March 2017

A frequently cited solution to reducing rising healthcare costs is to place patients in the lowest cost setting of care. Accordingly, home health has become a forefront discussion of the healthcare industry. Large health systems contemplate better ways to integrate home health services into their continuum of care offerings while traditional operators (including private equity back organizations) are positioning themselves to financially benefit from increasing demand and interest in the space. As valuation and advisory professionals, we are constantly monitoring the market to understand how these industry dynamics and current events impact the transaction environment. In FYE 2016, there were approximately 55 announced home health transactions with an estimated value of $1.2 billion.[1] Overall, we are observing market consolidation and / or strategic positioning through acquisition or joint venture in the space. In instances where the involved parties can affect referrals patterns, fair market value is the standard used to ensure market participants remain compliant with key regulatory statues.

Key Drivers of Transaction Activity

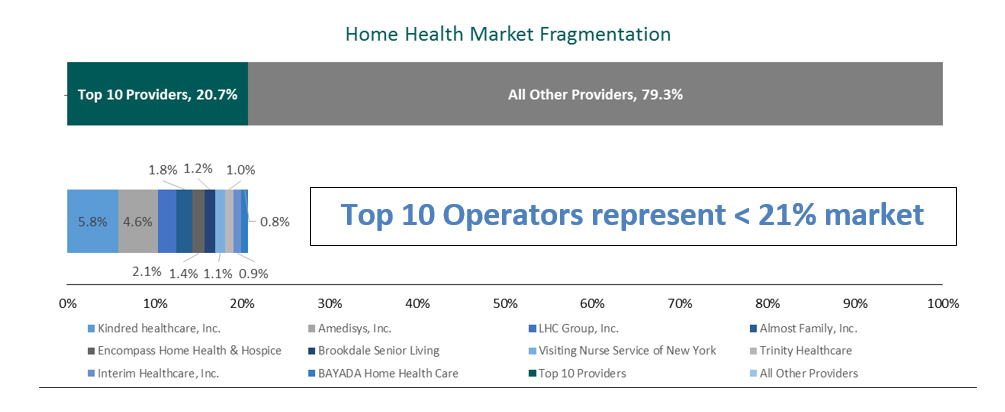

The home health services industry can be characterized as highly fragmented, where above-average growth potential is challenged by profit margin pressures. As broadly defined, the $88.8 billion home care industry is estimated to be growing 6.7% per annum[2]. Within this large sector, home health services are estimated to comprise approximately $22.1 billion[3] which includes 3.4 million Medicare beneficiaries that received $17.7 billion of episodic care in 2014[4]. With over 12,400 Medicare – certified home health agencies[5], the top ten operators represent less than 21% of the market and the largest operator (Kindred Healthcare[6]) has a 5.8% market share[7]. The following chart is representative of the market’s fragmentation.

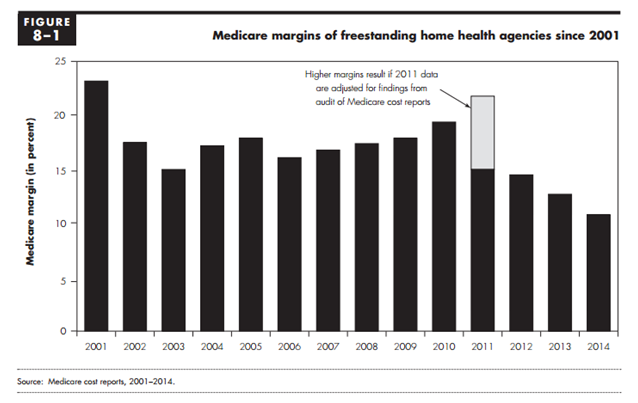

To the detriment of the vast number of smaller agencies, scale is becoming increasingly important to withstanding reimbursement and compliance headwinds. Since the rebasing of the Medicare payment system in 2010 as a result of the Patient Protection and Affordable Care Act, reimbursement for home health services have been negatively impacted.[8] More recently, CMS’s final rule for 2017, after all policy changes, continued the downward reimbursement trend for home health services resulting in a net reduction of approximately 0.7%[9]. Starting in 2017, CMS also updated its Conditions of Participation (CoP)[10] to include additional communication, coordination and documentation requirements. These increased compliance standards are causing some operators to lose revenue opportunities if they do not make investments in information and communication technology. As a result of these changes, Medicare margins of freestanding home health service agencies has declined as indicated in the following chart.

