In the Fall of 2022, we wrote an article discussing not-for-profit health (NFP) system financial performance trends. At the time, NFP systems were experiencing major financial struggles given labor market and supply chain issues coupled with other inflation and industry pressures. While not the primary focus of our 2022 study, VMG Health also raised a concern relative to mid-size hospitals (larger than critical access, but not large enough to provide tertiary/quaternary care). Unfortunately, the concern has proven to be valid as hospital closures and bankruptcies continue. The outlook for these mid-size, independent hospital organizations is not promising given the lack of financial flexibility as larger systems continue the pursuit of acquiring any independent hospitals that have demonstrated any degree of financial success. In 2022, we also noted systems would experience increased competition by private equity–funded niche players and other organizations that could shift profitable services and commercial business from the systems. Their increased presence as disruptors in new markets has accelerated quicker than originally anticipated.

Our 2022 article summarized the financial performance of 21 systems across 32 states, with a combined fiscal year (FY) 2022 operating revenue of $188 billion. As noted in the prior article, the study was not intended to represent a statistically valid sample across all NFP systems, but did include a cross section of systems that provide care to patients in over 30 states with net revenues greater than $2 billion. Of these 21 systems, approximately 15 percent are clients of the VMG Health authors, but the vast majority are not.

Our updated article assesses how those same 21 systems performed in FY 2023 as compared to FY 2022 levels. As a result of this study, our team discovered the importance of understanding the broader implications resulting from the unfavorable financial performance of NFP health systems. This report also discusses the actions our clients and other NFP systems are taking to address the existing financial pressures and to proactively address potential future issues.

Snapshot of Financial Performance from FY 2022 to FY 2023

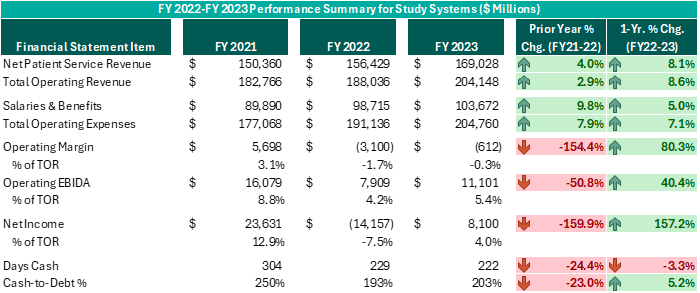

Executive leadership in these systems have made commendable decisions over the past 12–18 months despite ongoing challenges. While operating margins on a combined basis have improved by $2.5 billion from FY 2022 (and combined operating EBIDA improved over $3 billion), these organizations still experienced combined operating losses of ($612 million) in FY 2023. However, while positively trending toward break-even operating margins and 5% or higher operating EBIDA margins is no small feat following the adversity endured nationwide during FY 2022, these levels do not support long-term sustainability. Healthcare systems seeking sustainable financial operations should target operating margins of 3% or higher and operating EBIDA margins of 10% or higher. Those targets may not be achievable for all NFP Health Systems, but consecutive years of operating losses and minimal cash flows are not conducive for strategic growth and reduces an organization’s flexibility to certain strategic investments.

While the performance turnaround noted above is remarkable, the future of NFP healthcare systems continues to be very challenging. Organizations are seeking avenues to develop accretive opportunities to thrive—not just survive. Survival should not be the long-term objective. Systems are exploring and utilizing a variety of options and resources to improve performance, some of which have come to fruition in the past 12–18 months, as evidenced by the financial summary above.

Key Strategies for Adapting to Current Healthcare Challenges

Avenues some of our client system executives have pursued include the following. Note, each market and each situation is unique: One can apply similar approaches, but there is no cookie-cutter or templated solution. Rather, adjust the model to fit the situation as opposed to forcing the situation to fit the model.

- Address provider reimbursement challenges. While NFP systems continue to combat the inflationary and other pressures challenging all industries across the country since the pandemic, The Centers for Medicare & Medicaid Services (CMS) proposed a reduction to 2025 professional reimbursement for the second consecutive year: (-3.4%) and (-2.8%) for 2024 and proposed 2025, respectively. Conversely, CMS proposed an overall increase of 2.6% to reimbursement for services provided in either a hospital outpatient department (HOPD) or ambulatory surgery center (ASC) setting. These trends, in addition to other industry-wide pressures, contributed to an increasing number of independent physician practices seeking employment or an affiliation to a certain degree with systems. VMG Health is currently assisting various clients in assessing the performance of physician practices under consideration and evaluating innovative affiliation options that would result in mutually beneficial, long-term relationships for our clients to consider.

- Enhance physician alignment vehicles to increase the value proposition of the aligned medical groups. Specific structures to address this need vary by market and client, but we are working with several clients to revamp their physician alignment model and strategy where the system retains the long-term tie with the physicians but does so in a more cost-effective manner and returns some of the leadership of the practice back to the physicians.

- Understand that NFP systems can no longer be all things to all people and adjust service offerings to match those that can be provided in a financially prudent manner. NFP systems by nature try to provide as many services as possible. However, in many settings, this is no longer a viable option. Clients are looking to outsource or partner for some services that the systems find difficult to provide in a reasonable economical manner. Examples of our clients’ non-core asset divestitures over the last 18 months include urgent care, home health, and behavioral health. Some divestitures have resulted in partnerships while other clients are purely exiting that service line.

- Assess market reallocation. Recently, there has been a great deal of public reporting relative to systems exploring opportunities to exit certain markets via sale or closure. For some of our clients, we aided management in assessing these options and how well certain markets may fit into an organization’s plans to remain a sustainable healthcare provider. An example could include undertaking a process to determine which markets a system can afford to as a “mission” market. This process can be difficult, but it is critical for organizations to consider more non-traditional opportunities to remain a provider of choice in markets where they can adequately serve the needs of a population in a strategic and cost-efficient manner.

- Shift to outpatient/ambulatory sites of care. Organizations appear to be making more of a concerted effort toward strategic planning focused on developing ambulatory platforms. Recent CMS payment updates for professional services reinforce the preference to shift volume from hospitals to outpatient settings. CMS also continues to remove certain surgeries from inpatient-only status, which enables these cases to be performed in an outpatient environment. Organizations are becoming increasingly aware of the growing list of ASC-eligible procedures, and VMG Health is currently assisting various clients in assessing the impact of shifting some of these volumes. While understanding reimbursement will be lower in an ASC, the cost effectiveness of an ASC should theoretically generate more favorable operating margins while creating opportunity through additional hospital operating room capacity for other surgeons to backfill those cases with other accretive services.

- Become more aggressive in negotiations with third-party payers. As has been reported publicly, there are myriad healthcare organizations that have shifted away from contracting with managed Medicaid or Medicare Advantage plans. These plans have become much more aggressive in denying claims and implementing prior authorization processes that limit access to care for Medicare Advantage patients. Other clients are becoming more aggressive in recent negotiations with payers. Receiving a 3% increase in inpatient rates while costs are increasing 6–8% is not a sustainable path forward. Payers clearly want to limit their own risk in trying to address the financial pain for systems, but opportunities also exist for other agreements with payers involving increased risk sharing which can potentially improve a system’s financial position.

Embracing Innovation for Long-Term Success

To achieve long-term financial success, NFP systems should consider more innovative strategies that complement the evolving healthcare landscape. Patient preferences are not the same as they were 20 years ago, nor is the manner in which healthcare providers deliver care. Competitors and other organizations will capitalize on those who remain complacent and do not adapt. Therefore, sustainable success will require a willingness to adapt to the current industry environment in addition to proactive planning to meet the anticipated future needs of the patients and communities served.