- About Us

- Our Clients

- Services

- Insights

- Healthcare Sectors

- Ambulatory Surgery Centers

- Behavioral Health

- Dialysis

- Hospital-Based Medicine

- Hospitals

- Imaging & Radiology

- Laboratories

- Medical Device & Life Sciences

- Medical Transport

- Oncology

- Pharmacy

- Physician Practices

- Post-Acute Care

- Risk-Bearing Organizations & Health Plans

- Telehealth & Healthcare IT

- Urgent Care & Free Standing EDs

- Careers

- Contact Us

ASCs in 2020: A Year in Review

March 3, 2021

Written by Jack Hawkins & Colin Park, CPA/ABV, ASA

2020 was a unique year for the healthcare industry as it experienced a once in a lifetime event. While the healthcare market as a whole was tremendously impacted by the coronavirus (“COVID-19”) pandemic, the Ambulatory Surgery Center (“ASC”) sub-industry was acutely impacted due to interruptions in normal operations caused by the pandemic. Along with a major, multi-site, transaction in the ASC market in 2020, the fragmented ASC industry continued to consolidate. For ASC’s, we have continued to see the continuation of certain trends from 2019 through 2020: the shift of higher acuity procedures from the inpatient setting to the outpatient setting, increased Medicare reimbursement rates, consolidation, and increased activity by hospitals seeking to grow their ambulatory footprint with a particular focus on ASCs.

COVID-19 Pandemic

For a detailed, macroeconomic analysis on the impact of the COVID-19 pandemic on healthcare M&A, please see VMG Health’s Healthcare M&A Report.

In 2020, we saw the outbreak of the coronavirus COVID-19 pandemic impact the entire world. What first and foremost was a global health crisis, the virus quickly resulted in an unprecedented socio-economic crisis as well. First detected in December 2019, the virus has now spread to over 200 countries, and was characterized as a pandemic by the World Health Organization on March 11, 2020.

The pandemic spared very few industries, the least of which being healthcare, requiring an immediate response by health systems and hospitals around the world. Acute care hospitals across the country were strained for capacity. While all surgery centers were impacted, the duration and severity were mixed based upon a number of factors. Overall, a decline in expected ASC procedure volume was observed. Geographic location of the ASC was the prominent factor impacting volume early during the pandemic —depending on infection rates, local government restrictions, and market-specific healthcare capacity, centers had to react differently in different regions. During the first several months of COVID-19, 100% of ASCs stopped elective surgeries, 73% stopped semi-elective surgeries, and 33% stopped non-elective surgeries. This led to different durations of cash flow disruption created by lower volume levels across the board for ASCs, along with increased levels of bad debt, and restructured staffing models.

On March 27, 2020, Congress passed the third COVID-19 Emergency Supplemental package, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, totaling over $2.2 trillion in relief. The stimulus package addressed topics such as healthcare delivery, state funding, small business and non-profit relief, and overall economic stimulus. Further, the US Department of Health & Human Services (HHS) allocated

an additional $20 billion in grants to Medicare providers including ASCs on April 24, 2020. Both relief efforts allowed qualifying ASCs to receive government funding for coronavirus aid.

Once ASC operations could resume, pent up demand for procedures impacted the centers, with generally higher levels of volume observed in Q3 of 2020 compared to prior quarters. While all specialties were impacted by lower levels of volume, we saw centers that were high in Gastroenterology (“GI”), Ophthalmology, and Pediatric Otolaryngology (“ENT”) impacted the most. Generally these procedures were considered more elective, along with a patient population less likely to schedule procedures during and even after peak COVID infection rate periods. Additionally, GI and Ophthalmology have a more elderly population in comparison to other specialties that has resulted in a slower recovery in volume. Lastly, ENT has appeared to have a slower recovery due to the decline in common infections in children and the concern of parents surrounding COVID transmission.

