Written by David LaMonte, CFA and Max Swan

On November 1, 2022 the Centers for Medicare & Medicaid Services (CMS) released the calendar year (CY) 2023 Medicare Physician Fee Schedule (MPFS) final rule as well as the Hospital Outpatient Prospective Payment System (HOPPS) final rule with both rules going into effect January 1, 2023.

CY 2023 Final Rule – MPFS

Reimbursement decreases were seen previously under the MPFS annual rules for radiology in 2021 and 2022 when CMS first began phasing in the plan to reallocate reimbursement to physicians who consistently bill for E&M codes. However, these cuts were mitigated by legislation that increased the conversion factor in 2022 after the final rule was issued. Considering the previous precedent and similar political pressures, many industry participants are hoping for similar legislation in order to mitigate the cuts reflected in the final rule this year.

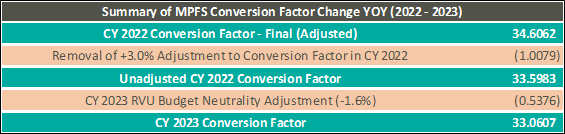

As the chart below illustrates, the CY 2022 Conversion Factor is adjusted to exclude the 3.0% one-time increase allowed by legislation which came after the final rule was issued. Additionally, the CY 2023 conversion factor reflects a reduction of 1.6% related to budget neutrality requirements. As a result, the MPFS Conversion Factor will decrease from 34.6062 in CY 2022 to 33.0607 in CY 2023 reflecting a 4.47% decrease.

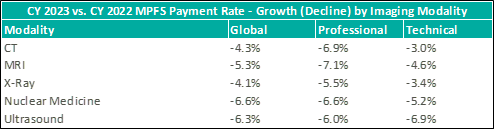

Concerning radiology specifically, the final rule is expected to result in even further decreases in payment rates relative to CY 2022 levels. The table below illustrates changes in global, professional, and technical payment rates for specific modalities based on CMS’ published CPT-level payment data for CY 2022 and CY 2023. In addition to the conversion factor change, imaging and radiology providers have indicated the declines are attributable to changes in how relative value units (RVUs) are determined for several imaging procedures.

CY 2023 Final Rule – HOPPS

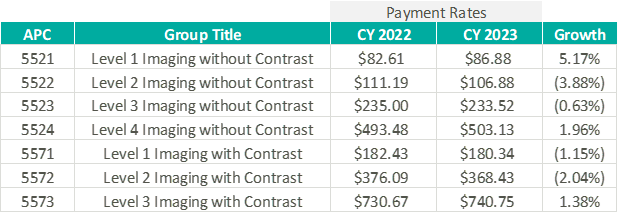

The final HOPPS rule included a 3.8% increase in the conversion factor relative to CY 2022 to reach 85.59 for CY 2023. The conversion factor, which is similar in function to MPFS, impacts all types of outpatient procedures and is updated annually. Below is a chart that outlines payment rates and growth relative to CY 2022 for the seven imaging ambulatory payment classifications (APCs). These APCs are also updated each year with weightings specific to individual procedure types that serve as an indicator of complexity and use of resources.

Transaction Implications for Owners & Operators

“With respect to our growth initiatives, we believe the opportunities for continuing consolidation could accelerate as a result of reimbursement pressures.”

– Mark D. Stolper, CFO of RadNet, Q3 2022 Earnings Call discussing the CY 2023 MPFS Final Rule

The reimbursement pressures noted above should continue to drive acquisition activity by larger operators of free-standing diagnostic imaging facilities. This is due to their ability to mitigate the impacts of reimbursement cuts with synergies realized from reduced overhead and other cost-savings that come from their scale and operational expertise. Outright acquisitions of these practices and facilities should continue in the future with the continuing drops in reimbursement under MPFS for most imaging modalities.

“Another one of our significant initiatives is expansion through hospital and health system joint ventures. In the past, we have stated that we see a path forward toward holding as much as 50% of our imaging centers in these partnerships. Most hospitals have been challenged by the loss of patient volumes to outpatient free-standing facilities who offer significantly lower pricing along with better and more convenient patient experience.”

– Howard G. Berger, CEO of RadNet, Q3 2022 Earnings Call

Reimbursement for imaging and radiology services under MPFS has created difficulties for operators for several years now. However, hospitals and hospital outpatient departments (HOPDs) struggle with a different set of problems as it relates to imaging and radiology services. Outpatient imaging volumes at hospitals have steadily declined as patients increasingly migrate to outpatient free-standing facilities due to more favorable costs for the patient. As noted above, larger independent operators of free-standing facilities expect that hospitals and health systems will continue to be targeted for partnership opportunities through joint venture models allowing them to retain some level of control and influence over the patient trajectory.