Fair Market Value Insights for Multi-Tiered Therapy Service Agreements

Christa Shephard

October 2, 2024

Effective October 8, 2024, Carnahan Group has joined VMG Health. Learn more.

October 15, 2024

Written by Clark Wilson, CVA; Greg Begun; and Ash Midyett, CFA

In the broadest sense, remote monitoring refers to a physician assessing a patient’s health through the use of a medical device or software while physically away from the patient. There are two main types of remote monitoring: remote patient monitoring (RPM) and remote therapeutic monitoring (RTM). RPM focuses on gathering physiological data from medical devices attached to the patient’s body, while RTM focuses on non-physiological data that is generally self-reported.

As it relates to physical therapy, RTM can be used to treat and monitor a wide range of conditions, including musculoskeletal conditions, respiratory conditions, geriatric conditions like osteoporosis, and others. Given the broad range of RTM services, there is a growing list of software providers targeting specific and use cases. Some of these entrants include Medsien, Owlytics Healthcare, and Zimmer Biomet, all of which have proprietary RTM software platforms.

The clinical advantages of RTM include improved adherence to treatment plans, enhanced recovery speeds, reduced re-injury rates, and increased patient satisfaction and engagement. Reducing the chance of reinjury and the number of post-injury visits may increase member satisfaction while enhancing data collection to improve treatment and outcomes. Practices may also see increased patient volumes through improved patient access to care and diagnostics, while minimizing the need for unnecessary in-person appointments.

As a new method of patient engagement, research on the efficacy of RTM remains limited. While research often considers remote monitoring as an effective method of treatment for many conditions, limited research specific to RTM exists for physical therapy applications. Additionally, critics often cite data privacy concerns as a primary headwind for further industry adoption.

In response to the growing adoption of RPM and RTM, the Centers for Medicare & Medicaid Services (CMS) first introduced CPT codes for RPM in 2018 and for RTM in 2021. Since the CPTs were first introduced, CMS has amended billing rules multiple times in response to the pandemic. As of the 2024 Final Rule, CMS allows for billing “incident to” under the direct supervision of a qualified provider (physical therapists, occupational therapists, and speech-language pathologists). RTM and RPM must also be delivered via an approved medical device (which may include software) as certified by the FDA.

The care lifecycle for RTM can generally be characterized by an initial diagnosis, in person or via a telehealth visit, followed by periodic monitoring of the condition, telehealth check ins, or exercise appointments. A provider must monitor a patient for at least 16 days of a 30-day period. As the typical physical therapy course of treatment can range from a few weeks to a couple months, it is easy to understand how RTM may be worked into the treatment life cycle.

RTM is newer than RPM, and payers have been slower to adopt coverage for RTM services as a result. Approved codes are relatively narrow in the scope of conditions covered. Medicaid coverage varies by state, and many states do not have a clear policy around reimbursement. Similarly, commercial payers have been slow to adopt coverage and are generally less likely to cover RTM than RPM.

RTM presents a unique opportunity for physical therapy practices to add an additional revenue stream without significant, up-front investment of time or capital and may broaden the practice’s eligible market for care. With the nearly ubiquitous adoption of mobile phones and growing popularization of fitness wearables, the cost of care for physical therapy RPM and RTM is primarily driven by the cost of software to administer the service ($15–$40 per month) and clinician time.

The RTM industry is in the early stage of the industry lifecycle, characterized by fragmentation, high margins, and a robust growth outlook. Current estimates by the Bipartisan Party Center suggest RPM adoption has been limited but is growing quickly, with 594 monthly claims per 100,000 Medicare enrollees as of 2021, which represents a six-fold increase since 2018. It is too early to say whether RTM will follow a similar growth trajectory. Statistics on usage and efficacy remain limited given the novelty of the technology and the fragmentation of its end market. For instance, there are over 37,000 outpatient rehabilitation clinics in the United States with the largest provider only controlling approximately 5% of the market.

In recent years, the adoption of RPM and RTM has been catalyzed by three primary headwinds: technological progress and the proliferation of mobile devices, an industry-wide shift toward value-based care, and the COVID-19 pandemic. For years, insurance payers, regulators, and thought leaders have heralded the adoption of value-based care initiatives to better align the cost of care with improved patient outcomes. RPM and RTM facilitate data collection and may improve patient outcomes while reducing costs through enhanced recovery speed, improved adherence to treatment plans, reduction in re-injury rates, and improved patient satisfaction and engagement. As value-based care continues to gain market share, RTM technology will likely benefit. The confluence of expanded coverage, patient demand, clinical research, and value-based care advocacy will likely bolster RTM adoption among physical therapy providers. While growth projections remain limited, Global Market Estimates predicts annual RTM market growth in the high teens over the coming years. Physical therapy business operators will likely continue to adopt RTM.

Physical therapy and remote patient monitoring. (2022). Telehealth.HHS.gov. https://telehealth.hhs.gov/providers/best-practice-guides/telehealth-for-physical-therapy/physical-therapy-and-remote-patient-monitoring

Saag, JL & Danila, MI. (2022). Remote Management of Osteoporosis. Curr Treatm Opt Rheumatol. DOI: 10.1007/s40674-022-00195-4. Epub 2022 Sep 2. PMID: 36068838; PMCID: PMC9438367.

ROI of RPM CCM and RTM. (n.d.). Humhealth. https://www.humhealth.com/blog/roi-of-rpm-ccm-and-rtm/

Remote Patient Monitoring (RPM) CPT Code Billing Summary. (n.d.). Healthsnap. https://healthsnap.io/resources/rpm-billing-overview/#:~:text=CPT%20Code%20Billing%20Summary&text=In%202018%2C%20CMS%20began%20providing,reimbursement%20associated%20with%20these%20codes.

Centers for Medicare & Medicaid Services (CMS). (2022). CMS Manual System. CMS. https://www.cms.gov/files/document/r11118cp.pdf

CMS.gov. Calendar Year (CY) 2024 Medicare Physician Fee Schedule Final Rule. (2023). CMS. https://www.cms.gov/newsroom/fact-sheets/calendar-year-cy-2024-medicare-physician-fee-schedule-final-rule

Thomas, JJ. (2022). How long is physical therapy session? Primal Physical Therapy. https://primalphysicaltherapy.com/how-long-is-physical-therapy-session/

Curtis, J., et. al. (2024). The Future of Remote Patient Monitoring. Bipartisan Policy Center. https://bipartisanpolicy.org/report/future-of-remote-patient-monitoring/

U.S. Physical Therapy (USPh). (2024). USPh IR Presentation Q1 2024. U.S. Physical Therapy. https://www.usph.com/wp-content/uploads/2024/05/USPH_IR_Presentation_Q1_2024_FINAL.pdf

Global Market Estimates (GME). (2024). Global Remote Therapeutic Monitoring Market Size. Global Market Estimates. https://www.globalmarketestimates.com/market-report/remote-therapeutic-monitoring-market-3954#:~:text=The%20global%20remote%20therapeutic%20monitoring,getting%20infected%20by%20the%20virus

October 10, 2024

Written by Ingrid Aguirre, CFA; Don Barbo, CPA/ABV

A solvency opinion is a professional assessment of a company’s financial health, specifically its ability to meet its long-term obligations. This opinion evaluates whether a company is solvent—meaning its assets exceed its liabilities—based on both current and projected financial conditions and that it has the ability to pay its obligations within a specified amount of time if required by lenders. A solvency opinion serves as a critical tool in corporate finance and transactional contexts, providing stakeholders with confidence in a company’s financial viability.

Solvency opinions are vital for ensuring compliance with various legal and regulatory requirements. They assure boards of directors, shareholders, and lenders that financial decisions—such as mergers, acquisitions, and dividend distributions—are made with a clear understanding of the company’s financial standing.

By obtaining a solvency opinion, companies can mitigate risks associated with potential insolvency claims. A well-supported opinion can protect directors and officers from liability by demonstrating that they acted in good faith and made informed decisions based on sound financial analysis.

A credible solvency opinion enhances transparency and builds trust among investors, creditors, and other stakeholders. It reassures them that the company is on solid financial footing, thereby facilitating smoother transactions and negotiations.

In a litigation context, solvency opinions play a pivotal role.

If a company faces lawsuits related to insolvency, such as fraudulent transfer claims, an independent solvency opinion can serve as a robust defense. It provides evidence that the company was solvent at the time of the transaction in question, helping to protect against accusations of misconduct.

Solvency experts can be called to provide testimony in court, explaining the methodologies and analyses that led to the solvency opinion. Their insights can clarify complex financial matters for judges and juries, lending credibility to the company’s position.

In disputes involving insolvency, a well-prepared solvency opinion can facilitate settlement discussions. It provides a factual basis for negotiations, helping to establish fair terms based on the company’s actual financial situation.

VMG Health provides comprehensive solvency opinions tailored to your specific needs. Our team of financial experts uses rigorous analysis and proven methodologies to ensure our opinions stand up to scrutiny, both in and out of the courtroom.

Our services include:

Secure your company’s financial future and protect your interests with a reliable solvency opinion from VMG Health. Contact us today and discover how we can help you navigate the complexities of financial integrity and legal compliance.

