- About Us

- Our Clients

- Services

- Insights

- Healthcare Sectors

- Ambulatory Surgery Centers

- Behavioral Health

- Dialysis

- Hospital-Based Medicine

- Hospitals

- Imaging & Radiology

- Laboratories

- Medical Device & Life Sciences

- Medical Transport

- Oncology

- Pharmacy

- Physician Practices

- Post-Acute Care

- Risk-Bearing Organizations & Health Plans

- Telehealth & Healthcare IT

- Urgent Care & Free Standing EDs

- Careers

- Contact Us

Oncology: Private Equity Investment in Cancer Care

July 27, 2021

By: Vince Kickirillo, Jordan Tussy & Hunter Hamilton

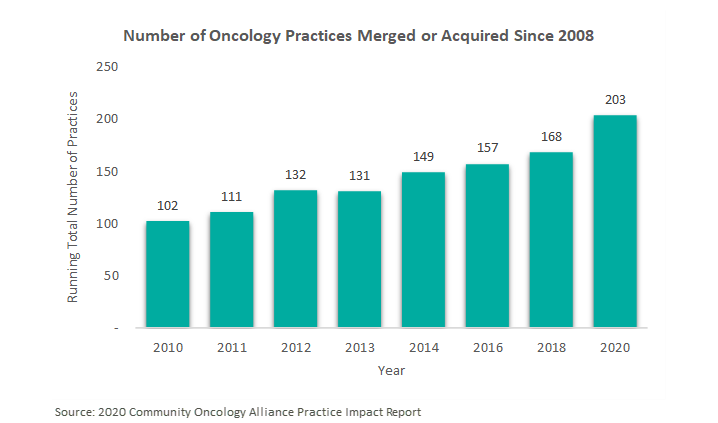

In August 2019, VMG Health published an article titled “Oncology on the Rise: Private Equity Investment in Cancer Care.” This article discussed the emerging interest in the oncology provider industry by private equity (“PE”) firms, most notably through the formation of PE-backed platform practices. Since this article was published, the oncology practices have continued to trend toward consolidation. According to the 2020 Community Oncology Alliance Practice Impact Report, the number of community oncology practices merging or being acquired by another practice or corporate entity, such as a private equity firm, has increased almost 21% since 2018. In fact, trends over the previous ten years suggest there has been an approximately 7.0% annual increase, on average, in the number of community oncology practices that have been acquired by a corporate entity and/or merged with another oncology practice. [1]

However, more recent deal activity suggests a shift from the large-scale platform transactions to tuck-in acquisitions by these platform entities as they seek to scale their businesses in both geography and size.

Tuck-in Acquisitions

As previously mentioned, there has been an uptick in tuck-in acquisitions in the oncology space following the emergence of these PE-backed platforms throughout 2018. These platforms strategically target practices for consolidation to leverage geographic expansion, economies of scale, or hospital affiliations. Below is a summary of the recent activity of the major PE-backed oncology platforms.

Alliance Health Services

Following its acquisition by Tahoe Investment Group in April 2017, Alliance Healthcare Services has continued its national oncology and radiology platform expansion through direct partnerships with physicians and hospitals, such as Beaufort Memorial Hospital in South Carolina and SCL Health in Colorado. “Across the US, we work side by side with more than a thousand hospitals to deliver effective and efficient diagnostic radiology, radiation therapy and related services. We believe it is the best of both worlds: a focus on each unique community, partnership and patients, supported by national resources,” said Rhonda Longmore-Grund, President and CEO of Alliance HealthCare Services. [2]

On June 25, 2021, Alliance announced its acquisition by Akumin for $820 million, which is expected to close in Q3 2021. After holding the platform for 5 years, Tahoe Investment Group will transition to a minority ownership position in the publicly traded, combined entity. Regarding the transaction, Riadh Zine, President and CEO of Akumin, stated “The acquisition of Alliance is transformative in a changing healthcare ecosystem that continues to shift toward outpatient, price-transparent, value-based care. There’s no other organization that has the complement of attributes we will offer together as outpatient healthcare services experts, in particular with Alliance’s longstanding hospital and health system relationships and Akumin’s freestanding operational expertise.” The combined company is projected to have pro forma revenue in excess of $730 million and EBITDA of approximately $210 million based on the trailing twelve months ended March 31, 2021. [3]

