Navigating Tax Due Diligence in Healthcare Acquisitions

Christa Shephard

May 9, 2024

Effective January 16, 2024, Compliance Risk Analyzer has joined VMG Health. Learn more.

June 4, 2024

Written by Frank Fehribach, MAI, MRICS; Danny Cuellar

There was once a time when no one considered a lease as an asset. It was just an expense to be paid at the end of the month and ignored until the following month. Then ASC 842 came around in 2018 and operating leases became assets—right-of-use assets (ROUs), to be exact. ROU assets had to be put on the balance sheet and depreciated. Then they had to be tested for impairment. Now, for some firms that are downsizing their operations (or downsizing their physician practices), they must be impaired.

In the beginning, there was FAS 13, Accounting for Leases. For lessees, leases were either operating or capital leases. Operating leases were expensed and capital leases, if they passed the test, were put on the balance sheet. To be a capital lease, you had to meet one or more of the four criteria:

FAS 13, which came into effect in 1977, became known as ASC 840 under the codification of the accounting standards. ASC 840 would continue until it was replaced by ASC 842 in 2019 for public companies and 2021 for private companies. ASC 842 was developed over nearly a decade and released in 2016. The main difference between the ASC 840 and 842 was that all operating leases greater than 12 months in term would be recognized on the balance sheet as both an ROU asset and a liability. The Financial Accounting Standards Board had hoped this difference would increase transparency. It certainly had the effect of producing large lease guidance manuals from all the major accounting firms. It also produced a whole new category of assets that potentially need to be tested for impairment, and to be impaired if they failed.

Accounting firm guidance indicates that ROU assets are subject to ASC 360-10 impairment guidance applicable to long-lived assets. ROU assets must be assessed for potential impairment if there is an internal or external indicator, like the decision to vacate a leased space entirely or partially. However, vacating a leased space does not mean that it has been abandoned. Abandonment accounting would only apply if the space were vacated and not used at all (even for storage) without intent to sublease the space.

ASC Topic 360, Property, Plant, and Equipment was issued in August 2001. Because of ASC 842, former operating leases of more than one year are now long-lived assets. These leases are subject to the same asset impairment guidance in ASC 360 that applies to any other property, plant, and equipment assets. ASC 360-10-35-23 states, “For purposes of recognition and measurement of an impairment loss, a long-lived asset or assets shall be grouped with other assets and liabilities at the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities.”

An ROU asset has identifiable cash flows based on the lease payments. Testing is performed based on an undiscounted cash flow. During normal business operations, leased space is often vacated as operations are right-sized to the current business environment, creating a need to test for impairment. If the undiscounted cash flow is lower than the carrying amount of the asset, ASC 360 requires the owner of that ROU asset to reduce it to its fair value.

What is the fair value of an ROU asset that is no longer used for the purpose that it was created for through the lease? To answer this question, we must know what market participants would pay for this asset if offered on the market as of the trigger date. For an ROU asset, this would be a sublease and the present value of future sublease payments. Typically, there is a certain period to find a sublease tenant, and then the sublease tenant would occupy the space for the remainder of the primary term. Option periods, that before may have been included in the ROU asset, may be excluded because the landlord may not allow it, or the actual tenant may want to end the lease and not exercise an option. If option periods were included in the ROU asset value originally, the impairment amount would increase. Additionally, the discounting of the sublease payments is done at a market rate not an internal borrowing rate (IBR) used to establish the ROU asset value initially.

During a lease term, an organization’s operations in the leased space can be completely shut down or downsized. Typically, a completely vacated space will fail Step 1 of the testing, as there is no cashflow being generated for the lease space. For a partial vacancy, the Step 1 test becomes even more important, as part of the space is still being utilized. However, our experience is that a partially vacated space will still trigger the need to test for impairment. For a completely vacated lease, there is usually the assumption that the ROU asset must be impaired.

In this new world of ROU assets, health systems need to be wary of physician practice downsizing in a leased space. Downsizing in a leased space could and should trigger impairment testing and possibly adjustment to fair value. The transition to ASC 842 represents a significant shift toward greater transparency in lease accounting, as the new standards provide a clearer picture of an entity’s financial obligations, though they also require more complex accounting. VMG Health has extensive experience assisting health systems and physician practices with this financial reporting exercise.

May 29, 2024

Written by Isabella Rosman and Tim Spadaro, CFA, CPA/ABV

The following article was published by Becker’s Hospital Review.

