Five Key Analyses for Healthcare Financial Due Diligence

Christa Shephard

May 20, 2024

Effective January 16, 2024, Compliance Risk Analyzer has joined VMG Health. Learn more.

July 23, 2024

Written by Matthew Marconcini, CPA

Selling your company can be an exciting time, filled with potential opportunities for growth and new horizons. Whether your company is accrual based, following GAAP, or it reports on a cash basis, proper preparation for the sale of your company is extremely important. This journey often involves a complex web of financial transactions and negotiations, with numerous parties at the table. Among the critical elements in this process are financial due diligence and performing a quality of earnings (QOE) analysis. The QOE process is a critical aspect of financial reporting and analysis that helps stakeholders, like investors and creditors, assess the reliability and sustainability of a company’s reported earnings.

The QOE analysis can play a pivotal role in shaping the outcome of the sale and can significantly impact the perceived value of your business. Therefore, as management, it is essential to be well-prepared and proactive in assessing and evaluating the quality of your business’ earnings, as it influences the selling price and builds trust and confidence among potential investors and other stakeholders. We have outlined eight steps management can take to best prepare for the QOE process.

Management should have a clear understanding of what QOE means. It assesses the underlying economic substance of reported earnings, ensuring they are not distorted by accounting manipulations or one-time events.

Accurate financial record-keeping is fundamental to high-quality earnings. Management must ensure that financial statements are free from material misstatements and that all transactions are properly recorded.

Transparency is crucial. Ensure all material transactions, both positive and negative, are adequately disclosed in the financial statements and related footnotes.

Maintain consistency in financial reporting practices. Frequent changes in accounting policies can raise questions about the QOE. If policies do change, explain the rationale behind it and the financial impact of the change.

Recognize revenue in accordance with accounting standards only when it’s earned and realizable. Avoid prematurely recognizing revenue or engaging in overly aggressive practices. If your company reports on a cash basis, pulling together the proper data that will show revenue based on date of service rather than the collection date will be key.

Clearly distinguish between one-time or non-recurring events and ongoing operations in financial reporting. Disclose the nature and impact of such events to prevent misinterpretation.

Be prepared to provide a comprehensive and honest analysis of the company’s financial results. Explain the drivers of earnings, changes in accounting policies, and potential future risks and uncertainties. The more support you can provide related to both historical performance and future growth initiatives, the more accurate and comprehensive your analysis.

Take the time to review the various systems used to operate the business and start pulling data together. If certain systems are maintained by third parties, informing them of the situation and discussing what they need to do will create a smoother process. If certain reports don’t have the necessary inputs or data, be prepared to discuss that and what alternative information would be useful.

By considering these guidelines and implementing the underlying thought processes, management can best prepare for the QOE process, demonstrating a commitment to transparency, accuracy, and integrity in financial reporting. This, in turn, builds trust and credibility with investors and other stakeholders, creating a smooth transaction process for management.

June 13, 2024

Written by Johnny Zizzi, CPA; Lukas Recio, CPA

When considering a new acquisition or transaction, accurate financial reporting is paramount for informed decision making. One significant aspect of financial reporting is the choice of accounting method: cash, accrual, or a hybrid of both. Many companies begin their journey with cash accounting, but as they grow and evolve or are otherwise acquired by a larger entity, they often transition to accrual accounting to meet regulatory requirements or achieve a more comprehensive financial picture.

This transition is not without its pitfalls and considerations, particularly when understanding its impact on enterprise valuation resulting from the quality of earnings process. Key considerations when converting from cash to accrual accounting include revenue recognition in accordance with ASC 606, expense accrual recognitions, managing changes in working capital, and earnings volatility.

Cash accounting, also called checkbook accounting, entails recording transactions when cash changes hands, which provides management with a straightforward method for tracking cash flow. Small businesses often prefer this method because the IRS allows it when certain size criteria are met and because it is easier to track money as it moves in and out of bank accounts. Further, there is no need to evaluate accounts receivable or payable to determine income when using cash accounting, simplifying the management of the financial statements as a whole.