Hayes, A. (2024). What Is Solvency? Definition, How It Works With Solvency Ratios. Investopedia. https://www.investopedia.com/terms/s/solvency.asp

Jacobsen, C. (2018). Solvency Opinions: Legal Insights and Best Practices for Valuation. BV Research Pro. https://www.bvresources.com/articles/training-event-transcripts/solvency-opinions-legal-insights-best-practices-for-valuation

Jacobson, C. A., & Selbst, S. B. (2014, July 9). BVR’s Advanced Webinar Series on Valuations for Business Transactions: Part 1: Solvency Opinions [Webinar]. Business Valuation Resources LLC.

June 11, 2024

Written by Timothy Kent, CVA; Jordan Tussy, CVA; Molly Smith

GenesisCare, a prominent provider of cancer services worldwide, filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code on June 1, 2023, in the United States Bankruptcy Court for the Southern District of Texas (Case No. 23-90614). The Australian-based company, once valued at $5 billion and backed by private equity firm KKR, faced financial difficulties due to high debt levels and operational challenges.

Founded in 2004 by Dan Collins, GenesisCare (the “Company”) served Australian cancer patients until 2015, when the Company expanded to Europe via its purchase of eight cancer centers from Cancer Partners UK. During 2016, GenesisCare continued growing its European operations through the acquisitions of 17 centers in Spain from IMOncology and Oncosur Group.

In late 2019, GenesisCare made headlines with the acquisition of U.S.-based cancer provider 21st Century Oncology for $1.5 billion. Two years prior, 21st Century Oncology filed for bankruptcy because of declining reimbursement and “regulatory costs concerning electronic records and legal expenses.” At the time of acquisition by GenesisCare, 21st Century Oncology operated 294 locations, including 124 radiation oncology centers, with an estimated $230 million of earnings before interest, tax, and depreciation (EBITDA).

While rapidly expanding GenesisCare’s footprint, the 21st Century acquisition left the Company with significant levels of debt and a new operations base that was reemerging from bankruptcy. GenesisCare faced significant challenges in its effort to turnaround the U.S. operations, including an aging equipment base and IT system, operational inefficiencies, and increased competition. Prior to GenesisCare’s Chapter 11 filing, they reported approximately $2 billion of total debt on its balance sheet, largely associated with the 21st Century acquisition.

In March 2023, CEO and Founder Dan Collins stepped down, and three months later, the Company filed for bankruptcy on June 1, 2023.

Five months after its initial filing, GenesisCare announced the U.S. Bankruptcy Court for the Southern District of Texas confirmed the Company’s Chapter 11 Plan of Reorganization after receiving support from approximately 95% of voting creditors. The plan included significant deleveraging of GenesisCare’s balance sheet, with a reduction in total debt by approximately $1.7 billion.

On February 16, 2024, GenesisCare completed its reorganization process and emerged from Chapter 11. As part of its reorganization plan, GenesisCare will operate as four distinct businesses in the U.S., Australia, Spain, and the UK, with an independent governance structure and Board of Directors for each business. Furthermore, the businesses will be responsible for the strategies and performance of their market. The Company also received approximately $56 million of new capital infusion from investor groups to help support the growth of the remaining businesses. As a result of the restructuring plan, the Company is prepared to move forward well capitalized with a relatively low level of debt and a more focused operational strategy.

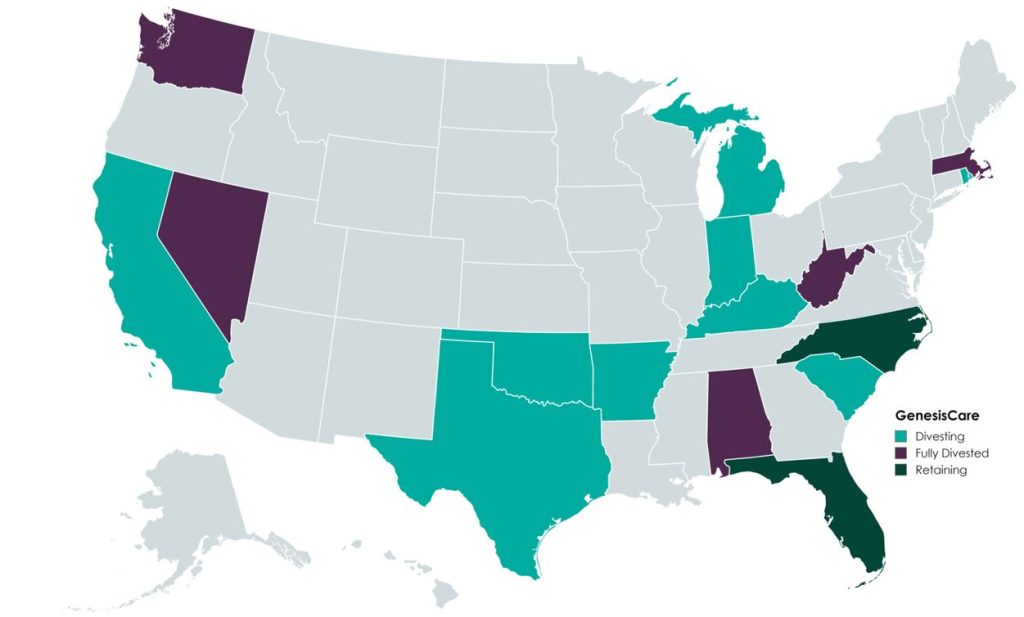

In the U.S., GenesisCare will retain practices in the “fast-growing markets” of Florida and North Carolina, which will continue to offer similar cancer care services (medical oncology, radiation oncology, surgery, and imaging). Currently, the Company operates 145 locations across the two states. GenesisCare has sold or is in the process of divesting its remaining assets across 14 states.

Newly appointed chief executive officer David Young said, “I am confident that our independently run businesses are strongly positioned to capture the exciting opportunities available to them in the markets they serve while never losing sight of our core goal: delivering better life outcomes to patients.”

A primary objective of GenesisCare’s restructuring plan was to divest all U.S.-based assets outside of North Carolina and Florida. This decision was part of its strategic plan to focus on core operations to ensure long-term sustainability.

According to bankruptcy filing documents, GenesisCare has divested 32 locations across 14 states. Assuming all of the transactions close at the defined purchase price in the transaction agreements, cash proceeds to GenesisCare would be approximately $113 million, with an implied equity value of approximately $131 million (see chart below). The assets have drawn interest from many different buyer types, including health systems, large oncology platforms, and practices. Dr. Shaden Marzouk, President of GenesisCare U.S., said, “The strong interest we received from a wide variety of buyers from across the U.S. is a reflection of what we have long known―that GenesisCare’s U.S. business benefits from an incredible team, a desirable footprint and a proven ability to care for patients.”

One notable transaction was OneOncology’s acquisition of two radiation oncology practices in South Carolina for $25.0 million (per the asset purchase agreement), expanding OneOncology’s service offerings in an existing market. CEO of OneOncology, Jeff Patton, MD, said, “For OneOncology, these are two great business assets that are really the only radiation facilities that are open in that market. It’s a market we were already in, so sometimes things match up well.” Specifically, OneOncology acquired a Myrtle Beach facility with three linear accelerators and a Conway Center with one.

California-based Sutter Health purchased five radiation oncology practices in Modesto, San Luis Obispo, Santa Cruz, Stockton, and Templeton, California. According to the purchase agreement, the total purchase price for these centers was $32 million. President and CEO of Sutter Health, Warner Thomas said, “We know how important it is for specialty services like cancer care to be offered close to home so patients can stay on track with their treatments. Keeping continued cancer care accessible in these communities was a driving force for Sutter to acquire these care centers.” Sutter also has certain capital investments in mind, including new radiation oncology equipment, technologies, and other support services.

Based on Kroll’s bankruptcy docket, there are medical and radiation oncology assets still available for sale, which could result in increased transaction activity with interest buyers, such as health systems, private equity–backed oncology platforms, and practice acquisitions. After successfully emerging from Chapter 11, GenesisCare is entering a new chapter, as emphasized by CEO David Young: “GenesisCare has achieved the goals it set out at the beginning of its restructuring process. We exit Chapter 11 with great businesses, each with a compelling future.” The Company’s focus on continuous growth is highlighted by the planned construction of three new radiation oncology centers in Australia, scheduled to open in 2024. With a more concentrated U.S. and global platform, GenesisCare has indicated that it is well positioned for future growth as a newly capitalized, low-debt entity committed to providing the highest level of care for its patients.

