Written by Quinn Murray and Ed McGrath

Not-for-profit health systems nationwide are experiencing material financial pressures as the industry recovers from the impact of the COVID-19 pandemic. Now providers are faced with the difficult task of adjusting to the new challenges that healthcare systems are experiencing in 2022. The VMG Health Strategic Advisory Services team works primarily with not-for-profit systems, which is one of the reasons we decided to complete this report and the associated analytics. A consistent theme in this study finds that few organizations have been immune to material declines in financial and operational performance in 2022. This performance is not sustainable for the long term.

In addition to the costs associated with labor, supply, purchased services, and other inflation pressures, not-for-profit healthcare systems are also experiencing increased competitive threats. These threats are coming from niche players supported by private equity and other financially backed organizations that are typically focused on more profitable commercial business instead of serving all, which is the historical tradition of not-for-profit healthcare systems.

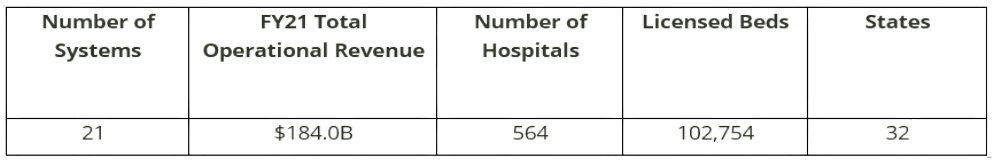

This report is based on data from publicly available sources and represents a statistical sample size of various organizations across the nation, but with that said, our findings may not be applicable in all markets. However, the organizations reviewed for this report represent a large cross-section of not-for-profit health systems in the country. The composition of these systems is summarized below.

On a combined basis, the 21 systems analyzed as part of this study represent $184 billion in total operating revenue for fiscal year 2021. A significant portion of this total was generated from the systems operating 560+ hospitals with approximately 100,000 beds across 32 states.

Other advisory firms have also noted recent declines in industry performance. The contributing factors identified by other firms are wide-ranging, some of which are consistent with the findings of this report.

For example, KaufmanHall reported in September 2022 that for the first six months of CY 2022, hospital operating margins declined 100% compared to 2019 before the pandemic. In addition, KaufmanHall noted the number of hospitals with negative margins in 2022 is projected to be greater than pre-pandemic levels since hospital margins continue to be consistent with, or worse than, 2020 levels.

Another example from RevCycleIntelligence from July 2022 cited survey results from over 200 CFOs of health systems and large physician groups. The results indicated that only 8% reported they were on track to exceed 2022 goals. Additionally, RevCycleIntelligence noted hospitals and health systems are experiencing increases in volumes and patient revenues. Research completed for this report is consistent with the findings noted in the RevCycleIntelligence article.

As noted, the factors driving poor financial performance in 2022 are wide-ranging. Discussions with management for purposes of this report have indicated that some of the issues include the following:

- Contract Labor – Many VMG Health clients have been successful in managing contract labor costs due to reductions in hourly rates. Others are reducing clinical capacity, including beds, to minimize travel and agency staff needs.

- Employed Staff Labor Costs – In order to attract and retain staff during increased market pressures and demand, systems are implementing pay raises well above traditional industry norms. Based on our research, this is expected to continue going into 2023. Conversations with the management of various systems included in this report indicate planned salary increases of 4% to 8% in 2023.

- Medical and Other Supplies – Recently, systems have experienced material increases in the cost of goods purchased and services purchased by these systems. The calendar year 2023 expectations from VMG Health clients indicate planned increases of approximately 6% or greater, which would be materially higher than traditional industry norms.

- IT and Other Support Services – Beyond clinical staff, market competition also exists for IT and other support staff who are in short supply. This is another contributing factor driving up the cost for health systems.

- Medical Malpractice – As a result of cases being delayed for the greater parts of 2020 and 2021, clients are beginning to experience increased malpractice activity from cases during this time period. This is leading to increased malpractice costs which are rising to levels that may have not been anticipated.

Key Findings & Conclusions

The findings and forecast based on this report do not necessarily paint a pretty picture for not-for-profit systems. While our research is focused on healthcare systems, VMG Health’s experience with standalone hospitals in 2022 also indicates, in most cases, financial performance is weaker than what is being reported for several other systems.

Of the 21 systems analyzed for this report, in calendar year 2022, 16 are reporting negative operating margins (75+%). The other five are reporting breakeven or very minimal operating margins. Each of these systems reported positive FY 2019 operating margins before the pandemic.

