- About Us

- Our Clients

- Services

- Insights

- Healthcare Sectors

- Ambulatory Surgery Centers

- Behavioral Health

- Dialysis

- Hospital-Based Medicine

- Hospitals

- Imaging & Radiology

- Laboratories

- Medical Device & Life Sciences

- Medical Transport

- Oncology

- Pharmacy

- Physician Practices

- Post-Acute Care

- Risk-Bearing Organizations & Health Plans

- Telehealth & Healthcare IT

- Urgent Care & Free Standing EDs

- Careers

- Contact Us

Radiation Oncology Alternative Payment Model – Valuation & Transaction Considerations

April 23, 2020

Written by William Teague, CFA and Anthony Metke

Alternative Payment Model (“APM”) Overview

CMS introduced the Radiation Oncology Alternative Payment Model (“APM”) on July 10, 2019 with public commentary ending September 16, 2019. Medicare may publish the final rule at any time and implement it shortly thereafter. Please note, this article is intended to analyze the proposal, but significant modifications in the methodology or exemptions may be made by CMS in the final version of the rule.

The APM is for an initial five-year period and will be mandatory for all providers of radiation therapy services in randomly selected Core Based Statistical Areas (“CBSA”) based on zip code. CMS expects the model to involve approximately 40.0% of physician group practices, hospital outpatient departments (“HOPDs”) and freestanding radiation oncology centers, while the other 60.0% of providers will remain on the current Medicare fee for service reimbursement model. The APM is expected to cover approximately 322,000 beneficiaries, 364,000 episodes of care and manage $5.4 billion in total Medicare spending.

Similar to a bundled payment, the APM will reimburse providers on a prospective, per case basis for all radiation therapy services provided in a 90-day episode of care regardless of modality utilized. Services covered under the payments would include treatment planning, simulation and treatment delivery. All relevant modalities are included such as three-dimensional conformal radiotherapy (“EBRT”), intensity-modulated radiotherapy (“IMRT”), stereotactic radiosurgery (“SRS”), stereotactic body radiotherapy (“SBRT”), proton therapy and brachytherapy.

