By: Savanna Dinkel, CFA, Madi Whyde, Grayson Burchard, Alex Whitley, and Colin Geraghty, Colin McDermott, CFA, CPA/ABV

Contributors: Blake Madden, Chris Madden, Alex Malin, Eric Noyer, and Olivia Wilson

In March 2020, the coronavirus (“COVID-19”) pandemic began reshaping the world economy. At the time, many factors about the disease were unknown and impossible to predict. Some of these factors include the evolution of the disease, timeline to produce a vaccine, and the economic effects of worldwide lockdowns. The healthcare industry was uniquely affected, and many healthcare operators felt that they were not in the position to forecast future financial performance. After a year of operations in a COVID-19 impacted world, operators resumed the disclosure of earnings guidance. VMG analyzed guidance figure trends from publicly traded acute care hospitals, post-acute providers, home health and hospice companies, and a variety of other operators to better understand how the industry is recovering and evolving as the pandemic continues.

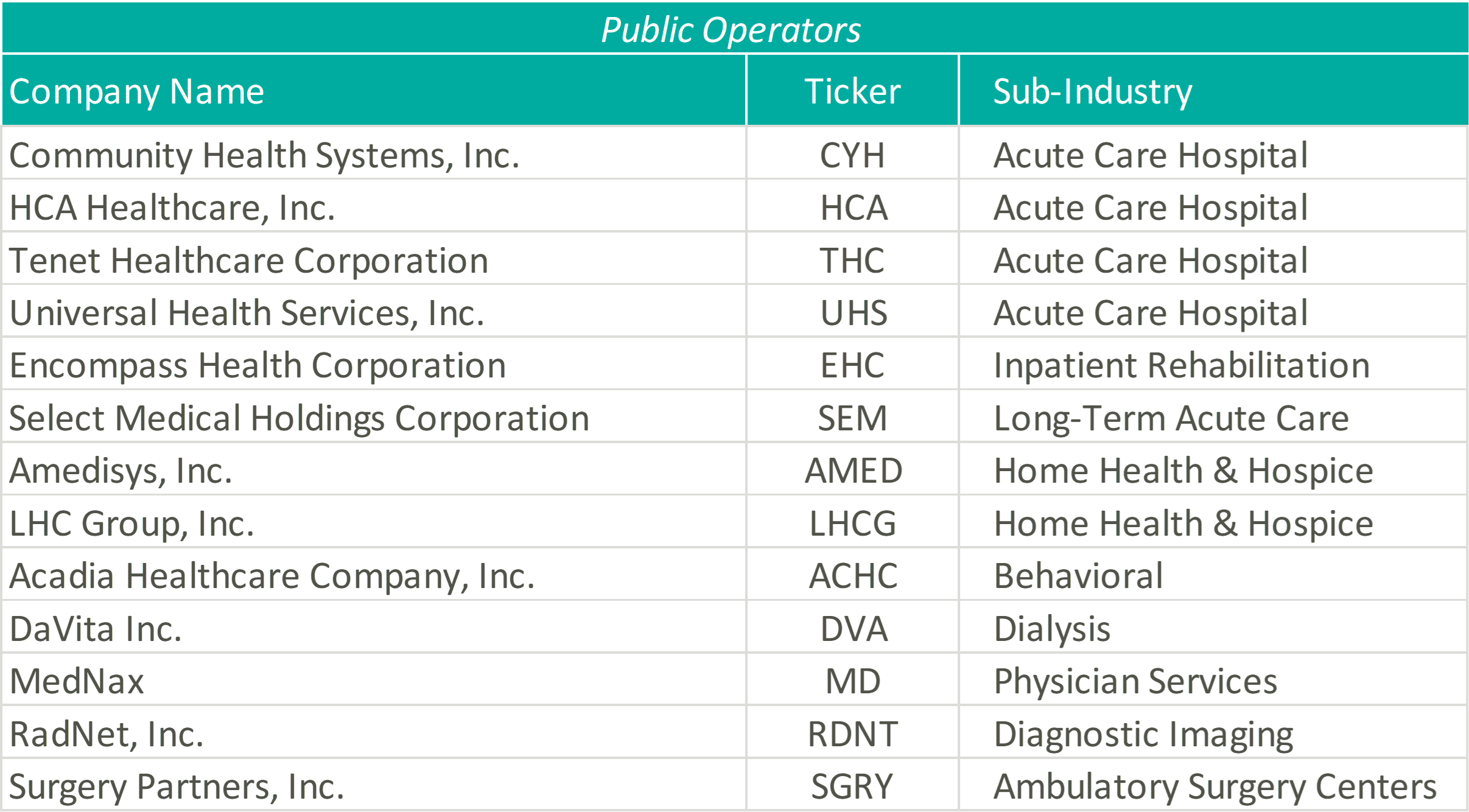

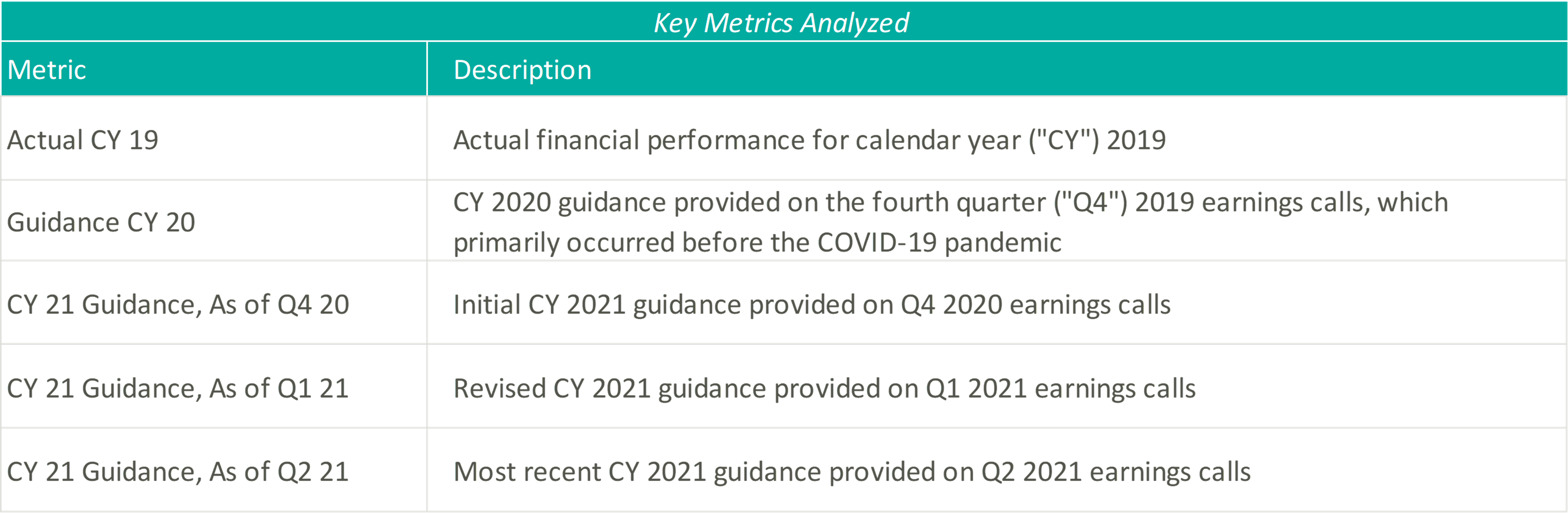

Please see below for a list of the companies examined, as well as further detail regarding the various metrics considered.

Acute Care Hospitals

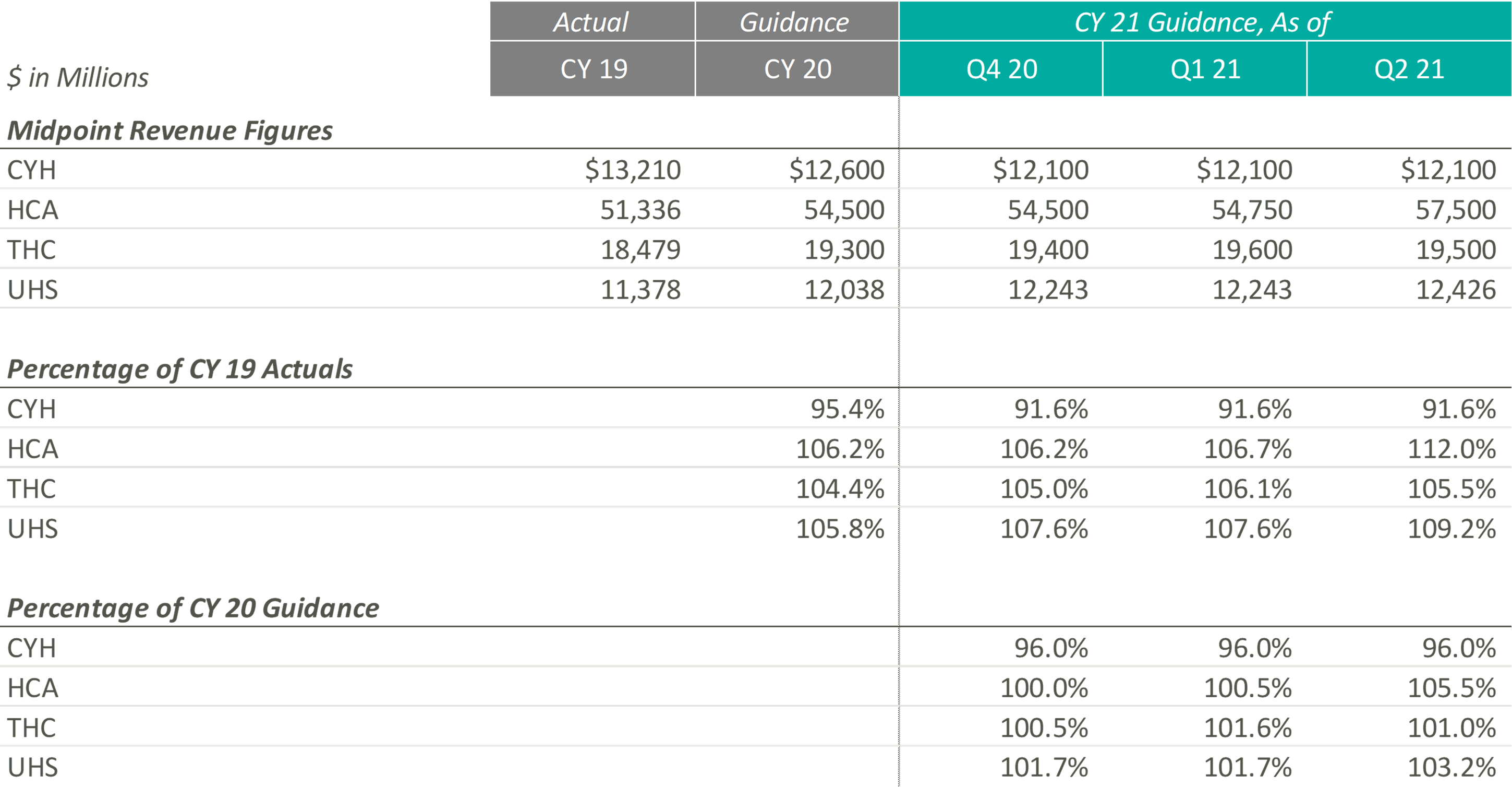

Revenue

The pandemic’s grip on acute care moderated through Q2 2021 resulting in significant revenue increases for the public hospital operators. Management, often with a tone of surprise, cited strong demand for services as the primary driver of the revenue upticks and reports of double-digit volume growth frequented earnings call highlights.