Verdi Oncology

Founded in 2018 with the acquisition of Horizon Oncology by Pharos Capital Group, Verdi Oncology has since expanded into the Tennessee and Texas Markets. In July 2019, Verdi announced a partnership with Nashville Oncology Associates, a two-physician medical oncology practice, in which the platform would provide management services, economies of scale, and infrastructure.[4] Similarly, in August 2019, the company launched Verdi Cancer and Research Center of Texas, which would provide medical oncology services and early phase clinical trials in Dallas-Fort Worth. [5]

OneOncology

Since its founding in 2018 by General Atlantic, OneOncology has continued to expand its physician network in both size and geography. The platform, now comprised of 600 providers at 189 sites, has acquired, and subsequently grown, practices in Arizona, California, New England, Pennsylvania, New Jersey, and Texas. [6] For example, OneOncology partnered with North Texas-based Center for Cancer and Blood Disorders (“CCBD”) in 2020 and recently announced the addition of three practices and fourteen physicians to the Texas affiliate. [7] OneOncology targets leading community oncology practices to provide comprehensive and cost-effective cancer care. Oncologists are attracted to the platform’s business model which allows them to remain independent while expanding their services and offering advanced treatment options. “OneOncology gives us the best path forward to continue to bring our patients in Central Pennsylvania advanced cancer care and to grow our clinical trial program. Working with other leading oncology practices across the country who share our vision for delivering the highest quality care in the community setting is what sets OneOncology apart” said Satish Shah, MD of Gettysburg Cancer Center, one of the platform’s most recent targets. [8]

Integrated Oncology Network

Silver Oak Services Partners led the recapitalization of Integrated Oncology Network (“ION”) in October 2018. Shortly thereafter, ION continued its growth strategy with the 2019 acquisitions of Gamma West Cancer Services (“Gamma West”) and e+CancerCare. As a result of the e+CancerCare acquisition from Kohlberg & Company, ION added 21 outpatient cancer care centers in 10 states. [9] Similarly, the platform expanded their services into communities in Utah, Nevada, Wyoming, and Idaho with the Gamma West acquisition. [10] This partnership also advanced ION’s strategy to affiliate with quality healthcare systems. Recently, ION created a new multispecialty platform in the Cleveland, Ohio market with the acquisition of Southwest Urology in January 2021. As stated by Josh Johnson, ION CEO, “This new venture with Southwest Urology represents a pivotal moment in ION’s strategic direction. Our entrance into the urology space with such a highly-respected practice strengthens our capabilities and positions ION to continue growing specialty networks across the country.” [11]

21st Century Oncology

KKR-backed GenesisCare, an Australian oncology platform, acquired previous standalone operator, 21st Century Oncology. The transaction was completed in May 2020 and valued at over $1 billion. At the time, 21st Century Oncology operated out of 293 locations with nearly 900 affiliate physicians in 15 states. [12] Now the combined entity collectively operates with over 5,000 physicians at 440 locations across the world. [13]

Corporate-Backed, Standalone & Other Operators

Updating our August 2019 article, the following section addresses follow-up items on previously discussed corporate-backed and standalone operators, McKesson’s The US Oncology Network and Cancer Treatment Centers of America, as well as two new operators, American Oncology Network and The Oncology Institute.

The US Oncology Network

Since July 2019, The US Oncology Network has expanded its presence in California, Pennsylvania, Indiana, and Texas through partnerships with Northern California Prostate Cancer Center, Alliance Cancer Specialists, Northwest Oncology, and Texas Colon & Rectal Specialists. Since April 2020, the Network has brought over 131 new physicians into the organization.[14]

Cancer Treatment Centers of America

Cancer Treatment Centers of America, an owner and operator of cancer care hospitals and outpatient care centers, announced in November 2020 a partnership with Miller County Hospital designed to meet cancer care needs of Southwest Georgia residents. The organization also notably sold CTCA Philadelphia to Temple University Hospital and announced the closure of CTCA Tulsa in March of this year. CTCA Atlanta opened a comprehensive Women’s Cancer Center this past June with 8 physicians.[15]

