Insights into Healthcare Provider Compensation Trends for 2024

Christa Shephard

March 4, 2024

Effective October 8, 2024, Carnahan Group has joined VMG Health. Learn more.

May 8, 2024

Written by Christa Shephard, Maureen Regan

Physician assistants (PAs) and advanced practice registered nurses (APRNs), like nurse practitioners (NPs), midwives, CRNAs, and clinical nurse specialists, have been around for decades. The first class of PAs graduated from Duke University in1967, and in 1965, the first training program for NPs began at the University of Colorado. Since then, for many reasons, both professions have become integral to the quality delivery of healthcare. Through advanced practice nonphysician provider (APP) integration, patients experience increased access to the healthcare services they need, and they are more satisfied with the care they receive. Physicians experience greater job satisfaction, as APP integration helps to alleviate the burden on overburdened work schedules. Through these benefits, APP integration leads to better patient retention, physician satisfaction, and stronger financial health for practices and health systems overall.

The Centers for Medicare & Medicaid Services (CMS) certainly plays a role in the practice and reimbursement environment of PAs and APRNs; however, most of the legislative and regulatory environment for practice is determined at the state level. Due to the evolution of each profession and the historical and ongoing shortage of physicians, it’s important for health systems and practices to stay abreast of primary source legislative and regulatory guidance changes regarding scope, documentation, and billing compliance. These factors are also important to ensure an employer is capturing maximum reimbursement for clinical work done by both professions while minimizing their risk of an audit and resulting penalties. Systems and practices must uphold an ongoing, longitudinal review of Medical Staff Bylaws, delineation of privileges, policies, and processes.

CMS recognizes qualified billing providers to render services independently and establishes billing and coding rules for APPs to ensure accurate reimbursement and quality care delivery within the Medicare program. These rules outline the scope of practice and reimbursement guidelines for nurse practitioners, physician assistants, certified nurse-midwives, clinical nurse specialists, and certified registered nurse anesthetists. APPs must adhere to specific documentation requirements, including maintaining accurate patient records and submitting claims using appropriate evaluation and management (E/M) codes. Additionally, CMS provides guidance on incident-to billing, which allows certain services provided by APPs to be billed under a supervising physician’s National Provider Identifier (NPI). Understanding and following CMS billing and coding rules are essential for APPs to navigate the complexities of reimbursement and ensure compliance with Medicare regulations.

Because CMS recognizes APPs as qualified billing providers but not as physicians, APPs fall into a separate reimbursement category. When APPs are billing under their own NPI numbers, the reimbursement level is less than what it would be if the physician were to bill for the same services. Physicians may bill for a service that was rendered by an APP with incident-to services and with split/shared E/M services.

VMG Health Managing Director and coding and compliance expert Pam D’Apuzzo says, “There are two rules, which are where everybody gets themselves into trouble… Those two rules have specific guidelines, both from a documentation and a billing standpoint. The patient type, the service type—everything needs to be adhered to.”

To bill for incident-to and split/shared E/M services, practices must meet specific criteria outlined by Medicare. For incident-to services, the criteria include:

For split/shared E/M services, the criteria include:

These criteria ensure that incident-to and split/shared services are billed appropriately and in compliance with Medicare guidelines. Practices must continually educate and train so that they can successfully adhere to these criteria to avoid billing errors and potential audits. Additionally, practices must continuously monitor to ensure all documentation, billing, and coding processes are followed correctly.

There are tools and services that allow for easier monitoring. “We utilize a tool called Compliance Risk Analyzer, which provides us with statistical insight on coding practices,” D’Apuzzo says. “So, we can data mine ourselves and see what’s happening just based on our views. And this is what the payors, specifically, and the government does as well: They can see the [relative value unites] RVUs are for a physician or off the chart, or that a physician has submitted claims for two distinct services at two different locations on the same day.”

This is more common than you might think.

“What’s normally happening in those interactions is that [a doctor with two locations] realizes he can’t keep up with all of that patient flow in two places, so they hire a PA and put them at location number two,” D’Apuzzo says. “But now all that billing goes under the doctor, so it flags for Medicare.”

With VMG Health’s Compliance Risk Analyzer (CRA), practices can see the same data mining and areas of risk, as the program would flag the RVUs as a potential audit risk. This gives practices the opportunity to self-audit and refine their processes to ensure they are billing and coding appropriately.

VMG Health offers multiple comprehensive services that help health systems and practices implement and follow new procedures like APP utilization without issue, from honoring existing care models to ensuring provider compensation is fair, compliant, and reasonable.

Cordell Mack, VMG Health Managing Director, says, “We’ve spent a lot of time trying to make sure we get that right, both in terms of the underlying, practice-level agreements as well as the ways in which the compensation model works for both the physician and the APP.”

In many practices, physicians struggle to handle their case load, which means their busy schedules can prevent them from seeing existing patients when they need services and from taking on new patients. Bringing APPs into the fold allows physicians to offload some of their patient care so that they can see new patients while APPs see more established patients.