Samuel N. Hazen, CEO of HCA noted, “On a year-over-year basis, revenues grew 30.0% to $14.4 billion… To highlight a few areas, outpatient surgeries were up 53.0%, emergency room visits grew 40.0%, cardiology procedures increased 41.0%, and urgent care visits were up 82.0%.”

Similarly, Tim L. Hingtgen, CEO and Director of CYH revealed, “For the second quarter, on a same-store basis, net revenue increased 30.2% year-over-year… For the full quarter, year-over-year, same-store admissions increased 17.0%, while adjusted admissions were up 28.5%. Surgeries increased 43.7% and ER visits were up 39.2%.”

As a result of the performance of Q2 2021, public hospital operators further increased their guidance for CY 2021. Still, 2021 revenue guidance remains relatively in-line with pre-COVID 2020 estimates indicating revenue stagnated in 2020. The outlier, CYH, completed a planned divestiture program at the end of 2020, making it difficult to compare post-COVID revenue guidance to the pre-COVID figures.

Adjusted EBITDA and EBITDA Margin

In terms of profitability, HCA and THC were the earliest Acute Care Hospital operators to predict CY 2021 adjusted EBITDA to exceed the figures estimated at the beginning of CY 2020 and CY 2019, which they publicly estimated as early as Q4 2020. In light of the positive results reported during Q2 2021, CYH and UHS joined their peers in predicting favorable improvements in profitability. As of Q2 2021, the public hospital operators were unanimous in their guidance for the full year in terms of exceeding pre-COVID CY 2020 adjusted EBITDA.

Steve G. Filton, CFO and Secretary of UHS noted, “This robust recovery in volumes exceeded the pace of our original forecast and drove the favorable operating results even in the face of continuing labor pressures in both of our business segments.”

On a margin basis, all Acute Care Hospital operators have estimated CY 2021 adjusted EBITDA margins to exceed CY 2019 and 2020 levels. The pandemic has forced Acute Care Hospitals to take a closer look at their expense structures and streamline operations, leading to the predicted EBITDA margin growth.

The management teams have all reacted positively to a successful first half of 2021, as all four operators expect CY 2021 revenue and adjusted EBITDA levels near or above their initial CY 2021 estimates. However, although the guidance figures seem positive, CY 2021 levels are only at or slightly above pre-COVID CY 2020 expectations, proving that these operators are remaining cautious when providing forward-looking estimates. The Acute Care Hospital industry, while showing signs of recovery after the initial peak of the pandemic, is still experiencing the effects of the COVID crisis, and the recent rise of the Delta variant could further exacerbate the impacts that the COVID-19 pandemic had on the Acute Care Hospital providers.

During UHS’ Q2 2021 earnings call, Steve G. Filton, CFO and Secretary of UHS, cautioned, “During the past 4 to 6 weeks, many of our hospitals have experienced significant surges in the number of COVID patients, and it is not evident that this surge has yet reached its peak. Given the uncertain impact of this most recent surge on non-COVID volumes and on labor shortages, we based our guidance for the second half of the year, primarily on our original internal forecast.”

Post-Acute Care

Revenue

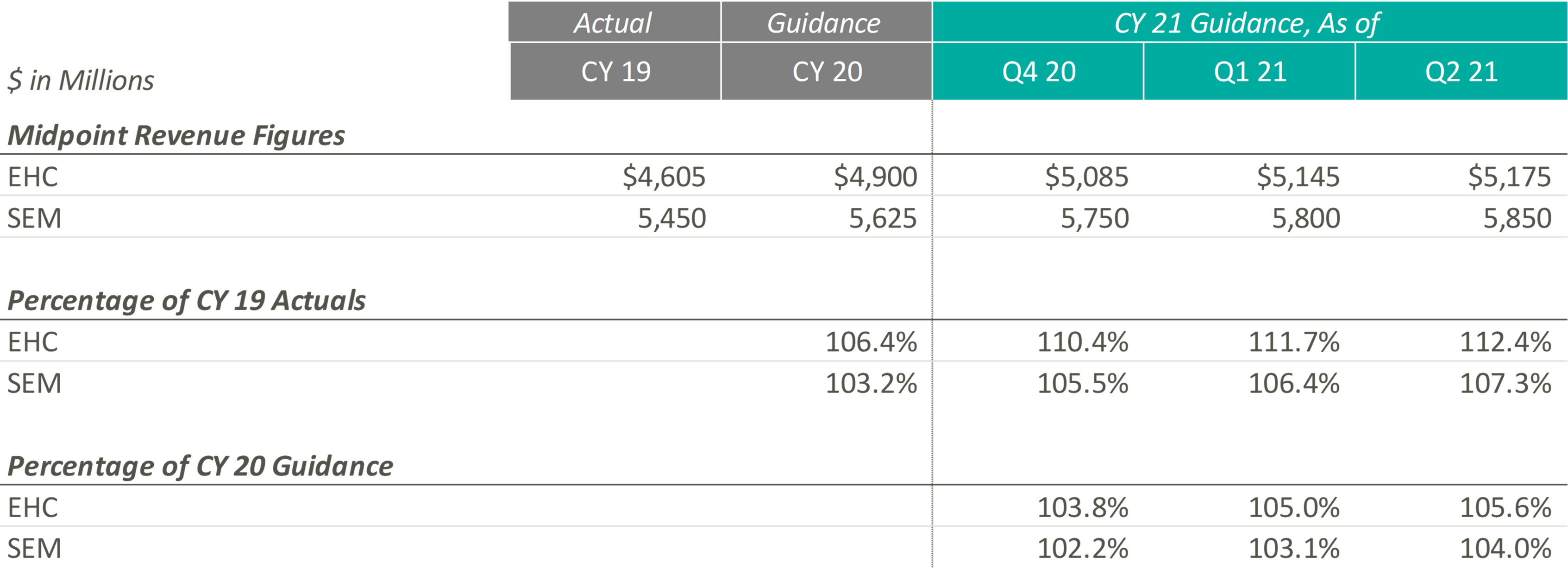

In CY 2021, Post-Acute Care operators expect growth above both CY 2019 revenues and expected pre-COVID CY 2020 revenues. Most notably, when these operators released their original CY 2020 guidance, they projected mid-single digit growth. Looking at their CY 2021 guidance as a percentage of CY 2019 levels and as a percentage of CY 2020, it appears that they expect to still achieve mid-single digit growth on a compounded annual basis from CY 2019. These data points suggest that the Post-Acute Care operators’ growth trajectory was likely not hindered or set back a year by the COVID-19 pandemic.

