ASCs in 2023: A Year in Review

Rachel Linch

February 13, 2024

Effective October 8, 2024, Carnahan Group has joined VMG Health. Learn more.

February 23, 2024

Written by Jordan Tussy, CVA; Hunter Hamilton; and Vincent Kickirillo, CVA, CFA

Following the emergence of several oncology private equity (PE)–backed platforms in 2018, there has been an uptick of tuck-in acquisition activity in the oncology space, both by these PE-backed entities, as well as by other prominent public and corporate-backed oncology platforms. These platforms have targeted geographic expansion and economies of scale through strategic affiliations with practices and physicians.

In fact, a Harvard study published in JAMA Internal Medicine indicated that over 700 oncology practices had partnered with or had been acquired by a PE firm from 2003 to 2022. According to the study, this number represented approximately 10% of total oncology practice locations in the US.

While increased regulatory scrutiny and a more difficult funding environment have hampered overall physician practice transaction activity, several notable platform and tuck-in acquisitions have defined the recent environment for investment in oncology.

After a quiet couple of years from Pharos Capital Group’s Verdi Oncology, it was announced in November 2023 that the platform’s two practices, Nashville Oncology Associates and Horizon Oncology, had joined The US Oncology Network. Additionally, Verdi Cancer and Research Center of Texas, formed in August 2019, announced its closure in September 2023. With Verdi Oncology having been founded in March 2018 through the initial acquisition of Horizon Oncology, Pharos Capital Group’s assumed exit after nearly six years aligns with typical PE holding period expectations.

Perhaps most notable among recent transactions in the oncology space was the $2.1 billion acquisition of OneOncology from General Atlantic by TPG and AmerisourceBergen Corporation, which closed in June 2023. TPG will be the majority owner in the new joint venture, as AmerisourceBergen reportedly purchased a minority interest of approximately 35% for around $685 million in cash. TPG also has a one-year put option effective on the third anniversary of the deal closing. If exercised, this option would require Amerisource Bergen to purchase the remaining interest in OneOncology at a price equal to 19.0x the company’s adjusted EBITDA for the most recently ended 12-month period. AmerisourceBergen will also have a call option to purchase the remaining interest at the same price between the third and fifth anniversaries. Applying the 19.0x multiple to the transaction price of $2.1 billion would imply approximately $110 million of EBITDA for OneOncology today.

General Atlantic originally invested $200 million in OneOncology in September 2018 and held the investment for nearly five years. In that time, OneOncology has expanded considerably in both size and geography. The platform now includes 19 practices across 15 states with just under 1,000 providers. The structure is that of an affiliation model in which OneOncology charges a management fee and introduces partner practices to new ancillaries (e.g., oral pharmacy, laboratory services, radiation therapy) as well as lower drug-purchasing costs. Providers further benefit from a reduction in administrative burden and a resulting increase in clinical autonomy. In addition, OneOncology also has robust data analytics capabilities, which it utilizes to help define better clinical pathways, improve outcomes, and monetize the data.

Since the announcement of OneOncology’s acquisition by TPG and AmerisourceBergen in April, several additional practice partnerships have been announced, including the affiliation of Coastal Cancer Center and Pacific Cancer Care in May, Mid Florida Cancer Centers in November, and Pacific Cancer Medical Center, Maury Regional Medical Group, and Genesee Cancer and Blood Disease Treatment Centers in December. On January 12, 2024, it was announced that OneOncology had finalized a partnership with Huntsville, Alabama–based Clearview Cancer Institute, which—with 25 medical oncologist providing care across 13 clinics—was identified in the announcement as one of the five largest community oncology practices in the nation and the largest in Alabama.

After its recapitalization by Silver Oak Services Partners in October 2018, Integrated Oncology Network (ION) has continued its geographic expansion and now operates from more than 50 centers across 14 states in the US. Like OneOncology’s model, the independence of partner practices is also maintained under ION’s model, which, in addition to the preservation of clinical autonomy, offers to reduce the regulatory burden and increase access to the enhanced technology and resources of a larger network. ION specifically advertises its fully supported EHR and the immediate access its providers have to accurate data analytics. Most notably, in April 2022, ION announced the acquisition of California Cancer Associates for Research and Excellence (cCARE), an integrated cancer care network that provides medical oncology, radiation oncology, diagnostic imaging, and other ancillary services in the Fresno and San Diego markets. Furthermore, the platform expanded its cCARE operations with the September 2023 acquisition of High Desert Oncology of Victorville, California as well as the December opening of its new clinic in Riverside, California.