Patrick, A. (2024, February 18). GenesisCare emerges from bankruptcy, cuts deal with government. Australian Financial Review. Retrieved from https://www.afr.com/companies/healthcare-and-fitness/genesiscare-emerges-from-bankruptcy-cuts-deal-with-government-20240218-p5f5t5

Staff Writer. (2024). Amid major cancer care bankruptcy, oncology clinics sold. Oncology News Central. Retrieved from https://www.oncologynewscentral.com/article/amid-major-cancer-care-bankruptcy-oncology-clinics-sold

GenesisCare. (2024). GenesisCare’s reorganisation plan confirmed with overwhelming support from voting creditors. GenesisCare. Retrieved from https://www.genesiscare.com/au/news/genesiscare-reorganisation-plan-confirmed-with-overwhelming-support-from-voting-creditors

GenesisCare. (2024). GenesisCare completes reorganisation and emerges from Chapter 11. GenesisCare. Retrieved from https://www.genesiscare.com/au/news/genesiscare-completes-reorganisation-and-emerges-from-chapter-11

Patrick, A. (2019, December 13). Aussie cancer outfit makes first US move in $1.5b deal. Australian Financial Review. Retrieved from https://www.afr.com/companies/healthcare-and-fitness/aussie-cancer-outfit-makes-first-us-move-in-1-5b-deal-20191213-p53js7

Private Equity Stakeholder Project. (2024). Private equity healthcare bankruptcies are on the rise. Private Equity Stakeholder Project. Retrieved from https://pestakeholder.org/reports/private-equity-healthcare-bankruptcies-are-on-the-rise/

May 22, 2024

Written by Ashleigh Surgeon and Caroline Dean, CVA

In recent years, the anesthesiology market has seen many changes in compensation trends and practice models. With continued provider shortages and a growing demand for anesthesia services, providers in this specialty are becoming increasingly valuable. Specifically, certified registered nurse anesthetists (CRNAs) have become some of the most sought-after advanced practice providers in the industry, leading to significant increases in compensation for these providers. In addition, hospitals and health systems are shifting to expanded CRNA utilization as opposed to physicians due to the ongoing push for cost-effective treatment options. Understanding the factors impacting CRNA compensation trends is crucial to anticipating and addressing potential challenges in the pursuit of CRNA arrangements.

According to Becker’s ASC Review, the anesthesiology market is facing a projected shortage of 12,500 providers by 2033. As basic economic principle rules, a decrease in supply of any healthcare provider drives demand upward, forcing costs of anesthesia services and provider compensation upward as well. In 2023, median compensation for CRNAs in the United States was reported at $221,300, an increase in total cash compensation of 11.3% from 2022.

Source: Sullivan, Cotter and Associates, Inc. 2019-2023 Physician Compensation and Productivity Survey and 2019-2023 Advanced Practice Provider Compensation and Productivity Survey

This is a significant rise as compared to general physician assistants and nurse practitioners, who saw only a 5% increase on average from 2022 to 2023. This level of compensation is mostly accredited to the additional education and training required for the certification, as well as the increased risk and level of independence associated with their standard practice.

To receive certification from the National Board of Certification and Recertification for Nurse Anesthetists (NBCRNA), a candidate must first complete registered nurse training and the appropriate clinical experience. Then CRNAs complete a Nurse Anesthesia program, which grants the candidate a master’s degree. Program length varies from two to four years and includes a clinical experience requirement in addition to coursework. In total, the process of becoming a certified nurse anesthetist takes at least seven years to complete, surpassing a standard registered nurse by an average of three years in education and experience. As with any advanced degree, CRNAs often receive increased compensation due to a higher level of education and training than a standard practicing registered nurse.

Because of their advanced training, CRNAs have an increased level of independence in a clinical setting. Though anesthesiologists may manage high-acuity surgeries, CRNAs in many states and facilities may be responsible for primary patient care, including informing the patient, completing examinations, developing pain management plans, prescribing medications, administering and monitoring medications, and responding to adverse reactions or emergencies. A CRNA’s involvement in responsibility for patient care puts the provider in higher-risk scenarios when compared to other registered nurse professions. In 23 states, CRNAs may operate independently without the supervision of a medical doctorate. CRNAs are also typically the sole anesthesia provider in many plastic surgery centers, eye surgery centers, dental surgery centers, and gastrointestinal surgery centers. Additionally, in the U.S., many facilities in rural areas with limited healthcare providers use CRNAs for routine surgical services in the specialties of general surgery, obstetrics, and pain management. According to the American Association of Nurse Anesthesiology, CRNAs comprise over 80% of anesthesia providers in rural areas.

Though CRNAs’ level of autonomy may vary depending on location, state government regulations and a facility’s scope of services, the importance of CRNAs is often constant across markets. With their ability to operate nearly identically to an anesthesiologist in most general cases, CRNAs also incur the same level of risk as physicians and the increased costs associated with such risk. Increased utilization, higher malpractice insurance expenses, and reimbursement difficulties play a large role in these higher costs for CRNAs, which create a competitive environment amongst healthcare systems when considering compensation in recruitment efforts.

Historically, anesthesiology services have been provided by a mix of physicians and CRNAs together. However, with continued physician shortages and health systems and facilities seeking more profitable provider options, CRNA-heavy care team models have risen to the forefront. In a care team model, one physician typically supervises between one and four CRNAs, allowing the facilities to rely on CRNAs as opposed to more expensive physician coverage. As CRNA utilization grows, so grows CRNA compensation as facilities are forced to offer more lucrative recruitment packages, inclusive of commencement bonuses and higher-dollar salaries to retain top CRNA talent and stay competitive. In addition, as many U.S. lawmakers are pushing to expand the scope of CRNA independent practice, it is likely CRNA utilization will continue to increase.

Additionally, according to the Centers of Medicare and Medicaid Services (CMS), average CRNA malpractice insurance in 2024 is $5,968—nearly 50% higher than the average for all other midlevel providers. This is most likely attributed to the large number of CRNAs practicing independently, and therefore solely liable for any case complications. The most common malpractice claims involving CRNAs include subpar performance during procedures, poor patient monitoring and improper positioning. All three of these claims are extremely serious and can result in recovery complications, severe injury, and even death. As a result, CRNAs face higher medical malpractice premiums than providers not solely responsible for a patient’s care. Health systems and facilities must consider this expense when employing CRNAs’ services, whether they reimburse, subsidize, or include the expense in compensation.

Lastly, anesthesia has seen a downward trend in reimbursement based on the CMS Medicare Physician Fee Schedules as Anesthesia Base Units (ASAs) reimbursement have decreased from $22.27 per unit in 2019 to $20.44 in 2024. In the states where CRNAs can practice independently, CMS will reimburse services provided by CRNAs at these rates. This reduction in reimbursement can impact a provider’s ability to collect sufficient revenue based on professional services alone, often requiring additional compensation or subsidization from a facility to sustain operational costs. This issue is commonly present for providers in a community highly comprised of governmental payors. Public payor rates, such as Medicare and Medicaid, reimburse medical services at a significantly lower rate than private insurance, less than 28% of median commercial rates in 2022. As such, facilities serving a population with a significant amount of governmental insured patients must offer providers a compensation plan not only to offset the practice’s operational costs, but also as an alluring salary serving as incentive to relocate to the market. With a CRNA shortage looming, these underserved areas must stay competitive in compensation offers to recruit and retain the essential services CRNAs provide to the community. This level of competition contributes largely to the upward drive of average CRNA compensation, as majority of the CRNAs are operating in the U.S. in lower-income markets.

In summary, the CRNA compensation market will continue to evolve in the coming years, and health systems and facilities must understand and address these changes to capitalize on the benefits associated with CRNA utilization. VMG Health is frequently engaged to provide fair market value and consultative services to ensure CRNA compensation packages are both competitive and compliant with government regulations. Utilizing in-depth analyses of revenue, market data, costs and recruitment expenditures, and expert experience in similar arrangements, VMG Health can assist in navigating the increasingly important CRNA market.

Becker’s ASC Review. (June 28, 2022). Weathering the storm in Anesthesiology: making the business case and demonstrating the value of Anesthesiology. https://www.beckersasc.com/asc-news/weathering-the-storm-in-anesthesiology-making-the-business-case-and-demonstrating-the-value-of-anesthesiology.html

Sullivan Cotter. 2019-2023 Physician Compensation and Productivity Survey and 2019-2023 Advanced Practice Provider Compensation and Productivity Survey

O’Brien, E. Health eCareers. (January 23, 2023). How Long is CRNA School? https://www.healthecareers.com/career-resources/nurse-credentialing-and-education/how-long-is-crna-school

Munday, R. Nurse Journal. (November 16, 2023). CRNA Supervision Requirements by State. https://nursejournal.org/nurse-anesthetist/crna-supervision-requirements/

AMN Healthcare. (June 23, 2023). CRNAs Practice Updates and Trends. https://www.amnhealthcare.com/blog/physician/locums/crnas-practice-updates-and-trends/

Centers for Medicare & Medicaid Services. 2019-2024 Anesthesia Conversion Factors. https://www.cms.gov/medicare/payment/fee-schedules/physician/anesthesiologists-center

Baxter Pro. (May 6, 2022). The 3 Most Common CRNA Malpractice Claims. https://baxterpro.com/the-3-most-common-crna-malpractice-claims/#:~:text=Do%20CRNAs%20Get%20Sued%20More,the%20benefits%20of%20the%20job

