Fair Market Value Insights for Multi-Tiered Therapy Service Agreements

Christa Shephard

October 2, 2024

Effective October 8, 2024, Carnahan Group has joined VMG Health. Learn more.

October 15, 2024

Written by Clark Wilson, CVA; Greg Begun; and Ash Midyett, CFA

In the broadest sense, remote monitoring refers to a physician assessing a patient’s health through the use of a medical device or software while physically away from the patient. There are two main types of remote monitoring: remote patient monitoring (RPM) and remote therapeutic monitoring (RTM). RPM focuses on gathering physiological data from medical devices attached to the patient’s body, while RTM focuses on non-physiological data that is generally self-reported.

As it relates to physical therapy, RTM can be used to treat and monitor a wide range of conditions, including musculoskeletal conditions, respiratory conditions, geriatric conditions like osteoporosis, and others. Given the broad range of RTM services, there is a growing list of software providers targeting specific and use cases. Some of these entrants include Medsien, Owlytics Healthcare, and Zimmer Biomet, all of which have proprietary RTM software platforms.

The clinical advantages of RTM include improved adherence to treatment plans, enhanced recovery speeds, reduced re-injury rates, and increased patient satisfaction and engagement. Reducing the chance of reinjury and the number of post-injury visits may increase member satisfaction while enhancing data collection to improve treatment and outcomes. Practices may also see increased patient volumes through improved patient access to care and diagnostics, while minimizing the need for unnecessary in-person appointments.

As a new method of patient engagement, research on the efficacy of RTM remains limited. While research often considers remote monitoring as an effective method of treatment for many conditions, limited research specific to RTM exists for physical therapy applications. Additionally, critics often cite data privacy concerns as a primary headwind for further industry adoption.

In response to the growing adoption of RPM and RTM, the Centers for Medicare & Medicaid Services (CMS) first introduced CPT codes for RPM in 2018 and for RTM in 2021. Since the CPTs were first introduced, CMS has amended billing rules multiple times in response to the pandemic. As of the 2024 Final Rule, CMS allows for billing “incident to” under the direct supervision of a qualified provider (physical therapists, occupational therapists, and speech-language pathologists). RTM and RPM must also be delivered via an approved medical device (which may include software) as certified by the FDA.

The care lifecycle for RTM can generally be characterized by an initial diagnosis, in person or via a telehealth visit, followed by periodic monitoring of the condition, telehealth check ins, or exercise appointments. A provider must monitor a patient for at least 16 days of a 30-day period. As the typical physical therapy course of treatment can range from a few weeks to a couple months, it is easy to understand how RTM may be worked into the treatment life cycle.

RTM is newer than RPM, and payers have been slower to adopt coverage for RTM services as a result. Approved codes are relatively narrow in the scope of conditions covered. Medicaid coverage varies by state, and many states do not have a clear policy around reimbursement. Similarly, commercial payers have been slow to adopt coverage and are generally less likely to cover RTM than RPM.

RTM presents a unique opportunity for physical therapy practices to add an additional revenue stream without significant, up-front investment of time or capital and may broaden the practice’s eligible market for care. With the nearly ubiquitous adoption of mobile phones and growing popularization of fitness wearables, the cost of care for physical therapy RPM and RTM is primarily driven by the cost of software to administer the service ($15–$40 per month) and clinician time.

The RTM industry is in the early stage of the industry lifecycle, characterized by fragmentation, high margins, and a robust growth outlook. Current estimates by the Bipartisan Party Center suggest RPM adoption has been limited but is growing quickly, with 594 monthly claims per 100,000 Medicare enrollees as of 2021, which represents a six-fold increase since 2018. It is too early to say whether RTM will follow a similar growth trajectory. Statistics on usage and efficacy remain limited given the novelty of the technology and the fragmentation of its end market. For instance, there are over 37,000 outpatient rehabilitation clinics in the United States with the largest provider only controlling approximately 5% of the market.

In recent years, the adoption of RPM and RTM has been catalyzed by three primary headwinds: technological progress and the proliferation of mobile devices, an industry-wide shift toward value-based care, and the COVID-19 pandemic. For years, insurance payers, regulators, and thought leaders have heralded the adoption of value-based care initiatives to better align the cost of care with improved patient outcomes. RPM and RTM facilitate data collection and may improve patient outcomes while reducing costs through enhanced recovery speed, improved adherence to treatment plans, reduction in re-injury rates, and improved patient satisfaction and engagement. As value-based care continues to gain market share, RTM technology will likely benefit. The confluence of expanded coverage, patient demand, clinical research, and value-based care advocacy will likely bolster RTM adoption among physical therapy providers. While growth projections remain limited, Global Market Estimates predicts annual RTM market growth in the high teens over the coming years. Physical therapy business operators will likely continue to adopt RTM.