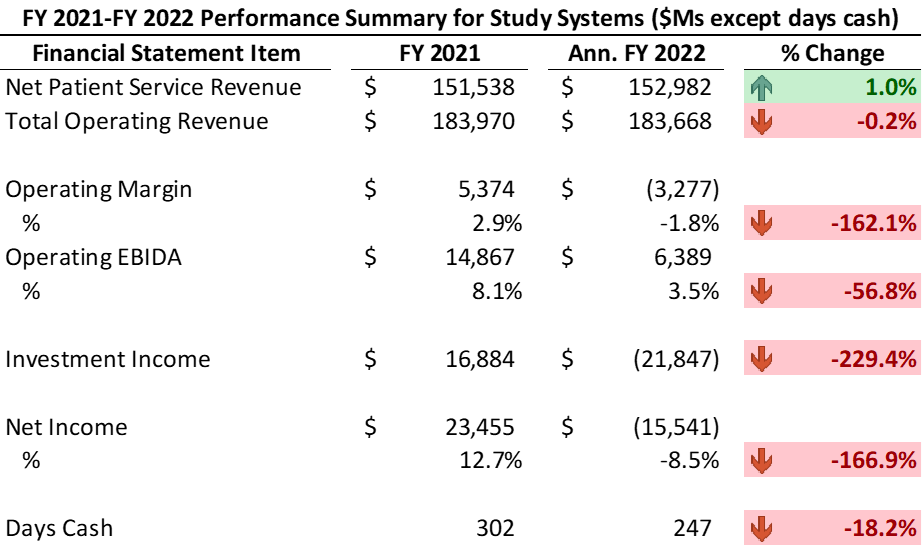

The range of the operating margin declines in 2022 as compared to 2021 and/or pre-pandemic levels approximates from 4.0% to 7.0%. In other words, if the operating margin was a positive 2.0% in 2021, then the 2022 operating margins will likely approximate between -2.0% to -5.0%. Likewise, operating EBIDA for these systems has deteriorated materially to approximately 3.5% of total operating revenue in comparison to 8.0% in 2021 before the pandemic.

Similarly, these systems have experienced a significant decline in days cash, specifically in 2022, approximating -18% from 2021. The systems have also experienced material losses from investment income in 2022. Recognizing this mostly includes unrealized losses, these systems reported investment losses of approximately negative -$22 billion on a combined basis.

Summary Performance Results from FY 2021 to Annualized FY 2022

Negative operating margins in addition to poor investment performance (and other non-operating activity for certain organizations) are driving declining cash balances. 2022 performance indicates systems reporting somewhat material declines in days cash on hand. These 21 systems are reporting a 15% to 25% decline in days cash with an average of an 18% decline from fiscal year-end 2021.

As an additional consequence of the material losses, especially for smaller systems, debt service coverage ratio (DSCR) covenants may not be met. Most of the systems included in this report have the cash reserves necessary to avoid procedural requirements relative to the days cash covenant in their bond agreements, and this includes taking into account the poor 2022 performance.

Organizations in 2023 may be required to develop a financial improvement plan outlining the recovery path to fulfilling the DSCR covenant in a subsequent fiscal year. In many cases when a bond covenant such as DSCR is not met, systems are required to hire management consultants to report on their opinion relative to the likelihood the system can meet the DSCR threshold in the near term.

VMG Health recently completed one of these assignments for a large hospital in the northeast. Based on this assignment and discussions with others, based on 2022 performance it appears other organizations will unfortunately need this type of study completed by experts such as VMG Health.

Areas of Consideration – Initiatives to Address the Impact of 2022 and Beyond

It is clear most organizations will not be able to shrink their way to success, and over time, strategic growth is imperative to long-term success. The following are example actions either undertaken or being contemplated by VMG Health clients to address recent performance:

- Addressing care management issues to better utilize limited clinical care resources.

- Increased focus on APP utilization to the max of their skill levels.

- Enhance utilization of scarce clinical staff resources.

- Digital care to increase patient access at a lower cost.

- Expansion of remote monitoring and other vehicles to reduce more expensive utilization.

- Expansion of hospital-at-home services.

- Assessment of the value proposition of employed/aligned medical groups.

- Identification of how best to maximize the group size, strength, and the system’s investment in the group.

- Contract negotiations with managed care payors.

- Will likely be difficult to obtain increases that will address inflation pressures.

- Strategic assessments of existing operating assets/investments.

- Reevaluation of the continuation of existing service lines.

- Closure and/or sale of hospital assets in non-strategic markets.

- Disposition of unprofitable ventures that are no longer strategically imperative.

- Reassessment of the need for existing real estate and/or MOBs.

- Evaluation of the potential sale of other non-core assets.

- Operational improvements.

- Reducing bed and other capacities to match available non-agency/travel staff.

- Identifying opportunities to improve revenue cycle efficiency.

- Staff modifications, primarily in non-clinical areas.

- Acquisition of organizations that are struggling.

- Based on discussions with VMG Health clients, systems are being more diligent relative to making investments in new facilities.

- Partner/affiliate with other systems for non-clinical services.

- Example areas include IT, revenue cycle, cybersecurity, analytics, and others to improve cost efficiency and reduce potential future investments.

- Price transparency.

Summary

Not-for-profit healthcare systems are experiencing extreme challenges in 2022. Based on conversations with many of these organizations and other clients, this is unlikely to improve materially in 2023. Not-for-profit hospitals and systems need to explore other innovative avenues to work smarter and more efficiently so they can be well-positioned for success in the future. VMG Health has a history of experience developing long-term relationships with clients through providing assistance across a variety of areas. These areas primarily consist of financial and strategic related assistance, which has prepared and positioned VMG Health to provide support and insight to not-for-profit hospitals and health systems. As we continue to assess the not-for-profit landscape, VMG Health has the experience to add value and help systems address some of the issues outlined in this report.

The assistance VMG Health’s experts are able to provide can take many forms. Some examples are:

- Medical Group Transformation

- Bond Covenant Repair Reports

- Financial Projections

- Service Line Planning

- Revenue Cycle

- Performance Improvement

- Mergers and Acquisitions

Sources

- Muoio, Dave. (August 29, 2022). July’s hospital margins were among the worst of the pandemic, Kaufman Hall says. Fierce Healthcare.

- LaPointe, Jacqueline. (July 7, 2022). Healthcare Revenue Falling Short of 2022 Goals for Many Providers. RevCycleIntelligence.

- Kaufman, Kenneth. (September 21, 2022). The Sobering State of Hospital Finances. KaufmanHall.