Throughout VMG Health’s client base, we are privileged to work with many major players across the physician practices landscape—from solo practitioners and independent physician groups to large platform practices, private equity (PE)–backed physician practice rollups, and those affiliated with large health systems.

VMG Health has been engaged to assist clients in varying capacities associated with transactions, ranging from providing business valuations to financial due diligence (quality of earnings). This insight has provided important visibility into the buyer’s perspective. Further, our work has delved into the operations of practices, including coding and compliance, physician compensation, and strategy work. As a result, our experience offers us a unique glimpse into physician practices and the underlying transaction environment. From our experience, including anecdotal discussions with clients and operators in this space, we’ve outlined a few major headwinds and tailwinds facing physician practice transactions in 2024.

Reimbursement Pressure: Physician practices continue to face reimbursement pressure. In November 2023, the Centers for Medicare & Medicaid Services (CMS) issued its final rule announcing policy changes for Medicare payments under the Physician Fee Schedule (PFS) for 2024. Per CMS, overall payment rates under the PFS will be reduced by 1.25% in 2024, following a 2.0% decline in 2023. Although the overall impact on reimbursement varies across specialties, the rate cuts will continue to suppress margins and put pressure on physician practices. For more information on operational challenges and opportunities with physician practices, see VMG Health’s most recent Physician Alignment Tips & Trends Report.

Persistent Inflation: Wage inflation (largely driven by a tight labor market, an aging physician base, and recruiting challenges) and the rising costs of drug and medical supplies have been persistent. According to the government’s Medicare Economic Index (MEI), medical practice costs are expected to increase by 4.6% in FY 2024 on top of last year’s 3.8% increase. Without reimbursement keeping pace with increasing costs, many physician practices’ profit margins have contracted.

Many physician practices seek out a partner to help combat the daily pressures they face. Practices may benefit from operational synergies by consolidating with a larger organization, particularly if the larger organization has favorable reimbursement rates or anticipated cost savings from duplicate services (back-office employees, external accounting, etc.). In fact, many buy-side clients run a managed care or “black box” analysis to assess the potential rate lift and the resulting practice economics on a post-transaction basis to better inform themselves and their investment committees during diligence. Contact VMG Health’s Revenue Consulting & Analytics team to analyze the potential rate lift on your next deal.

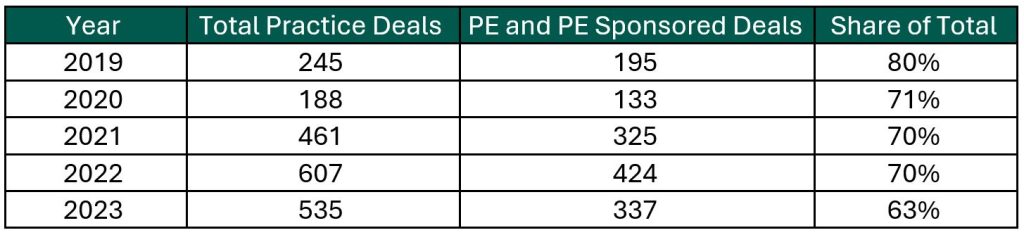

Record High Dry Powder: PE has been an active participant in the physician practice transaction space for many years, as evidenced by recent deal volume presented in the table below. Capital committed to PE funds but not yet deployed (dry powder) is presently at record highs for healthcare services. The current estimate of dry powder earmarked for healthcare services among U.S. headquartered PE managers is approximately $100 billion, according to Pitchbook’s Q4-2023 Healthcare Report. PE funds are regularly searching for a home to deploy this capital and physician practices are a common target.

