CARES Act Impact on Home Health Agencies

Zach

April 20, 2020

Effective January 16, 2024, Compliance Risk Analyzer has joined VMG Health. Learn more.

March 19, 2024

Written by Grace McWatters, Danny Cuellar, Carlos Flores-Rodriguez, Blake Pierro, and Cameron Tolbert

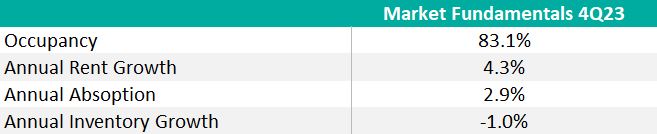

Inflation, a shaky supply chain, and rate hikes have extended production schedules and increased the cost and risk associated with developing new skilled nursing facilities. While new supply is constrained, existing nursing facilities grapple with staffing shortages and weak reimbursements. Despite positive chatter about recovering occupancy, rent growth, and a looming “silver tsunami” of retirees, the industry sits in a precarious position.

The inflated cost to build, buy, and operate skilled nursing facilities has led to a downward pressure on valuations. This affects the risk profile of the sector, both from a regulatory risk perspective (in the context of joint ventures or lease renewals, for instance) and from an underwriting or acquisition/disposition perspective (due to the elevated cost of debt combined with rising operating costs).

Strong demand for skilled nursing facilities is primarily driven by an aging populace in the United States; over the next 10 years, the 75+ population is projected to grow by 44%. According to research funded by the National Investment Center for Seniors Housing & Care, 60% of this population will have mobility limitations, with 20% requiring high healthcare or functional needs.

Cushman and Wakefield predict consumer demand for senior housing and care facilities, including independent living, assisted living, memory care, and skilled nursing, will overwhelm the market within the next five years. It would take approximately 3,100 new skilled nursing facilities by 2030, or about 500 net openings annually, to meet the forecasted need. Despite robust demand, skilled nursing inventory fell 1% in 2023.

Over the last year, closures continually outpaced openings as financial pressures from inflation, poor reimbursement rates, and staffing shortages led to industry-wide “right sizing” to control cost and mitigate labor shortages. For example, in 2022 and 2023 when labor shortages became a flashpoint, operators, bound by minimum staffing requirements, had to consider contract labor. The contract nursing labor utilization increased 56% in 2022, which “equates to approximately $400,000 in additional costs for the average facility in the country.” Average overall nursing wages increased 10.6% in 2022, a much faster clip than revenue growth.

These cost surges came at a price, and without a mechanism to raise prices, taking beds offline was often inevitable. The American Health Care Association surveyed thousands of skilled nursing facilities in an August 2023 report and found that 21% of homes are downsizing beds or units, and 24% have closed a wing, unit, or floor because of the labor shortages.

Since 2020, an estimated 579 facilities have closed (approximately 162 per year, over the 43-month period), and 38% of these closures were 4- or 5-star rated facilities. Only three skilled nursing facilities opened in 2023, down significantly from an average of 64 openings in both 2020 and 2022.

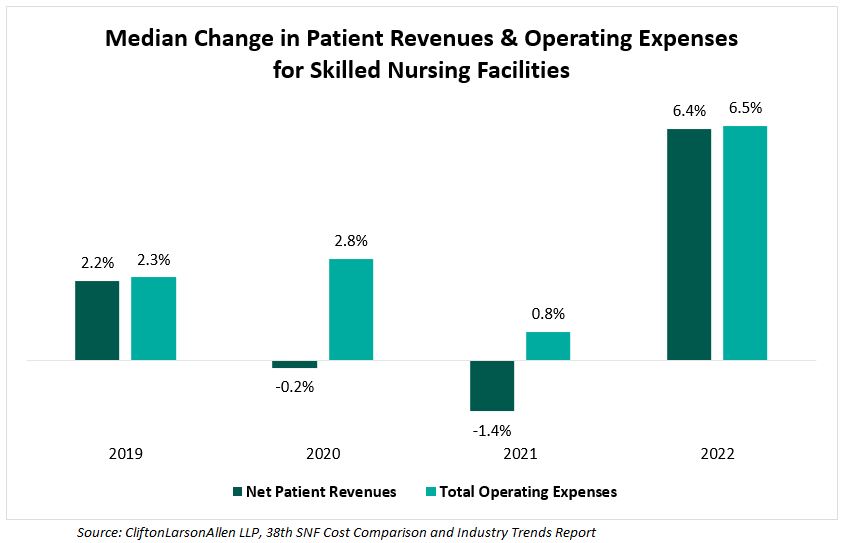

The tight supply has supported rent growth and occupancy recovery across the industry, but these gains have been outpaced by increased costs for staffing and supplies, exacerbating structural forces specific to the industry. From 2019 to 2022, Clifton Allen Larson analyzed cost reports for 10,500 facilities (nearly two-thirds of all Medicare-certified SNFs in the country) and found that expenses have consistently grown faster than revenues.