KKR-backed GenesisCare filed for Chapter 11 bankruptcy in June 2023, announcing that its US operations would be spun out from the broader enterprise. At the time of the announcement, David Young, CEO of GenesisCare, said, “The past three years have presented significant operational and financial challenges, requiring a comprehensive restructuring of the operations and balance sheet of the company.” No disruption of patient care was anticipated, and in November 2023, it was reported that GenesisCare had developed a reorganization plan to reduce its debt load by approximately $1.7 billion, down from the $2.0 billion it had at the time of filing. The US segment will continue to operate as a sister company to the businesses in Australia, Spain, and the UK, as the enterprise entertains interest from potential buyers.

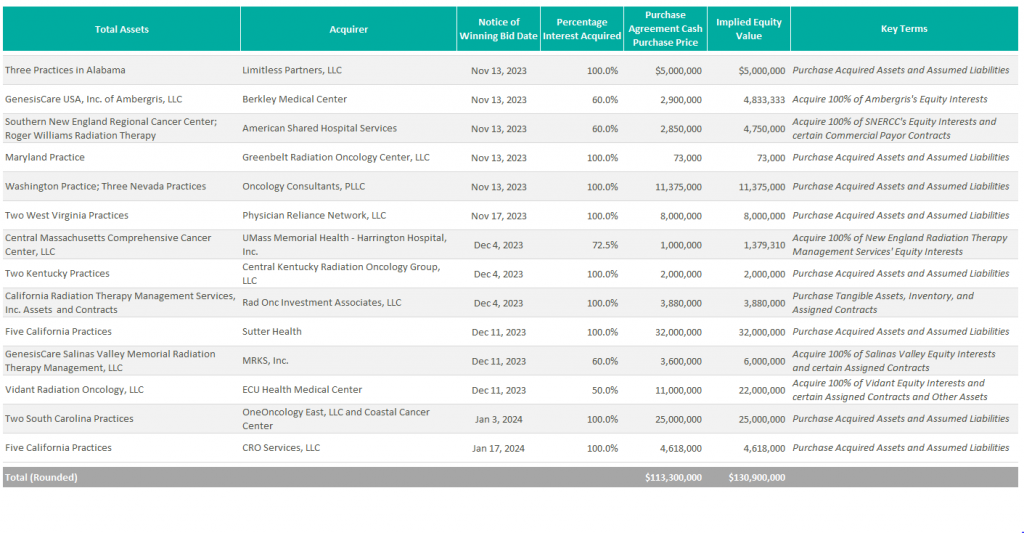

According to bankruptcy filing documents, a number of winning bids for GenesisCare assets across the country have already been announced. Assuming these transactions close at the indicated prices (as defined in the respective purchase agreements), it would imply total cash proceeds of over $100 million. Furthermore, the sales of these 31 practices have an implied consolidated equity value of approximately $131 million.

Additionally, it was announced in October 2023 that GenesisCare’s Orange County radiation oncology centers were acquired by UCI Health.

New to the scene is Oncology Care Partners (OCP). Backed by Welsh, Carson, Anderson, & Stowe’s healthcare platform, Valtruis, and partnering with oncology and cardiology care management provider Evolent Health, OCP opened its first two practices in Phoenix and Miami in January 2023 with the goal of advancing value-based care, particularly among Medicare Advantage patients. Based on the launch announcement of these first two practices, OCP appears to operate a hybrid model of practice partnership. The launch of its Arizona practice came in partnership with American Oncology Network, while its Miami-based medical group practice appears to have been an outright acquisition. Under both agreements, OCP says it will provide value for payors and at-risk primary care groups through the introduction of a new patient journey and digital tools to allow community providers to spend more time with their patients and reduce barriers to access. With the launch of its most recent location in Broward County, Florida in October 2023, OCP plans to continue expansion efforts across the country to further accelerate its value-based care initiatives.