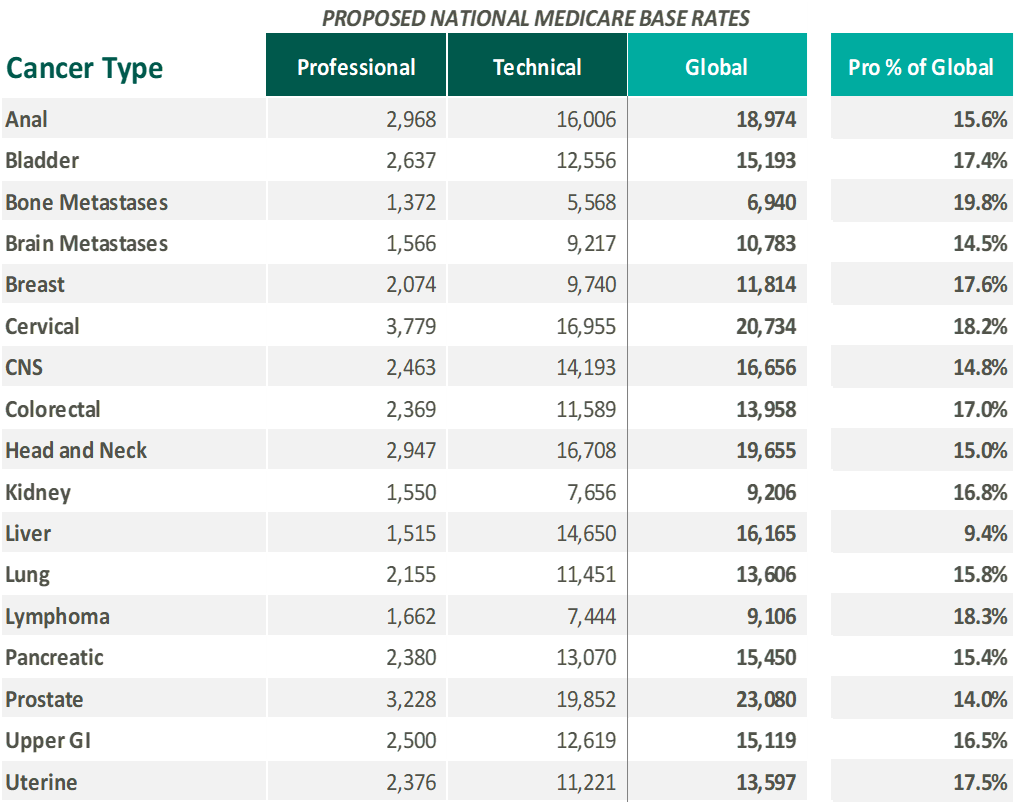

The APM will cover 17 cancer types and include both the professional and technical components. The selected 17 cancer diagnoses make up approximately 84.0% of all radiation therapy episodes. The national base rate for each cancer type was calculated by CMS based on the historical cost to Medicare for cancer episodes during the 2015-2017 time period. The cancer types included in the APM and national base rates (in 2017 dollars) are illustrated below:

Please note, the national base rates are subject to adjustments for case mix, historical experience and geographic location. Due to the model’s reliance on 2017 data, an additional inflationary adjustment is included to bring the case rates to current levels. The proposal also includes additional withholds/discounts to the case rate for quality, incomplete episodes and to lower beneficiary cost-sharing. The APM is site neutral in nature as reimbursement will not be affected if treatment is delivered by a physician practice, HOPD or freestanding center. As proposed, the APM is only expected to impact traditional Medicare Part B, while Medicare Advantage programs are not expected to be affected in the short term.

How will the APM impact current providers of radiation therapy services and their relative valuations? How will the new regulation impact the transaction market?