BSM Consulting (a division of VMG Health) Senior Consultant and subject matter expert Elizabeth Monroe provides an excellent example: “Let’s say we have an orthopedic surgeon who really wants to spend most of their time in surgery. We would want to have that physician in surgery because that’s what their skill set and licensure permits. With a nurse practitioner or physician assistant providing follow-up, post-operative care, that oftentimes is a much better model. It allows the MD to do the surgical cases only they can do, but it also eases patient access to care.”

This expansion of a physician’s schedule creates an opportunity to provide more patient services, which easily translates to improved patient satisfaction when, without this expansion, they would likely be unable to see their provider when they felt they needed to be seen. While APP-rendered services are reimbursed at 85% instead of 100%, our experts say that missing 15% shouldn’t dissuade practices and health systems from leveraging the APP integration.

“It’s a very short-sighted approach to just think about, ‘But we could be making 100% instead of 85% if we bill under the doctor,’ because ultimately, we are never able to do that 100% of the time, and it’s a higher risk than it is reward,” says D’Apuzzo.

Additionally, physicians with packed schedules and no APP support may inadvertently rush through appointments to see each patient scheduled for that day. Patients who feel rushed may leave an appointment feeling unheard and like their problem is unresolved. Alternatively, when a patient calls and asks for services but can’t be seen for multiple weeks or months, they may never make an appointment and instead turn to another provider for help.

All of this culminates in poor patient retention, which equals a loss of revenue for the practice. Dissatisfied patients will seek better treatment and better outcomes elsewhere. However, when practices and health systems embrace APP support, patients are more likely to be able to schedule appointments when they feel they need to be seen, feel heard in an appointment with an APP who has the time to sit and listen, and even spend less time in the doctor’s office overall, as patient wait times significantly decrease with APP appointments.

“Practices are better able to meet patient demand, and they’re able to really allow physician assistants, nurses… to add a tremendous value for the patients, offering them outstanding care,” Monroe says.

With both patient demand and physician scarcity placing the U.S. health system in crisis, many practices and health systems know they need to integrate APPs into their workflows, but they don’t know how. VMG Health offers strategic advisory services that can guide this implementation to ensure practices are educated, compliant, and working within the care model they prefer.

“Our team would want to spend time really trying to identify the underlying care model that practices are trying to, you know, work inside of,” says Mack.

One approach is to assess patient needs and practice capabilities to determine the most effective roles for APPs, such as providing primary care, specialty care, or supporting services like telemedicine. Implementing standardized protocols and workflows can ensure efficient APP utilization while maintaining quality and safety standards.

Finally, ongoing training, supervision, and quality monitoring are essential to support APPs and ensure their integration into the practice or health system effectively meets patient needs.

“It starts with getting your appropriate documentation in place… [with] supervisory responsibilities and collaborating physician agreements,” says Mack. “It migrates to, ‘What’s the operational agreement among the APP and the doctor?’ and how cases are presented, or how the physician is consulted. So, it’s getting an underlying clinical service agreement among those professionals.”

Optimal APP utilization shows up in the numbers. When practices increase patient access to care without overburdening physicians through APP utilization, they can accommodate more patients, leading to increased revenue generation. Moreover, because APPs often bill at a lower rate than physicians, utilizing them efficiently can improve cost-effectiveness, thereby enhancing the overall financial performance of the practice.

“It should realize an ROI, and that ROI should be something more in terms of duties and tasks that other teammates can’t do,” says Mack. “Meaning, it would be unfortunate if an advanced practice professional is working at such a capacity whereby duties some of the day-to-day responsibilities should probably be done by teammates working at a higher level of their own individual license.”

Changing existing workflows can be difficult, but the rewards heavily outweigh the risks. Physicians must support APP integration to successfully navigate the transition. Physicians are typically the leaders and decision-makers within medical practices, and their support is essential for implementing any significant changes in workflow or care delivery models. Without physician buy-in, resistance to change may arise, hindering the smooth integration of APPs into the practice.

Physicians play a vital role in collaborating with APPs and delegating tasks effectively. By endorsing and supporting the integration of APPs, physicians can foster a culture of teamwork and mutual respect within the practice. This collaborative approach promotes a cohesive care team where APPs work alongside physicians to provide high-quality patient care.

It’s important for physicians to trust that their APPs are qualified and capable of providing excellent patient care. Allowing an APP to care for an established patient does not sever the relationship between the physician and the patient; it can actually enhance the patient’s experience and trust in the practice.

“We want patients who have had a long-standing relationship with an MD to be able to see that doctor, and then we want to help the doctor know and understand how to appropriately transfer care over to an APP within their system or within their practice,” says Monroe. “So, that provider can be still linked to the doctor, and the doctor can still be linked to the patient.”