Additionally, both Post-Acute Care operators have continued to raise their CY 2021 guidance over the past two quarters. During EHC’s most recent earnings call, management highlighted that the return of elective procedures has been fueling inpatient rehabilitation facility (“IRF”) discharge growth. In addition, EHC is experiencing growth in IRF revenue per discharge due to strong reimbursement rates, continued suspension of sequestration, improved discharge destination, and cost report adjustments. These tailwinds, along with the improvement of home health and hospice volumes and IRF M&A activities, resulted in the continued increase of revenue guidance for EHC.

Similarly, SEM has experienced a rebound in volumes in all four segments (i.e., IRFs, long-term acute care hospitals (“LTACHs”), occupational health, and outpatient rehabilitation) at levels well above pre-pandemic levels, resulting in the continued increase in CY 2021 guidance figures. As stated in SEM’s Q1 2021 earnings press release, “In March 2021, both Select Medical’s outpatient rehabilitation clinics and Concentra centers experienced patient visit volume approximating the levels experienced in January and February 2020, the months preceding the widespread emergence of COVID-19 in the United States.”

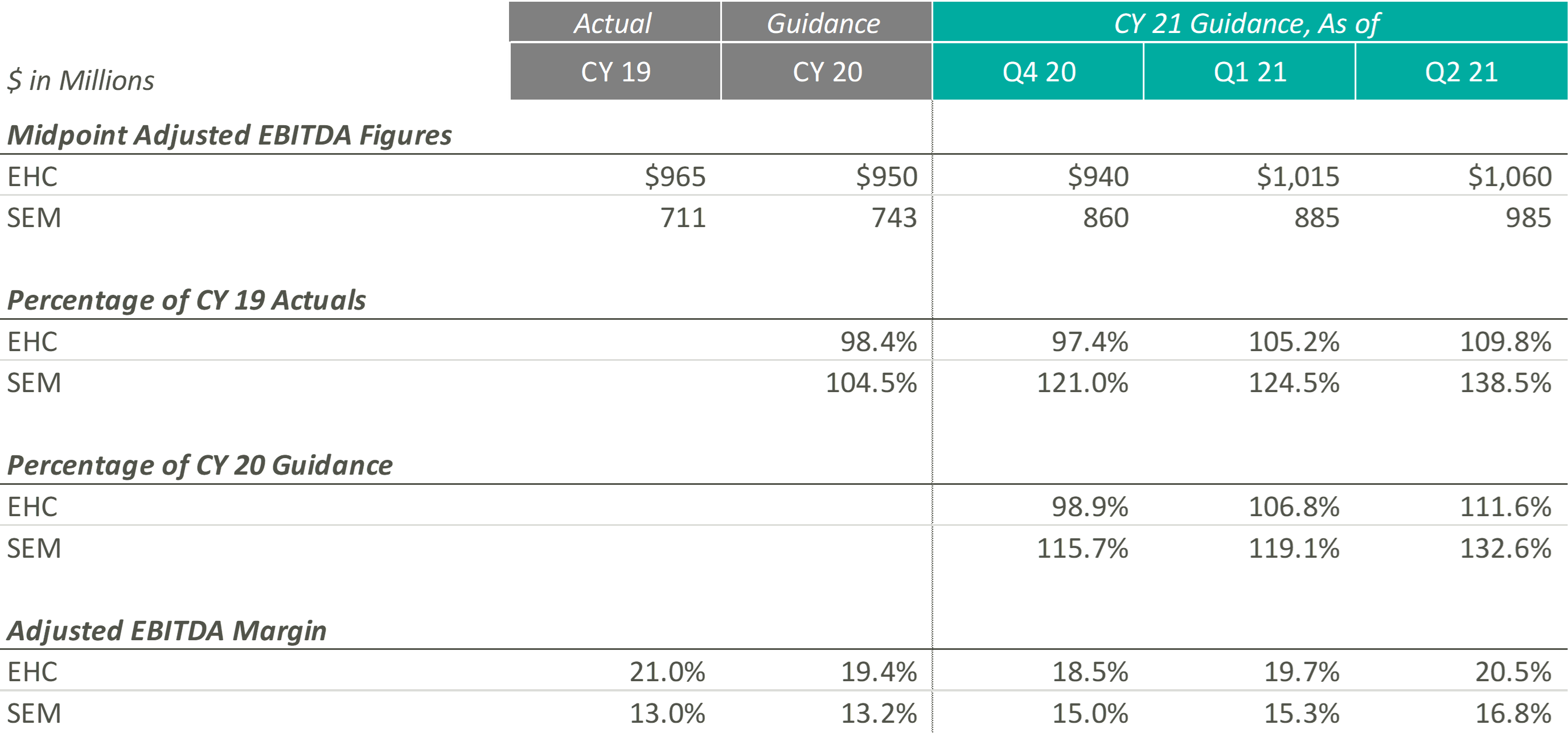

Adjusted EBITDA and EBITDA Margin

Similar to their CY 2021 revenue guidance figures, EHC and SEM have continued to raise their CY 2021 Adjusted EBITDA guidance ranges. According to EHC’s Q1 2021 earnings release, EHC increased CY 2021 guidance “to reflect Q1 performance and the extension of suspension of sequestration.” Similarly, in Q1 2021, SEM cited revenue growth as the primary driver of adjusted EBITDA growth, with revenue growth resulting from favorable pricing, a new joint venture, a higher acuity patient mix, increased reimbursement rates, and the suspension of sequestration.