American Society of Anesthesiologists. (December 2022). Anesthesia Payment Basics Series: #3 Payment, Conversion Factors, Modifiers. https://www.asahq.org/quality-and-practice-management/managing-your-practice/timely-topics-in-payment-and-practice-management/anesthesia-payment-basics-series-3-payment-conversion-factors-modifiers#:~:text=In%202022%2C%20the%20Medicare%20anesthesia,conversion%20factor%20survey%20was%20%2478.00.&text=Overall%2C%20Medicare%20was%20paying%20less,commercial%20rates%20in%20that%20year

Liao. C, et. all. Semantic Scholar (2015). Geographical Imbalance of Anesthesia Providers and its Impact on the Uninsured and Vulnerable Populations. https://www.semanticscholar.org/paper/Geographical-Imbalance-of-Anesthesia-Providers-and-Liao-Quraishi/77112f1f7ca09a86142b4f5e7c065ae9a073dec2

May 8, 2024

Written by Christa Shephard, Maureen Regan

Physician assistants (PAs) and advanced practice registered nurses (APRNs), like nurse practitioners (NPs), midwives, CRNAs, and clinical nurse specialists, have been around for decades. The first class of PAs graduated from Duke University in1967, and in 1965, the first training program for NPs began at the University of Colorado. Since then, for many reasons, both professions have become integral to the quality delivery of healthcare. Through advanced practice nonphysician provider (APP) integration, patients experience increased access to the healthcare services they need, and they are more satisfied with the care they receive. Physicians experience greater job satisfaction, as APP integration helps to alleviate the burden on overburdened work schedules. Through these benefits, APP integration leads to better patient retention, physician satisfaction, and stronger financial health for practices and health systems overall.

The Centers for Medicare & Medicaid Services (CMS) certainly plays a role in the practice and reimbursement environment of PAs and APRNs; however, most of the legislative and regulatory environment for practice is determined at the state level. Due to the evolution of each profession and the historical and ongoing shortage of physicians, it’s important for health systems and practices to stay abreast of primary source legislative and regulatory guidance changes regarding scope, documentation, and billing compliance. These factors are also important to ensure an employer is capturing maximum reimbursement for clinical work done by both professions while minimizing their risk of an audit and resulting penalties. Systems and practices must uphold an ongoing, longitudinal review of Medical Staff Bylaws, delineation of privileges, policies, and processes.

CMS recognizes qualified billing providers to render services independently and establishes billing and coding rules for APPs to ensure accurate reimbursement and quality care delivery within the Medicare program. These rules outline the scope of practice and reimbursement guidelines for nurse practitioners, physician assistants, certified nurse-midwives, clinical nurse specialists, and certified registered nurse anesthetists. APPs must adhere to specific documentation requirements, including maintaining accurate patient records and submitting claims using appropriate evaluation and management (E/M) codes. Additionally, CMS provides guidance on incident-to billing, which allows certain services provided by APPs to be billed under a supervising physician’s National Provider Identifier (NPI). Understanding and following CMS billing and coding rules are essential for APPs to navigate the complexities of reimbursement and ensure compliance with Medicare regulations.

Because CMS recognizes APPs as qualified billing providers but not as physicians, APPs fall into a separate reimbursement category. When APPs are billing under their own NPI numbers, the reimbursement level is less than what it would be if the physician were to bill for the same services. Physicians may bill for a service that was rendered by an APP with incident-to services and with split/shared E/M services.

VMG Health Managing Director and coding and compliance expert Pam D’Apuzzo says, “There are two rules, which are where everybody gets themselves into trouble… Those two rules have specific guidelines, both from a documentation and a billing standpoint. The patient type, the service type—everything needs to be adhered to.”

To bill for incident-to and split/shared E/M services, practices must meet specific criteria outlined by Medicare. For incident-to services, the criteria include:

For split/shared E/M services, the criteria include:

These criteria ensure that incident-to and split/shared services are billed appropriately and in compliance with Medicare guidelines. Practices must continually educate and train so that they can successfully adhere to these criteria to avoid billing errors and potential audits. Additionally, practices must continuously monitor to ensure all documentation, billing, and coding processes are followed correctly.

There are tools and services that allow for easier monitoring. “We utilize a tool called Compliance Risk Analyzer, which provides us with statistical insight on coding practices,” D’Apuzzo says. “So, we can data mine ourselves and see what’s happening just based on our views. And this is what the payors, specifically, and the government does as well: They can see the [relative value unites] RVUs are for a physician or off the chart, or that a physician has submitted claims for two distinct services at two different locations on the same day.”

This is more common than you might think.

“What’s normally happening in those interactions is that [a doctor with two locations] realizes he can’t keep up with all of that patient flow in two places, so they hire a PA and put them at location number two,” D’Apuzzo says. “But now all that billing goes under the doctor, so it flags for Medicare.”

With VMG Health’s Compliance Risk Analyzer (CRA), practices can see the same data mining and areas of risk, as the program would flag the RVUs as a potential audit risk. This gives practices the opportunity to self-audit and refine their processes to ensure they are billing and coding appropriately.

VMG Health offers multiple comprehensive services that help health systems and practices implement and follow new procedures like APP utilization without issue, from honoring existing care models to ensuring provider compensation is fair, compliant, and reasonable.

Cordell Mack, VMG Health Managing Director, says, “We’ve spent a lot of time trying to make sure we get that right, both in terms of the underlying, practice-level agreements as well as the ways in which the compensation model works for both the physician and the APP.”

In many practices, physicians struggle to handle their case load, which means their busy schedules can prevent them from seeing existing patients when they need services and from taking on new patients. Bringing APPs into the fold allows physicians to offload some of their patient care so that they can see new patients while APPs see more established patients.

BSM Consulting (a division of VMG Health) Senior Consultant and subject matter expert Elizabeth Monroe provides an excellent example: “Let’s say we have an orthopedic surgeon who really wants to spend most of their time in surgery. We would want to have that physician in surgery because that’s what their skill set and licensure permits. With a nurse practitioner or physician assistant providing follow-up, post-operative care, that oftentimes is a much better model. It allows the MD to do the surgical cases only they can do, but it also eases patient access to care.”

This expansion of a physician’s schedule creates an opportunity to provide more patient services, which easily translates to improved patient satisfaction when, without this expansion, they would likely be unable to see their provider when they felt they needed to be seen. While APP-rendered services are reimbursed at 85% instead of 100%, our experts say that missing 15% shouldn’t dissuade practices and health systems from leveraging the APP integration.

“It’s a very short-sighted approach to just think about, ‘But we could be making 100% instead of 85% if we bill under the doctor,’ because ultimately, we are never able to do that 100% of the time, and it’s a higher risk than it is reward,” says D’Apuzzo.

Additionally, physicians with packed schedules and no APP support may inadvertently rush through appointments to see each patient scheduled for that day. Patients who feel rushed may leave an appointment feeling unheard and like their problem is unresolved. Alternatively, when a patient calls and asks for services but can’t be seen for multiple weeks or months, they may never make an appointment and instead turn to another provider for help.

All of this culminates in poor patient retention, which equals a loss of revenue for the practice. Dissatisfied patients will seek better treatment and better outcomes elsewhere. However, when practices and health systems embrace APP support, patients are more likely to be able to schedule appointments when they feel they need to be seen, feel heard in an appointment with an APP who has the time to sit and listen, and even spend less time in the doctor’s office overall, as patient wait times significantly decrease with APP appointments.

“Practices are better able to meet patient demand, and they’re able to really allow physician assistants, nurses… to add a tremendous value for the patients, offering them outstanding care,” Monroe says.

With both patient demand and physician scarcity placing the U.S. health system in crisis, many practices and health systems know they need to integrate APPs into their workflows, but they don’t know how. VMG Health offers strategic advisory services that can guide this implementation to ensure practices are educated, compliant, and working within the care model they prefer.

“Our team would want to spend time really trying to identify the underlying care model that practices are trying to, you know, work inside of,” says Mack.

One approach is to assess patient needs and practice capabilities to determine the most effective roles for APPs, such as providing primary care, specialty care, or supporting services like telemedicine. Implementing standardized protocols and workflows can ensure efficient APP utilization while maintaining quality and safety standards.

Finally, ongoing training, supervision, and quality monitoring are essential to support APPs and ensure their integration into the practice or health system effectively meets patient needs.

“It starts with getting your appropriate documentation in place… [with] supervisory responsibilities and collaborating physician agreements,” says Mack. “It migrates to, ‘What’s the operational agreement among the APP and the doctor?’ and how cases are presented, or how the physician is consulted. So, it’s getting an underlying clinical service agreement among those professionals.”

Optimal APP utilization shows up in the numbers. When practices increase patient access to care without overburdening physicians through APP utilization, they can accommodate more patients, leading to increased revenue generation. Moreover, because APPs often bill at a lower rate than physicians, utilizing them efficiently can improve cost-effectiveness, thereby enhancing the overall financial performance of the practice.

“It should realize an ROI, and that ROI should be something more in terms of duties and tasks that other teammates can’t do,” says Mack. “Meaning, it would be unfortunate if an advanced practice professional is working at such a capacity whereby duties some of the day-to-day responsibilities should probably be done by teammates working at a higher level of their own individual license.”

