- About Us

- Our Clients

- Services

- Insights

- Healthcare Sectors

- Ambulatory Surgery Centers

- Behavioral Health

- Dialysis

- Hospital-Based Medicine

- Hospitals

- Imaging & Radiology

- Laboratories

- Medical Device & Life Sciences

- Medical Transport

- Oncology

- Pharmacy

- Physician Practices

- Post-Acute Care

- Risk-Bearing Organizations & Health Plans

- Telehealth & Healthcare IT

- Urgent Care & Free Standing EDs

- Careers

- Contact Us

Strategic Partnerships in the Inpatient Rehabilitation Industry: Highlights, Opportunities, and Risks

September 5, 2023

By Sydney Richards, CVA, Patrick Speights, and Christopher Tracanna

Approximately 45.0% of acute care discharges are subsequently admitted to a post-acute setting nationwide, including approximately 4.0% who are admitted to an inpatient rehabilitation facility (IRF). An IRF is a freestanding inpatient facility or specialized unit within an acute care hospital that offers intensive rehabilitation to patients after illness, injury, or surgery. Now more than ever, investment demand for IRFs is strong due to the unique value propositions relative to other healthcare verticals, including strong clinical outcomes at an efficient price to payors, a period of stable regulations, rising patient demand, and a high margin for efficient operators.

In response to this demand and the potential for high returns, acute care operators may consider affiliating their existing inpatient rehabilitation units (IRUs) with platform post-acute operators to drive financial returns while improving patient outcomes. IRUs are operated as distinct departments of acute care hospitals, while IRFs are freestanding facilities. Going forward we will use the generic term IRF when discussing the inpatient rehabilitation industry.

Below, VMG Health experts highlight key industry facts driving up investment. Additionally, our experts detail the potential benefits and risks of common IRF affiliation models, such as joint ventures, joint operating agreements, divestitures, and management agreements.

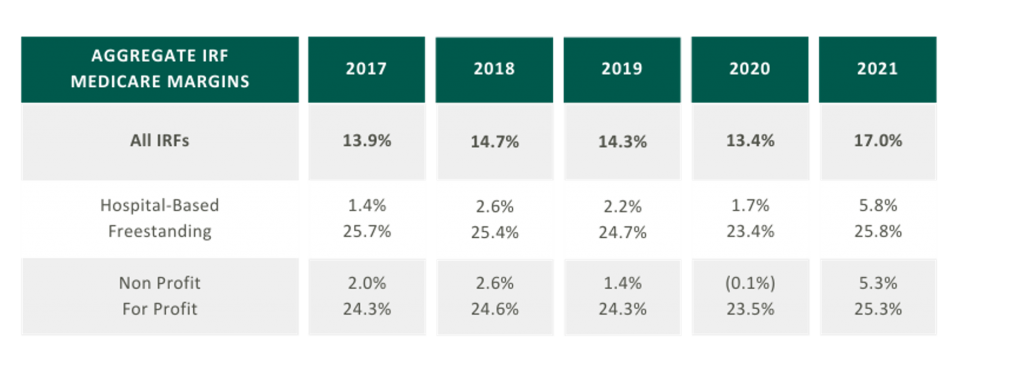

5-Year High Medicare Margins

As presented in the table in the below, aggregated IRF Medicare margins were at a five-year high in 2021 at 17.0%. One driver of this increase is the Centers for Medicare and Medicaid Services (CMS) COVID-19 waivers that allowed flexibility in admission criteria and therapy requirements to maintain IRF status. Now that the emergency declaration has ended, margins may become more pressured as IRFs return to standard operating criteria. It is also notable that freestanding Medicare margins were 25.8% in 2021 compared to hospital-based margins of 5.8%. Many factors contribute to this difference, including:

- Scale – Hospital-based IRFs typically have a lower bed count than freestanding IRFs.

- Strategic Differences – Hospital-based IRFs typically support the operations of a broader acute care hospital or health system.

