Akumin is a nationwide provider of outpatient radiology and oncology services to approximately 1,000 hospitals and health systems across 47 states. On October 20, 2023, Akumin announced the commencement of a restructuring process to delist themselves from the NASDAQ Stock Exchange and filed for Chapter 11 bankruptcy two days later. Within less than six months, on February 8, 2024, the company officially concluded the reorganization process, emerging as a private company under one of its major lenders, Stonepeak Capital.

Background

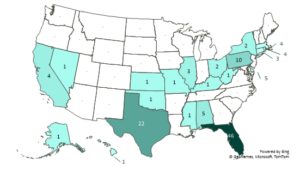

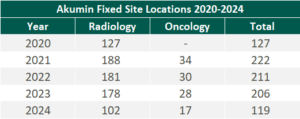

Akumin has over 3,500 employees, services approximately 1,000 hospitals and health systems across 47 states, and has approximately 120 fixed site radiology and oncology locations nationwide. Akumin’s multi-modality fixed site imaging locations offer a one-stop-shop for patients. Services include magnetic resonance imaging (MRI), computed tomography (CT), position emission tomography (PET), ultrasound, diagnostic radiology (X-ray), and mammography.

Akumin appears well-diversified in terms of its business line, geography, modality offerings, and payer mix. Its revenue is primarily generated by its net patient fees from third-party payers and patients, and revenue stemming from contractual agreements with hospitals and healthcare providers.

Acquisitions for Growth

Riadh Zine founded Akumin in 2014 to provide quality outpatient radiology services to patients, health systems, physician groups, and hospitals nationwide. After announcing its listing on the NASDAQ Stock Exchange in 2020, Akumin’s primary focus was to grow its operations into new markets throughout the United States. In 2021, Akumin took significant steps toward expanding its business nationwide. On September 1, 2021, Akumin announced the acquisition of Alliance Healthcare Services, Inc. from Thaihot Investment Co., Ltd., for a total purchase price of approximately $786 million. This acquisition allowed Akumin to further expand its operations across the country and initiate its oncology business. The transaction was financed through a mix of cash on hand, debt, and equity, with approximately $715 million of proceeds being funded through an issuance of senior secured and unsecured notes.

In addition to the acquisition of Alliance, Akumin acquired several outpatient diagnostic imaging centers, acquiring six imaging centers in Florida on May 1, 2021, with cash considerations of $34 million and $3 million through an issuance of 974,999 shares of common stock. Akumin also acquired one additional center in Florida on May 1, 2021, and three centers in Massachusetts on June 1, 2021, for cash considerations totaling $1.3 million.

Akumin’s Downfall: Post-Acquisition Struggles

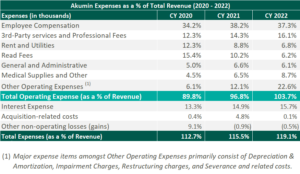

This series of strategic acquisitions in 2021, with the goal of revenue growth and operational expansion, failed to materialize into profit as several factors negatively impacted the business, forcing Akumin to incur significant losses post-acquisition. Despite increasing revenue growth following COVID-19, Akumin continued to struggle to gain operational efficiencies due to the rising cost of operations and outside factors. These rising costs were driven by higher employee compensation, third-party services and professional fees, and other acquisitions.

Outside of its primary operating expenditure, Akumin incurred several, one-time expenses that affected its profitability. In 2022, Akumin incurred an impairment charge of $46.5 million in goodwill impairment related to its oncology reporting unit, and a $16.6 million restructuring cost consisting of an incremental transformation and lease termination costs.

Because the business had incurred debt from the Alliance acquisition, interest expenses increased 89% from 2021 to 2022, with approximately $118 million dollars being paid to its lenders in 2022. These additional, non-operating expenses further affected Akumin’s profitability. Akumin eventually incurred a net operating loss carryforward of approximately $225 million, which was then reported as $686 million for tax purposes.

