Oncology: Private Equity Investment in Cancer Care

Zach

July 27, 2021

Effective January 16, 2024, Compliance Risk Analyzer has joined VMG Health. Learn more.

June 11, 2024

Written by Timothy Kent; Jordan Tussy, CVA; Molly Smith

GenesisCare, a prominent provider of cancer services worldwide, filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code on June 1, 2023, in the United States Bankruptcy Court for the Southern District of Texas (Case No. 23-90614). The Australian-based company, once valued at $5 billion and backed by private equity firm KKR, faced financial difficulties due to high debt levels and operational challenges.

Founded in 2004 by Dan Collins, GenesisCare (the “Company”) served Australian cancer patients until 2015, when the Company expanded to Europe via its purchase of eight cancer centers from Cancer Partners UK. During 2016, GenesisCare continued growing its European operations through the acquisitions of 17 centers in Spain from IMOncology and Oncosur Group.

In late 2019, GenesisCare made headlines with the acquisition of U.S.-based cancer provider 21st Century Oncology for $1.5 billion. Two years prior, 21st Century Oncology filed for bankruptcy because of declining reimbursement and “regulatory costs concerning electronic records and legal expenses.” At the time of acquisition by GenesisCare, 21st Century Oncology operated 294 locations, including 124 radiation oncology centers, with an estimated $230 million of earnings before interest, tax, and depreciation (EBITDA).

While rapidly expanding GenesisCare’s footprint, the 21st Century acquisition left the Company with significant levels of debt and a new operations base that was reemerging from bankruptcy. GenesisCare faced significant challenges in its effort to turnaround the U.S. operations, including an aging equipment base and IT system, operational inefficiencies, and increased competition. Prior to GenesisCare’s Chapter 11 filing, they reported approximately $2 billion of total debt on its balance sheet, largely associated with the 21st Century acquisition.

In March 2023, CEO and Founder Dan Collins stepped down, and three months later, the Company filed for bankruptcy on June 1, 2023.

Five months after its initial filing, GenesisCare announced the U.S. Bankruptcy Court for the Southern District of Texas confirmed the Company’s Chapter 11 Plan of Reorganization after receiving support from approximately 95% of voting creditors. The plan included significant deleveraging of GenesisCare’s balance sheet, with a reduction in total debt by approximately $1.7 billion.

On February 16, 2024, GenesisCare completed its reorganization process and emerged from Chapter 11. As part of its reorganization plan, GenesisCare will operate as four distinct businesses in the U.S., Australia, Spain, and the UK, with an independent governance structure and Board of Directors for each business. Furthermore, the businesses will be responsible for the strategies and performance of their market. The Company also received approximately $56 million of new capital infusion from investor groups to help support the growth of the remaining businesses. As a result of the restructuring plan, the Company is prepared to move forward well capitalized with a relatively low level of debt and a more focused operational strategy.

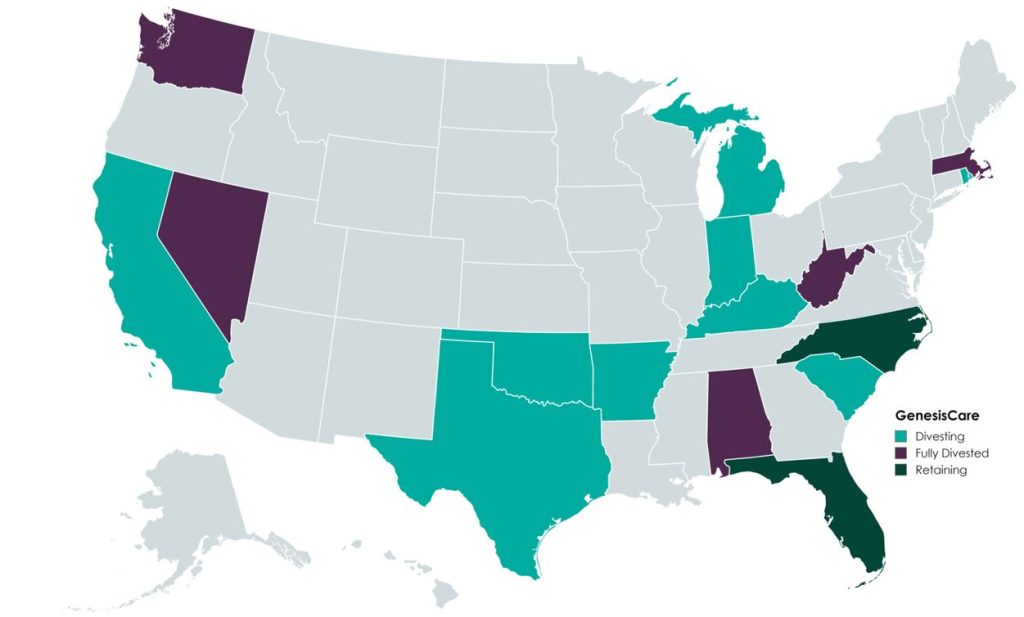

In the U.S., GenesisCare will retain practices in the “fast-growing markets” of Florida and North Carolina, which will continue to offer similar cancer care services (medical oncology, radiation oncology, surgery, and imaging). Currently, the Company operates 145 locations across the two states. GenesisCare has sold or is in the process of divesting its remaining assets across 14 states.

Newly appointed chief executive officer David Young said, “I am confident that our independently run businesses are strongly positioned to capture the exciting opportunities available to them in the markets they serve while never losing sight of our core goal: delivering better life outcomes to patients.”

A primary objective of GenesisCare’s restructuring plan was to divest all U.S.-based assets outside of North Carolina and Florida. This decision was part of its strategic plan to focus on core operations to ensure long-term sustainability.

According to bankruptcy filing documents, GenesisCare has divested 32 locations across 14 states. Assuming all of the transactions close at the defined purchase price in the transaction agreements, cash proceeds to GenesisCare would be approximately $113 million, with an implied equity value of approximately $131 million (see chart below). The assets have drawn interest from many different buyer types, including health systems, large oncology platforms, and practices. Dr. Shaden Marzouk, President of GenesisCare U.S., said, “The strong interest we received from a wide variety of buyers from across the U.S. is a reflection of what we have long known―that GenesisCare’s U.S. business benefits from an incredible team, a desirable footprint and a proven ability to care for patients.”

One notable transaction was OneOncology’s acquisition of two radiation oncology practices in South Carolina for $25.0 million (per the asset purchase agreement), expanding OneOncology’s service offerings in an existing market. CEO of OneOncology, Jeff Patton, MD, said, “For OneOncology, these are two great business assets that are really the only radiation facilities that are open in that market. It’s a market we were already in, so sometimes things match up well.” Specifically, OneOncology acquired a Myrtle Beach facility with three linear accelerators and a Conway Center with one.

California-based Sutter Health purchased five radiation oncology practices in Modesto, San Luis Obispo, Santa Cruz, Stockton, and Templeton, California. According to the purchase agreement, the total purchase price for these centers was $32 million. President and CEO of Sutter Health, Warner Thomas said, “We know how important it is for specialty services like cancer care to be offered close to home so patients can stay on track with their treatments. Keeping continued cancer care accessible in these communities was a driving force for Sutter to acquire these care centers.” Sutter also has certain capital investments in mind, including new radiation oncology equipment, technologies, and other support services.

Based on Kroll’s bankruptcy docket, there are medical and radiation oncology assets still available for sale, which could result in increased transaction activity with interest buyers, such as health systems, private equity–backed oncology platforms, and practice acquisitions. After successfully emerging from Chapter 11, GenesisCare is entering a new chapter, as emphasized by CEO David Young: “GenesisCare has achieved the goals it set out at the beginning of its restructuring process. We exit Chapter 11 with great businesses, each with a compelling future.” The Company’s focus on continuous growth is highlighted by the planned construction of three new radiation oncology centers in Australia, scheduled to open in 2024. With a more concentrated U.S. and global platform, GenesisCare has indicated that it is well positioned for future growth as a newly capitalized, low-debt entity committed to providing the highest level of care for its patients.

Patrick, A. (2024, February 18). GenesisCare emerges from bankruptcy, cuts deal with government. Australian Financial Review. Retrieved from https://www.afr.com/companies/healthcare-and-fitness/genesiscare-emerges-from-bankruptcy-cuts-deal-with-government-20240218-p5f5t5

Staff Writer. (2024). Amid major cancer care bankruptcy, oncology clinics sold. Oncology News Central. Retrieved from https://www.oncologynewscentral.com/article/amid-major-cancer-care-bankruptcy-oncology-clinics-sold

GenesisCare. (2024). GenesisCare’s reorganisation plan confirmed with overwhelming support from voting creditors. GenesisCare. Retrieved from https://www.genesiscare.com/au/news/genesiscare-reorganisation-plan-confirmed-with-overwhelming-support-from-voting-creditors

GenesisCare. (2024). GenesisCare completes reorganisation and emerges from Chapter 11. GenesisCare. Retrieved from https://www.genesiscare.com/au/news/genesiscare-completes-reorganisation-and-emerges-from-chapter-11

Patrick, A. (2019, December 13). Aussie cancer outfit makes first US move in $1.5b deal. Australian Financial Review. Retrieved from https://www.afr.com/companies/healthcare-and-fitness/aussie-cancer-outfit-makes-first-us-move-in-1-5b-deal-20191213-p53js7

Private Equity Stakeholder Project. (2024). Private equity healthcare bankruptcies are on the rise. Private Equity Stakeholder Project. Retrieved from https://pestakeholder.org/reports/private-equity-healthcare-bankruptcies-are-on-the-rise/

Authors

Subscribe

to our blog