Source: Irvin Levin, 2024 Health Care Services Acquisition Report

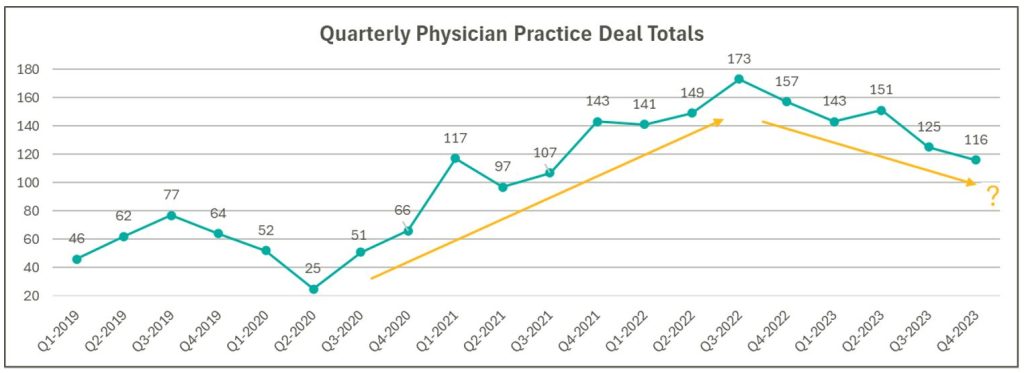

Source: Irvin Levin, Healthcare M&A Quarterly Reports

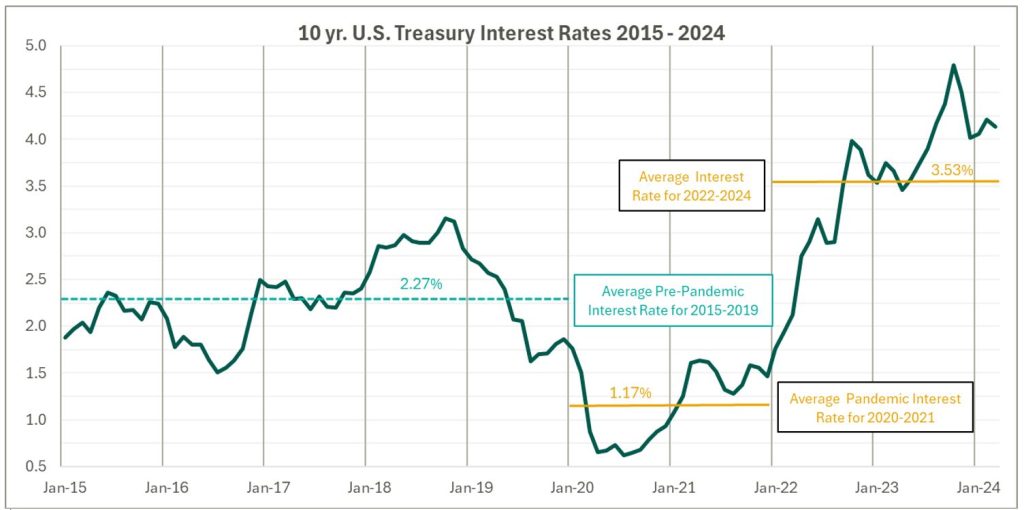

High Interest Rates: As the pandemic hit, fiscal stimulus and loosened monetary policy led to ultra-low interest rates relative to historical norms and spurred transaction activity. Interest rates began to materially rise throughout 2022, challenging overall transaction activity in the latter part of 2022 and during 2023 as access to capital tightened and the cost of capital increased. The below chart presents interest rates over the period as measured by the 10-year U.S. treasury.

Despite higher rates, transaction activity for physician practices has remained robust relative to pre-pandemic levels. However, there are signs that interest rates are having a lagged effect on deal volume considering the recent downward trend from Q3 2022 through Q4 2023 as observed in the above chart. While this does not necessarily mean that we should expect deal volume to revert to pre-pandemic levels, it does highlight that we have entered a new transaction environment. In this environment, the time to close deals lengthens as sellers digest lower valuation multiples and buyers increase scrutiny during due diligence given an uncertain future macroeconomic landscape. Contact VMG Health’s Financial Due Diligence team for details on how the changing tide is impacting the due diligence process.

At the start of 2024, interest rates remain elevated and volatile with an uncertain path to a normalized level, which continues to serve as a headwind for transaction activity. However, interest rates can change quickly, and the U.S. Federal Reserve has signaled that it will likely be appropriate to begin rate cuts at some point during 2024. Market participants have started anticipating rate cuts from this messaging, which could certainly serve as a tailwind throughout the remaining course of this year and into next.

Source: Federal Reserve 10 Year U.S. Treasury Market Data

Regulatory Transaction Oversight: Healthcare consumes a considerable amount of U.S. spending and is expected to continue increasing; CMS’ National Health Expenditure Accounts (NHEA) Healthcare projects healthcare spending to increase from approximately 18.3% of U.S. GDP in 2021 to 19.6% in 2031. Furthermore, it is an election year, with a current U.S. Presidential Administration keenly focused on the rising costs of healthcare. As a result, increased regulatory scrutiny has manifested itself over the ongoing consolidation across healthcare services, particularly within the physician practice space.

This heightened scrutiny is most recently evidenced by the Federal Trade Commission (FTC) suing U.S. Anesthesia Partners, Inc. (USAP), a prominent provider of anesthesia services in Texas, over an alleged “…anticompetitive acquisition spree to suppress competition and unfairly drive-up prices for anesthesiology services.” The FTC also hosted a workshop on March 5, 2024 to assess the public impact of private capital in healthcare. On that same day, the FTC, U.S. Department of Justice (DOJ) and U.S. Department of Health and Human Services (HHS) requested public comments on the effects of transactions involving PE, health systems, and payors on the healthcare providers and ancillary services space.