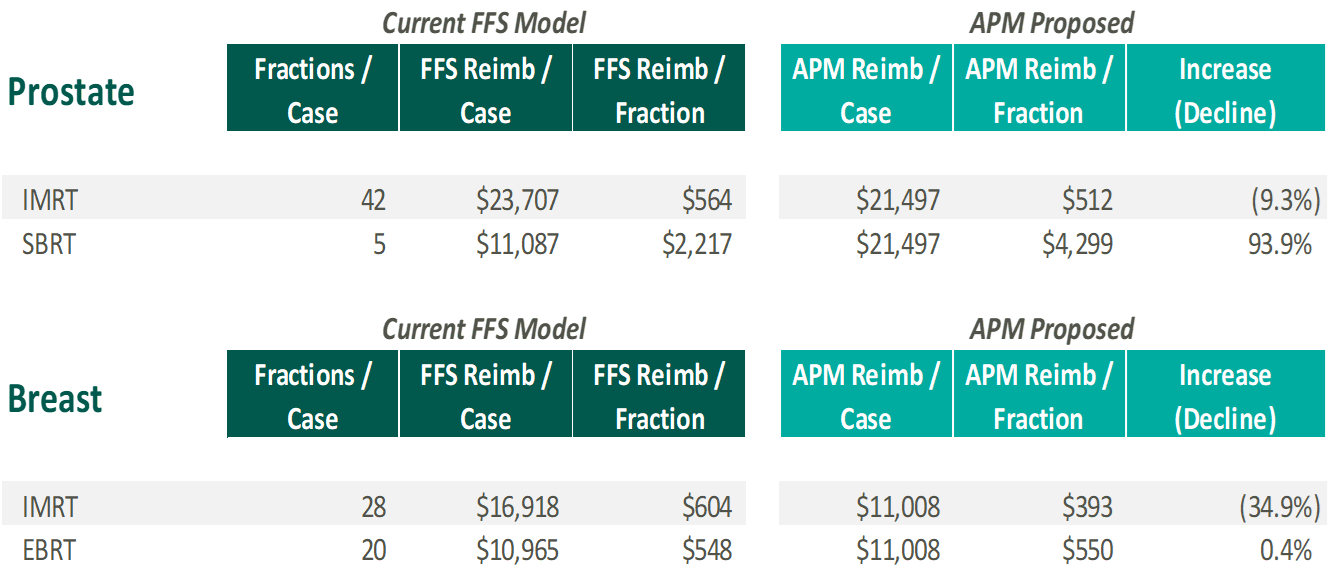

Traditional Radiation Oncology Providers

As the proposed rates are not affected by the modality selected, operators will not be financially incentivized to favor one treatment type over another. CMS believes this will encourage providers to select the most appropriate course of treatment from a clinical perspective regardless of monetary impact. In order to analyze the potential financial ramifications of APM, VMG Health calculated freestanding Medicare fee for service reimbursement based on the 2017 Medicare Physician Fee Schedule and assumptions around CPT coding for a normal course of treatment for certain cancer types and modalities. Please note, the calculations below are for illustrative purposes only and utilizes the national base rate. VMG Health has also applied the proposed discount factor (5% of professional, 4% of technical) and the 2.0% withhold for incomplete episodes. No adjustments are included to the amounts presented to account for historical experience and geographic location. Finally, the withholds/discounts for quality and patient experience are not applied as facilities will have the ability to recoup those monies if certain metrics are met.

As demonstrated, the APM may result in lower reimbursement for IMRT and higher reimbursement for SBRT. Therefore, centers that are currently more heavily weighted towards IMRT for specific disease sites may experience a negative financial impact and downward pressure on their relative valuations. On the other hand, centers that are more heavily weighted toward SBRT may experience a significant positive financial/valuation impact. Please note, CMS does adjust the payment for historical experience / case mix which should mitigate some of the calculated impact presented.

Based on these dynamics, VMG Health expects APM to drive consolidation as centers severely affected may seek to sell or partner with a stronger counterpart as financial returns decline. Furthermore, with high fixed costs, centers with lower throughput may not be able to survive long term on a stand-alone basis which could in turn drive additional transaction activity. Since site of service differentials are eliminated through APM, centers currently structured as HOPDs could transform to a freestanding setting. Re-structuring centers to freestanding entities could also encourage more joint venture activity between physicians, management companies and health systems.

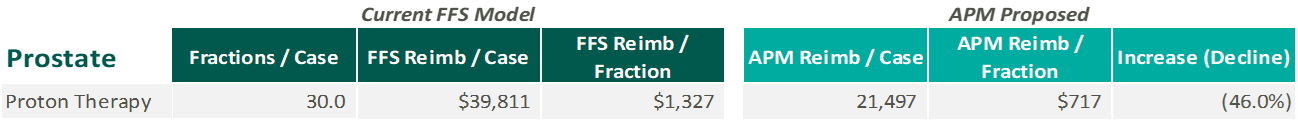

Proton Therapy

For proton therapy, VMG Health performed a similar exercise to compare 2017 Medicare fee for service reimbursement for prostate cancer to the APM national case rate. Please note, proton therapy treatment codes are priced by the local Medicare Administrative Contractor and, as a result, VMG Health has utilized the rates for Dallas, Texas in the estimated reimbursement presented below:

As demonstrated above, APM is expected to have a more significant impact on proton therapy centers when compared to traditional radiation oncology. Historically, some proton therapy centers have struggled financially resulting in numerous bankruptcies and restructurings across the nation. Under APM, the proposed reimbursement decline could lead to further financial hardship for the sector. Furthermore, the negative reimbursement outlook may drive lower valuations for centers required to participate in the APM when compared to facilities in CBSAs that are not selected.