Operating expense growth in other industries can be mitigated by “shrinkflation” or higher prices, but in healthcare, providers cannot ethically reduce the amount of care administered, nor can they regularly renegotiate their contracts and expect immediate increases in Medicare reimbursements.

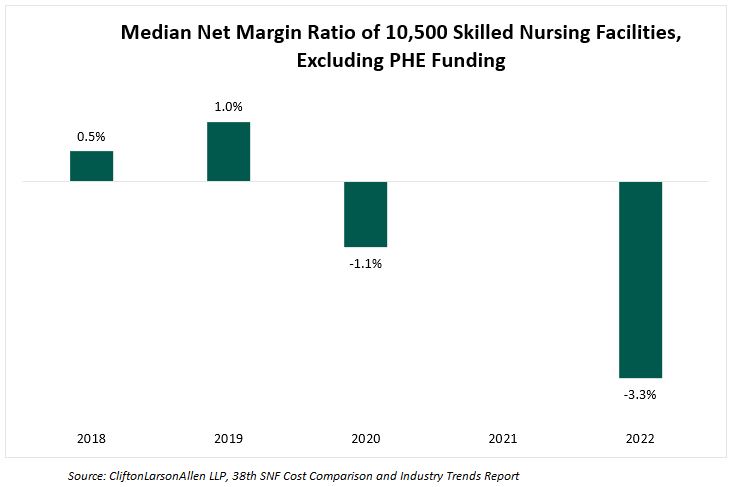

In 2023, Clifton Larson Allen analyzed cost reports of 10,500 nursing facilities and found a significant downward trend in the median net margin ratio since 2020. This ratio measures a facility’s efficiency in controlling costs in relation to its total revenue by comparing net income or loss to total revenue.

Construction for new facilities has dwindled since 2020, as high interest rates and inflation have developers wary. Costs are rising, but market valuations have not necessarily followed, which means developers would take on more risk for potentially less reward. These factors have decreased the overall incentive for developers to initiate new projects.

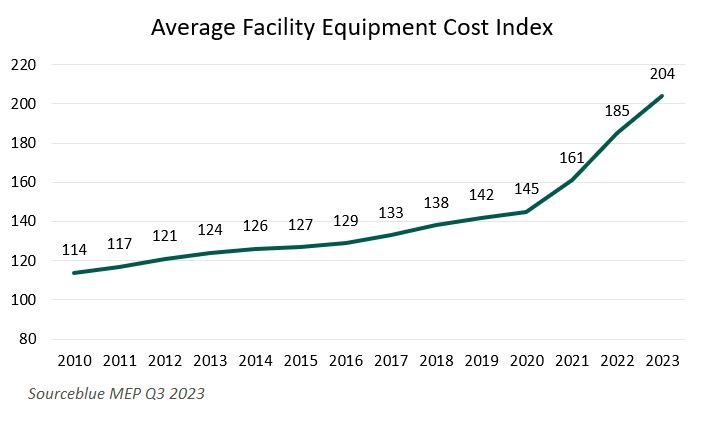

When analyzing the all-in construction costs of 142 senior housing developments in 2022, CBRE reported the average cost had increased 17.8% per unit since 2020, clarifying that this increase “is largely attributable to higher labor and materials costs, as well as operating expenses and outlays for entitlements.”

This is mostly attributable to hard cost increases, but there were significant increases in soft costs and FF&E costs as well. Hard costs, which include site work, foundation, shell, and finishes, increased 24% per revenue unit (i.e., per bed) since 2020. Soft costs, which can cover architect and design fees, permitting and inspection fees, rose 14% per unit, and FF&E bumped up 10% per unit . Similarly, an index based primarily on mechanical and electrical equipment in new construction showed a significant uptick in their average cost in 2022 (increased by 15.1%) and 2023 (increased by 10.4%).

While FF&E represents a small part of the overall senior care development budget (CBRE estimates 3% overall) , any transactions and leases involving FF&E at senior living and care facilities are subject to regulatory scrutiny, just like real property.