Even with the COVID-19 pandemic affecting performance in CY 2020, SEM beat its original CY 2020 midpoint guidance figures by approximately $57.0 million, primarily driven by revenue growth in its inpatient segments. As SEM’s outpatient segments return, SEM’s Adjusted EBITDA performance continues to improve in CY 2021. During SEM’s Q2 2021 earnings call, the Co-Founder & Executive Chairman, Robert A. Ortenzio, stated, “In addition to the volume growth, the inpatient and outpatient rehabilitation hospitals and clinics posted their highest quarters for adjusted EBITDA in the history of the company.”

On the margin side, although EHC has continued to increase its expected CY 2021 Adjusted EBITDA margin throughout the past two quarters, management has cited pressures in nursing staffing across the country that may result in “a little bit of cost climb as we move into 2021 and throughout the year.” On the other hand, SEM has projected Adjusted EBITDA margins at levels well above those expected pre-pandemic. As SEM continues to raise their expected Adjusted EBITDA margin, management has noted that their expenses are being managed well, resulting in current Adjusted EBITDA margins that are “the highest in the history of the company.”

Overall, both Post-Acute Care operators have reacted positively to successful performances over the first half of CY 2021. To this point, Mark Tarr, CEO and President of EHC, noted “the combination of the return of our former market, along with new referral sources we’ve added throughout COVID, leave us very encouraged about the strong organic growth opportunities beginning in the back half of the year.”

Home Health & Hospice

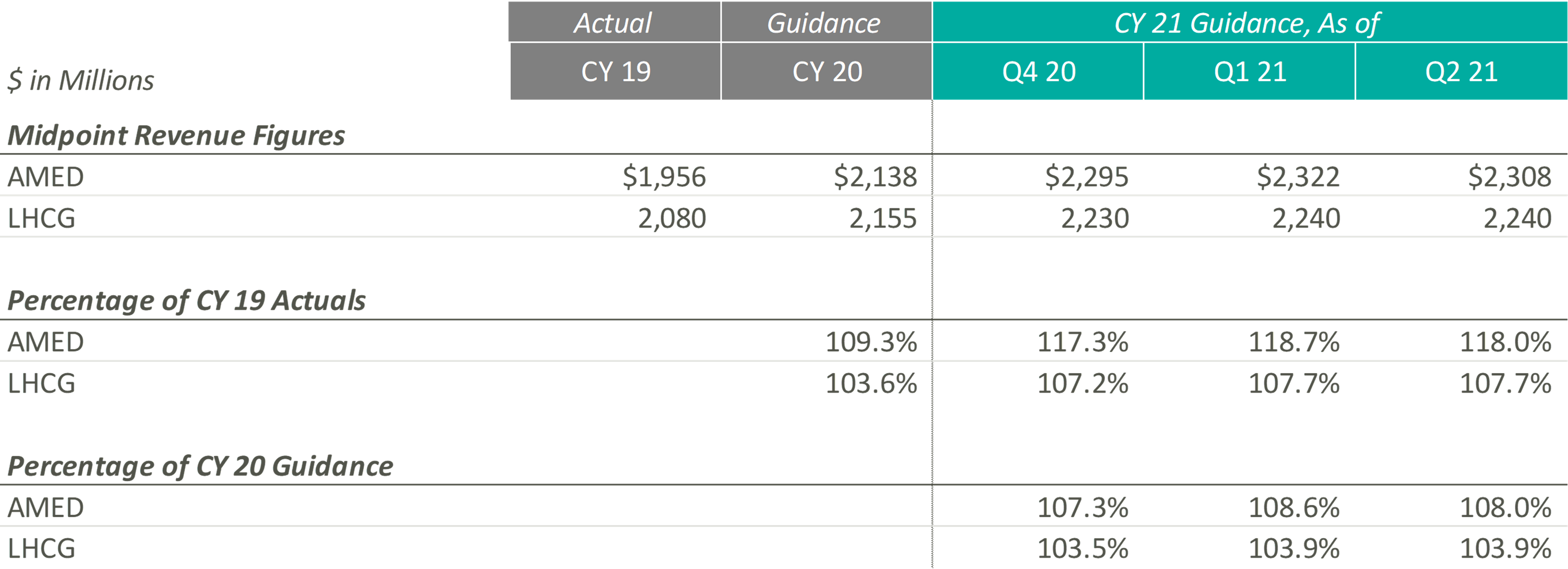

Revenue

Since the end of CY 2019, AMED and LHCG have both steadily increased their observed revenue estimates, until the most recent quarter. In fact, AMED lowered its CY 2021 guidance during its most recent earnings call citing more conservatism due to the “prolonged, and now, resurgent impact of COVID on our hospice business.” More specifically, the pandemic has resulted in a continued decline and suppression of occupancy rates in senior living facilities (a major referral source), a decrease in length of stay, and an increase in hospice staff turnover. AMED’s management noted that when previously releasing CY 2021 guidance, they had not expected the continuation of COVID impacts during the second half of the year. LHCG discussed similar headwinds but did not adjust the projected guidance figures.

