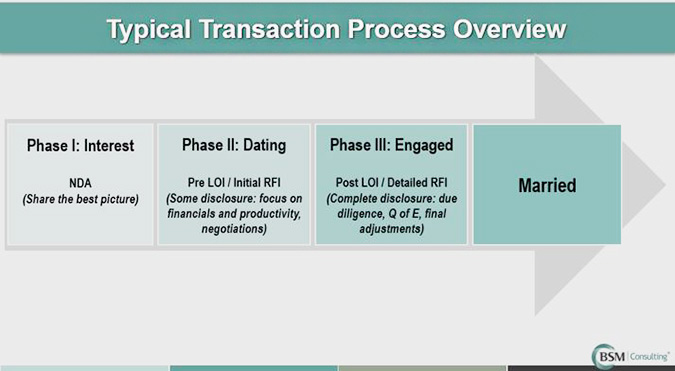

I like to use the analogy of dating when discussing the private equity transaction process. Similar to any relationship, transactions contain different stages (see Figure 1), and it’s best to prepare for the grueling third phase: engagement, otherwise called due diligence. Preparation involves reflecting on your current situation and making necessary changes before you even begin looking for a financial partner. Knowing that, let’s focus on this preparation process more closely.

Figure 1

Self-reflection

Before entering the “dating pool,” it is important to understand the perspective of any potential partner. A checklist will help you see your practice from another’s viewpoint more clearly. Below are a few key internal items to examine and ultimately check off.

Financial statements

Quality patient care is the most important business aspect for you, but for those looking to buy, it’s your finances. Therefore, the courting phase is dominated by the review of your financials, so take a careful look at the following documents.

- Income statements. Look back at the past four years and critically evaluate your statements. Are the categories clean and up to date? Are provider expenses separate from other expenses? Do the trends look favorable (growing revenue and controlled expenses)?

- Balance sheet. Many practices do not keep their balance sheet current. Work with your certified public accountant (CPA) to ensure this document is updated monthly. This document shows what the practice owns (its assets), its liabilities (what it owes), and equity (net worth) at a specific date in time.

These documents reveal the financial health of the practice and indicate to potential partners whether a good fiscal opportunity exists.

Assets

Your practice has gathered a variety of assets over the years to conduct business and support staff — from the new laser in the procedure room to the refrigerator in the staff lounge. It’s important to accurately track these assets. Ask yourself:

- Is your asset list up to date? What might be missing?

- Do you have depreciation schedules for your assets? How specific are they? Many depreciation schedules are vague and only list items as “medical equipment” rather than the actual type of equipment. Be precise and add detail where possible. (This may test your memory, but it’s worth it.)

Knowing your assets and their value will help you in creating an accurate income and balance sheet (mentioned above). This in turn will aid you in getting a better snapshot of your practice’s financial position.

Estimate of value

If you have never gone through the process of estimating fair market value for your practice, you should do this before seeking a potential partner. Also, this should be done by an experienced transaction professional; someone who is familiar with current market trends and comparable sales. An experienced advisor can:

- Determine fair market value wages for owner physicians. This is important for two reasons: 1) It will determine the employment agreement compensation, and 2) It will identify the true profit stream of the business after fair market compensation for the owners.

- Identify adjustments to the income statement. Again, an experienced advisor understands how operations will potentially change following a transaction and can adjust various expenses (or predict future revenue) to put forth the most favorable financial position.

- Provide ranges of multiples. There are enough stories about the multiples that are applied to the profit stream to determine the value of a business. An advisor who has completed enough transactions can provide the right range for a practice of your size.

A knowledgeable advisor will help you estimate fair market value for your practice. This is critical, since successful dating requires realistic expectations — on both sides.

Physician agreements/compensation

Physicians (and physician extenders) are the revenue generators for the practice. For this reason, special attention must be given to them before you start dating. Consider the following physician groups in your practice:

- Owner physicians. Do they all have current agreements? How are they currently compensated? Is the provider compensation model easy to understand? Is the method compliant with regulatory requirements? How might it change with a transaction? Is that acceptable to the owners?

- Employed doctors. Again, is everything up to date? Are they being compensated in accord with their agreements? Who might be at risk of leaving if a transaction occurs? Do you have enforceable covenants not-to-compete (this is attractive to buyers)? Who is on the partnership track and will need special attention? Are they being paid at fair market value levels?

When going through your checklist, remember to view everything from the eyes of a potential buyer. A possible loss of doctors equals a loss of revenue. Solid physician relationships and predictable revenue for the future make your partner willing to proceed with the relationship.

Leases and obligations

Contractual obligations need to be clearly documented. These items will likely be assumed by the new owner, so consider the following:

- Rental agreements. This is rarely an issue when the agreement is with a separate landlord. However, physicians are often their own landlords because they own the property/building. In those situations:

- Make certain there is a current written lease with defined square footage and rental rates.

- Make certain the rental rate is at fair market value.

- Equipment leases. Review these leases to make sure they are up to date and what is being paid aligns with the agreement. Determine if these leases are assignable/transferrable to new owners.

Many practices have various vendor agreements or other obligations that they need to clarify or put in writing. Doing this clean up now is useful when you actually enter due diligence and have to show the support for every line item on your financial statement — including presenting these types of agreements.

General operations

There are too many items to list in this section. However, during your self-reflection process, pay particular attention to those items that may have the biggest impact on your practice’s ability to generate revenue. Those are:

- Human resources (turnover rates and compliance with internal policies and performance reviews)

- Billing and coding compliance

- General compliance

- Payer-mix and up-to-date payer contracts

- Infrastructure (up-to-date IT systems, phone systems, and staffing processes)

- Solid sources for new patients/growth

Shortfalls in any of these areas might discourage a potential partner from proposing, so make sure you’re positioned well in them.

Making Touch-Ups

When we stand in front of the mirror, we may see certain attributes that need refinement. Engaging an outsider to help prioritize which items deserve attention is often extremely helpful. Touch-ups that may be needed include:

- Cleaning up your financials, including chart of accounts and entries. Work with your CPA on this effort.

- Conducting a billing and coding audit. While this may uncover some potential revenue losses, it may also uncover great opportunities to enhance revenue. In any case, it will help you meet your fraud, waste, and abuse compliance guidelines.

- Making necessary updates to HR records and employment agreements. This may require involvement from your HR attorney or an HR consultant.

- Implementing identified action items. These items will come out of your various reviews and audits.

Throughout this entire self-reflection and touch-up process, be sure to keep your records. Everything you have done to prepare for dating will be reviewed again. Get organized and keep materials in a folder (well-labeled) for when a serious suitor comes knocking.

Preparation Eases the Dating Process

Armed with necessary information and realistic expectations, you will be able to use your dating time to focus on potential partners. You will also be prepared for them to review the practice and conduct due diligence. This leaves you free to focus on the relationship and select the right partner that meets your goals.

LOOKING FOR DUE DILIGENCE ASSISTANCE? Contact BSM for an operational assessment and a billing and coding audit. We’re here to help.