Changing existing workflows can be difficult, but the rewards heavily outweigh the risks. Physicians must support APP integration to successfully navigate the transition. Physicians are typically the leaders and decision-makers within medical practices, and their support is essential for implementing any significant changes in workflow or care delivery models. Without physician buy-in, resistance to change may arise, hindering the smooth integration of APPs into the practice.

Physicians play a vital role in collaborating with APPs and delegating tasks effectively. By endorsing and supporting the integration of APPs, physicians can foster a culture of teamwork and mutual respect within the practice. This collaborative approach promotes a cohesive care team where APPs work alongside physicians to provide high-quality patient care.

It’s important for physicians to trust that their APPs are qualified and capable of providing excellent patient care. Allowing an APP to care for an established patient does not sever the relationship between the physician and the patient; it can actually enhance the patient’s experience and trust in the practice.

“We want patients who have had a long-standing relationship with an MD to be able to see that doctor, and then we want to help the doctor know and understand how to appropriately transfer care over to an APP within their system or within their practice,” says Monroe. “So, that provider can be still linked to the doctor, and the doctor can still be linked to the patient.”

Furthermore, physician buy-in is essential for maintaining continuity of care and ensuring patients feel confident in receiving treatment from both physicians and APPs. When physicians actively endorse the role of APPs and communicate the benefits of team-based care to their patients, it builds trust and acceptance of APP-provided services.

Physician engagement is critical for the long-term success and sustainability of APP integration initiatives. When physicians recognize the value that APPs bring to the practice, including increased efficiency, expanded access to care, and improved patient outcomes, they are more likely to champion these initiatives and advocate for their continued support and development.

The integration of APPs into physician practices and health systems presents a strategic opportunity to optimize patient care delivery and operational efficiency. By expanding access to healthcare services and alleviating the workload of overburdened physicians, APP integration improves patient and employee satisfaction, and enhances patient retention. However, successful integration requires careful attention to regulatory compliance, billing, and coding practices. VMG Health offers comprehensive billing, coding, and strategy advisory services to support practices in navigating the complexities of APP integration, ensuring compliance with Medicare regulations, and maximizing reimbursement while minimizing audit risk.

Optimal APP utilization yields tangible benefits, including increased patient access to care, improved patient satisfaction, and enhanced financial performance. By leveraging APPs’ unique skill sets, practices can accommodate more patients, reduce wait times, and deliver high-quality care cost-effectively. Physician engagement is essential for the successful implementation of APP integration initiatives, as physicians play a pivotal role in endorsing and supporting APPs within the care team. Through collaborative leadership and effective communication, physicians can foster a culture of teamwork and mutual respect, driving the long-term success and sustainability of APP integration efforts.

In summary, strategic APP integration presents a transformative opportunity for physician practices and health systems to meet evolving patient needs, enhance operational efficiency, and achieve sustainable growth. By partnering with VMG Health for expert guidance and support, practices can navigate the complexities of APP integration with confidence, realizing the full potential of this innovative care delivery model.

American Academy of Physician Assistants. (n.d.). History of AAPA. Retrieved from https://www.aapa.org/about/history/

American Medical Association. (2022). AMA president sounds alarm on national physician shortage. Retrieved from https://www.ama-assn.org/press-center/press-releases/ama-president-sounds-alarm-national-physician-shortage

Centers for Medicare & Medicaid Services. (2023). Advanced practice nonphysician practitioners. Medicare Physician Fee Schedule. https://www.cms.gov/medicare/payment/fee-schedules/physician-fee-schedule/advanced-practice-nonphysician-practitioners

Centers for Medicare & Medicaid Services. (2023). Advanced Practice Registered Nurses (APRNs) and Physician Assistants (PAs) in the Medicare Program. Retrieved from https://www.cms.gov/medicare/payment/fee-schedules/physician-fee-schedule/advanced-practice-nonphysician-practitioners

Centers for Medicare & Medicaid Services. (2023). Incident-to billing. Medicare. https://www.cms.gov/medicare/payment/fee-schedules/physician-fee-schedule/advanced-practice-nonphysician-practitioners

Mujica-Mota, M. A., Nguyen, L. H., & Stanley, K. (2017). The use of advance care planning in terminal cancer: A systematic review. Palliative & Supportive Care, 15(4), 495-513. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5594520/

May 17, 2023

Written by Debra Rossi, CCS, CCS-P, CPC, CPMA and Stephanie England, MBS

The following article was published by VMG Health’s Oncology Affinity Group

As healthcare costs continue to rise and the regulatory burden increases, oncology practices are facing significant challenges in managing their revenue cycle while delivering high-quality cancer care. In this discussion, VMG Health experts explore the typical reimbursement concerns for oncology practices, including managing the revenue cycle, proper Electronic Health Record (EHR) management, and policy concerns related to value-based care trends. We will also examine the unique concerns of clinical oncology and radiation oncology, including documentation integrity and quality improvement initiatives. By understanding these concerns and taking proactive steps to address them, oncology practices can navigate the complex healthcare landscape while providing the best possible care for their patients.

The cost to deliver high-quality cancer care is rising due to inflation, increasing regulatory burden, and increasing overhead costs—not the least of which is the need for additional personnel to meet payers’ administrative demands. An accumulating body of data suggests that patients are deferring treatment because of high out-of-pocket costs. Public and private payers are attempting to decrease these costs by reducing their reimbursements which leaves oncology practices trapped in the middle of looming overhead expenses and creeping payment decreases [1].

Monitoring and understanding reimbursement revenue and keeping track of patient outcomes can open the door to value-based care with a renewed focus on patients. Oncology practices need to take steps to mitigate revenue losses for services that are already being performed while also staying on top of an ever-changing landscape of policy, litigation, and guidelines. The little things add up and cutting corners can lead to problems down the line. Therefore, investing in staff and practice resources now helps limit the risk of audits and paybacks in the future.

Optimizing the revenue cycle for an oncology practice can feel like troubleshooting countless small components to keep a larger, more complex system running smoothly. With significant investments in specialized equipment, treatment protocols, and drugs, as well as the challenge of decreasing reimbursement trends, managing revenue can be daunting. Unfortunately, audits and denials are a common reality that practices must prepare for since the most severe cases can result in significant losses.

To ensure revenue cycle optimization, oncology practices should ask themselves the following questions:

The list of concerns may seem inexhaustive, but establishing clear, consistent policies and procedures for all staff members forms a concrete foundation for proper accountability, increased opportunities for education, and more effective feedback. And in the end, you could see better reimbursement by focusing on revenue integrity.

Proper management of electronic health records (EHRs) is crucial in today’s healthcare landscape since a high volume of information is recorded and demanded. If your practice happens to still use paper charts, transitioning to an electronic system is essential for optimizing workflow, integrating clinical support tools, and streamlining processes. With that said, it is essential to ensure that EHR templates and documentation are compliantly used to avoid increased audit risk and to avoid decreased chances of winning appeals. Additionally, the more time that is invested in setting up a good foundation increases the opportunities for employee efficiency which can result in increased revenue. Funding is also available for optimizing current healthcare systems using data gathered during encounters. This can lead to care-based contracts that improve both financial and patient outcomes.

There has been a movement in recent years to try out value-based care alternative payment models and to move away from fee-for-service schedules. Eventually, the goal is to shift from incentivizing the performance of as many procedures/diagnostics as possible, and instead to incentivizing the promotion of overall wellness through screening, prevention, and care management. Successful programs will not be tied to how many services are provided, but concordant screening and testing for increased prevention.

One of the most current models in use is the Enhancing Oncology Model (EOM), which comes right on the heels of the Oncology Care Model (OCM) and builds upon its principles. Moving toward more care management services and advanced care planning brings unique documentation requirements in-and-of themselves. Is your staff ready for any of these changes? To succeed with this kind of model, you would need more services that may not have been in place before such as:

To achieve the goal of spending more time with patients, providers need to be properly compensated for their efforts. Proper alignment of compensation incentives can encourage providers to change routines and take advantage of discounts and payments available through federal programs. Therefore, designing progressive compensation models is an important step. It is important for practices to stay up to date with these programs and requirements, and to implement them as soon as possible to maximize their benefits. Additionally, payor agreements should be carefully reviewed to ensure that all available opportunities are being taken advantage of. Failing to do so could lead to outdated workflows and potential reimbursement issues in the future. It may not be the most exciting task, but reading the fine print can save practices from costly mistakes down the line. Lastly, it is important to pay attention to how you design compensation models to ensure they are consistent with fair market value.

Every oncology specialty has unique needs and concerns due to its patient population and the demands inherent to pathology. The complexity level of these cases is particularly high since the median age of cancer diagnoses is 662 and cancer is the second leading cause of death in the U.S.3. Capturing this complexity can later pay dividends in the form of Hierarchical Conditions Categories (HCC) and Merit-based Incentive Payment Systems (MIPS). An example of this would be such as documenting comorbidities properly in the HER. These coding systems use chronic conditions and social determinants of health (SDH) to project costs of patient care and to provide financial incentives when opted in. It would make sense that a lung cancer patient with uncontrolled chronic kidney disease and obesity would require more services than a lung cancer patient who only has hypertension. However, if not documented, it is hard to make that case to payers. As a result, proper coding and documentation are incredibly strategic from a compliance and revenue perspective.