Those willing to take the risk of building a new facility find it difficult to acquire capital in the wake of rate hikes and bank failures in the broader economy. A significant amount of funding for the purchase of senior living and care assets originates from commercial bank loans, but lending grew scarce following the failings of Silicon Valley Bank and Signature Bank in March 2023.

As other banks teetered on the edge of bankruptcy and commercial bank stocks dropped up to 50%, banks began to stop the flow of lending, and instead focused on cleaning up their balance sheets. Preserving limited capital, banks began to raise interest rates and stiffen security terms for available loans. This folded into rising rates on a larger macroeconomic scale, as the Federal Reserve hiked their rates to curb inflation, increasing interest rates by 525 basis points in 2022 and 2023.

Higher interest rates lend themselves to higher projected operating costs of acquired facilities. This increase in operating costs has been offset by a substantial decrease in purchasing prices. Cain Brothers reported a 20–30% decrease in skilled nursing facility valuations since the beginning of 2023, citing several deals in their report, including a New York facility that declined in value 47% in less than two years, and a Kentucky facility that dropped 28% in less than one year. Haven Senior Investments notes valuation declines between 15% and 30% but emphasizes the influence of factors like rising property taxes and insurance premiums, as well as the portfolio penalty.

The inflationary environment combined with longer-term industry headwinds continue to place pressure on the senior living and skilled nursing industry. Over the last two years, the cost of capital has increased, and commercial loans have become less available, making it more expensive and time consuming to acquire the funds necessary for new developments or strategic acquisitions. Operating costs continue to outpace revenue growth, and the median net margin ratio for two-thirds of the country’s facilities was negative 3.3% in 2022. This environment has contributed to rising capitalization rates and downward pressure on valuations.

The decline in skilled nursing facility valuations has increased the industry’s risk profile, both from a regulatory risk perspective and from an underwriting or acquisition/disposition perspective. The turbulent market conditions over the last 18 months have created a need for increased diligence when developing, buying, or selling senior living assets. However, long-term demographic trends will continue to drive transaction activity in the sector, as market participants seek solutions to address demand in the face of rising costs and increased cost of capital.

Beets, K., Ferroni, L. (2024). Seniors Housing & Care Investor Survey and Trends. JLL. https://www.us.jll.com/en/trends-and-insights/research/seniors-housing-care-investor-survey-and-trend-outlook

Pearson, C., et. al. (2019). The Forgotten Middle: Many Middle-Income Seniors Will Have Insufficient Resources For Housing And Health Care. HealthAffairs. https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2018.05233

Boywer, Z. (2023). Investor Survey and Trends Report: U.S. Senior Living & Care. Cushman & Wakefield. https://www.cushmanwakefield.com/en/united-states/insights/senior-living-and-care-investor-survey-and-trends-report

Shuman, T. (2023). How Will America’s “Silver Tsunami” Impact Demand for Nursing Homes? Seniorliving.org. https://www.seniorliving.org/nursing-homes/nursing-home-demand-projections/

Vison, N. (2024). 4Q23 Market Fundamentals. NIC MAP Vision. https://info.nicmapvision.com/rs/016-QJL-848/images/4Q23-NIC-MAP-Market-Fundamentals-PDF.pdf

Connect, C. (2024). 38th SNF Cost Comparison and Industry Trends Report: One Industry, Thousands of Stories. CLA. https://www.claconnect.com/en/resources/white-papers/snf-cost-comparison-industry-trends-report

Vance, M., et. al. (2022). 2022 Seniors Housing Development Costs. Intelligent Investment. https://www.cbre.com/insights/reports/2022-seniors-housing-development-costs

SourceBlue. (2023). 2023 MEP Cost Index Q4. https://media.licdn.com/dms/document/media/D4E1FAQFQj5FKBkLXVg/feedshare-document-pdf-analyzed/0/1705173887049?e=1711584000&v=beta&t=FlP19mqHb4j8iSVBePK8gHaWLHauSTUgdorcMH2TTlg

Goldreich, M. (2023). 2023 Debt Capital Markets Impact on Senior Living Asset Valuation. Cain Brothers Industry Insights. https://www.key.com/content/dam/kco/documents/businesses___institutions/Industry_Insights_11.15.23.pdf

Investments, H. (2023). The Present and Future of Senior Living Sector Acquisitions. Haven Senior Investments. https://havenseniorinvestments.com/downloadable/the-present-and-future-of-senior-living-sector-acquisitions/

Related Content

Subscribe

to our blog