Proliferation of Strategic Post-Acute Buyers; Growth in Freestanding IRFs

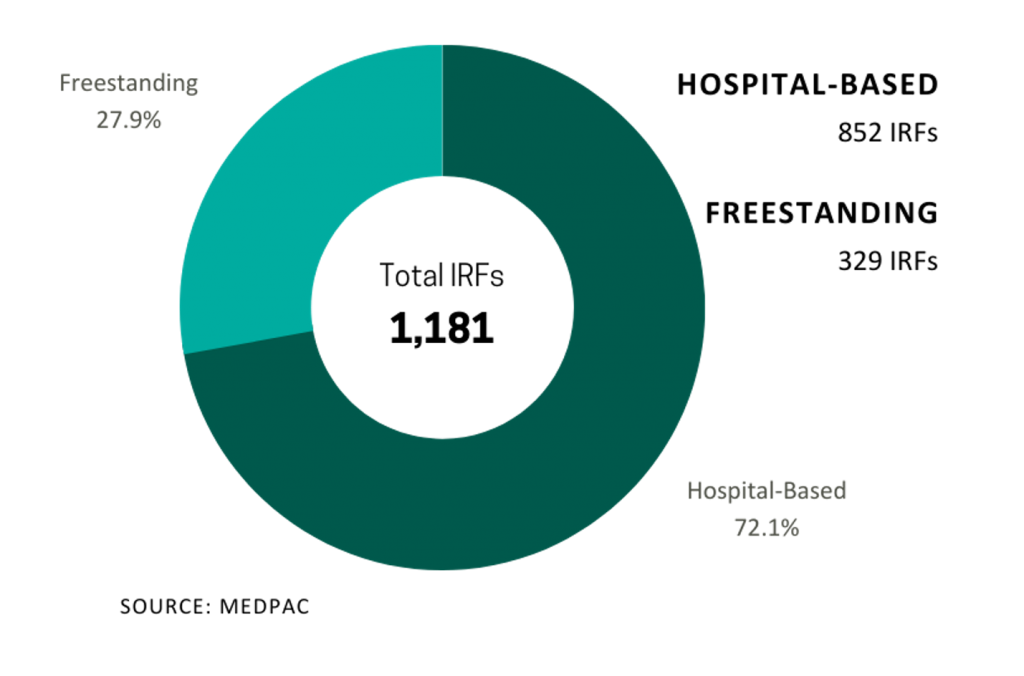

In 2021, five IRFs closed while 22 new IRFs began operations, resulting in a net gain of 17 IRFs. According to MedPAC, the majority of new IRFs were freestanding and for-profit, and most closures were hospital-based nonprofits. As reflected in the chart on the right the top six freestanding IRF operators control approximately 91.5% of freestanding IRFs in the market.

Large Industry with Growing Patient Demand

In 2021, Medicare spent $8.5 billion on 379,000 fee-for-service (FFS) discharges across 1,180 IRFs nationwide. These FFS Medicare stays accounted for approximately 52.0% of IRF discharges on average.

Fragmented

Despite the proliferation of specialized post-acute IRF operators, the IRF industry remains fragmented with over 70.0% of all IRF locations being hospital-based IRUs. The remainder are freestanding facilities. However, based on their relatively larger size and bed counts, freestanding IRFs accounted for approximately 55.0% of Medicare discharges. Additionally, while for-profit IRFs make up about 37.0% of all IRFs, they account for approximately 60.0% of the total Medicare discharges.

Many of the aforementioned factors turned the IRF industry into an attractive sector for a strategic post-acute investor. For acute care systems, collaborating with a post-acute operator can offer significant benefits, including reducing the length of stay and readmission rates, and providing access to clinical and operational best practices. Collectively, these enhancements improve both patient outcomes and financial returns. We have identified several affiliation models for post-acute and IRF unit operators, as well as advantages and disadvantages to consider for each model.