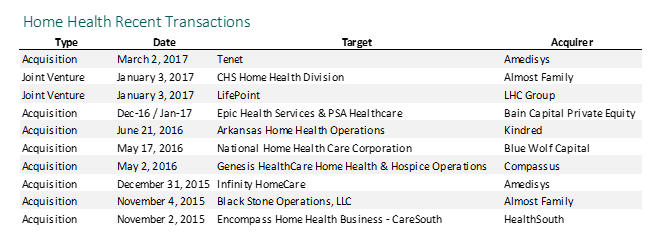

Notable Recent Transactions

While transaction activity amongst independent operators has been more prevalent, recent announced deals and market participant commentary suggests health systems are becoming more engaged. Reasons for increased health system participation vary from the ability to drive population health initiatives to removing (i.e. divesting) or improving (i.e. partnering) non-core businesses which may or may not be profitable inside the larger organization. In any case, heath systems are becoming more interested in supporting the well being of their patients both within and outside the hospital setting.

During 2016 two of the largest publicly traded home health operators in the nation, Almost Family (NASDAQ: AFAM) and LHC Group, Inc. (NASDAQ: LHCG), acquired home health and hospice operations by entering into partnerships with health systems. In October 2016, Almost Family announced a partnership with Community Health Systems (NYSE: CYH) by acquiring 80% of its home health business for $128 million. In a recent Almost Family investor presentation, management indicated joint ventures are increasingly becoming an important “go-to market” strategy in post-acute.[11]

Likewise, in November 2016, LHC Group, Inc., announced it would partner with LifePoint Health (Nasdaq: LPNT) to jointly own and operate home health and hospice agencies. LHC Group’s CEO Keith Meyers made the following comment on March 9, 2017, during the Q4 2016 earnings conference call:

“We continue to evaluate a robust pipeline of potential joint venture and freestanding transactions…So the robust pipeline that we’re talking about now is a pipeline that has opportunities that look similar to that of Lifepoint. Different sizes, but what’s changed for us is the hospitals and health systems used to come to us primarily one-offs in the pipeline, so one stand-alone hospital. And some of them were big, but it was just one. Now we seem to have got to a level where we have a healthy mix of systems that are involved. So in one transaction, you have multiple hospitals that you’re bringing on.”

LHC Group has a long history of strategic partnerships with health systems. With the newly formed joint venture with LifePoint, LHC Group now has 150 joint ventures under management. During the Q4 2016 earnings conference call, Keith Meyers commented on a continued joint venture focus:

“Historically, our geographic expansion has primarily focused on 19 Certificate of Need States that are favorable for freestanding agencies. In fact, about 80% of our home health locations are in these Certificate of Need States. However, through our joint venture partnership with hospitals and health systems, we can operate very effectively in any market and as a result, are focused on hospital and health system joint venture expansion in all 50 states.”

While some health systems are engaging in partnership activities, others are outright selling their non-core home health business lines. Shortly after CHS announced its deal with Almost Family, Tenet Healthcare (NYSE: THC) announced it had entered into a letter of intent to sell home health and hospice businesses. Additionally, at a recent Barclays Global Healthcare Conference[12], Benjamin Breier, CEO of Kindred Healthcare, Inc. stated the following:

“I think that referral sources are having to decide whether they want to be in that business or not. I mean, I think if you just look over the last 6 months, you’ve seen the — at least I think the 3 of the 4 largest for-profit hospital companies have also left all of their home health and hospice assets…they didn’t want to be in those businesses. You have others that, I think, see a lot of the same growth characteristics that we talked about and would like to get into it…I would say, over the last 6 months or more, it seemed like they’re getting out of it more than they are necessarily getting into it.”

In summary, there appears to be an increasing interest from health systems to either partner or exit the home health business. In either case, market commentary suggests health systems are interested in enhanced post-transaction relationships (whether co-invested or not) and are being selective to find the right partner. In addition to the larger transactions referenced, there continues to be a steady amount of consolidation by for-profit operators with all public operators referencing their backlog of potential transaction targets.

Fair Market Value Considerations

Market participants must consider whether the key acquisition or joint venture terms are consistent with fair market value. In addition to appeasing Stark and Anti-kickback regulations, the fair market value standard helps to protect tax-exempt organizations from private increment issues.