As mentioned previously, trends toward consolidation require rigorous practice evaluation and capacity planning. Evaluations can be great opportunities for auditing current standards along with new providers joining the system which ensures consistency. If there are any hiccups during this process, outsourcing the production coding in the interim can be utilized to keep revenue consistent. Growth is a great thing but without the proper due diligence in all areas, it can become a greater hassle than it is worth, and can eventually lead to a worse outcome than if the consolidation never happened to begin with.

Ensuring maximal coverage for chemotherapy along with other cancer therapies is of the utmost importance with recent surveys reporting prior authorization as a significant concern that can lead to life-altering delays for critically ill patients [4]. What was once a tool for proper resource utilization has become a barrier to care that needs to be taken seriously to increase approvals. Prior authorization requirements tend to increase over time which can become a hurdle for patients due to the increase of experimental treatments used to combat cancer on average and the ever-moving goalposts.

Prior-authorization programs and denial resolution should be a priority investment for any oncology practice. Proper staff workflows and documentation are critical given that most times initiation of the prior authorization is not done by the oncologist but by office staff relying on the medical records available. Some ways to mitigate delays include ensuring the accurate and timely completion of charts, having education regarding guidelines, and the availability of peer-to-peer support. In many cases, practices lack education in this regard. Additionally, with movements toward “gold carding” providers that have a good history of prior authorization approval, there are possibilities for offices with a good track record to bypass the need for prior authorizations entirely in the future.

There are many ways to mitigate loss of reimbursement and ensure you receive the maximum possible even in an ever-changing healthcare landscape. Fortunately, you do not have to navigate this complex terrain alone. Whether it is an issue with coding, documentation, denials, reporting, operational workflows, payer contracts, staff, or Fair Market Value analysis and physician compensation model review, consultation services can be customized to address your current needs. Your work is too important not to receive optimal reimbursement for the services you provide, and if you’re unsure do not hesitate to seek assistance.

In conclusion, ensuring optimal reimbursement revenue and patient outcomes is crucial for the success of oncology practices in a rapidly evolving healthcare landscape. By monitoring and understanding reimbursement policies and patient outcomes, practices can transition toward value-based care and can prioritize the needs of their patients. This will require taking proactive steps to mitigate revenue losses, staying current with policy changes, and investing in staff and practice resources. To aid in this process, our experts at VMG Health encourage you to seek consultation services and resources that can help you navigate the complexities of reimbursement and regulatory compliance. With the right support and guidance, you can optimize your practice’s financial performance and deliver the highest quality of care to your patients.

December 15, 2022

By: Madi Whyde, Savanna Ganyard, CFA, Jordan Tussy, and Madison Higgins

VMG Health reviewed the earnings calls of publicly traded healthcare operators that reported earnings for the third quarter that ended on September 30, 2022. By focusing on the major players in select subsectors defined below, we analyzed the frequency of certain keywords including inflation, COVID-19, interest rates, premium labor, and others. We used these keywords to identify which topics commanded the room this earnings season. Highlights from the calls are summarized in this article.

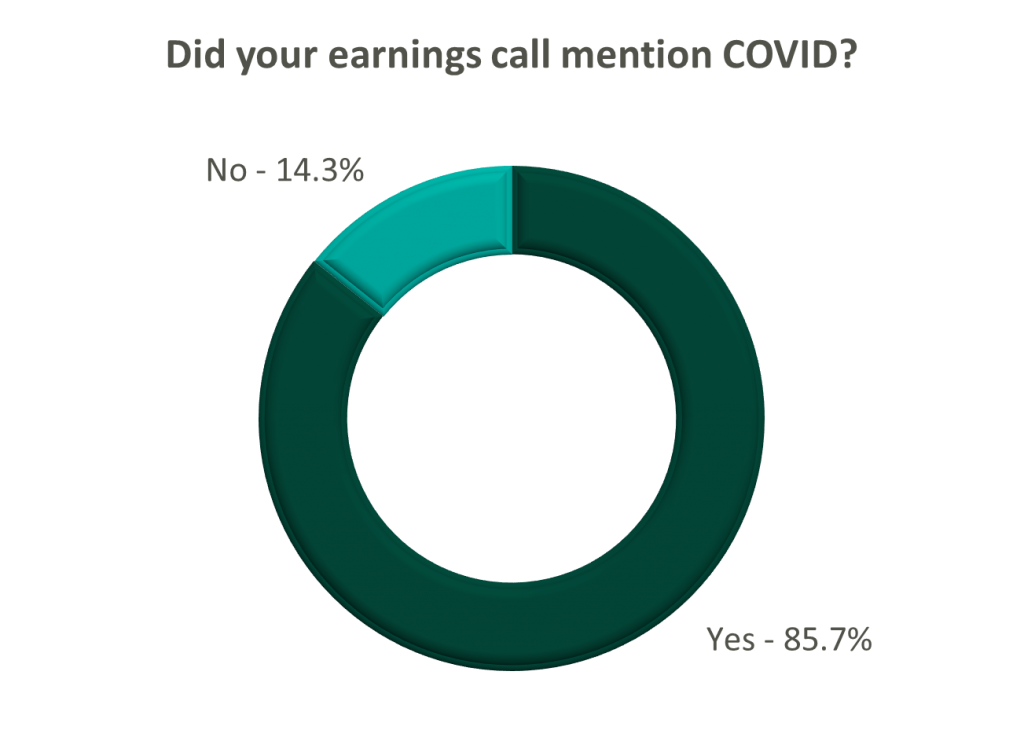

Volume: Although volume trends are unique to each industry sector nearly all operators remained focused on the impacts of COVID.

Poll: Did the earnings call mention COVID-19?

On a same-facility basis, admission volumes declined as much as 5.0% from the comparable prior year quarter (Q3 2021) for acute care hospital operators. Despite the weakening of COVID-19, the decline in volumes was attributed to higher-than-average cancellation rates (THC), the migration of certain procedures to outpatient status (CYH and HCA), and capacity constraints (HCA). Inpatient volumes generally remained at or below pre-pandemic levels.

Ambulatory surgery center (ASC) operators reaped the benefits of the migration to the outpatient setting and reported positive volume trends when compared to Q3 2021. Surgical volumes were reported as consistent with 2019 pre-pandemic levels (THC), and one operator claimed the business did not experience any material direct impact related to COVID-19 during Q3 2022 (SGRY).

The post-acute sector reported mixed results in volume trends. One operator reported a year-over-year decline of 14.0% in hospice admissions, citing capacity constraints and reduced referrals from acute care hospitals (EHAB). However, another operator indicated that increases in admissions in the second half of the third quarter showed growth that they “haven’t experienced since the start of the pandemic” (CHE).

Volume trends among other industry players including dialysis providers, risk-bearing organizations, and physician services were also affected by COVID-19 in Q3 2022. Headwinds in dialysis volumes are expected to persist for the foreseeable future (DVA), and inpatient volumes for risk-bearing organizations remain below pre-pandemic levels (AGL). Notably, AGL also reported a rebound in physician office visits and outpatient volumes were in line with pre-pandemic levels.

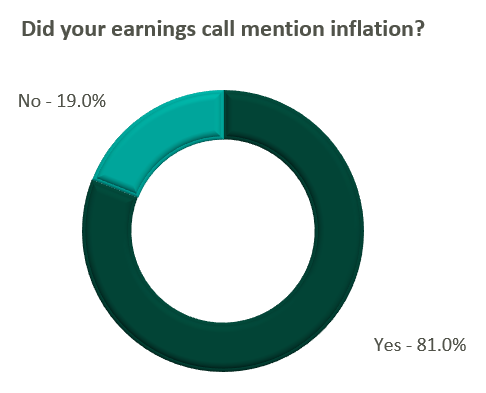

Reimbursement: Declining COVID-19 volumes mean less incremental government revenue for certain industry players who also now contend with an uncertain inflationary environment.

Poll: Did the earnings call mention inflation?

Declining COVID-19 volumes resulted in lower acuity patients and reduced incremental government reimbursement. This softened the reimbursement per admission for the acute care hospital segment. Further exacerbated by inflation, these dynamics were evident in reported EBITDA margins which declined as much as 17.0% (CYH) over Q3 2021. In response, some acute care hospital operators are turning to commercial payor negotiations. Rate increases for the next year are anticipated to range from a minimum of 3.0% (THC) to upwards of 6.0% (CYH).

The post-acute sector did not release specific figures regarding contract rate hikes. However, the sector is optimistically looking for high single-digit rate increases (SEM) to provide relief in the current inflationary environment.