Furthermore, physician buy-in is essential for maintaining continuity of care and ensuring patients feel confident in receiving treatment from both physicians and APPs. When physicians actively endorse the role of APPs and communicate the benefits of team-based care to their patients, it builds trust and acceptance of APP-provided services.

Physician engagement is critical for the long-term success and sustainability of APP integration initiatives. When physicians recognize the value that APPs bring to the practice, including increased efficiency, expanded access to care, and improved patient outcomes, they are more likely to champion these initiatives and advocate for their continued support and development.

The integration of APPs into physician practices and health systems presents a strategic opportunity to optimize patient care delivery and operational efficiency. By expanding access to healthcare services and alleviating the workload of overburdened physicians, APP integration improves patient and employee satisfaction, and enhances patient retention. However, successful integration requires careful attention to regulatory compliance, billing, and coding practices. VMG Health offers comprehensive billing, coding, and strategy advisory services to support practices in navigating the complexities of APP integration, ensuring compliance with Medicare regulations, and maximizing reimbursement while minimizing audit risk.

Optimal APP utilization yields tangible benefits, including increased patient access to care, improved patient satisfaction, and enhanced financial performance. By leveraging APPs’ unique skill sets, practices can accommodate more patients, reduce wait times, and deliver high-quality care cost-effectively. Physician engagement is essential for the successful implementation of APP integration initiatives, as physicians play a pivotal role in endorsing and supporting APPs within the care team. Through collaborative leadership and effective communication, physicians can foster a culture of teamwork and mutual respect, driving the long-term success and sustainability of APP integration efforts.

In summary, strategic APP integration presents a transformative opportunity for physician practices and health systems to meet evolving patient needs, enhance operational efficiency, and achieve sustainable growth. By partnering with VMG Health for expert guidance and support, practices can navigate the complexities of APP integration with confidence, realizing the full potential of this innovative care delivery model.

American Academy of Physician Assistants. (n.d.). History of AAPA. Retrieved from https://www.aapa.org/about/history/

American Medical Association. (2022). AMA president sounds alarm on national physician shortage. Retrieved from https://www.ama-assn.org/press-center/press-releases/ama-president-sounds-alarm-national-physician-shortage

Centers for Medicare & Medicaid Services. (2023). Advanced practice nonphysician practitioners. Medicare Physician Fee Schedule. https://www.cms.gov/medicare/payment/fee-schedules/physician-fee-schedule/advanced-practice-nonphysician-practitioners

Centers for Medicare & Medicaid Services. (2023). Advanced Practice Registered Nurses (APRNs) and Physician Assistants (PAs) in the Medicare Program. Retrieved from https://www.cms.gov/medicare/payment/fee-schedules/physician-fee-schedule/advanced-practice-nonphysician-practitioners

Centers for Medicare & Medicaid Services. (2023). Incident-to billing. Medicare. https://www.cms.gov/medicare/payment/fee-schedules/physician-fee-schedule/advanced-practice-nonphysician-practitioners

Mujica-Mota, M. A., Nguyen, L. H., & Stanley, K. (2017). The use of advance care planning in terminal cancer: A systematic review. Palliative & Supportive Care, 15(4), 495-513. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5594520/

December 15, 2022

By: Madi Whyde, Savanna Ganyard, CFA, Jordan Tussy, and Madison Higgins

VMG Health reviewed the earnings calls of publicly traded healthcare operators that reported earnings for the third quarter that ended on September 30, 2022. By focusing on the major players in select subsectors defined below, we analyzed the frequency of certain keywords including inflation, COVID-19, interest rates, premium labor, and others. We used these keywords to identify which topics commanded the room this earnings season. Highlights from the calls are summarized in this article.

Volume: Although volume trends are unique to each industry sector nearly all operators remained focused on the impacts of COVID.