Physical therapy and remote patient monitoring. (2022). Telehealth.HHS.gov. https://telehealth.hhs.gov/providers/best-practice-guides/telehealth-for-physical-therapy/physical-therapy-and-remote-patient-monitoring

Saag, JL & Danila, MI. (2022). Remote Management of Osteoporosis. Curr Treatm Opt Rheumatol. DOI: 10.1007/s40674-022-00195-4. Epub 2022 Sep 2. PMID: 36068838; PMCID: PMC9438367.

ROI of RPM CCM and RTM. (n.d.). Humhealth. https://www.humhealth.com/blog/roi-of-rpm-ccm-and-rtm/

Remote Patient Monitoring (RPM) CPT Code Billing Summary. (n.d.). Healthsnap. https://healthsnap.io/resources/rpm-billing-overview/#:~:text=CPT%20Code%20Billing%20Summary&text=In%202018%2C%20CMS%20began%20providing,reimbursement%20associated%20with%20these%20codes.

Centers for Medicare & Medicaid Services (CMS). (2022). CMS Manual System. CMS. https://www.cms.gov/files/document/r11118cp.pdf

CMS.gov. Calendar Year (CY) 2024 Medicare Physician Fee Schedule Final Rule. (2023). CMS. https://www.cms.gov/newsroom/fact-sheets/calendar-year-cy-2024-medicare-physician-fee-schedule-final-rule

Thomas, JJ. (2022). How long is physical therapy session? Primal Physical Therapy. https://primalphysicaltherapy.com/how-long-is-physical-therapy-session/

Curtis, J., et. al. (2024). The Future of Remote Patient Monitoring. Bipartisan Policy Center. https://bipartisanpolicy.org/report/future-of-remote-patient-monitoring/

U.S. Physical Therapy (USPh). (2024). USPh IR Presentation Q1 2024. U.S. Physical Therapy. https://www.usph.com/wp-content/uploads/2024/05/USPH_IR_Presentation_Q1_2024_FINAL.pdf

Global Market Estimates (GME). (2024). Global Remote Therapeutic Monitoring Market Size. Global Market Estimates. https://www.globalmarketestimates.com/market-report/remote-therapeutic-monitoring-market-3954#:~:text=The%20global%20remote%20therapeutic%20monitoring,getting%20infected%20by%20the%20virus

October 10, 2024

Written by Ingrid Aguirre, CFA; Don Barbo, CPA/ABV

A solvency opinion is a professional assessment of a company’s financial health, specifically its ability to meet its long-term obligations. This opinion evaluates whether a company is solvent—meaning its assets exceed its liabilities—based on both current and projected financial conditions and that it has the ability to pay its obligations within a specified amount of time if required by lenders. A solvency opinion serves as a critical tool in corporate finance and transactional contexts, providing stakeholders with confidence in a company’s financial viability.

Solvency opinions are vital for ensuring compliance with various legal and regulatory requirements. They assure boards of directors, shareholders, and lenders that financial decisions—such as mergers, acquisitions, and dividend distributions—are made with a clear understanding of the company’s financial standing.

By obtaining a solvency opinion, companies can mitigate risks associated with potential insolvency claims. A well-supported opinion can protect directors and officers from liability by demonstrating that they acted in good faith and made informed decisions based on sound financial analysis.

A credible solvency opinion enhances transparency and builds trust among investors, creditors, and other stakeholders. It reassures them that the company is on solid financial footing, thereby facilitating smoother transactions and negotiations.

In a litigation context, solvency opinions play a pivotal role.

If a company faces lawsuits related to insolvency, such as fraudulent transfer claims, an independent solvency opinion can serve as a robust defense. It provides evidence that the company was solvent at the time of the transaction in question, helping to protect against accusations of misconduct.

Solvency experts can be called to provide testimony in court, explaining the methodologies and analyses that led to the solvency opinion. Their insights can clarify complex financial matters for judges and juries, lending credibility to the company’s position.

In disputes involving insolvency, a well-prepared solvency opinion can facilitate settlement discussions. It provides a factual basis for negotiations, helping to establish fair terms based on the company’s actual financial situation.

VMG Health provides comprehensive solvency opinions tailored to your specific needs. Our team of financial experts uses rigorous analysis and proven methodologies to ensure our opinions stand up to scrutiny, both in and out of the courtroom.

Our services include:

Secure your company’s financial future and protect your interests with a reliable solvency opinion from VMG Health. Contact us today and discover how we can help you navigate the complexities of financial integrity and legal compliance.

Hayes, A. (2024). What Is Solvency? Definition, How It Works With Solvency Ratios. Investopedia. https://www.investopedia.com/terms/s/solvency.asp

Jacobsen, C. (2018). Solvency Opinions: Legal Insights and Best Practices for Valuation. BV Research Pro. https://www.bvresources.com/articles/training-event-transcripts/solvency-opinions-legal-insights-best-practices-for-valuation

Jacobson, C. A., & Selbst, S. B. (2014, July 9). BVR’s Advanced Webinar Series on Valuations for Business Transactions: Part 1: Solvency Opinions [Webinar]. Business Valuation Resources LLC.

August 28, 2023

Written by James Tekippe, CFA and Zach Strauss

For those in the healthcare industry, telemedicine has been viewed as a way to increase access to healthcare, while mitigating the challenges of limited resources of physicians and healthcare providers. Although the use of telehealth has steadily grown over the past two decades, the challenges presented by the COVID-19 pandemic supercharged this growth. As the United States and the world move beyond the worst months and years of the pandemic, telemedicine usage will continue to change within the industry. This article will explore the state of telehealth immediately prior to and during the early years of the pandemic to provide context for the question, “What will be the next stage of telemedicine in the U.S. healthcare system?”

Prior to the COVID-19 pandemic, many people in the industry believed telemedicine had the potential to make healthcare more accessible, especially for underserved communities. However, in 2016 only 15% of physicians worked in healthcare practices that used telemedicine in any fashion.1 Part of why utilization was low pertained to reimbursement rates. Physicians who utilized telemedicine were not reimbursed at the same level by Medicare as in-person services, and only a limited amount of visit types provided through telemedicine were reimbursable.2,3 In addition, Medicare outlined certain stipulations that allowed providers to use telemedicine for care, including requiring that the provider had a pre-existing relationship with a patient, limiting a provider to only providing services at the practice where they typically provided in-person services, and necessitating the provider was licensed and physically in the same state as the patient being treated.2,4 Finally, the technology used to provide telemedicine had to meet the requirements of the Health Insurance Portability and Accountability Act (HIPAA), which required providers to invest in compliant technology to be able to offer care using telemedicine.5

During 2020, the COVID-19 pandemic became a catalyst that rapidly changed the direction of telemedicine in the U.S. From February 2020 to February 2021 telehealth claims volumes increasing 38x year over year.6 As the world, began implementing lockdown orders in February and March 2020 to limit the spread of COVID-19, legislators in the U.S. looked for a solution to assist the public in accessing the healthcare system while mitigating the public’s fear of contracting this virus. Various solutions were enacted as part of the CARES Act, which was passed in March 2020. These solutions were aimed at increasing the use of telemedicine by healthcare providers. Through CARES, many of the barriers that previously made it harder for providers to adopt the usage of telemedicine were relaxed. This created an unprecedented opportunity for providers to explore the capacity of this medium of care.

First, Medicare changed reimbursement for telemedicine visits to be the same as in-office visits.3 Additionally, physicians were given the ability to reduce, or even fully waive, the Medicare patient cost-sharing for telehealth services which made telemedicine more attractive to patients.3 The CARES Act also removed location barriers and made it possible for providers to see patients who were in different states from the provider during a visit.2 The CARES Act also allowed healthcare providers to offer more types of visits through telemedicine means, like emergency department visits, remote patient monitoring visits, and check-in visits.2 Additionally, providers who historically were not able to provide care through telemedicine, like occupational therapists and licensed clinical social workers, were able to use telemedicine as an option to treat patients.4 Finally, technology HIPAA requirements were relaxed such to allow more two-way audio-visual options, such as Facetime, Skype, Zoom, and audio-only telephonic services for telemedicine visits. This realty increased the ability for providers to offer this service to their patients.2, 5

As the country moves beyond the public health emergency COVID-19 created, the future of telemedicine will depend on whether = regulations revert back to the pre-COVID state. States across the country, from Washington to New Hampshire to Virginia, are introducing legislation to expand telemedicine beyond the CARES Act.7 Despite different geographical locations and political leanings, states seem to agree about telemedicine’s ability to increase access to healthcare. For example, Oregon has introduced legislation to permanently allow out-of-state physicians and physician assistants to provide specified care to patients in Oregon.7 Texas has proposed legislation that would remove the requirement of being “licensed in this state” from an array of licensing and practice requirements for providers to practice telemedicine in the state.7 Virginia has also proposed legislation that offers a solution for telemedicine service provider groups that employ health care providers licensed by the Commonwealth. The legislations would establish that these groups do not need a service address in the Commonwealth to maintain their eligibility as a Medicaid vendor or provider group.7

At the national level, two active bills, HR 4040 and HR 1110, both contain pro-telemedicine legislation. HR 4040, passed by the House in July of 2022, extended certain Medicare telehealth flexibilities beyond the end of the COVID-19 public health emergency (PHE). The bill would allow for Medicare beneficiaries to continue receiving telehealth services in any location they wish until December 31, 2024, or the end of the PHE, whichever comes later..8 In addition, this legislation would continue to grant other healthcare providers, such as occupational therapists and physical therapists, the freedom to continue practicing telemedicine via the CARES Act.8 Finally, behavioral health services, alongside evaluation/management services, would still be allowed via audio-only technology.8 Within the industry, this bill has seen support, specifically from the American Telemedicine Association and the American Counseling Association.7, 9

HR 1110 is a report commissioned by Congress with the explicit purpose of expanding access to telehealth services to Medicare and Medicaid beneficiaries.10 Under this legislation, Congress would require that two reports be provided, one by the U.S. Department of Health and Human Services, and the second by the Medicaid and CHIP Payment and Access Commission (MACPAC) and the Medicare Payment Advisory Commission (MedPAC).10 In the report led by HHS, Congress would require HHS to provide a comprehensive list of telehealth services available during the PHE. This report would include details about the types of providers that could supply these services, a comprehensive list of actions the secretary of the HHS took to expand access to telehealth services, and the reasons for these actions.10 Additionally, this report would require a quantitative and qualitative analysis of the previously mentioned telehealth services, specifically calling out data regarding use by rural, minority, elderly, and low-income populations.10

Regarding the MedPAC and MACPAC report, Congress would require an assessment of the improvements or barriers in accessing telehealth services during the PHE. And in addition, the information MedPAC and MACPAC know regarding the increased risk of fraudulent activity that could result due to expanding telehealth services.10 To conclude the report, Congress has asked both MedPAC and MACPAC to provide recommendations for improvements to current telehealth services and expansions of these services, as well as potential approaches for addressing fraudulent activity previously outlined in the report.10 Ultimately, these reports would be vital in shaping future policies around telemedicine to increase access to and improve the effectiveness of telehealth.

The last few years there have been major changes in many aspects of life, including the ways healthcare is delivered. The U.S. was able to tap into the large potential telemedicine has to offer during the worst stages of the pandemic. However, as we move into the future, it will be important for local and federal governments to continue improving the regulations that impact telemedicine to help expand access.

December 15, 2022

By: Madi Whyde, Savanna Ganyard, CFA, Jordan Tussy, and Madison Higgins

VMG Health reviewed the earnings calls of publicly traded healthcare operators that reported earnings for the third quarter that ended on September 30, 2022. By focusing on the major players in select subsectors defined below, we analyzed the frequency of certain keywords including inflation, COVID-19, interest rates, premium labor, and others. We used these keywords to identify which topics commanded the room this earnings season. Highlights from the calls are summarized in this article.

Volume: Although volume trends are unique to each industry sector nearly all operators remained focused on the impacts of COVID.

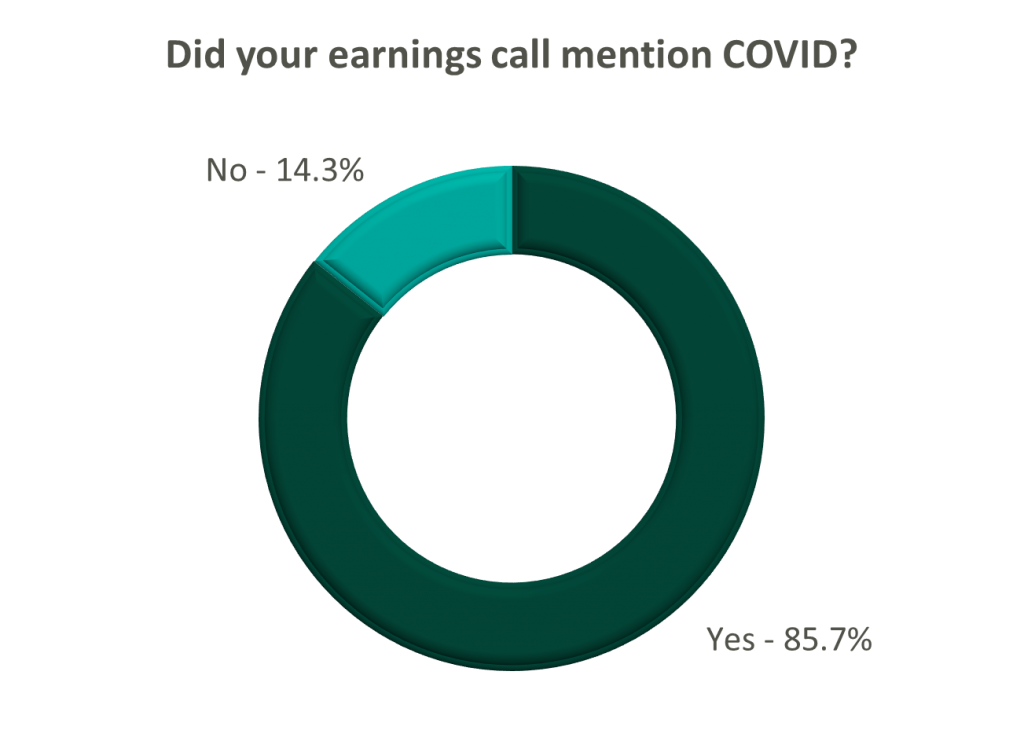

Poll: Did the earnings call mention COVID-19?

On a same-facility basis, admission volumes declined as much as 5.0% from the comparable prior year quarter (Q3 2021) for acute care hospital operators. Despite the weakening of COVID-19, the decline in volumes was attributed to higher-than-average cancellation rates (THC), the migration of certain procedures to outpatient status (CYH and HCA), and capacity constraints (HCA). Inpatient volumes generally remained at or below pre-pandemic levels.

Ambulatory surgery center (ASC) operators reaped the benefits of the migration to the outpatient setting and reported positive volume trends when compared to Q3 2021. Surgical volumes were reported as consistent with 2019 pre-pandemic levels (THC), and one operator claimed the business did not experience any material direct impact related to COVID-19 during Q3 2022 (SGRY).

The post-acute sector reported mixed results in volume trends. One operator reported a year-over-year decline of 14.0% in hospice admissions, citing capacity constraints and reduced referrals from acute care hospitals (EHAB). However, another operator indicated that increases in admissions in the second half of the third quarter showed growth that they “haven’t experienced since the start of the pandemic” (CHE).

Volume trends among other industry players including dialysis providers, risk-bearing organizations, and physician services were also affected by COVID-19 in Q3 2022. Headwinds in dialysis volumes are expected to persist for the foreseeable future (DVA), and inpatient volumes for risk-bearing organizations remain below pre-pandemic levels (AGL). Notably, AGL also reported a rebound in physician office visits and outpatient volumes were in line with pre-pandemic levels.

Reimbursement: Declining COVID-19 volumes mean less incremental government revenue for certain industry players who also now contend with an uncertain inflationary environment.

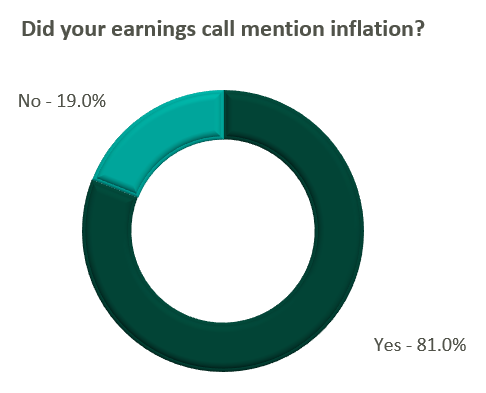

Poll: Did the earnings call mention inflation?

Declining COVID-19 volumes resulted in lower acuity patients and reduced incremental government reimbursement. This softened the reimbursement per admission for the acute care hospital segment. Further exacerbated by inflation, these dynamics were evident in reported EBITDA margins which declined as much as 17.0% (CYH) over Q3 2021. In response, some acute care hospital operators are turning to commercial payor negotiations. Rate increases for the next year are anticipated to range from a minimum of 3.0% (THC) to upwards of 6.0% (CYH).

The post-acute sector did not release specific figures regarding contract rate hikes. However, the sector is optimistically looking for high single-digit rate increases (SEM) to provide relief in the current inflationary environment.

Labor: Unsurprisingly, management teams across the sector were faced with questions about labor trends and management techniques during their earnings calls. Contract labor remained pivotal for the operations of some, but premium labor appears to have softened during the quarter.

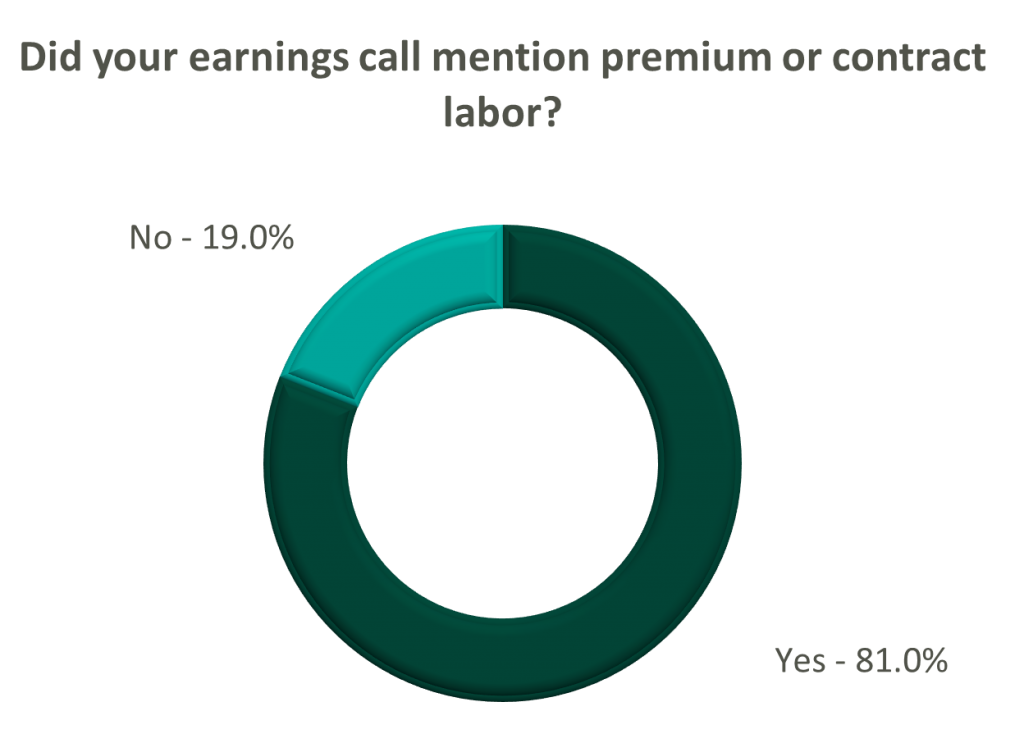

Poll: Did the earnings call mention premium or contract labor?

The reliance on contract labor continued its downward trend in Q3 helping moderate expenses. HCA even indicated overall labor costs were stable due to targeted market adjustments. However, contract labor and premium pay remain at uncomfortably high levels for most acute care hospital operators. UHS revealed during their call it will be unlikely to reach pre-pandemic levels in the near future.

Staffing challenges persisted among the post-acute operators and directly impacted volume by as much as 60.0% (AMED). Increased indirect labor costs including orientation, training, and sign-on bonuses were the leading drivers of decreased EBITDA (AMED). Wage inflation, particularly for nursing positions, is expected to rise as much as 5.0% next year (SEM). However, several management teams are optimistic wages will stabilize to historical levels (SEM, EHC) in the near future.

Other industry players, including dialysis and physical therapy providers, also faced challenges with contract labor during the quarter. USPH reported labor costs were approximately 200 basis points higher than Q3 2021 levels, and DVA indicated such costs showed no improvement.

Go Forward Expectations and Guidance: Considering the quarter’s performance, the companies we reviewed were divided relatively evenly in terms of revised FY 2022 revenue guidance, (i.e., raised, lowered, unchanged). In general, the quarter brought about a more pessimistic view of FY 2022 EBITDA, and the majority of public companies lowered their guidance for the year. Further, most stakeholders were left with no guidance for FY 2023.

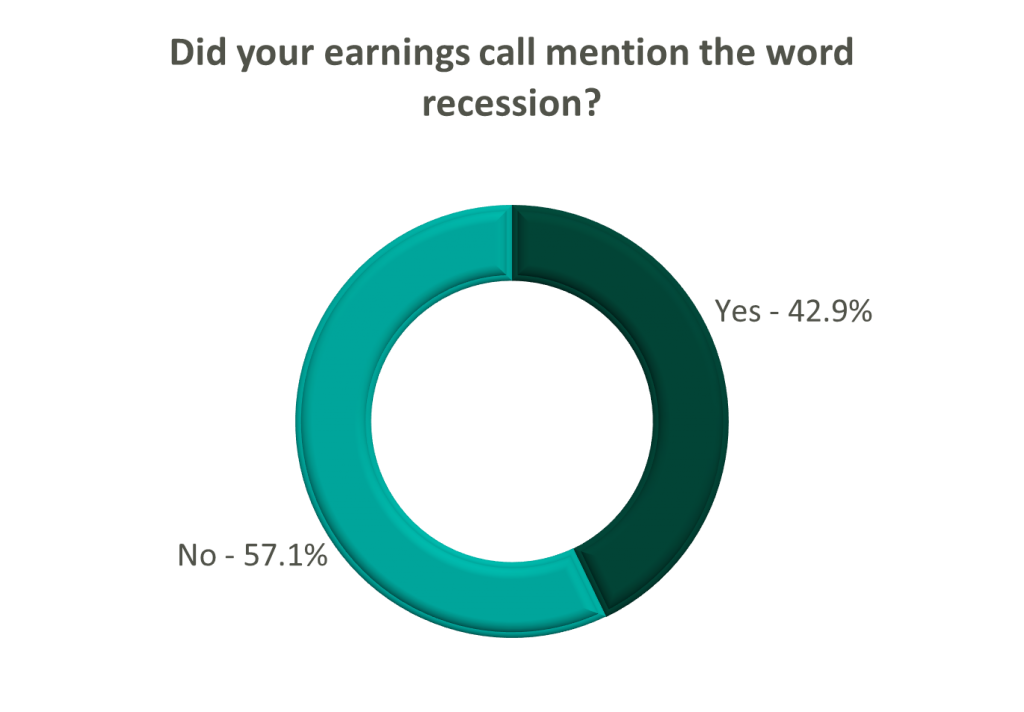

Poll: Did the earnings call mention a recession?

FY 2022 revenue and EBITDA guidance among the acute care hospital operators was generally left unchanged except for THC which lowered EBITDA guidance. However, all companies that were reviewed declined to provide FY 2023 guidance during the call, and primarily cited economic uncertainty (HCA).

The post-acute sector appeared nearly unanimous in the outlook for the rest of 2022, and most operators lowered their revenue and EBITDA guidance. Unsurprisingly, no one offered FY 2023 guidance during the earnings calls.

Interestingly, risk-bearing organizations mostly raised their revenue guidance for FY 2022 (AGL, CMAX, PRVA). However, EBITDA guidance was less predictable and was lowered (AGL, TOI), raised (PRVA), and unchanged (CMAX).

Most other healthcare operators followed similar patterns in terms of providing guidance for FY 2023. Of the companies we reviewed, only DVA revealed an outlook for the next year. The company anticipates revenue to be flat (driven by unfavorable volume trends) and margins to continue to feel the impact of labor market pressures.

July 21, 2022

By: Bartt Warner, CVA and Dane Hansen

The Office of Inspector General (OIG) and Department of Health and Human Services (HHS) released a Special Fraud Alert (Alert) on July 20, 2022 related to the inherent fraud and abuse risk associated with physicians or other health care professionals entering into arrangements with telemedicine companies (Telemedicine Companies).1 Specifically, addressing fraud schemes related to telehealth, telemedicine, or telemarketing services based on dozens of civil and criminal investigations. The Alert identified seven characteristics that the OIG believes could suggest a given arrangement has potential risk for fraud and abuse. However, the OIG was cautious not to state that all Telemedicine Companies and arrangements are suspect, but rather to identify key characteristics in potentially problematic arrangements as the prevalence of telehealth services continually increases. In addition, the Alert was designed to provide practical compliance guidance and help establish guardrails with relation to telemedicine arrangements. Simultaneously, the OIG also updated its Telehealth Resource Page2 which aggregates compliance and enforcement resources.

The Alert provided a specific example of how Telemedicine Companies have utilized kickbacks to aggressively recruit and reward telemedicine practitioners to further their fraud schemes. According to the example:

“…in some of these fraud schemes Telemedicine Companies intentionally paid physicians and nonphysician practitioners (collectively, Practitioners) kickbacks to generate orders or prescriptions for medically unnecessary durable medical equipment, genetic testing, wound care items, or prescription medications, resulting in submissions of fraudulent claims to Medicare, Medicaid, and other Federal health care programs. These fraud schemes vary in design and operation, and they have involved a wide range of different individuals and types of entities, including international and domestic telemarketing call centers, staffing companies, Practitioners, marketers, brokers, and others.”

Based on the OIG’s experience with fraud and abuse in this realm, the Telemedicine Companies often work out an arrangement with the Practitioners to order and prescribe medically unnecessary items and services. Oftentimes, the Telemedicine Companies pay the Practitioners for prescribing items or various services to patients who have had limited interaction with the Practitioner and without regard to the medically necessity for this service or prescription. In addition, these kickbacks are routinely disguised as payment per review, audit, consult, or for the assessment of medical charts and are often tied to the volume of federally reimbursable items or services ordered or prescribed by the Practitioners. As a result, the fees associated with the problematic arrangements are being used as a mechanism to incentivize a Practitioner to order medically unnecessary items or services according to the Alert. Of additional concern, the OIG noted that in many cases the Telemedicine Companies sell the prescriptions that are generated by the Practitioners to other entities who in turn will fraudulently bill for the medically unnecessary items or services.