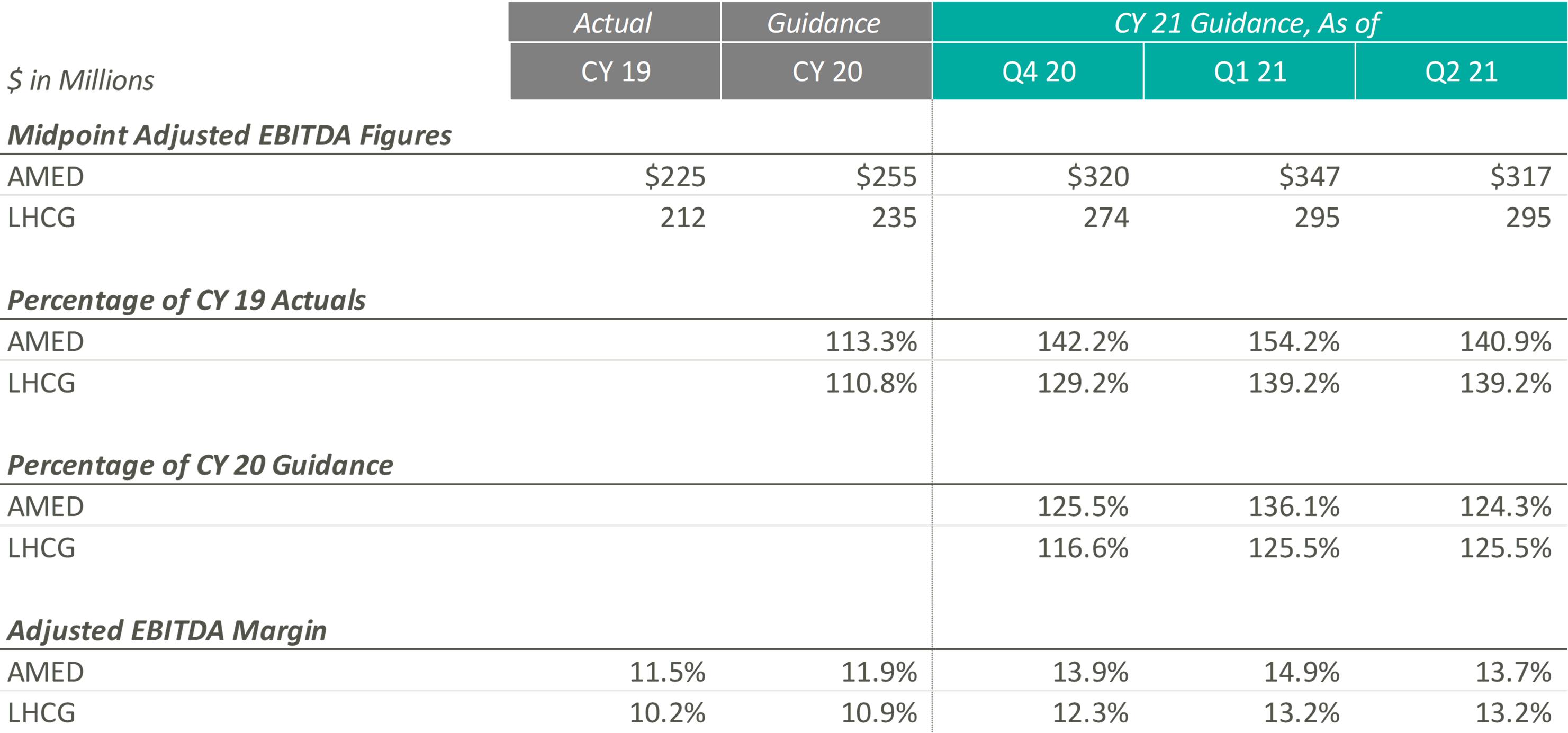

Adjusted EBITDA and EBITDA Margin

During Q4 2020 and Q1 2021, the Home Health & Hospice operators expected to significantly improve upon their CY 2019 and pre-COVID CY 2020 adjusted EBITDA guidance levels. Keith Myers, CEO of LHCG, discussed the company and overall industry’s success, stating “We are also benefiting from an improved legislative and regulatory outlook as legislative initiatives from Congress, innovation from CMS and stated budget and stimulus priorities of the Biden Administration are all emphasizing the need for at home care.” In addition to improved expected adjusted EBITDA levels since the pandemic, the adjusted EBITDA margin for the Home Health & Hospice operators has also increased compared to CY 2019 and pre-COVID expected CY 2020 levels.

While these Home Health & Hospice operators expected strong performance as they emerge from the pandemic, referrals from senior housing have remained low since the pandemic. Kevin McNamara, CEO and President of Chemed, a company in the space that does not provide guidance for its Home Health & Hospice subsidiary, stated, “The most complex issue still facing [our subsidiary] is the disruptive impact that the pandemic has had on traditional hospice referral sources and low occupancy in senior housing. This disruption continues to impact our admissions and traditional patient census patterns.” This sentiment was reflected in AMED’s Q2 2020 earnings call, where they decreased guidance to reflect the headwinds discussed previously.

Despite the recent concerns related to the continuation of COVID, operators remain optimistic about the future of the space, specifically the demographic tailwinds. During the Q4 2020 earnings call, Paul Kusserow, CEO and President of AMED stated “[Demographics are] in our favor with the baby boomers creating a potential surge of patients in the coming year, with more people turning 65 years old than ever before. The burgeoning 75-plus population, coupled with ever-increasing unsustainable health care costs puts us in a very advantageous position.”