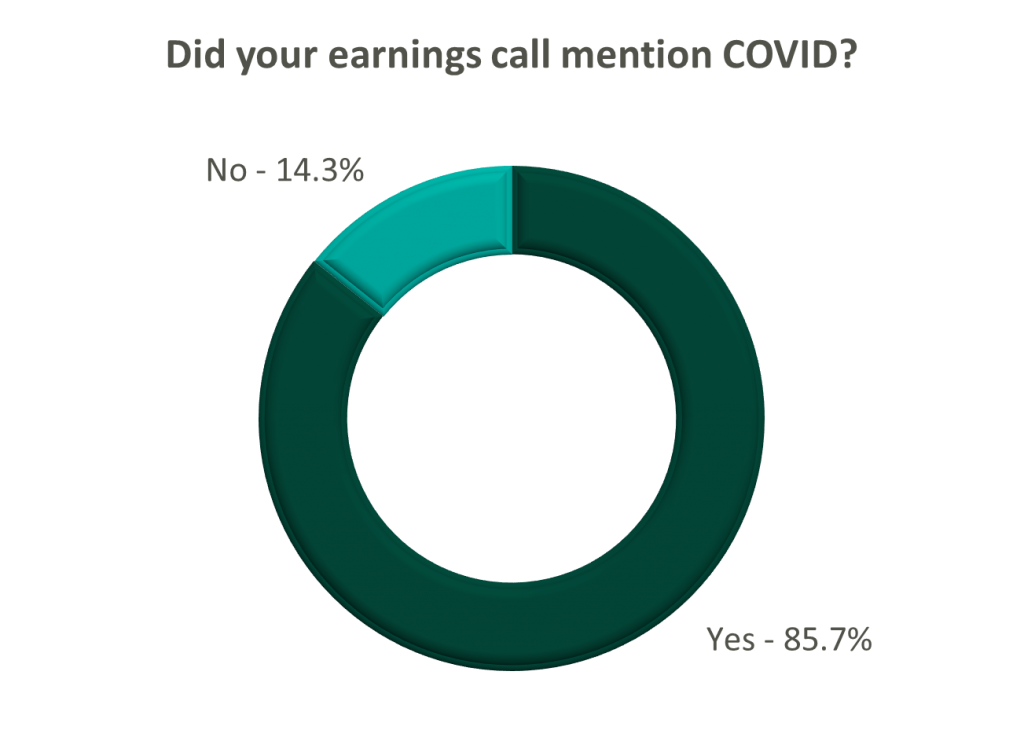

Poll: Did the earnings call mention COVID-19?

On a same-facility basis, admission volumes declined as much as 5.0% from the comparable prior year quarter (Q3 2021) for acute care hospital operators. Despite the weakening of COVID-19, the decline in volumes was attributed to higher-than-average cancellation rates (THC), the migration of certain procedures to outpatient status (CYH and HCA), and capacity constraints (HCA). Inpatient volumes generally remained at or below pre-pandemic levels.

Ambulatory surgery center (ASC) operators reaped the benefits of the migration to the outpatient setting and reported positive volume trends when compared to Q3 2021. Surgical volumes were reported as consistent with 2019 pre-pandemic levels (THC), and one operator claimed the business did not experience any material direct impact related to COVID-19 during Q3 2022 (SGRY).

The post-acute sector reported mixed results in volume trends. One operator reported a year-over-year decline of 14.0% in hospice admissions, citing capacity constraints and reduced referrals from acute care hospitals (EHAB). However, another operator indicated that increases in admissions in the second half of the third quarter showed growth that they “haven’t experienced since the start of the pandemic” (CHE).

Volume trends among other industry players including dialysis providers, risk-bearing organizations, and physician services were also affected by COVID-19 in Q3 2022. Headwinds in dialysis volumes are expected to persist for the foreseeable future (DVA), and inpatient volumes for risk-bearing organizations remain below pre-pandemic levels (AGL). Notably, AGL also reported a rebound in physician office visits and outpatient volumes were in line with pre-pandemic levels.

Reimbursement: Declining COVID-19 volumes mean less incremental government revenue for certain industry players who also now contend with an uncertain inflationary environment.

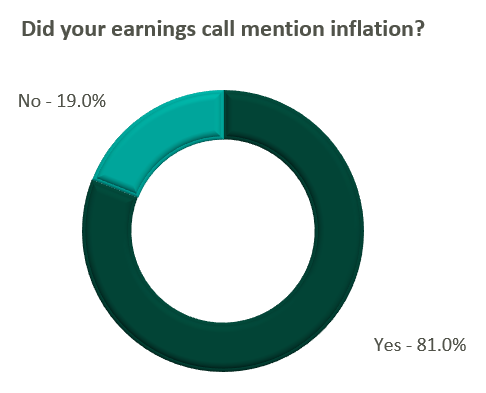

Poll: Did the earnings call mention inflation?

Declining COVID-19 volumes resulted in lower acuity patients and reduced incremental government reimbursement. This softened the reimbursement per admission for the acute care hospital segment. Further exacerbated by inflation, these dynamics were evident in reported EBITDA margins which declined as much as 17.0% (CYH) over Q3 2021. In response, some acute care hospital operators are turning to commercial payor negotiations. Rate increases for the next year are anticipated to range from a minimum of 3.0% (THC) to upwards of 6.0% (CYH).

The post-acute sector did not release specific figures regarding contract rate hikes. However, the sector is optimistically looking for high single-digit rate increases (SEM) to provide relief in the current inflationary environment.

Labor: Unsurprisingly, management teams across the sector were faced with questions about labor trends and management techniques during their earnings calls. Contract labor remained pivotal for the operations of some, but premium labor appears to have softened during the quarter.