McKesson’s The US Oncology Network (The Network) has also remained active expanding its footprint in California, New Mexico, and Kansas with the 2023 acquisitions of Epic Care, Nexus Health, and Cancer Center of Kansas, respectively. In April 2023, The Network also announced a strategic partnership with Regional Cancer Care Associates, a multispecialty oncology with more than 20 sites of service and over 60 providers throughout the Northeast. As previously mentioned, it was announced in the fourth quarter that Verdi Oncology’s Nashville Oncology Associates and Horizon Oncology had joined The Network as well. Under The Network’s affiliation model, the operational and clinical activities of its partner practices are converted to value-based care through greater focus on the negotiation of value-based contracts for revenue optimization, empowerment of practice transformation with proven solutions, alignment of GPO and payer contracts, and support for all oncology specialties. As of the most recent transactions, The US Oncology Network’s total provider count exceeds 2,400.

Previous stand-alone operator Cancer Treatment Centers of America (CTCA) was acquired by City of Hope in February 2022 for $364.4 million. At the time of its acquisition, the business operated three oncology hospitals located in Atlanta, Chicago, and Phoenix, as well as five outpatient facilities. On the one-year anniversary of the transaction, it was announced that CTCA was officially being re-branded to bear the City of Hope name at its facilities, further cementing the evolution of the organization into a national system.

In April 2023, American Oncology Network (AON) received a $65 million strategic growth investment from AEA Growth Partners “to help further AON’s goals of supporting community practices and improving the patient experience,” according to the Company’s press release. As a result of the investment, AEA Growth gained a minority interest in the business. AON opened Lone Star Oncology in Georgetown, Texas in June and announced the affiliation with Florida Oncology & Hematology in Safety Harbor, Florida in July. AON also ventured into urology through its affiliation with Triple Crown Urology on September 1. As a result of this transaction, AON’s platform now includes over 200 providers across 85 locations in 19 states and the District of Columbia. AON has a partnership model through which affiliated practices enter a management agreement and are charged a central services fee. Synergies realized through a partnership with AON are advertised as new revenue streams through centralized ancillaries, including oral pharmacy, clinical lab, and pathology as well as economies of scale with vendor services and drug pricing. With such revenue enhancements and cost reductions, providers can earn more than they otherwise might have as independent practices.

Most notable among AON’s recent transaction activity was the closing of a business combination with Digital Transformation Opportunities Corp., a special purpose acquisition company (SPAC), in September 2023. As a result of the transaction, AON began trading on the Nasdaq on September 21, 2023 under the ticker AONC. The transaction had an implied enterprise value of $497 million, with an implied TEV/Revenue multiple of 0.4x and an implied TEV/EBITDA multiple of 13.8x.

In November 2021, The Oncology Institute (TOI) was acquired by DFP Healthcare Acquisitions Corp., a SPAC, and became the first publicly traded oncology company. At the time of the acquisition, TOI’s pro forma enterprise value was $842 million. Underperforming initial expectations, the company ended 2023 with an enterprise value of approximately $148 million. To address these issues, TOI completed a corporate restructuring in Q2 2023 and has a strategic plan to eliminate cash burn and generate positive adjusted EBITDA by the end of 2024. According to their most recent earnings call, the company also plans to improve margins in legacy markets through expansion in capitated partnerships, radiation oncology, and clinical trials program. As part of this initiative, TOI acquired Southland Radiation Oncology Network in June 2023, which includes five radiation oncology clinics in the Los Angeles market. Despite the operational difficulties, The Oncology Institute remains the largest value-based care oncology operator in terms of lives served and revenue under value-based arrangement. To advance these efforts, The Oncology Institute acquires and employs the providers of its partner practices. The synergies it promotes include access to clinical trials, transfusions, and additional care delivery models more typically associated with the most advanced care delivery organizations.

Burdened with reimbursement headwinds and rising costs, it is anticipated that oncologists will continue to seek out strategic affiliations. Platforms such as OneOncology and The US Oncology Network offer an attractive alternative that allows physicians to maintain their independence while receiving the infrastructure and growth support of a large entity.

Furthermore, the long-term performance of major players in the oncology value-based care space remains to be seen, as does The Oncology Institute’s ability to achieve on its path to profitability in 2024.