American Oncology Network

Though not currently backed by a private equity group, American Oncology Network (“AON”) has gained significant ground in the oncology space over the past few years. Since its founding in mid-2018, AON, a nationwide group of physician practices focused on improving outcomes in community-based oncology, has expanded to include over 170 providers across 17 states. New partnerships in the past year have been forged in Michigan, Georgia, Washington, Arizona, and Maryland. They also have a presence in Idaho with the recent addition of Summit Cancer Centers.[16] According to recent press releases, reasons given for aligning with AON include greater access to resources (i.e., outpatient pharmacy, pathology, and laboratory services), enhanced care management and technological capabilities. Most recently, AON finalized an $85 million financing package with PNC Bank, priming the organization for continued growth in the development of its information technology platforms, pharmaceutical purchases, practice acquisitions, and expansion of service-line offerings.[17]

The Oncology Institute

Another sub-sector within the oncology space that has garnered recent interest is value-based care. Recently, DFP Healthcare Acquisitions Corp (“DFP”), a special purpose acquisition company (“SPAC”) announced the acquisition of The Oncology Institute (“TOI”), a market-leader in providing value-based oncology care. Regarding the transaction, Richard Barasch, one of the sponsors of DFP, stated “[TOI] has created a scalable, replicable model with difficult-to-duplicate capabilities that facilitate rapid expansion… this business combination will create a well-capitalized company that is poised to expand organically, through accretive M&A activity, and via strategic payor relationships.” While TOI currently operates 50 community-based practices in Florida, Arizona, Nevada, and California, they plan to pursue organic growth opportunities and strategic acquisitions in both new and existing markets.[18]

Future of the Field

While the oncology industry continues to trend toward consolidation, there has been a shift from the acquisition or establishment of platform practices to the acquisition of tuck-ins as existing platforms focus on growth through strategic partnerships with practices and physicians. Even with the emergence of such platforms and their subsequent tuck-in activity, the oncology market remains fragmented and poised for continued consolidation as physicians seek alternatives to hospital employment.

Furthermore, private equity firms hold their investments for an average of three to seven years. This trend can be evidenced by the recently announced acquisition of Alliance Healthcare Services by Akumin after five years of ownership by Tahoe Investment Group. Given the age of several of the other platforms, it is likely there will be recapitalizations of these businesses over the next few years.

Sources:

[1] https://communityoncology.org/wp-content/uploads/2020/04/COA_PracticeImpactReport2020_FINAL.pdf

[2] https://www.alliancehealthcareservices-us.com/alliance-cancer-care-colorado-at-red-rocks-partners-with-scl-health/

[3] https://www.alliancehealthcareservices-us.com/alliance-healthcare-services-announces-acquisition-by-and-integration-with-akumin/

[4] https://www.prnewswire.com/news-releases/verdi-oncology-inc-completes-partnership-with-nashville-oncology-associates-pc-300880500.html

[5] https://www.prnewswire.com/news-releases/verdi-oncology-launches-verdi-cancer-and-research-center-of-texas-300896938.html

[6] https://www.oneoncology.com

[7] https://www.prnewswire.com/news-releases/in-growth-spurt-since-joining-oneoncology-the-center-for-cancer-and-blood-disorders-in-fort-worth-adds-3-practices-and-14-physicians-301331169.html

[8] https://www.oneoncology.com/blog/gettysburg-cancer-center-joins-oneoncology-platform

[9] https://ionetwork.com/2019/06/26/integrated-oncology-network-acquires-ecancercare/

[10] https://ionetwork.com/2019/05/13/integrated-oncology-network-and-gamma-west-announce-transaction/

[11] https://ionetwork.com/2021/01/07/integrated-oncology-network-announces-strategic-partnership-with-southwest-urology/

[12] https://www.genesiscare.com/us/21st-century-oncology-now-genesiscare-collaborates-with-landmark-cancer-center/

[13] https://www.genesiscare.com/us/21st-century-oncology-becomes-part-of-genesiscare/

[14] https://usoncology.com/our-company/news/media-releases/

[15] https://www.cancercenter.com/community/press-releases?page=1

[16] https://www.aoncology.com

[17] https://www.aoncology.com/2021/06/24/american-oncology-network-secures-85-million-in-financing-from-pnc-bank/

[18] https://www.businesswire.com/news/home/20210628005481/en/DFP-Healthcare-Acquisitions-Corp.-Announces-Proposed-Business-Combination-With-The-Oncology-Institute

Categories: Uncategorized

Oncology

Oncology Consulting Services As the demand for oncology providers grows, healthcare organizations are seeking new ways to stand out in...

Learn MoreSubscribe

to our blog