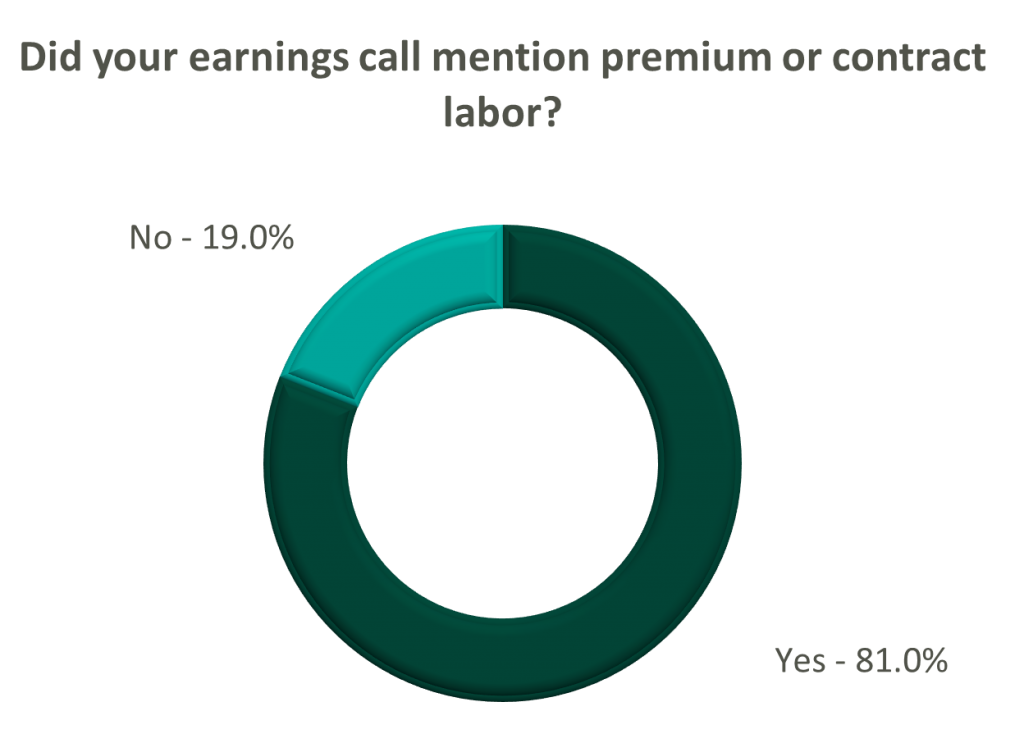

Poll: Did the earnings call mention premium or contract labor?

The reliance on contract labor continued its downward trend in Q3 helping moderate expenses. HCA even indicated overall labor costs were stable due to targeted market adjustments. However, contract labor and premium pay remain at uncomfortably high levels for most acute care hospital operators. UHS revealed during their call it will be unlikely to reach pre-pandemic levels in the near future.

Staffing challenges persisted among the post-acute operators and directly impacted volume by as much as 60.0% (AMED). Increased indirect labor costs including orientation, training, and sign-on bonuses were the leading drivers of decreased EBITDA (AMED). Wage inflation, particularly for nursing positions, is expected to rise as much as 5.0% next year (SEM). However, several management teams are optimistic wages will stabilize to historical levels (SEM, EHC) in the near future.

Other industry players, including dialysis and physical therapy providers, also faced challenges with contract labor during the quarter. USPH reported labor costs were approximately 200 basis points higher than Q3 2021 levels, and DVA indicated such costs showed no improvement.

Go Forward Expectations and Guidance: Considering the quarter’s performance, the companies we reviewed were divided relatively evenly in terms of revised FY 2022 revenue guidance, (i.e., raised, lowered, unchanged). In general, the quarter brought about a more pessimistic view of FY 2022 EBITDA, and the majority of public companies lowered their guidance for the year. Further, most stakeholders were left with no guidance for FY 2023.

