, which can effectively reduce the number of paid hours per scan. In contrast, these staffing efficiencies are not attainable by the SSO. Although decreases in reimbursement rates will negatively impact the net revenue for MPOs, effective operational efficiencies and economies of scale can reduce operating expenses and mitigate the impact that reimbursement cuts have on the MPO’s bottom line.

Publicly traded imaging center companies serve as the closest industry benchmark for the MPO. The largest publicly traded diagnostic imaging center company identified is RadNet, Inc. (NASDAQ: RDNT). RadNet’s stock price has increased over the last twelve months and has remained relatively steady at 9.3x Total Enterprise Value / EBITDA. As discussed in RadNet’s 2020 fourth quarter earnings release, the recent positive performance of the company is attributable to a focus on cost reductions, center consolidations, and operational efficiencies, resulting in an Adjusted EBITDA margin of 16.4 percent, an increase of 80 basis points (0.8%) relative to the previous year’s fourth quarter1.

Ultimately, the continued success of the MPO model relies on management’s ability to capitalize on the cost-cutting benefits associated with operating multiple imaging center locations. Although reimbursement rate cuts will impact revenue, realizing the available operational efficiencies will result in a lessened impact to the bottom line. Coupled with advantageous access to capital, the market will see expansion in the scope and size of MPO imaging services.

Conclusion

The 2021 Medicare rate cuts for the diagnostic imaging industry will affect the profitability of the industry, but SSOs, as opposed to MPOs, will likely be impacted more negatively. It is reasonable to assume that there will be continued consolidation in the market as reimbursement pressures negatively impact earnings of SSOs. Without the ability to increase scan volume, SSOs will likely be approached by larger organizations (MPOs) or health systems that have access to capital looking to expand breadth of sites and services. Depending on the specific operator, measures can be taken to reduce the impact of rate cuts, but if the SSO is unable to adapt to the current pricing pressures by engaging in the strategies outlined above, it is probable the SSO will seek joint venture models or outright buyouts by MPOs, health systems, or management companies.

Sources: