Utilizing Telehealth Services to Improve Access to Behavioral Healthcare

Rachel Linch

August 9, 2022

Effective January 16, 2024, Compliance Risk Analyzer has joined VMG Health. Learn more.

March 14, 2024

Written by William Teague, CFA; Justin Vachon; and Ash Midyett, CFA

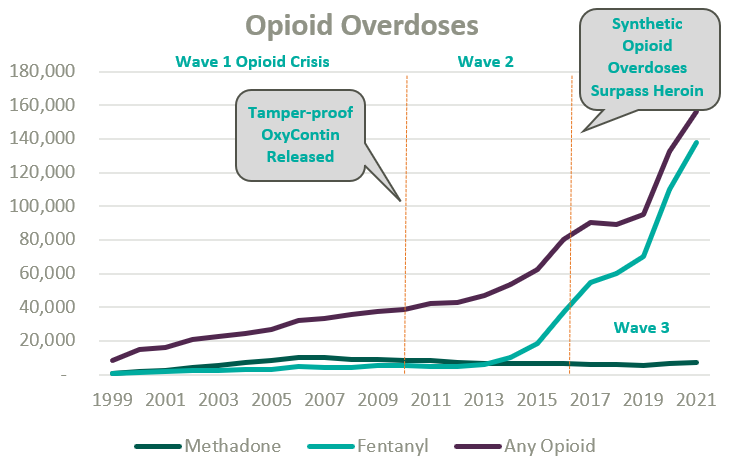

Since the start of the opioid epidemic in the late 1990s, over one million overdoses have been recorded. This figure continues to climb at an accelerated rate following the COVID-19 pandemic and the proliferation of fentanyl. Since 2020, opioid overdoses increased 64%, prompting lawmakers and regulators alike to initiate widespread deregulation and funding of Medication Assisted Treatment (MAT) for Opioid Use Disorder (OUD) to increase access to care amidst what is widely considered a national crisis.1

Medication-assisted treatment (MAT) is a primary method for treating opioid use disorder (OUD) and integrates prescription opioid agonists, which can help manage cravings and withdrawal symptoms, with comprehensive care. Typically, this care combines prescription medications with behavioral health and occupational therapy, drug screenings and occupation advocacy, and other counseling services. MAT can widely be categorized as formal opioid treatment programs (OTPs) and less formalized office-based opioid treatment programs.

OTPs were first established in the mid-1960s from the established medical community’s reluctance to treat the stigmatized patient group and unwillingness to prescribe opioid drugs to those suffering from OUD. Traditionally, OTPs have relied on Methadone, a synthetic analgesic drug similar to morphine, to ease opioid withdrawal symptoms while patients simultaneously attended mental health and occupational counseling.

Office-based opioid treatment (OBOT) refers to outpatient treatment services provided outside of licensed OTPs by clinicians. OBOT treatment allows patients to obtain care at the convenience of their typical primary care provider or local healthcare facilities and does not require comprehensive behavioral health services to be integrated into the delivery model.

Methadone treatment remains the preferred drug type for high-acuity addiction and can be prescribed by a physician, physician’s assistant, nurse practitioner, or clinical nurse specialists, and is typically administered daily through a liquid shot and occasionally as a pill. After a detoxification process at progressive dosing, the patient’s response is typically monitored through a series of physicals. Afterward, maintenance dosages are prescribed on a daily frequency for a recommended one-year period. Methadone may only be distributed through a SAMHSA-certified and DEA-registered OTP clinics.

Since its initial approval by the FDA in 2002, Buprenorphine, a partial opioid agonist, is increasingly relied upon within the OTP and OBOT settings for OUD detoxification and maintenance for less acute addiction. As a partial opioid agonist, Buprenorphine has a lower risk profile than methadone and is thus more widely accessible. For instance, while Methadone may only be distributed in an OTP setting, Buprenorphine can be distributed in an OBOT setting. By market share, Buprenorphine currently dwarfs similar medications for opioid use disorder.2

Because opioid agonists are inherently prone to abuse, regulation of MAT has been historically stringent to prevent further misuse or illicit trade. All OTPs are required to receive full certification by the Substance Abuse and Mental Health Services Administration (SAMHSA), and many states require a Certificate of Need. SAMHSA also regulates prescription protocols and procedures.

On January 31, 2024, SAMHSA made the most impactful change to MAT regulation in decades by finalizing recommendations initiated during the COVID-19 pandemic.3 Most notably, SAMHSA eliminated the one-year OUD qualification and further expanded eligibility for Methadone take-home doses. Additionally, guideline updates granted permanent approval for Buprenorphine telehealth induction without an in-person exam, expanded the definition of “practitioner,” and eliminated the X-waiver requirement, which formerly authorized the outpatient use of Buprenorphine and stipulated patient caps per prescriber.

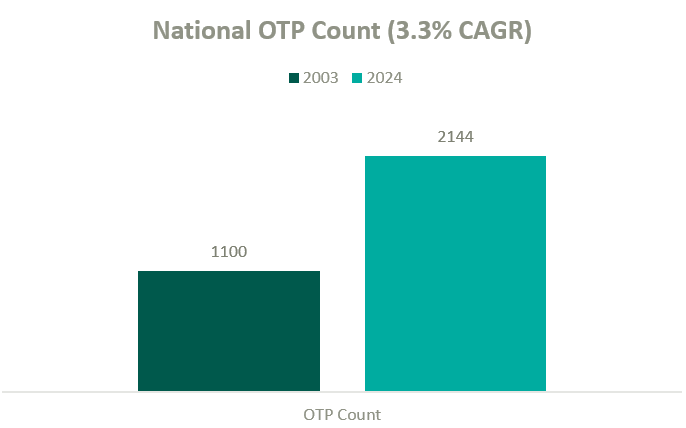

According to the Opioid Treatment Program Directory, patient demand in conjunction with deregulation and clinical advocacy has resulted in a near doubling of OTP clinics nationally over the past two decades. As federal funding and popular outcry grows, OTP growth continues to gain momentum.

The growth in OTPs over the past two decades has resulted in a highly fragmented industry where several notable players hold significant leverage in what will likely become a consolidating market. There are many examples of private equity (PE)–backed companies beginning to participate in merger and acquisition activity in the MAT space.

BayMark Health Services, backed by Webster Equity Partners, claims to be the largest provider of MAT services in North America. BayMark, with over 280 facilities in North America, has acquired over a dozen facilities since the pandemic throughout the U.S.

Acadia Healthcare is the largest publicly traded behavioral health provider in the United States and maintains a significant focus on opioid use disorder. Recent comments from Acadia’s CEO, Chris Hunter, chart an ambitious acquisition strategy to acquire 14 OTPs in fiscal year 2024 after kicking off the year with two MAT acquisitions in North Carolina.4

Key players in the behavioral health industry that are building a presence in the MAT space include, but are not limited to, the following:

Other notable behavioral healthcare providers growing their presence in the industry’s substance use disorder (SUD) and MAT sub-sector include Acadia Health and Universal Health Systems. However, it’s difficult to determine how many stand-alone MAT clinics they have in operation from publicly available information.

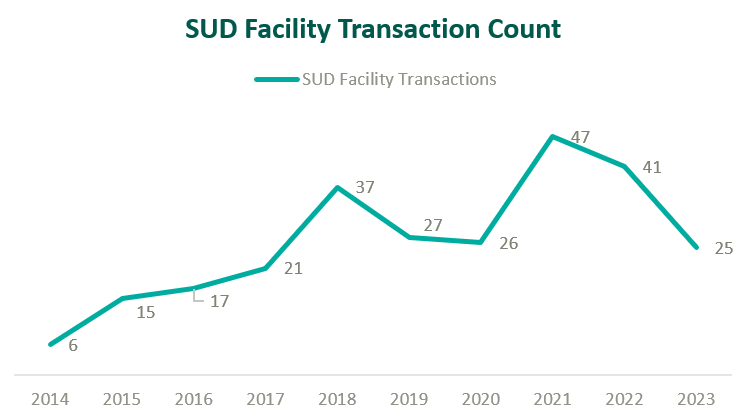

Based on data from Irving Levin Associates, Inc., SUD transaction activity has grown significantly over the past decade while having receded marginally from pandemic highs.

MAT clinics operate with a unique reimbursement model compared to other healthcare sectors, and OTPs specifically bill under a set of HCPCS G-Codes. Upon admittance, new patients are billed under an intake code while maintenance visits are reimbursed by the Centers for Medicare & Medicaid Services with bundled payments based on weekly episodes of care.

The table below outlines frequently utilized HCPCS G-Codes for OTP services:

| HCPCS Code | Description of Services |

| G2076 | Intake activities, including medical exam, physical evaluation, initial assessment, and preparation of comprehensive treatment plan. |

| G2067 | Weekly bundle for medication assisted treatment (Methadone). Includes the drug itself, administration, substance use counseling, therapy, and toxicology testing. |

| G2068 | Weekly bundle for medication assisted treatment (Buprenorphine, oral). Includes the drug itself, administration, substance use counseling, therapy, and toxicology testing. |

| G2078 | 7-day, take-home supply of Methadone |

| G2079 | 7-day, take-home supply of Buprenorphine |

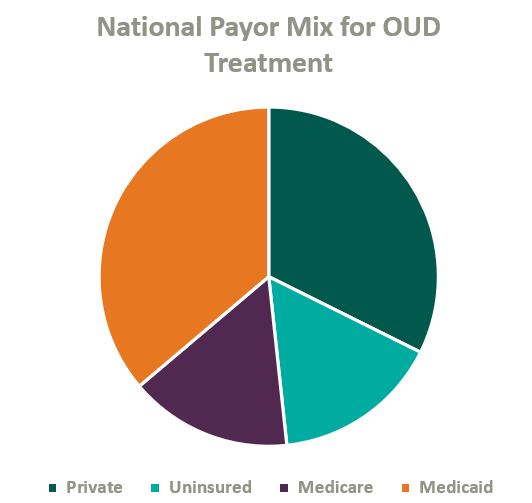

Over the past two decades, Congress has made strides to expand public and private insurance coverage for MAT care. According to the National Survey on Drug Use and Health, roughly 84% of those who suffer from OUD in the United States are covered by some form of insurance (see chart below for total payor mix). Nonetheless, out-of-pocket expense for OUD treatment remains prohibitively expensive for many patients, and sporadic and disparate coverage discourages many operators from accepting insurance. This may change as Congress continues to pass legislation improving affordability of OUD treatment.

On January 1, 2020, Congress passed the SUPPORT Act,5 which established a new Medicare Part B benefit for OUD treatment services provided by OTPs and mandated that all states cover OTP services in their Medicaid programs effective October 1, 2020.6