Longer term impacts of the pandemic include potential rescheduling of delayed elective cases, the impact of local and macroeconomic conditions to a recovery of procedure volumes at ASCs and patient payor mix, and centers requiring additional credit facilities, financial restructuring or an outright sale in order to continue operations during depressed revenue generating periods.

Transaction Activity

In 2020, we saw a prominent mega-merger/platform level transaction, as well as a lower number of transactions at the individual-facility level than seen in prior years. Along with the larger platform-level transaction, the fragmented ASC industry has continued to consolidate. It is worth noting that although the industry continues along the trend of consolidation, approximately 72% of ASC facilities remain independent, leaving room for further consolidation at the individual-facility level. M&A activity during the majority of 2020 was largely stifled due to Covid-19.

On December 10, 2020, Tenet Health announced the acquisition of 45 ASCs from SurgCenter Development for $1.1 billion in cash and the assumption of approximately $18 million of center-level debt. The 45 surgical facilities were added to Tenet’s ambulatory business, United Surgical Partners International (“USPI”), bringing the total number of facilities operated by USPI in the US to 310 (inclusive of surgical hospitals). USPI will have up to 60% ownership in the acquired centers, acquiring SurgCenter Developments’ ownership interest and additional interest from physicians in the deal. The transaction was billed by Tenet leadership as transformative, with facility case mix weighted towards musculoskeletal procedures (orthopedics, spine, and pain) that “cements Tenet’s position as preeminent national musculoskeletal services leader across care continuum” as stated in a Tenet Health press release. As a result of the transaction, USPI will enter new markets in Maryland, Indiana, and Ohio, as well as expand the company’s reach in Arizona, Florida, and Texas, where it already owns centers. Tenet expects adjusted EBITDA from its ambulatory business to be approximately 42 percent in 2021, up from 33 percent in 2019 and 25 percent in 2016 of total EBITDA.

“This is a transformative transaction within our stated strategy to expand our ambulatory platform. It will enhance our overall business mix and further diversify our earnings profile by accelerating our shift toward lower cost of care, consumer-friendly, faster-growing assets for Tenet, USPI and our physician and health system partners.”

Ron Rittenmeyer, Executive Chairman & CEO

The ASC marketplace continues to be an active transaction arena as major operators look to consolidate and look for new opportunities in this space. Although the ASC industry has been temporarily impacted by the COVID-19 pandemic, the role of ASCs in their ability to generate consistent, distributable cash flows, and their contribution to lowering the cost of care in the U.S. will allow ASCs to remain attractive targets over a long-term investment horizon. The disruption in M&A activity within the space in 2020 as a result of the pandemic is expected to result in enhanced activity in 2021.