FTC Focus on Non-compete Agreements: It is not uncommon for physicians to a sign non-compete agreement upon joining a physician practice. The intent of a non-compete agreement, as well as the potential impact, are being hotly debated, with the FTC proposing a rule to ban non-compete clauses. A recent VMG article, Non-Compete Agreements: A Prevailing Quagmire provides details highlighting the arguments and broader implications of non-compete agreements and the proposed ban.

Overall interest in acquiring physician practices remains high, and we don’t expect that to change in the foreseeable future. The dynamics outlined above will likely dictate the path and volume of transactions throughout 2024 and beyond. To read more and stay informed as the year unfolds, please visit VMGHealth.com.

Centers for Medicare & Medicaid Services. Calendar Year (CY) 2024 Medicare Physician Fee Schedule Final Rule. Centers for Medicare & Medicaid Services website. Published November 2, 2023. https://www.cms.gov/newsroom/fact-sheets/calendar-year-cy-2024-medicare-physician-fee-schedule-final-rule

Centers for Medicare & Medicaid Services. CMS Finalizes Physician Payment Rule, Advances Health Equity. Centers for Medicare & Medicaid Services website. Published November 2, 2023. https://www.cms.gov/newsroom/press-releases/cms-finalizes-physician-payment-rule-advances-health-equity

Landi H. Physician groups decry finalized Medicare payment cuts as 2024 expenses rise. FierceHealthcare. Published November 3, 2023. https://www.fiercehealthcare.com/providers/physician-groups-decry-finalized-medicare-payment-cuts-2024-expenses-rise

American Medical Association. Only Cure for Medicare Payment Mess: Wholesale Reform. American Medical Association website. https://www.ama-assn.org/about/leadership/only-cure-medicare-payment-mess-wholesale-reform#:~:text=To%20put%20this%20into%20perspective,top%20of%20last%20year’s%203.8%25https://www.ama-assn.org/about/leadership/only-cure-medicare-payment-mess-wholesale-reform#:~:text=To%20put%20this%20into%20perspective,top%20of%20last%20year’s%203.8%25

VMG Health. 2023 Healthcare M&A Report. Published [publication date not provided]. https://vmghealth.com/2023-healthcare-ma-report/ https://vmghealth.com/2023-healthcare-ma-report/

PitchBook. Q4 2023 Healthcare Services Report. Published [publication date not provided]. https://pitchbook.com/news/reports/q4-2023-healthcare-services-report

Reuters. Fed’s Powell Set Election-Year Stage with Testimony on Rate Cuts, Inflation. Reuters website. Published March 6, 2024. https://www.reuters.com/markets/us/feds-powell-set-election-year-stage-with-testimony-rate-cuts-inflation-2024-03-06/

Centers for Medicare & Medicaid Services. National Health Expenditure Fact Sheet. Centers for Medicare & Medicaid Services website. Published [publication date not provided]. https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/nhe-fact-sheet

Federal Trade Commission. FTC Challenges Private Equity Firm’s Scheme to Suppress Competition in Anesthesiology Practices Across the United States. Federal Trade Commission website. Published September [publication date not provided], 2023. https://www.ftc.gov/news-events/news/press-releases/2023/09/ftc-challenges-private-equity-firms-scheme-suppress-competition-anesthesiology-practices-across

McDermott Will & Emery LLP. Top Takeaways: FTC Hosts Workshop, Solicits Public Comment on Private Equity in Healthcare. McDermott Will & Emery LLP website. Published [publication date not provided]. https://www.mwe.com/pdf/top-takeaways-ftc-hosts-workshop-solicits-public-comment-on-pe-in-healthcare/

Aguirre I. Non-Compete Agreements: A Prevailing Quagmire. VMG Health website. Published [publication date not provided]. https://vmghealth.com/thought-leadership/blog/non-compete-agreements-a-prevailing-quagmire/https://vmghealth.com/thought-leadership/blog/non-compete-agreements-a-prevailing-quagmire/https://vmghealth.com/thought-leadership/blog/non-compete-agreements-a-prevailing-quagmire/

May 20, 2024

Written by Grayson Terrell, CPA

The following article was published by Becker’s Hospital Review.