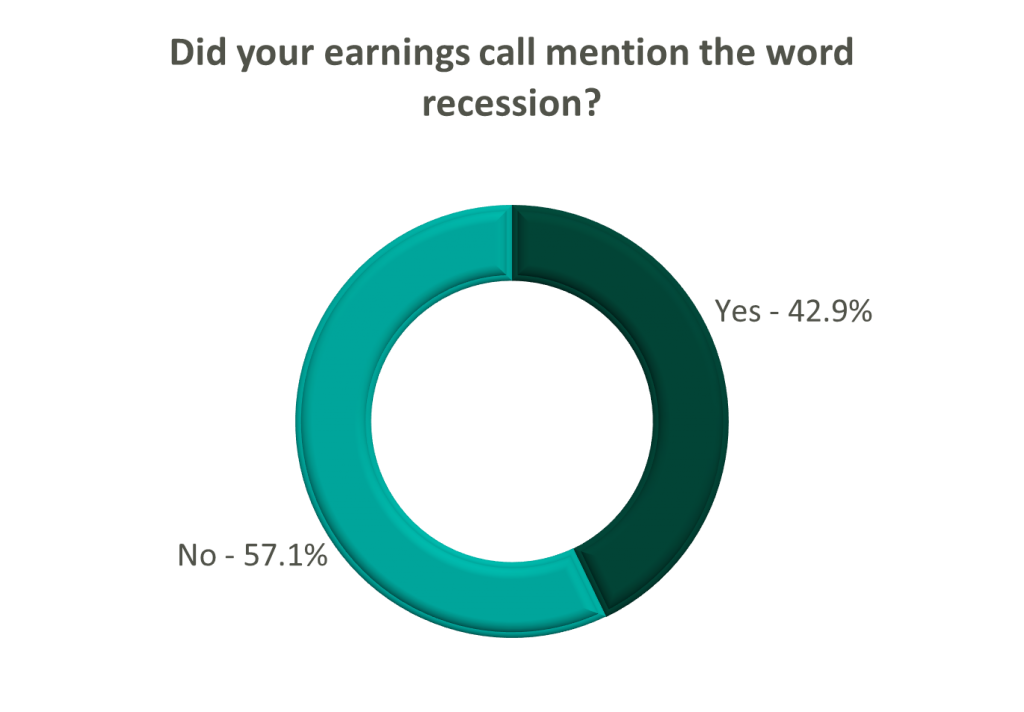

Poll: Did the earnings call mention a recession?

FY 2022 revenue and EBITDA guidance among the acute care hospital operators was generally left unchanged except for THC which lowered EBITDA guidance. However, all companies that were reviewed declined to provide FY 2023 guidance during the call, and primarily cited economic uncertainty (HCA).

The post-acute sector appeared nearly unanimous in the outlook for the rest of 2022, and most operators lowered their revenue and EBITDA guidance. Unsurprisingly, no one offered FY 2023 guidance during the earnings calls.

Interestingly, risk-bearing organizations mostly raised their revenue guidance for FY 2022 (AGL, CMAX, PRVA). However, EBITDA guidance was less predictable and was lowered (AGL, TOI), raised (PRVA), and unchanged (CMAX).

Most other healthcare operators followed similar patterns in terms of providing guidance for FY 2023. Of the companies we reviewed, only DVA revealed an outlook for the next year. The company anticipates revenue to be flat (driven by unfavorable volume trends) and margins to continue to feel the impact of labor market pressures.

October 12, 2022

By: Scott Ackman

The following article was published by Becker’s Hospital Review

Behavioral health is a highly fragmented market. With an increased demand for providers as well as the recent supply shortage, this sector requires innovative partnerships and strategic thinking.

Here are the top three strategic issues in behavioral healthcare to consider currently.

Most health systems and provider groups struggle to recruit and retain enough psychiatrists to meet community needs. In many cases, a lack of provider resources limits the growth of existing services or prevents clients from offering a behavioral health program at all. Residency programs or other less formal relationships with medical schools have proven to be effective recruitment tools.

From a contribution margin and net income perspective, behavioral health services are well below average for many health systems. This is largely due to some combination of the following:

Organizations assuming higher levels of financial risk generally favor the economics of behavioral health due to the service line’s impact on the total cost of care. This phenomenon has resulted in increased interest and investment in behavioral health for many clients. VMG Health’s advisory clients have recently identified behavioral health as one of the most important service lines moving forward.

The care model needed to provide behavioral health continues to be an area of interest for many organizations. Clients are increasing investment in pre-inpatient and post-admission services and community resources to improve program performance.

August 10, 2021

At the American Health Law Association’s 2021 Annual Meeting, held in June, VMG Health Managing Director Clinton Flume, presented trends within the behavioral health industry, along with co-presenter Jenna Gunville of the law firm Polsinelli. The excerpt highlights Mr. Flume’s observations of the continued consolidation within the behavioral health industry.

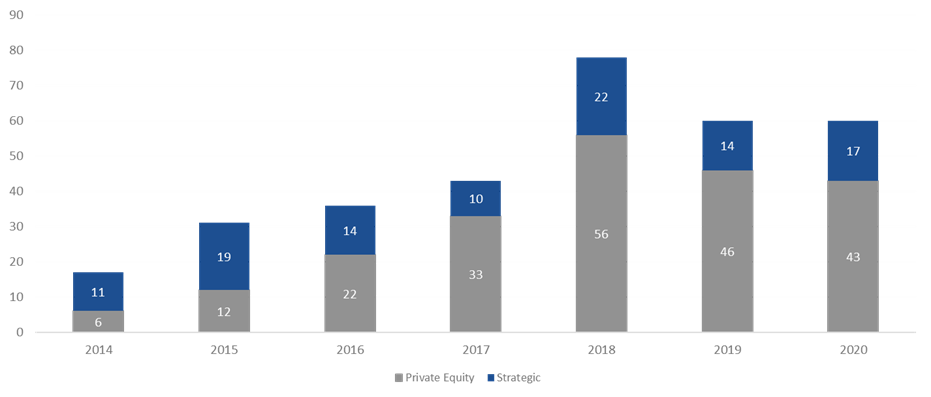

Behavioral health has been a very active market over the last three to four years. 2018 was the high-water mark, with over 75 transactions. 2019 fell off a bit as owners and operators integrated these transactions within their platforms. Obviously, COVID-19 hit 2020, but the year started off well. As year-end numbers became available at the beginning of 2021, the industry anticipated total transaction numbers to be a bit soft but was pleasantly surprised that the deal count came in roughly the same as 2019. This boded very well for continued transaction acceleration in 2021, which is on pace to surpass 2019.