Lastly, with the acquisition of OneOncology, ION is one of the last pureplay, PE-backed oncology platforms that has yet to recapitalize. Given Silver Oak Services Partners has held onto this investment for over five years now, it would not be surprising if there was a recapitalization of this platform within the next couple of years.

Silver Oak Services Partners LLC. (2023). Integrated Oncology Network acquires California Cancer Associates for research & excellence. PR Newswire. https://www.prnewswire.com/news-releases/integrated-oncology-network-acquires-california-cancer-associates-for-research–excellence-301530782.html

Integrated Oncology Network. (2023). Integrated Oncology Network announces High Desert Oncology joins cCare. PR Newswire. https://www.prnewswire.com/news-releases/integrated-oncology-network-announces-high-desert-oncology-joins-ccare-301933873.html

Integrated Oncology Network. (2023). Integrated Oncology Network announces cCare expansion with specialty clinic in Riverside, California. PR Newswire. https://www.prnewswire.com/news-releases/integrated-oncology-network-announces-ccare-expansion-with-specialty-clinic-in-riverside-california-302009492.html

Sebastian, D. (2023). KKR-Backed Radiotherapy Group GenesisCare Files for Bankruptcy. Wall Street Journal. https://www.wsj.com/livecoverage/stock-market-today-dow-jones-06-01-2023/card/kkr-backed-radiotherapy-group-genesiscare-files-for-bankruptcy-LIVUzBoTLS8Z2Z8qPcP9

GenesisCare. (2023). GenesisCare’s Plan of Reorganization Confirmed by Bankruptcy Court with Overwhelming Support from Voting Creditors. GenesisCare Newsroom. https://www.genesiscare.com/us/news/genesiscares-reorganisation-plan-confirmed-with-overwhelming-support-from-voting-creditors

UCI Health. (2023). UCI Health purchases GenesisCare radiation oncology centers. UCI Health News. https://www.ucihealth.org/news/2023/10/fountain-valley-radiation-oncology#:~:text=Acquisition%20expands%20access%20to%20world,cancer%20care%20in%20Orange%20County&text=Orange%2C%20Calif.,filed%20for%20Chapter%2011%20bankruptcy.

American Shared Hospital Services. (2023). American Shared Hospital Services Enters Into Agreement to Acquire 60% Majority Interest in Three Radiation Therapy Cancer Centers in Rhode Island. GlobeNewsWire. https://www.globenewswire.com/news-release/2023/11/20/2783147/0/en/American-Shared-Hospital-Services-Enters-Into-Agreement-to-Acquire-60-Majority-Interest-in-Three-Radiation-Therapy-Cancer-Centers-in-Rhode-Island.html

United States Securities and Exchange Commission. (2023). Form 8-K for American Shared Hospital Services. https://app.quotemedia.com/data/downloadFiling?webmasterId=101803&ref=317881267&type=PDF&symbol=AMS&cdn=1833bea1c9c3490a4573fbbc20a1fc5e&companyName=American+Shared+Hospital+Services&formType=8-K&formDescription=Current+report+pursuant+to+Section+13+or+15%28d%29&dateFiled=2023-11-21

Oncology Care Partners. (2023). Oncology Care Partners Launches First Three Locations, Bringing Patient Experience Focus to Cancer Care in Phoenix, Miami. PR Newswire. https://www.prnewswire.com/news-releases/oncology-care-partners-launches-first-three-locations-bringing-patient-experience-focus-to-cancer-care-in-phoenix-miami-301724825.html

Oncology Care Partners. (2023). Oncology Care Partners Launches Broward Location Expanding Value-Based Cancer Care in South Florida. PR Newswire. https://www.prnewswire.com/news-releases/oncology-care-partners-launches-broward-location-expanding-value-based-cancer-care-in-south-florida-301947441.html

American Oncology Network. (2023). American Oncology Network, a Rapidly Growing Network of Community-Based Oncology Practices, Receives Strategic Investment from AEA Growth. American Oncology Network News. https://www.aoncology.com/2023/04/28/american-oncology-network-receives-strategic-investment-from-aea-growth/

Subscribe

to our blog