In today’s complex healthcare environment, mergers and acquisitions (M&A) are proving to be more challenging than ever, with heightened governmental regulations impacting both the operation of an entity and the purchase and sale of an entity.

To successfully navigate a transaction in the healthcare sector, it is paramount that buyers and sellers make informed decisions through all of the tools made available to them. For sellers, this can come in the form of understanding how their business operates, understanding inefficiencies and growth opportunities, and even understanding what their business is worth. For buyers, informed decision making relies heavily upon understanding the markets in which they are investing, including governmental regulations in some states that may impact their ability to invest and operate; understanding the key operating metrics of similar companies in similar industries; and ensuring that they are paying an appropriate amount for the business. This is especially important because, in healthcare transactions, the capital used to purchase is often provided by investors who are counting on timely positive returns.

Financial due diligence (FDD) is pivotal to the success of any healthcare transaction, as it requires detailed investigation and analysis of a company’s financial information and is used to validate a company’s true run-rate operating potential. With most healthcare M&A transactions, purchase price is based on a multiple of a company’s salable earnings before interest, taxes, depreciation, and amortization (EBITDA). As such, the buyer and seller must perform the appropriate financial due diligence procedures prior to executing a transaction. Below are five vital aspects of the financial due diligence process.

The Quality of Earnings (QofE) process consists of making adjustments to the entity’s reported financial statements to normalize EBITDA. The bulk of these adjustments involve adjusting or removing impacts of non-recurring and one-time items from earnings to arrive at an adjusted EBITDA figure that represents a more accurate view of the entity’s true cashflows. This process also gives the FDD team the opportunity to pose pointed questions related to the entity’s operations, finances, and accounting functions, highlighting key information that could negatively or positively impact adjusted earnings. Specific to healthcare transactions, some of the relevant areas of interest with respect to potential EBITDA adjustments are:

The Quality of Revenue (QofR) analysis may be the most important part of the FDD process when it comes to healthcare-related transactions, given the unique characteristics and nuances of healthcare revenue. During this process in many middle-market healthcare deals, the conversion of revenue from cash basis to accrual basis is a fundamental exercise with respect to the QofE analysis. The cash waterfall approach is the gold standard and therefore the most common method for accomplishing the cash-to-accrual conversion. With this method, detailed billing data is obtained from the entity’s revenue cycle management (RCM) system, which includes charges by date of service and payments by date of service and by date of payment. In this analysis, payments are adjusted back to their specific date of service (accrual basis), and outstanding collections on charges billed during the period under analysis are estimated based on historical collection patterns cut by payor, CPT code, or various other means.

Pro forma adjustments are forward-looking projections on certain aspects of the business, which are layered back in across the historical financial statements. These assumptions can help buyers understand potential areas of future direction and growth opportunities for the company; however, these adjustments should be thoroughly scrutinized during buy-side FDD procedures to ensure the adjusted EBITDA and purchase price are not over- or understated. These estimations tend to lean more in favor of the seller and are often a primary area of focus by the opposing buy-side FDD team. As such, a seller should understand all aspects of the business, especially as they relate to these forward-looking projections, and should be able to support the key inputs utilized to derive these pro forma adjustments. If properly supported, these adjustments often increase the sale price of the business enough to cover the cost of FDD procedures incurred by the seller, if not many times over. Some examples of commonly observed pro forma adjustments in healthcare related QofE reports include:

Another common analysis in FDD procedures is a Net Working Capital analysis, which is used to determine the working capital (current assets less current liabilities, excluding cash and debt) required to operate a business in the post-transaction environment. This subsection of FDD typically involves substantial negotiation between buyers and sellers when approaching the close of a deal, as both parties will view various inputs differently, often striving to set a working capital peg that is more favorable for themselves. As a miscalculation of this peg can cost a seller on a dollar-for-dollar basis if the agreed-upon level of net working capital is not met, it is imperative that management and their advisors are involved and knowledgeable on this calculation.

Most of the time, healthcare transactions occur on a cash-free, debt-free basis. Standard with any cash-basis business, many debt and debt-like items have the potential to be inaccurately reflected within a company’s balance sheet. As such, a Debt and Debt-Like Items analysis can assist buyers and sellers in understanding a company’s debts and liabilities as of the date of sale. These items can include potential tax-related exposures, outstanding litigation and legal settlements, deferred compensation, notes payable, and others.

In closing, FDD is a necessary step in ensuring that sellers have the keys to sell their businesses at the best possible price, and buyers can protect the money of their companies, firms, or investors by making a sound investment in the target company. This proactive approach creates trust between all parties and leads to more lucrative transactions for all.