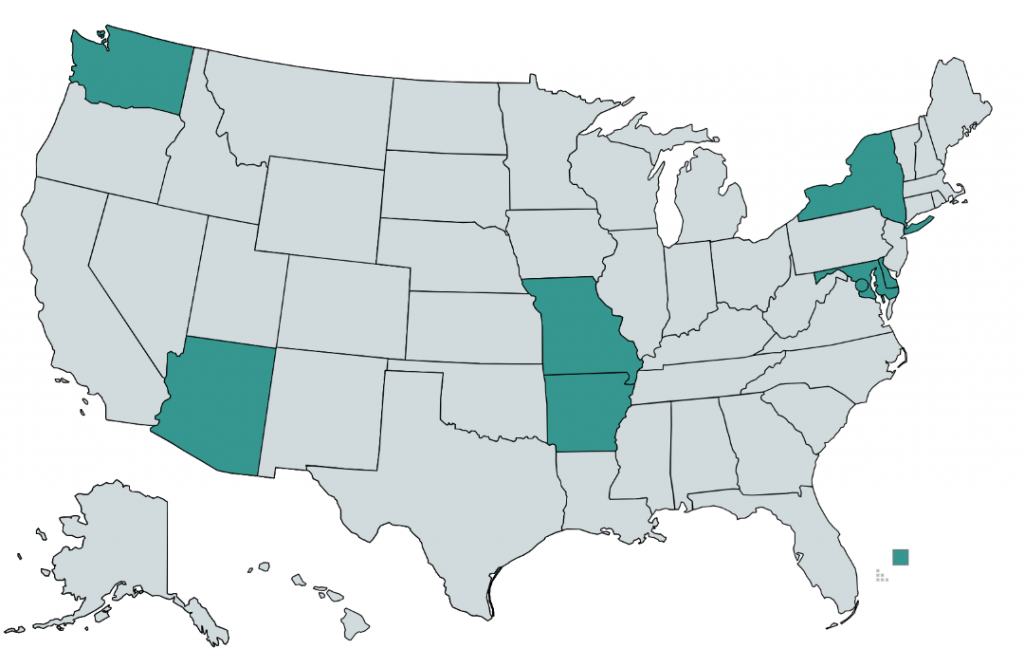

As of 2020, only eight states and the District of Columbia require commercial insurers to provide coverage of medications for opioid use disorder (see map below).7 Although many plans provide coverage regardless of state requirements, coverage is often restricted to a provider network or limited to a cap on services and many MAT clinics choose to pursue an out-of-network or self-pay strategy.8

Grant revenue is critical in lowering out-of-pocket costs for OUD patients and can play a significant role in the operational sustainability of MAT clinics. In 2017, the U.S. Department of Health and Human Serviced committed $485 million in grants to be distributed through SAMSHA, which is intended to increase access for patients, bolster existing MAT operations, and catalyze continued facility expansion.

As access and reimbursement for OUD treatment expands, we expect the supply of care to continue to lag demand for the foreseeable future. In addition, we expect PE-backed platforms to continue consolidating the fragmented industry, driving transaction activity. We also anticipate federal funding, patient inelasticity, and a lack of competition within many markets to fortify pricing while demand continues to attract practitioners into the market—ultimately incentivizing further industry growth and higher valuations.

1 NSC. (2021.) Drug Overdoses. Injury Facts. https://injuryfacts.nsc.org/home-and-community/safety-topics/drugoverdoses/data-details/

2 Faizullabhoy, M. et. al. Opioid Use Disorder Market – By Drug (Buprenorphine [Sublocade, Belbuca, Suboxone, Zubsolv], Methadone, Naltrexone), By Age, By Route of Administration (Intravenous, Oral), By Distribution Channel, Global Forecast 2023-2032. GMI. https://www.gminsights.com/industry-analysis/opioid-use-disorder-market#:~:text=OUD%20Drug%20Market%20Analysis&text=Based%20on%20drug%20type%2C%20the,continue%20during%20the%20forecast%20period

3 SAMHSA. (2024). The 42 CFR Part 8 Final Rule Table of Changes. SAMHSA. https://www.samhsa.gov/medications-substance-use-disorders/statutes-regulations-guidelines/42-cfr-part-8/final-rule-table-changes

4 Larson, C. (2024). Acadia Healthcare CEO: ‘M&A Will Be a Focus for Us in 2024 and Beyond. Behavioral Health Business. https://bhbusiness.com/2024/03/15/acadia-healthcare-ceo-ma-will-be-a-focus-for-us-in-2024-and-beyond/?mkt_tok=NjI3LUNQSy0xNjIAAAGR8QypR-X5kqkF13vlTMemkLPjc9HrQkCohRl5m3BJW-6PGihP1pbXWREONNPExs-ZmjjZapnsDC1-6TKdnqewr8hn5XCGQleZfTGK-JO7lgw

5 CMS. (2020). Opioid Treatment Programs: Enrolling in Medicare. Medicare Learning Network. https://www.cms.gov/files/document/opioid-treatment-program-training-slides.pdf

6 CMS. (2023). Opioid Treatment Programs: Medicaid. https://www.cms.gov/medicare/payment/opioid-treatment-program/medicaid

7 Staff, P. (2020). Commercial Insurance and Medicaid Coverage of Medications for Opioid Use Disorder Treatment. PDAPS. https://pdaps.org/datasets/medication-assisted-treatment-coverage-1580241551

8 Aetna. (2024). Opioid FAQs for individuals and families. https://www.aetna.com/faqs-health-insurance/opioid-faqs.html

Related Content

Subscribe

to our blog