The Global Behavioral Health Market is expected to garner growth at a compounded annual growth rate of 5.0% from 2020 to 2027 and to reach a value of around $242 billion by 2027[2]. The two main factors that I believe will continue to help spur activity are public perception and acceptance and continued investment by private equity. Perception and acceptance involve the acknowledgement and social understanding that mental health services are just as important as the physical treatments we receive as a collective. High profile government official and celebrities certainly aid in bringing awareness to and lessening the social stigma around mental health struggles.

In addition, I believe that payor parity and investment in platform digital health services are key contributors to the increase in transactions. Payor parity focuses on the historical noncompliance of insurers in reimbursing providers for mental health services and creating equal footing for reimbursement and access to services. Increased legislative scrutiny and enforcement of health plans and reimbursement expansion though the Coronavirus Preparedness and Response Supplemental Appropriations Act are two ways payor parity has recently been addressed.

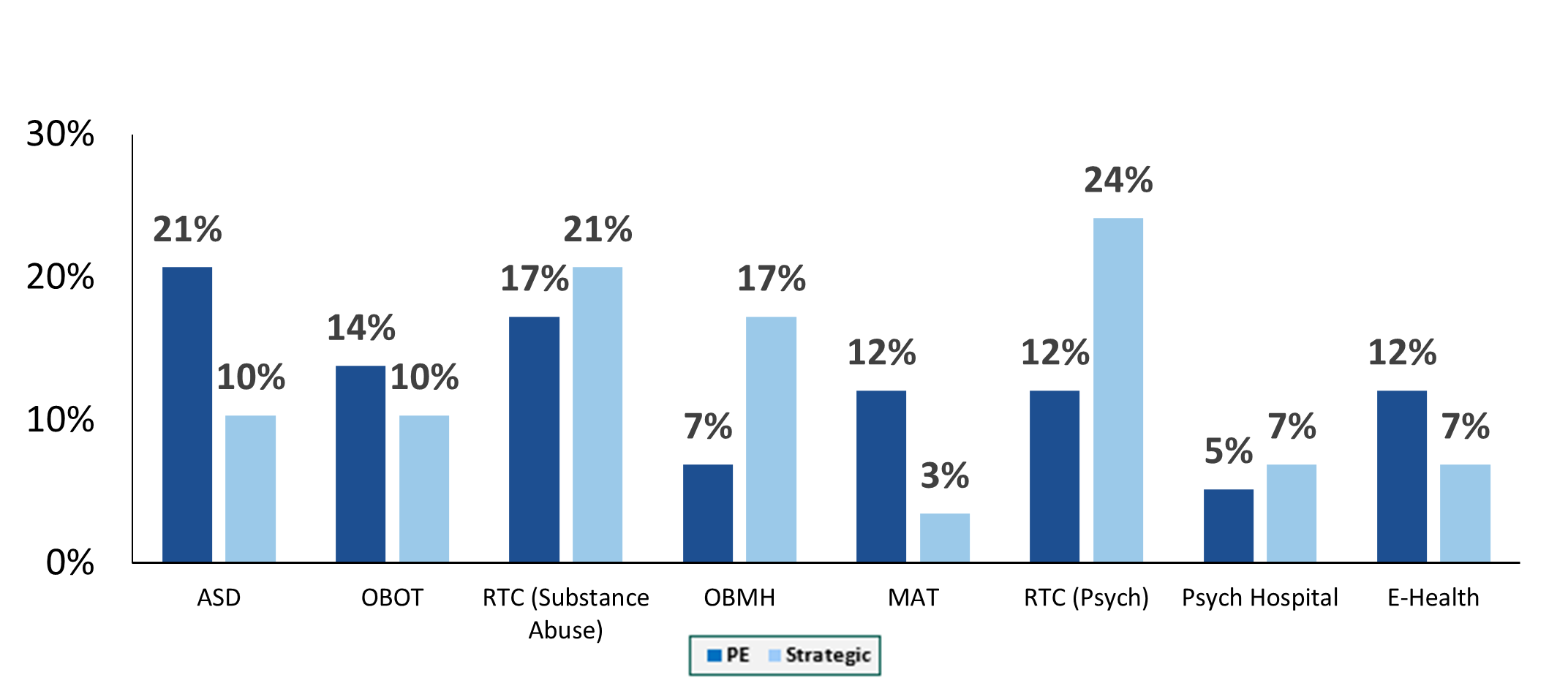

Autism spectrum disorder transactions have exhibited the greatest share of transaction growth since 2018. This is largely driven by acknowledgement of an underserved industry, legislation that includes the Autism CARES Act of 2019, and improvements in reimbursement. Residential treatment centers (both substance abuse and mental health), along with office-based treatment facilities, continue to occupy the bulk of transactions. One area we have been seeing real growth in over the last two years is digital health transactions. These deals include digital technology administration of services such as direct-to-consumer care, revenue cycle performance improvement and automation, and artificial intelligence applications for managing and treating substance abuse and mental health disorders. In June, Rock Health[3] stated that U.S. behavioral health digital startup companies raised $588 million in the first half 0f 2021, which is equal to the annual amount this segment received in funding for any prior year. As we look at 2021 and beyond, we expect that digital health platforms and direct-to-consumer technology will accelerate the growth and acceptance of mental health services.

[1] The merger and acquisition data contained in various charts and tables in this report has been included only with permission of the publisher of Deal Search Online, HealthCareMandA.com. All rights reserved.

[2] Globenewswire.com, IBIS World

[3] https://www.fiercehealthcare.com/tech/funding-for-digital-behavioral-health-startups-surged-amid-covid-19-pandemic

[4] The merger and acquisition data contained in various charts and tables in this report has been included only with permission of the publisher of Deal Search Online, HealthCareMandA.com. All rights reserved.

August 10, 2021

Behavioral health has been of one of the most active sectors in the healthcare transaction marketplace in recent years. Driven by plentiful investment capital, regulatory changes, the opioid crisis, public recognition of the need for mental healthcare and broader coverage from payors, the industry has seen numerous companies pursue consolidation strategies. A common trend that has emerged in the behavioral health industry involves the proliferation of joint ventures between non-profit health systems and for-profit companies to operate full service behavioral health hospitals. Some recent examples of joint ventures over the last two years include:

UHS and Acadia have traditionally been the most active for-profit operators pursuing this model. However, new entrants have emerged, as highlighted by Kindred Healthcare’s entrance in the behavioral health space, which has historically focused on joint ventures with health systems to provide post-acute care. It appears this type of behavioral health joint venture will only continue to be a strategic focus for these companies going forward. Rob Marsh, recently highlighted Kindred’s perceived opportunity with the model to Behavioral Health Business:

“Right now, we’re probably working with somewhere in the neighborhood of 15 health systems throughout the United States. Some of those are a little further along than others, but I feel very confident that the pipeline is just going to continue to expand.”

Acadia’s 2021 Q1 earnings call, Acadia’s CEO, Debra Osteen, stressed the importance of these strategic partnerships:

“We will continue to pursue this important pathway of growth for Acadia in the year ahead and beyond. With a solid pipeline of joint venture projects in different stages, we expect 2022 to be our strongest year for joint ventures with 4 to 5 facilities expected to open.”

UHS’ CFO, Steve Filton, expressed similar sentiments to its shareholders during the companies’ Q4 2019 earnings call:

“We also continue to grow our behavioral health joint venture portfolio with 3 new facilities already operational; 7 under construction or announced, which are expected to open in 2020 and 2021; and over 40 opportunities in the pipeline.”

Why would a non-profit hospital want to joint venture their behavioral health service line with a for-profit operator? Based on our experience, motivations for these transactions from a health system perspective may include the following:

From a for-profit operator perspective, some of the major motivations behind the joint venture model are as follows:

The transaction generally consists of a non-profit hospital contributing its existing service lines existing behavioral health service lines such as inpatient psychiatric units, outpatient programs, certificates of need (where applicable), and licenses for use of the health system trade name. The for-profit operator contributes capital to construct a new facility that expands capacity and service capabilities. In addition, the for-profit partner usually provides management services post-transaction.

As a large referral source to the new partnership, the health system contribution should be consistent with Fair Market Value (“FMV”) for regulatory purposes. In addition, any service agreements between the new joint venture and the parent entities also need to be carefully negotiated and consistent with FMV. Key examples include the management agreement between for-profit operator and the joint venture, or if physicians employed by the hospital are provided to the joint venture through a professional services agreement. Finally, there may be other service agreements with either party providing IT, pharmacy or other ancillary services that payments will need to be at FMV

Another key consideration is the impact to revenue. Reimbursement for the service line when structured as a department of the hospital might not be achievable on a freestanding basis. Generally speaking, the joint venture has to negotiate new contracts and rates with the payors. Stakeholders should perform careful analyses around the impact of freestanding commercial rates when compared to what the health system was able to historically achieve. Furthermore, the hospital DSH or other government subsidy payments could possibly be impacted post transaction with the loss of Medicaid patient days. This impact to DSH can prove to be a strong disincentive for a health system to pursue affiliations.

In summary, behavioral health joint ventures have been common in recent years. With the large increase in demand for behavioral health services, limited bed capacity nationwide and the ability for both non-profit and strategic operators to achieve benefits, it is expected this type of transaction will continue to grow in popularity in the future.

Related Content