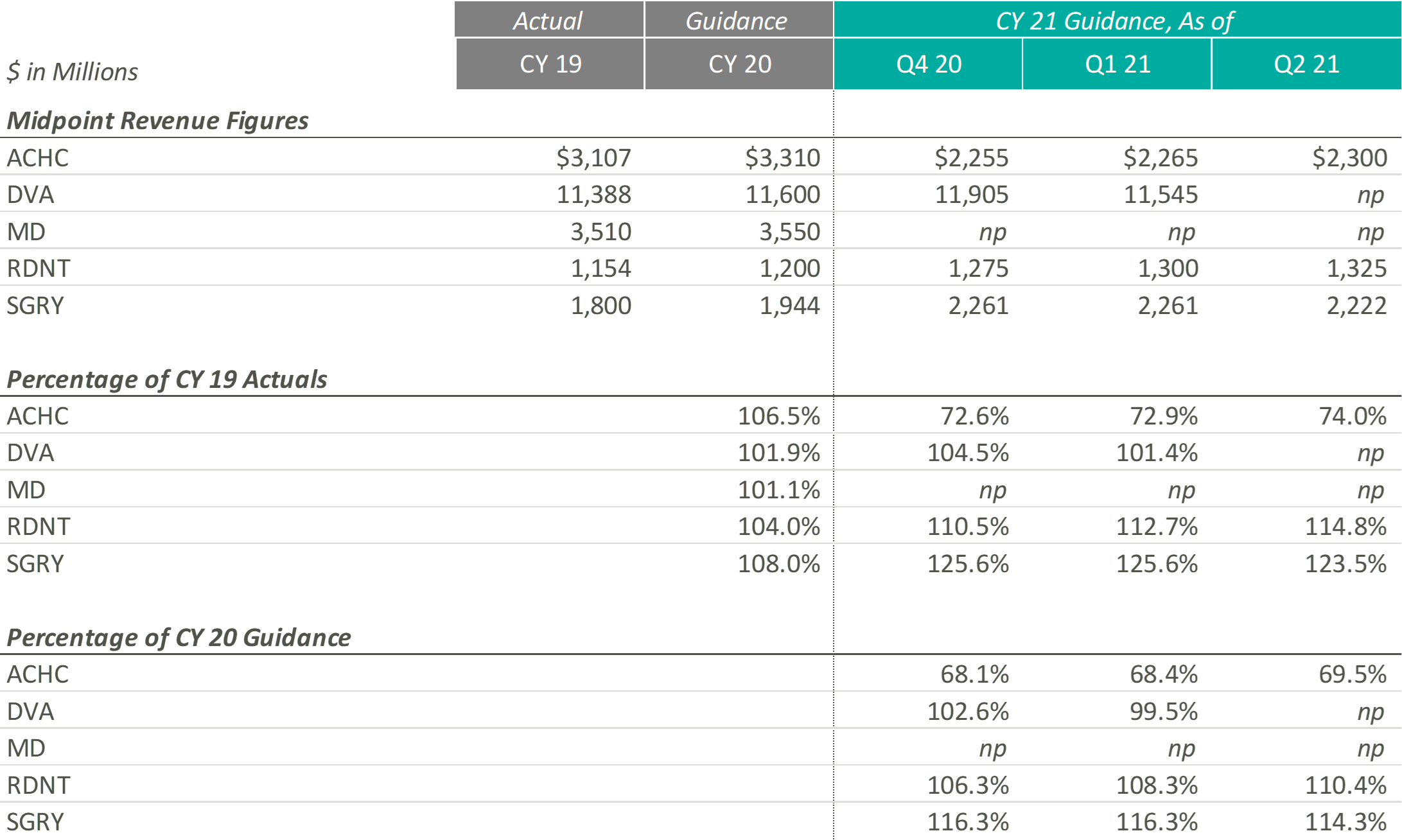

Outpatient & Other

Revenue

Revenue projections for Outpatient and Other operators are varied as they represent a variety of industries and markets that have been affected by COVID-19 in different ways. RDNT, which provides diagnostic imaging services, and SGRY, which runs ambulatory surgery centers, expect growth above both CY 2019 revenues and expected pre-COVID CY 2020 revenues. RDNT increased their revenue guidance as volume, in virtually all areas of the business, has increased as the states in which they operate have loosened COVID-19 restrictions. While still higher than CY 2019 and CY 2020, SGRY has decreased their CY 2021 revenue guidance as low acuity cases are expected to represent a larger portion of the case mix than previously thought.

On the other end, ACHC, a behavioral health company, expects growth below both CY 2019 revenue and expected pre-COVID CY 2020 revenues. However, ACHC is an outlier as they sold UK operations to a private equity firm in December 2020, making it difficult to compare going forward guidance estimates with historical estimates. ACHC increased CY 2021 guidance as patient volume increased due to the mental health crisis that evolved during the pandemic as well as an increase due to the societal acceptance of mental health services.

DVA, which performs dialysis services, did not provide CY 2021 guidance during the most recent earnings call. Additionally, MD, a physician-led medical group that partners with hospitals, health systems and health care facilities to offer women’s and children’s care, has still not resumed guidance since they announced in their Q1 2020 earnings report that they would no longer provide guidance due to the rapidly evolving nature of the COVID-19 pandemic.