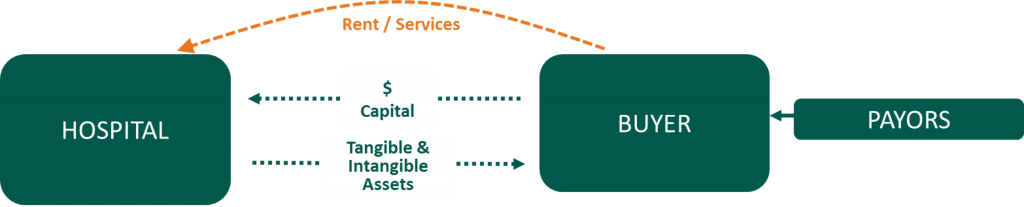

Divestiture

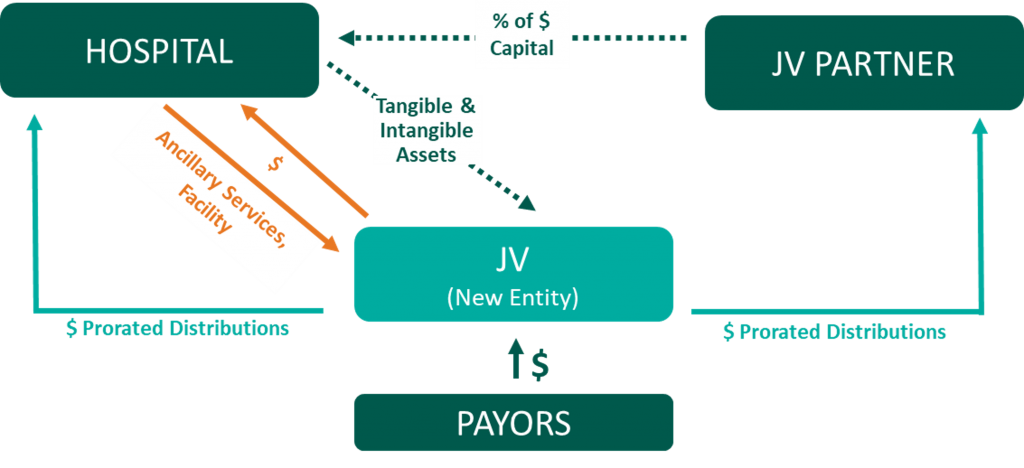

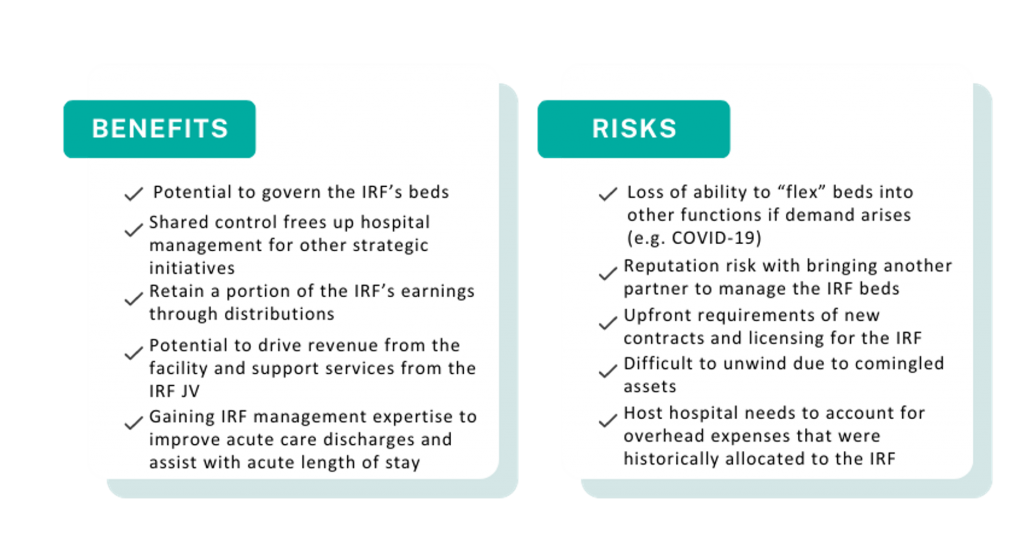

Joint Venture

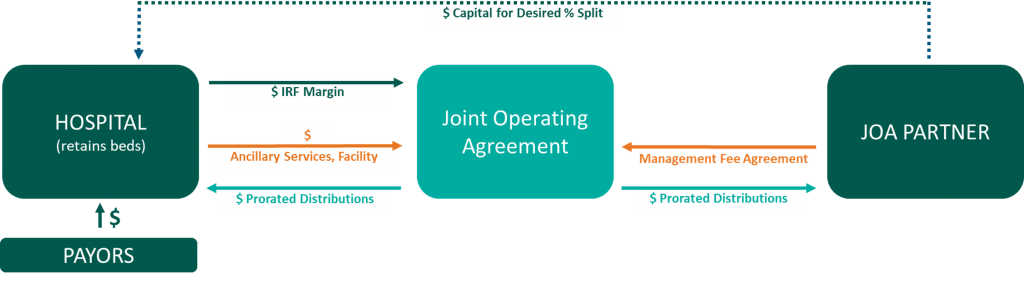

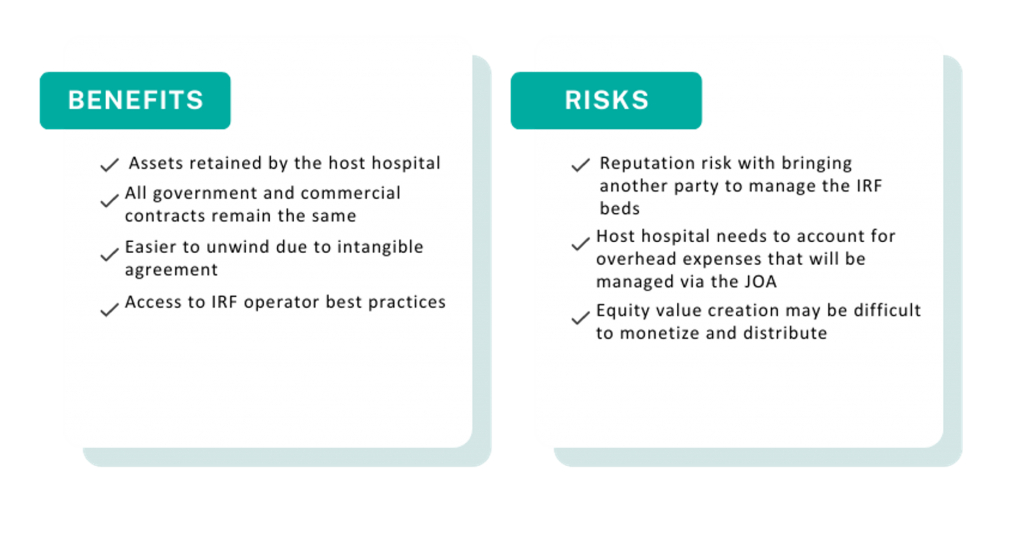

Joint Operating Agreement

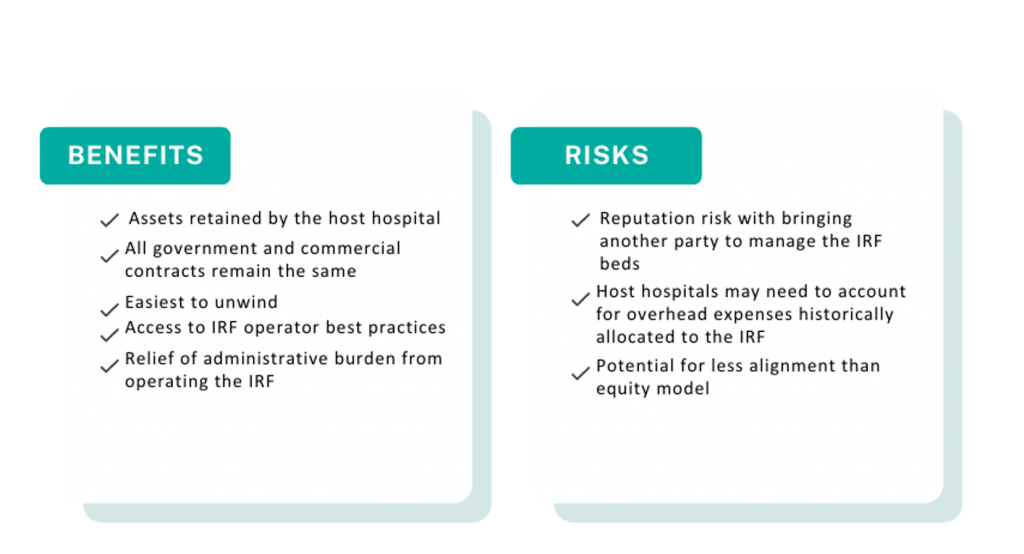

Management Agreement

A post-acute care strategy is vital for acute care providers seeking to elevate patient outcomes while maximizing value to their organization. Forming strategic alliances with post-acute operators in inpatient rehabilitation may be one successful approach. Operators have many avenues to consider whether it is through the sale of an existing inpatient rehabilitation unit, joint venturing with a partner to create a de novo freestanding IRF, or employing a post-acute manager to drive performance in an existing IRF. No matter your path forward, VMG Health experts can provide actionable insights into the value of your existing IRF business and assist with a potential IRF partnership in a model that fits your post-acute strategy.

Sources

- ATI Advisory. (2023, February 10). National Medicare FFS Hospital Discharges to SNF and HHA Trending Toward Pre-Pandemic Patterns.

- Medpac. (2023). Inpatient rehabilitation facility services. Report to the Congress: Medicare Payment Policy.

- Encompass Health Corporation. (2023). Find a location.

- Ernest Health. (2023). Our hospitals.

- Pam Health. (2023). Inpatient Rehabilitation Hospitals.

- Lifepoint Health. (2023). Locations.

- Select Medical. (2023). Locations.

Categories: Uncategorized

Authors

Is There Value in Your Inpatient Rehabilitation Facility?

By: Sydney Richards, CVA and Stephan Peron, CVA Inpatient rehabilitation utilization has experienced remarkable growth over the past decade, fueled...

Learn MoreContact the Experts

Subscribe

to our blog