The OIG makes it clear in the Alert that these fraudulent telemedicine schemes pose a significant risk to the health care system and that both Practitioners and health systems should exercise extreme caution when entering into arrangements with Telemedicine Companies. Specifically, the Alert stated,

“These schemes raise fraud concerns because of the potential for considerable harm to Federal health care programs and their beneficiaries, which may include: (1) an inappropriate increase in costs to Federal health care programs for medically unnecessary items and services and, in some instances, items and services a beneficiary never receives; (2) potential to harm beneficiaries by, for example, providing medically unnecessary care, items that could harm a patient, or improperly delaying needed care; and (3) corruption of medical decision-making.”

These telemedicine schemes have the potential for violating multiple Federal Laws, but most specifically, the Federal anti-kickback statute. Violations of the Federal Anti-kickback statute ascribes liability to both sides of the arrangement and can potentially lead to criminal, civil, or administrative liability under other Federal laws as well.

Based on the OIG’s experience with various problematic telemedicine arrangements, seven “suspect characteristics” were identified that taken together, or separately, could suggest an arrangement presents a heightened risk for fraud and abuse. However, it should but noted that the list is not exhaustive, but rather illustrative and the presence or absence of these characteristics does not determine if a particular telemedicine arrangement would constitute grounds for legal sanctions.

Given the heightened regulatory scrutiny placed on telehealth service arrangements by the OIG and HHS, it is pertinent for health systems, hospitals, and Practitioners to employ certain best practices when considering, implementing, and operating any type of virtual care program. Many of the best practices for traditional face-to-face professional services arrangements are directly applicable to telemedicine arrangements. For example, a telehealth arrangement should be justifiable for all parties involved. From the perspective of a health system or hospital for example, the addition of a virtual care service line could be pursued to fill a highly desired gap in medical care, increase the quality of medical care currently available to its patient base, or alleviate overburdened Practitioners.

Prior to entering any business relationship for telehealth services, it is a best practice to consult with legal counsel. Telemedicine service contracts should be explicit in outlining the expectations of medical care and the structure and magnitude of remuneration. Further, it is particularly important to maintain ongoing dialogue with legal counsel throughout the life of a telemedicine relationship to ensure that a program that was once compliant does not break the bounds into non-compliance over time. Preserving a compliant telehealth business relationship is typically aided by a robust compliance program, created with the help of legal counsel, which outlines specific guidelines for professional examinations, prescribing and billing practices, administrative and record maintenance procedures. Compliance programs should be consistently reviewed and updated as regulatory bodies issue more literature on the subject matter. A static compliance program may quickly become inadequate as the virtual care regulatory landscape continues to evolve. Obtaining third party support of an arrangement is often a pillar of successful compliance programs. The arrangement should be commercially reasonable to all parties involved and any compensation should be directly attributed to services performed and have no consideration of referrals. Obtaining a third-party fair market value (FMV) review is a key best practice in maintaining regulatory compliance within the context of telemedicine arrangements. In addition, seeking a third-party commercial reasonableness assessment should also help mitigate compliance risk by documenting and assessing both qualitative and quantitative factors as to why the telemedicine arrangement is a sensible and prudent business decision without the consideration of referrals.

Although the Special Fraud Alert addresses that it is not intended to discourage legitimate telemedicine arrangements, serious compliance risk may occur if an arrangement has any of the seven “suspect characteristics” as previously discussed. In addition, the OIG made it clear that Practitioners have both legitimately and appropriately utilized telehealth services to provide medically necessary care to their patients during the current public health emergency. Best practices should include a cautious approach to telemedicine arrangements while ensuring there are specific guidelines and guardrails, determining and documenting the justification for the arrangement, ensuring the arrangement is commercially reasonable, and determining if the remuneration paid to the Practitioners is consistent with FMV.

Endnotes

1 Special Fraud Alert: OIG Alerts Practitioners To Exercise Caution When Entering Into Arrangements With Purported Telemedicine Companies available at: https://oig.hhs.gov/documents/root/1045/sfa-telefraud.pdf

2Telehealth Featured Topic from HHS and the OIG available at: https://oig.hhs.gov/reports-and-publications/featured-topics/telehealth/

Authors

Related Content