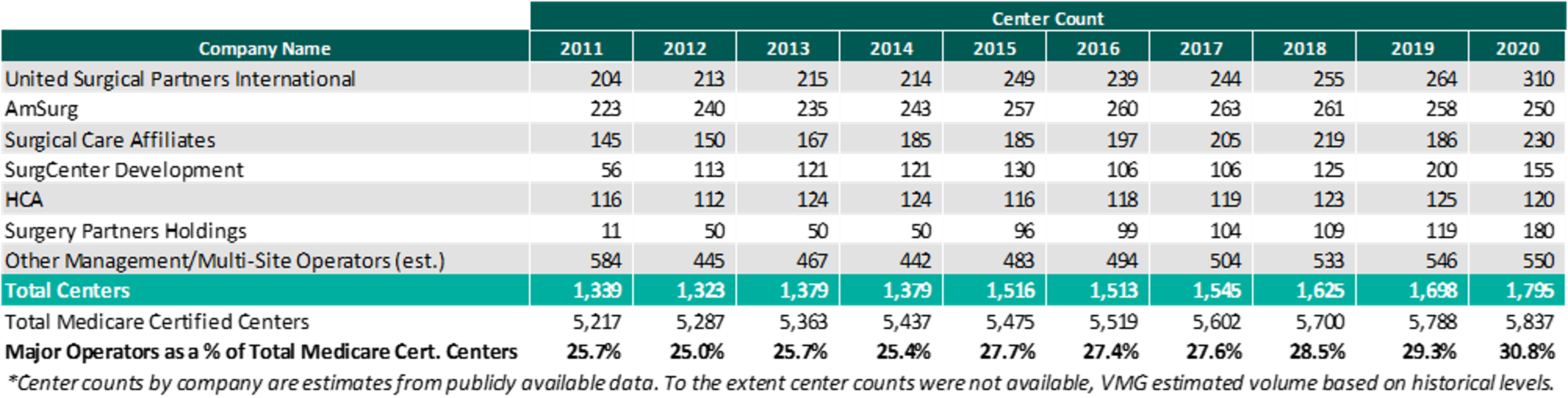

As of December 31, 2020, the largest operators (in terms of number of ASCs) are United Surgical Partners International (“USPI”), Envision Healthcare/Amsurg Corporation, and Surgical Care Affiliates (“SCA”), with ownership of approximately 310, 250, and 230 ASCs, respectively. As noted in the chart below, the number of total centers under partnership by a national operator, as a percentage of total Medicare certified centers, saw an increase from 2019 to 2020 growing from approximately 5,788 centers to 5,837 centers. Additionally the top 5 management companies have increased the number of centers under management by approximately 490 centers since 2011, which represents a compound annual growth rate of 5.1%. As management companies have increased in size, they are able to increasingly provide a greater level of strategic value by bringing greater leverage with commercial payors, enhanced management and reporting capabilities, and improved vendor contracts to acquisition targets.

Reimbursement

On November 1, 2019, the Medicare reimbursement fee schedule for ASCs in 2020 was finalized by the Centers for Medicare & Medicaid Services (“CMS”). For CYs 2019 through 2023, CMS will update the ASC payment system using the hospital market basket update, rather than the Consumer Price Index for All Urban Consumers (“CPI-U”). CMS published the 2020 ASC payment final rule, which resulted in overall expected growth in payments equal to 2.6% in CY 2020. This increase is determined based on a hospital market basket percentage increase of 3.0% less the multifactor productivity (“MFP”) reduction of 0.4% mandated by the ACA. Moreover, the ASC payment final rule for CY 2021 was released by CMS on December 2, 2020, and the rate will increase by 2.4% in CY 2021. This increase is determined based on a hospital market basket percentage increase of 2.4% less the MFP reduction of 0.0% mandated by the ACA. The ASC industry sees the 2020 and 2021 reimbursement increases as a win as CMS continued to follow its proposal to align update factors, moving ASCs to the hospital market basket which historically was used to update HOPD payments. Under the final rule, CMS will use the hospital market basket to update ASC payments through CY 2023.

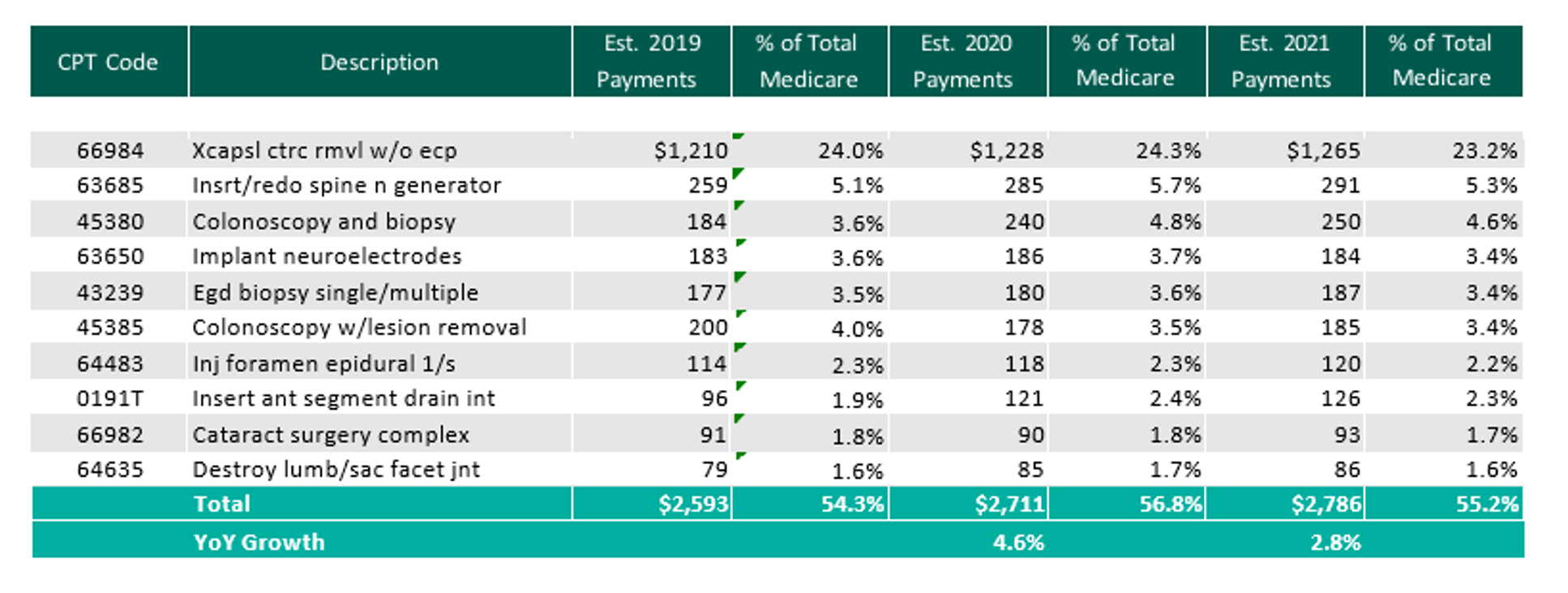

The table below reflects a summary of the estimated Medicare ASC payments for 2019, 2020 and 2021 for the top 10 CPT codes performed in ASCs in 2020. As noted below, the estimated 2021 payments by Medicare for the top 10 CPT codes for 2020 is projected to increase 2.8% through the estimated 2021 payments.

Procedures

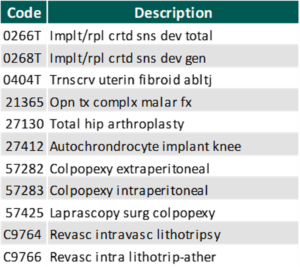

On November 1, 2019, CMS released the 2020 OPPS and ASC Payment System final rulings, which finalized the addition of 8 CPT codes to the ASC-Payable List, meaning they are eligible for Medicare payment in the ASC setting in 2020.

In addition, CMS released on December 2, 2020 the addition of 11 procedures to the ASC covered procedures list (CPL), most notably including total hip arthroplasty (hip replacement surgery). Additionally, CMS revised the criteria used to add covered surgical procedures to the ASC CPL. Under the revised criteria, CMS is adding an additional 267 surgical procedures to the ASC CPL beginning in CY 2021.

With the addition of the new codes and the final ruling for increases to ASC payments by CMS as well as the recovery from Covid-19, it would be expected that total Medicare ASC payments in 2021 would increase compared to 2020. Ultimately, CMS has projected total ASC payments in 2021 to increase approximately $120 million from 2020 payments, to be approximately $5.42 billion. The source of the increase in payments is a combination of enrollment, case-mix, and utilization changes. It should also be noted that CMS reduced the device intensive threshold for ASC procedures to 30% for CY 2019 and subsequent years.

In conclusion, we are continuing to see themes from 2019 play out in 2020 and into 2021. As a whole, the ASC market weathered the COVID-19 storm and was able to recover relatively quickly. The expectation is that there will be further consolidation within the ASC market with the potential for an increase in involvement by private equity companies. At the center level, higher acuity case volume will continue to shift from the inpatient setting further cementing the ASC as the low-cost, efficient alternative to the hospital setting.

Categories:

Subscribe

to our blog