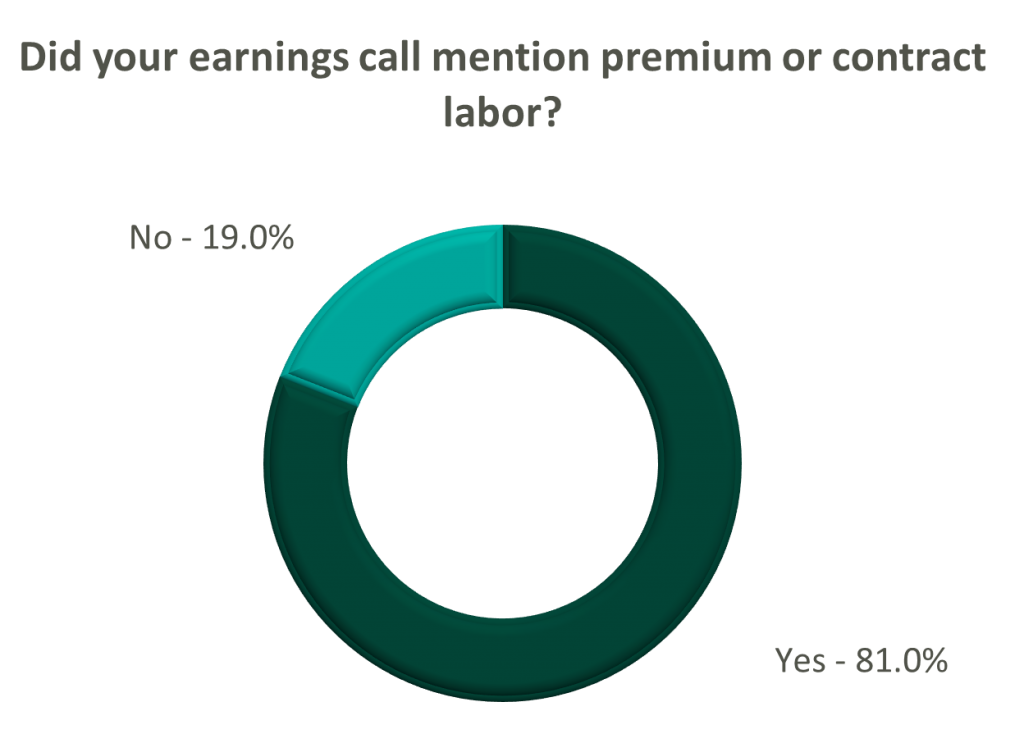

Labor: Unsurprisingly, management teams across the sector were faced with questions about labor trends and management techniques during their earnings calls. Contract labor remained pivotal for the operations of some, but premium labor appears to have softened during the quarter.

Poll: Did the earnings call mention premium or contract labor?

The reliance on contract labor continued its downward trend in Q3 helping moderate expenses. HCA even indicated overall labor costs were stable due to targeted market adjustments. However, contract labor and premium pay remain at uncomfortably high levels for most acute care hospital operators. UHS revealed during their call it will be unlikely to reach pre-pandemic levels in the near future.

Staffing challenges persisted among the post-acute operators and directly impacted volume by as much as 60.0% (AMED). Increased indirect labor costs including orientation, training, and sign-on bonuses were the leading drivers of decreased EBITDA (AMED). Wage inflation, particularly for nursing positions, is expected to rise as much as 5.0% next year (SEM). However, several management teams are optimistic wages will stabilize to historical levels (SEM, EHC) in the near future.

Other industry players, including dialysis and physical therapy providers, also faced challenges with contract labor during the quarter. USPH reported labor costs were approximately 200 basis points higher than Q3 2021 levels, and DVA indicated such costs showed no improvement.

Go Forward Expectations and Guidance: Considering the quarter’s performance, the companies we reviewed were divided relatively evenly in terms of revised FY 2022 revenue guidance, (i.e., raised, lowered, unchanged). In general, the quarter brought about a more pessimistic view of FY 2022 EBITDA, and the majority of public companies lowered their guidance for the year. Further, most stakeholders were left with no guidance for FY 2023.

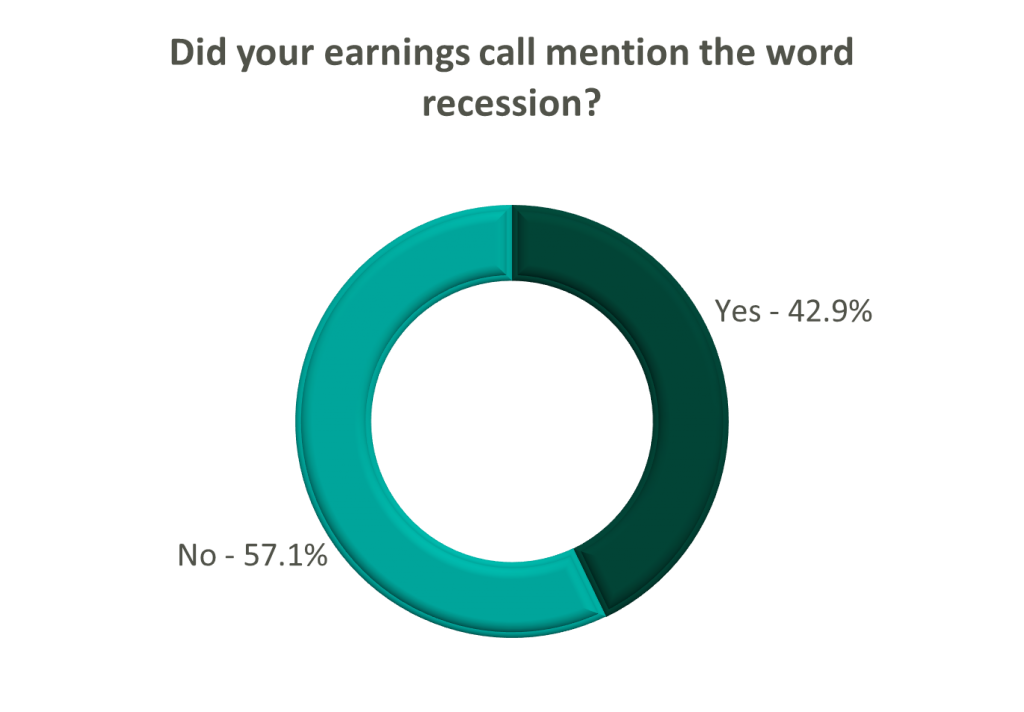

Poll: Did the earnings call mention a recession?

FY 2022 revenue and EBITDA guidance among the acute care hospital operators was generally left unchanged except for THC which lowered EBITDA guidance. However, all companies that were reviewed declined to provide FY 2023 guidance during the call, and primarily cited economic uncertainty (HCA).

The post-acute sector appeared nearly unanimous in the outlook for the rest of 2022, and most operators lowered their revenue and EBITDA guidance. Unsurprisingly, no one offered FY 2023 guidance during the earnings calls.

Interestingly, risk-bearing organizations mostly raised their revenue guidance for FY 2022 (AGL, CMAX, PRVA). However, EBITDA guidance was less predictable and was lowered (AGL, TOI), raised (PRVA), and unchanged (CMAX).

Most other healthcare operators followed similar patterns in terms of providing guidance for FY 2023. Of the companies we reviewed, only DVA revealed an outlook for the next year. The company anticipates revenue to be flat (driven by unfavorable volume trends) and margins to continue to feel the impact of labor market pressures.

August 9, 2022

Over the past few years, trends and events have occurred that have led to increased and continuing demand for mental health care services. First, the Affordable Care Act (ACA) expanded coverage and access to mental health care services.[1] Then, more recently, the COVID-19 Public Health Emergency (“PHE”), and corresponding citywide shutdowns, brought about a spike in anxiety and depression with these conditions increasing to four times pre-COVID-19 levels.[2,3] Healthcare workers were among some of the most heavily impacted with one study finding that almost half of healthcare workers reported serious psychiatric symptoms, including suicidal ideation.[4] While demand for mental health services has continued to increase, the number of providers actively practice in the United States is estimated to have the capacity to meet only 28% of all mental healthcare needs.[5]

As the COVID-19 pandemic increased demand for mental health care services, the healthcare industry rapidly expanded its offering of telehealth services. Specifically, telehealth services grew to represent up to 40% of outpatient care at the peak of the COVID-19 pandemic (up from less than 1% of outpatient care in 2019).[6] This increase in service offerings and patient care in the telehealth space was made possible by relaxed regulations related to the provision of telehealth services.[7] In the following sections, we discuss how healthcare organizations can implement or continue to expand telehealth services to meet demand for mental health care services in the communities they serve.

As discussed, the gap between the supply of mental health providers and the demand for mental health services is notably widening. As of June 30, 2022, Health Resources and Services Administration (HRSA) has designated 6,300 mental health provider shortage areas.[8]

These designated shortage areas collectively contain over 152 million Americans, approximately 46% of the total population. As health systems and hospitals attempt to navigate these challenges, telemedicine has emerged as a potential avenue for bridging the gap between the supply and demand for behavioral health services.

The American Telemedicine Association (“ATA”) describes telemedicine as the “natural evolution of healthcare in the digital world.” Precisely, telemedicine promotes and improves the quality, access and affordability of healthcare through the use of rapidly evolving technologies. Specifically, telemedicine refers to the use of medical information exchanged between parties via electronic communications to improve a patient’s clinical health status. Electronic communication including videoconferencing, streaming media, transmission of still images, remote patient monitoring devices and many other telecommunication methods allow(s) physicians to closely monitor and/or provide clinical services that would otherwise be unavailable for the patient. Oftentimes, the electronic information is combined with electronic medical records (“EMR”) to formulate a more accurate consultation or specialist opinion. Telehealth allows practitioners and patients to interact without the requirement to be face-to-face in a hospital or clinic setting.