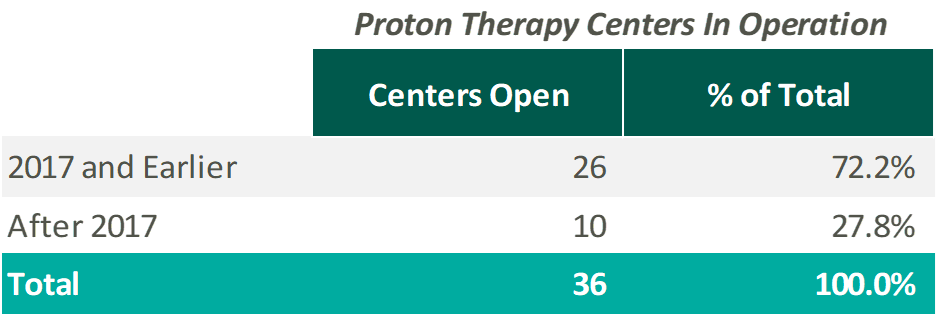

While the impact to proton therapy is substantially negative, several items may at least partially mitigate this impact for some centers. First, proton therapy is excluded from APM if patients are enrolled in a federally funded, multi-institutional, randomized clinical trial. Therefore, centers with a significant portion of patients enrolled in clinical trials may be able to mitigate the impact. Second, under the APM formula, if the proton therapy center was in operation from 2015-2017, a reimbursement adjustment is made based on historical experience/case mix. Since the historical cost for proton therapy centers is higher than the national average utilized to calculate the APM case rates, this should help mitigate a portion of the reimbursement decline. As currently proposed, any proton therapy centers opened after 2017 will not be eligible for the historical experience adjustments. As illustrated, over 70.0% of proton therapy centers currently in operation opened prior to the end of 2017:

Based on this dynamic, “grandfathered” facilities when compared to more recently developed centers may experience a significant positive financial/valuation impact. Please note, the historical experience adjustment is reduced over time during the demonstration period.

Due to APM, planned denovo centers may have to revisit their financial forecasts and determine whether the project is still financially feasible in the event APM is implemented as currently constructed. This may in turn cause the cancellation of planned projects or possibly a halt in the construction of new projects already underway. As previously discussed, it should be noted that CMS may exclude proton therapy from the APM final rule entirely or adjust the methodology.

Additional Mitigating Factors & Other Effects

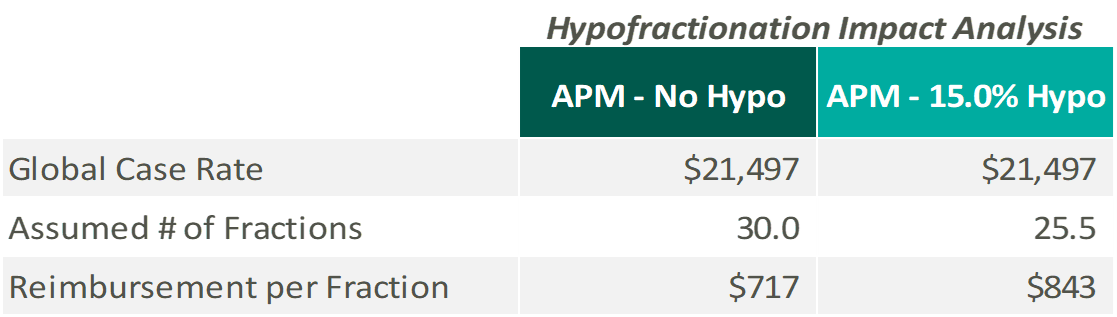

VMG Health expects a faster adoption of hypo-fractionation protocols in response to the APM. Lowering average fractions/per patient will increase reimbursement per fraction all else being equal, helping mitigate the financial impact of APM. See below for an example of reimbursement per fraction for prostate cancer under the APM assuming a 15.0% average reduction in fractions per patient:

However, hypo-fractionation would also need to be offset with higher patient throughput to keep machines utilized at historical rates. This dynamic may once again cause lower volume centers to seek partnership or consolidation opportunities with stronger market participants.

Conclusion

The APM is a significant change to the method Medicare intends to reimburse providers for radiation therapy services. While still only a proposal, CMS could publish a final rule at any time, albeit with possibly significant alterations, changes or exclusions. Operators, clinical partners and investors should keep a close eye on any developments in the proposed ruling as it could significantly impact financial performance, valuation and future transaction activity.

Sources:

- https://innovation.cms.gov/innovation-models/radiation-oncology-model

- https://www.cms.gov/Outreach-and-Education/Outreach/NPC/National-Provider-Calls-and-Events-Items/2019-08-22-Radiation-Oncology

- https://www.cms.gov/newsroom/fact-sheets/proposed-radiation-oncology-ro-model

- https://www.federalregister.gov/documents/2019/07/18/2019-14902/medicare-program-specialty-care-models-to-improve-quality-of-care-and-reduce-expenditures

Categories: Uncategorized

Subscribe

to our blog