A home health valuation is driven by several factors. Based on our experience, the following should be considered:

- Competition

- Regulatory environment (i.e. Certificate of Need or ability to receive Medicare license)

- Size as measured by revenue

- Payor mix

- Profitability

- Top and bottom line growth potential

- Ability for any third-party operator to improve operations

- Reputation and quality of services

- Affiliations or associations

- Key post-transaction terms and conditions

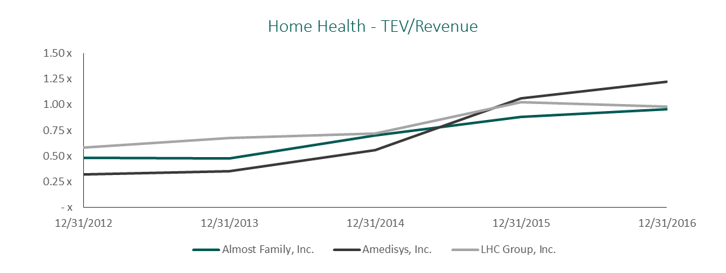

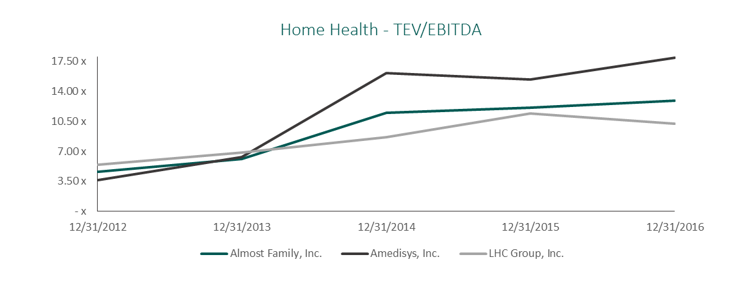

Market multiples for home health agencies continue to be strong. We tend to observe use of revenue and / or EBITDA multiples by market participants when evaluating potential acquisitions or joint ventures. The chart below references these multiples[13] for the public home health companies. It should be noted that these organizations are large and diversified and the implied trading multiples are not applicable for single stand-alone agencies.

Outlook of Home Health Industry in 2017

The outlook for home health transactions during FYE 2017 is strong. The observed industry fragmentation and growing importance of home health as a preferred patient destination will continue to create robust joint venture and acquisition opportunities. In addition to the health system transactions referenced, there continues to be a steady amount of other activity by specialized for-profit operators. We fully expect these specialized operators to be more aggressive in pursuing growth strategies to align with local health systems or execute upon market consolidation strategies. The specialized home health operators can manage staffing costs and quickly adapt to a more compliant-driven, lower reimbursement environment and will fare better than other operators.

Sources:

[1] Irving Levin Associates estimates for 2016.

[2] Based on National Health Expenditure Accounts (NHEA) Home Health Care information and The Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS), 2016-2025 projection. Covers medical care provided in the home by freestanding home health agencies (HHAs). These freestanding HHAs are establishments that fall into NAICS 6216-Home Health Care Services. This industry comprises establishments primarily engaged in providing skilled nursing services in the home, along with a range of the following: personal care services; homemaker and companion services; physical therapy; medical social services; medications; medical equipment and supplies; counseling; 24-hour home care; occupation and vocational therapy; dietary and nutritional services; speech therapy; audiology; and high-tech care, such as intravenous therapy.

[3] VMG estimate assumes 80% of total home health provider services are spent by Medicare ($17.7 billion in 2014, see footnote 4).

[4] MedPac Report to Congress: Medicare Payment Policy | March 2016.

[5] Ibid.

[6] Kindred’s acquisition of Gentiva in 2015 positioned the organization as the largest operator of home health services.

[7] LexisNexis 2015 Home Health Agencies Ranking.

[8] MedPac, A CMS audit in 2010 suggested agencies overstated expenses in their cost reports to Medicare. Since 2001, Medicare has been basing their fee-for-service reimbursement to home health agencies, in part, using a mark-up on cost assumption. Due to the results of the CMS audit, Medicare implemented an annual rebasing reduction to home health reimbursement. These rebasing adjustments have be partially offset by annual payment updates each year in 2014-2017. Additionally, CMS has increased their scrutiny on home health service fraud and abuse through various regulatory and compliance standards since the CMS audit.

[9] October 31, 2016, AHA News Now, CMS releases home health final rule for CY 2017.

[10] A set of standards which agencies must comply in order to get paid by Medicare.

[11] 35th Annual JP Morgan Healthcare Conference, January 2017, page 8 of presentation materials.

[12] March 14th, 2017, Barclays Global Healthcare Conference – Benjamin Breier, Chief Executive Officer, Kindred Healthcare, Inc.

[13] Source CapitalIQ & Public Filings as of 12/31/2016.