COVID-19 was also a major factor in Akumin’s struggle as it impacted its revenue and costs. In the post-COVID environment, labor shortages led to increased labor costs. This combined with clinical labor shortages limited Akumin’sability to grow its business in its existing locations nationwide. Additionally, supply chain issues caused numerous equipment delays, limiting Akumin’s growth in its newly acquired locations while also resulting in higher costs to its operations.

On October 11, 2023, Akumin fell victim to a ransomware attack that targeted and exposed confidential personal information. The ransomware attack affected Akumin’s operations, resulting in an incursion of additional losses to the business.

Reorganization Process

On July 10, 2023, the board established a special committee of independent directors tasked with negotiating with Stonepeak Capital, Akumin’s primary lender, on a restructuring process. Through months of negotiations between Akumin and its stakeholders, the committee approved to proceed with a restructuring support agreement and with a Chapter 11 bankruptcy process. The goal was to restructure Akumin’s debt obligations and satisfy its stakeholders while maintaining Akumin’s ability to operate its normal course of business post-bankruptcy.

Parties involved in the restructuring support agreement include:

- Holders of at least 69.9% of outstanding principal of 2025 secured notes

- Holders of at least 79.9% of the outstanding principal amount of 2028 secured notes

- 100% of Revolving Credit Facility (RCF) lenders

- Shareholders who own approximately 34.2% of Akumin’s common stock

Throughout the bankruptcy process initiated on October 22, 2023, Akumin negotiated for a balance sheet restructuring procedure known as the Prepackaged Plan. At the prepetition date, Akumin held approximately $1.4 billion in total funded debt, which consisted of $55 million in revolving credit facility, 2025 and 2028 Secured Notes of $475 million and $375 million, respectively, and $469 million worth of Series A Notes. With the Prepackaged Plan proposal, Akumin initiated a recapitalization transaction for the deleveraging process. To the benefit of all stakeholders, Akumin’s notes were replaced with new capital funding. Details of the Prepackaged Plan include the following for the reorganization transaction process:

- Prepetition 2025 Notes will be canceled and replaced with Prepetition 2027 Notes.

- Prepetition 2028 Notes will be canceled, and holders will receive new 2028 notes with additional covenants.

- Prepetition RCF facility will be amended and/or canceled and replaced with a new RCF facility with amended covenants.

- Prepetition Series A Notes will be converted into 100% common stock.

- Consenting Investor (Stonepeak) must provide the reorganized debtors with $130 million of new capital and provide $25 million additionally, distributed on a pro rata basis to all other holders of existing Common Stock.

With the support of Akumin and its stakeholders, the Prepackaged Plan was ultimately approved by the Bankruptcy Court on February 6, 2024.

Go-Forward Expectations

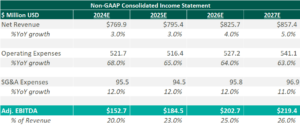

Akumin’s financial projections estimate a total of $769.9 million in net revenue by the end of 2024, with total revenue projected to reach $857.4 million by 2027. During the projected 2024 period, adjusted EBITDA is projected around 20% of total revenue, or $152.7 million. By 2027, EBITDA margin is expected to be around 26% of total revenue, or $219.4 million. The financial projections assume that the company will be able to execute approximately $50 million of new equipment financing each year throughout the projection period.

Balance sheet projections and assumptions on capital structures are all reflective of the Prepackaged Plan. The forecasts assume that the $845.6 million of funded debt will consist of approximately $402 million and $375 million in 2027 and 2028 Notes, respectively, and $77.3 million of equipment financings from both equipment debt and equipment finance leases.

Conclusion

In February 2024, Akumin successfully emerged from bankruptcy having deleveraged from $470 million in debt and under full ownership of Stonepeak Capital. Akumin has made significant steps towards its post-Chapter 11 recovery, having partnered with Sierra Medical Center in Nevada to continue its strategy of expanding its specialized radiology and oncology services into new markets nationwide. With an improved capital structure and new ownership, Akumin anticipates continuing its growth as a leading provider of outpatient radiology and oncology services nationwide, working to continue meeting expectations and maintaining financial stability.