At the same time, remote, or tele-, work was implemented across many industries to combat the challenges of the COVID-19 PHE shutdowns. As a greater percentage of the workforce had the option to participate in a remote work setting, 9 in 10 remote workers want to maintain remote work to some degree going forward.[9] One of the top reasons employees desire a hybrid or fully remote work arrangement is that it increases personal wellbeing. Given the well-documented physician burnout rates exacerbating provider shortages, it would be prudent for health systems, hospitals, and practitioners to consider using alternative coverage models, including employing the use of telemedicine. By leveraging virtual care offerings, practitioners can experience the same advantages that have led the majority of Americans to respond with resounding positivity to remote work, potentially alleviating some of the stressors that contribute to provider burnout.

Telemedicine offerings can also be used to redistribute the supply of practitioners. The hub and spoke model was one of the first practical telehealth models and is a common way to structure virtual care offerings while leveraging the existing practitioner base and extend care to facilities or communities in need. In this model, the hub facility is typically a larger facility that has the resources to provide specialized care that many smaller and/or rural facilities lack. By scaling the existing resources of the hub, the spoke sites are able to close gaps in care without incurring the costs associated with a full-time provider or locum tenens staffing. Behavioral health providers focused on increased access to care and better quality of care outcomes for their patients will find success in a virtual care-driven future.

Telemedicine is a tool for healthcare entities that, if embraced and properly utilized, can help bridge the behavioral health care gap. To effectively leverage virtual care services, it is important to understand the compliance and regulatory implications of these offerings and to establish equitable compensation models for providers that consider any limitations remote workplaces on of their scope of practice.

As of July 15, 2022, the COVID-19 PHE was extended through October 2022 by the Department of Health and Human Services (HHS) and, along with it, continued flexibility around regulatory compliance regarding telehealth and reporting deadlines. VMG’s Coding, Compliance, and Operational Excellence (CCOE) division has compiled current documentation and coding requirements for telehealth services, which are listed below. This list is not intended to be exhaustive, but rather an overview of important considerations related to a compliant telehealth service line.

In addition, the following guidelines should be considered when submitting claims to Medicare for virtual mental health services:

Additionally, in its CY 2023 Proposed Rule, CMS has proposed to make hospital outpatient behavioral telehealth services reimbursement permanent, which could increase access to behavioral health services in rural and other underserved communities.[11] It is important to note that after the PHE ends, additional behavioral health and telemedicine requirements will need to be met including:

As virtual services become more common through further regulatory shifts, healthcare organizations can expect increased scrutiny towards telehealth services arrangement by governmental enforcement bodies. The Office of Inspector General (OIG) and Department of Health and Human Services (HHS) released a Special Fraud Alert (Alert) on July 20, 2022, related to the inherent fraud and abuse risk associated with physicians or other health care professionals entering into arrangements with telemedicine companies, which specifically addresses fraud schemes related to telehealth, telemedicine, or telemarketing services based on dozens of civil and criminal investigations. The Alert identified seven characteristics that the OIG believes could suggest a given arrangement has potential risk for fraud and abuse. To learn more, reference this article and OIG’s statement.

By using telehealth, behavioral health providers can better fill the gap between growing demand and limited supply, providing quality and efficient services to those in need, particularly to underserved and isolated communities. Compliant telehealth arrangements can promote more efficient financial operations for health systems, provide increased access to care for patients, and improve the well-being of behavioral health providers.

1. https://www.commonwealthfund.org/blog/2020/aca-10-how-has-it-impacted-mental-health-care

2. https://www.psychiatrictimes.com/view/psychiatric-care-in-the-us-are-we-facing-a-crisis

4. https://pubmed.ncbi.nlm.nih.gov/33267652/

8. https://data.hrsa.gov/topics/health-workforce/shortage-areas

9. https://news.gallup.com/poll/355907/remote-work-persisting-trending-permanent.aspx

August 2, 2022

The private equity (PE) space is breaking records as the world continues to emerge from the COVID-19

pandemic. PE fundraising surged almost 20 percent in 2021 as firms looked to jump back in after the

uncertain financial climate created by the pandemic. When looking to deploy this capital, PE firms have

continued to take an interest in the healthcare industry. (1) Recently within this industry, PE firms made

investments in the $4.47 billion medical physics industry that has maintained a 5.9 percent CAGR from

2013 through 2021. There are numerous reasons why PE firms have increasingly targeted the medical

physics industry, such as the current industry composition along with the growth in the need and use of

the specialty. (2) These characteristics set medical physics apart as a particularly interesting area for future

investment.

Medical physics is a healthcare specialization focused on the application of physics to the treatment and

diagnosis of disease. Most often, medical physics is seen in the form of nuclear medicine, diagnostic

imaging, and radiation oncology. The medical physics industry is made up of numerous small-scale

providers that operate in localized geographical areas. Only a handful of substantially sized enterprises

operate in the medical physics space, resulting in a highly fragmented industry ripe for acquisitions and

roll-ups into large-scale platforms. The fragmentation of the industry provides ample opportunities for PE

to enter and expand its foothold in the medical physics industry. (3)

In addition to the extreme fragmentation, the demand for medical physics is expected to grow

significantly over the next six years. Experts predict the medical physics market will grow at a healthy 6.2

percent CAGR through 2028, exceeding a $6 billion market valuation. This growth is driven by the

increasing adoption and widening horizons of nuclear medicine across the healthcare landscape. (2)

Additional growth is expected as hospital consolidation continues to increase the use of outsourced

medical services. Even medical tourism is expected to contribute to industry growth as revenue comes in

from those traveling to seek specialized medical care from countries like China, Brazil, or India. (4) This

multisource growth is an appealing attribute for PE capital looking for favorable returns.

Lastly, significant barriers to entry exist for new medical physics operations, including high capital

requirements for expensive machinery, increasing regulation required for the specialty, and most

notably, the shortage of skilled providers in the medical physics space. In 2014 a mandatory residency

was implemented to better prepare new medical physicists for the complex field. While the new program

has produced well-prepared providers, it has also created a bottleneck that has put a strain on the

industry’s ability to create new operations. (5) This shortage places established operators with experience

at a significant advantage, setting them up as a prime target for PE investment.

PE firms can be beneficial collaborators and partners to medical physics practices. As PE interest in the

healthcare industry continues to increase, modern PE firms have gained the expertise to be effective

partners to healthcare practices. One of the most effective ways PE firms can enhance a medical physics

practice is through economies of scale. PE firms allow businesses to take advantage of efficiencies

created through economies of scale. By improving and centralizing back-office business operations and

providing greater access to technology, medical data, reporting and tracking systems, consolidated purchasing power, and marketing, private equity partners can create a more efficient business

structure and free up providers to focus on patient care.

Similarly, continued hospital consolidation may require other providers within their spheres of

influence to meet the greater demands and specialization needed in the industry. Some of

these demands include the growing regulation required of medical physics practices. (6)

Increasing regulatory demands may put monetary and staffing pressure on smaller

operations. The resources offered by PE investment could help alleviate some of these

pressures. (7) Furthermore, these resources could potentially improve the negotiating power

of businesses, resulting in better commercial payor rates and increased earnings.

Finally, PE investors could provide exit opportunities for retirement-age providers. PE

investment offers an exit strategy that enables these providers to monetize the business they

have built while also allowing the business to remain as an employer and provider of needed

care in its respective community. Based on an examination of the industry, as well as

discussions with industry professionals, sellers of a medical physics practice may be able to

expect a middle single-digit multiple on a given transaction. (4) For platform transactions, high

single-digit or low double-digit multiples may be warranted in the market.

As PE groups increase their interest in the medical physics industry, there have already been

several notable deals. Below is a summary of a few recent acquisitions, partnerships, and

platforms:

Blue Sea Capital, a PE firm based in Florida with over $750 million in assets, partnered with

mid-Atlantic firm Krueger-Gilbert Health Physics, LLC in April 2019 to form the platform

company Apex Physics Partners. Soon after, Apex entered partnerships with Ohio Medical

Physics Consulting, National Physics Consultants, Radiological Physics, and ZapIT! QA to

enter the Ohio, Texas, and New Mexico markets. (8) In 2021 Apex added several new

partnerships including Texas-based D. Harris Consulting, Indiana-based Advance Medical

Physics, Indiana-based INphysics, and Pacific Island-based Gamma Corporation to its

partnerships as the firm continued its expansion into new markets. (10, 11, 12, 13, 14)

L2 Capital, a PE firm based in Pennsylvania with over $100 million under management,

acquired Associates in Medical Physics, LLC and Radiation Management Associates, LLC in

May of 2017. L2 combined the medical physics service companies to create the platform

company Aspekt Solutions in April of 2021. In May of 2021, Aspekt Solutions acquired Nordic

Medical Physics to expand its geographical reach. (15, 16, 17)

LNC Partners, a PE firm with $500 million under management, completed a recapitalization

of West Physics Consulting, LLC in May 2018. West Physics has since acquired Phoenix