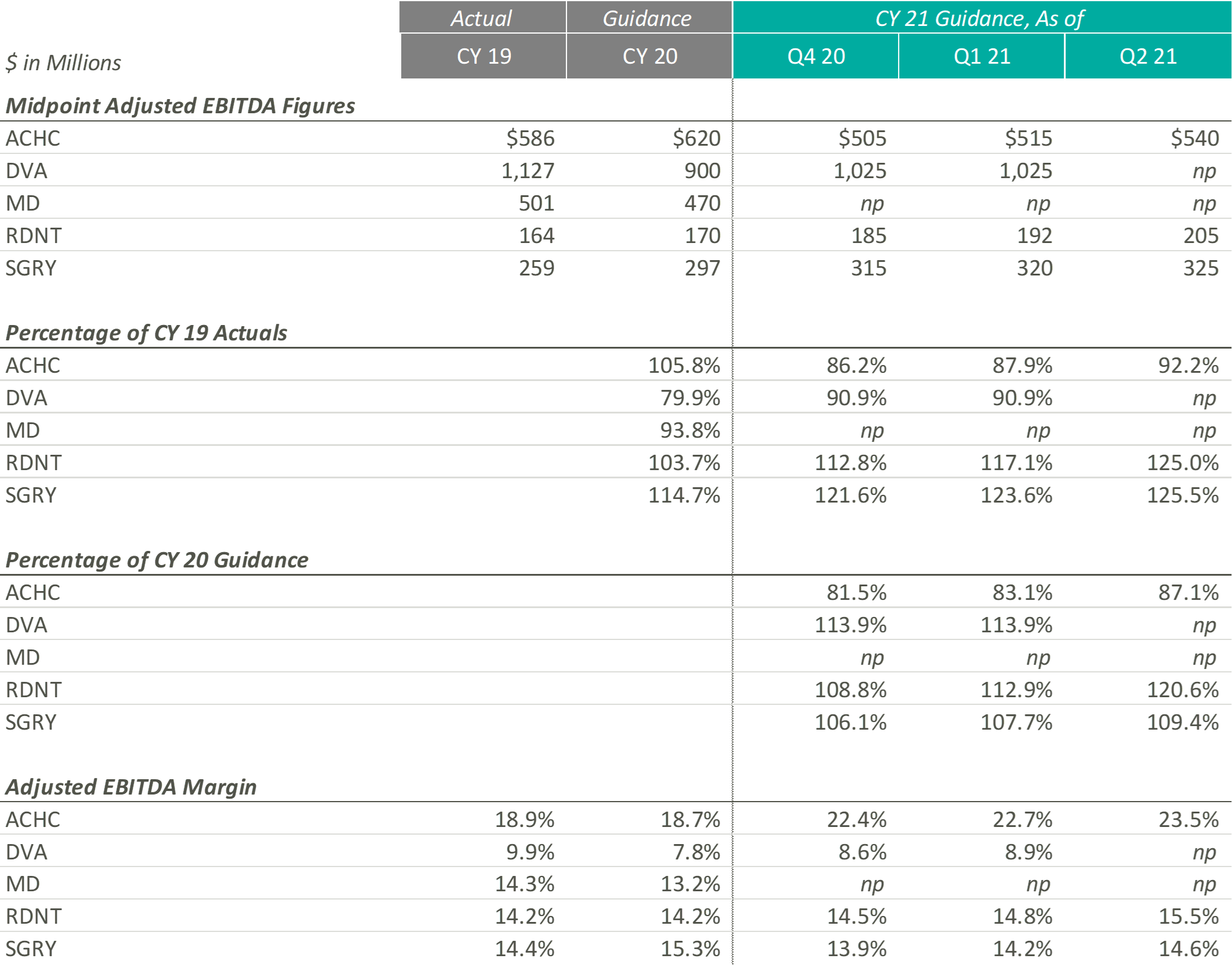

Adjusted EBITDA and EBITDA Margin

During the most recent earnings calls, every entity that provided guidance increased their CY 2021 guidance figures. ACHC increased adjusted EBITDA guidance due to a rise in patient volume and the expectation that the demand for mental health services is expected to increase. ACHC also expects their adjusted EBITDA margin to increase as more cost synergies are realized with the addition of new beds and facilities.

While DVA did not provide adjusted EBITDA guidance, the CFO & Treasurer, Joel Ackerman, stated “we’re also expecting an uptick on costs related to testing, vaccinations and teammate support as a result of the Delta variants” during the company’s Q2 2021 earnings call.

During the most recent earnings call, RDNT raised their CY 2021 EBITDA guidance from $192m to $205m. According to Mark D. Stolper, the Executive VP & CFO, RDNT’s adjusted EBITDA margins have improved due to regional cost efficiencies and an increase in reimbursement due to previous investments in new equipment. Howard G. Berger, President & CEO of RDNT, recently stated in the company’s Q2 2021 earnings call that “with patient volume returning to more normal levels and through implementing aggressive cost-cutting and cost containment programs, our same-store growth and performance model has returned.”

Like RDNT, SGRY has increased their most recent CY 2021 adjusted EBITDA guidance due to the expectation of volume increases due to seasonality and a rise in higher-acuity procedures. J. Eric Evans, CEO & Director of SGRY, stated in the Q2 2021 earnings call that margins “are projected to increase in the back half of 2021, consistent with historical performance as seasonal commercial mix intensifies.”

The entities in this section represent a variety of sub-industries that were all affected by the pandemic in a unique way. Overall, it appears that the companies that were able to create cost efficiencies and see a notable recovery in volume increase their guidance figures, while those who dealt with increasing expenses and continued volume variability decreased or did not provide guidance.

Conclusion

Although each industry and operator reacted to the pandemic uniquely, the overall outlook among these operators remains positive. Comparing the most recent guidance figures to CY 2019 performance, eight out of eleven operators with sufficient guidance data expect higher revenue in CY 2021 according to their most recent Q2 2021 earnings reports. Furthermore, nine of the same eleven operators estimate similar performance with adjusted EBITDA.

Comparing Q2 2021 guidance to the CY 2020 estimates released before the pandemic can provide additional insight on which companies not only survived but continued to grow throughout the COVID-19 pandemic. Eight out of the eleven operators expect CY 2021 revenue to exceed estimated revenue levels at the beginning of CY 2020. Additionally, ten out of eleven predict similar trends with adjusted EBITDA. However, it is interesting to note that some of these operators, specifically in the Acute Care Hospital sectors, expect CY 2021 estimates to outperform CY 2020 estimates only by a slim margin. Since these operators are only predicting a small amount of revenue and adjusted EBITDA margin expansion from 2020 to 2021, it appears they might not have experienced normal levels of development throughout the pandemic. The Post-Acute Care and Home Health & Hospice operators, on the contrary, expect to significantly outperform pre-COVID CY 2020 estimates in 2021, illustrating that these two sub-industries may not have experienced a “lost year” of growth in 2020 as a result of the COVID-19 pandemic.

Lastly, to understand how these operators’ performance has trended throughout CY 2021, we have compared the most recent CY 2021 guidance figures to those released during the Q4 2020 earnings calls. Nine out of eleven companies have adjusted revenue guidance to levels at or above the initial figures, and ten out of the eleven have either increased adjusted EBITDA estimates or left them equal. Based on these statistics, it appears operators have successfully started CY 2021.

Despite the lingering COVID-19 pandemic, it appears healthcare operators are optimistic about the recovery of their revenue and Adjusted EBITDA metrics over pre-pandemic levels. Further, many healthcare operators have taken the past year and a half to implement new strategies that will allow them to become more efficient long-term. Overall, it appears the healthcare operators have adapted during these times and are optimistic about their future performance despite the lingering COVID-19 pandemic.