However, for healthcare entities, this simplicity can be misleading, as it does not capture the true financial obligations and revenues tied to patient care and insurance reimbursements. Accrual accounting, on the other hand, records revenues when they are earned and expenses when they are incurred, regardless of when cash is exchanged. While cash accounting may be simpler for small businesses, accrual accounting offers a more accurate representation of a company’s financial health, especially as they grow and become more complex.

A crucial component of most healthcare services transactions is the quality of earnings analysis, which aims to assess the sustainability and accuracy of historical earnings and the achievability of future earnings, thereby providing potential buyers with a clear understanding of the company’s true earning potential.

Transitioning from cash-basis accounting to accrual accounting entails significant differences and challenges in revenue recognition. Under cash-basis accounting, revenue is recognized when cash is received, while accrual accounting dictates recognition when revenue is earned, irrespective of cash-flow timing. This shift necessitates adjustments to accurately reflect revenue generated within a given period, especially for long-term contracts or services rendered where cash receipts may occur at different points from when the revenue is earned. Challenges arise in estimating and timing revenue recognition, requiring careful assessment of performance obligations, delivery, and collectability.

Issues stemming from the diverse revenue streams and payment models prevalent in healthcare, such as fee-for-service, capitation, and bundled payments add an additional layer of complexity when converting from cash to accrual accounting, as each payment model has distinct timing and recognition criteria. Additionally, healthcare entities often engage in complex contractual arrangements with payors and providers, leading to variations in revenue and expense recognition practices. Moreover, healthcare organizations may have unique regulatory requirements and accounting treatments for certain transactions, further complicating conversion efforts.

Differences in case mix, payor mix, and procedure mix among healthcare entities can also impact revenue recognition as the collectability of outstanding accounts receivable is often different for specific payor and case mixes. Cash waterfalls, zero-balance analyses, and other revenue hindsight analyses are leveraged as part of VMG Health’s comprehensive quality of revenue analysis to ensure revenue recognition is converted from a cash basis to an accrual basis in accordance with ASC 606. Adherence to revenue recognition principles, while requiring meticulous analysis to mitigate misinterpretation and manipulation, is a critical component to a quality of earnings analysis, as it ensures financial statements provide a more comprehensive view of revenue performance, enhancing transparency and comparability. For further detail on quality of revenue analysis, see VMG Health’s previous article: Proceed with Caution: Five Key Considerations in Quality of Revenue Analysis.

Transitioning from cash to accrual accounting presents unique challenges beyond revenue recognition. One significant hurdle lies in accurately accounting for expenses, particularly in healthcare facilities where costs often span various departments and service lines. Accrual accounting requires recognizing expenses when incurred, irrespective of cash outflows, which can be intricate in healthcare settings due to the complex nature of patient care, procurement of medical supplies, and maintenance of facilities. Ensuring accountants properly match expenses to the periods in which they contribute to patient care or administrative functions may require complex allocation and estimation methodologies.

For instance, the timing and recognition of expenses related to medical supplies and pharmaceuticals can vary based on inventory management practices and rebate arrangements with suppliers. Historical cost of goods sold analysis and margin analysis are two of the most common strategies implemented to understand underlying changes in the business, providing a basis for accurately matching expenses to the relevant accounting periods. In large healthcare systems, these complexities are further amplified by the need to allocate costs accurately across multiple departments and service lines, such as inpatient, outpatient, surgical, and emergency services. Addressing expense accrual challenges necessitates a comprehensive understanding of healthcare operations and collaboration between finance and operational personnel to ensure the accuracy of accrual conversions.

In the context of a transaction, small businesses may prepay (malpractice insurance) or pay after the fact (common area maintenance charges) for certain expenses, which must be converted to an accrual basis to properly inform a buyer of the business’ financial condition.

Shifting from cash to accrual accounting also affects the management and assessment of working capital. Under cash accounting, working capital appears straightforward, often mirroring the cash flow directly. However, accrual accounting requires a more nuanced view, recognizing accounts receivable, accounts payable, and inventory changes that may not have immediate cash implications but significantly impact liquidity and operational efficiency. Accurate tracking and managing these elements is crucial, as they influence a healthcare organization’s true financial position and operational performance and may have purchase price implications.

Understanding and converting net working capital on an accrual basis also helps shareholders and potential buyers identify a business’ strengths and potential weaknesses. For healthcare entities, a rise in accounts receivable under accrual accounting indicates future cash inflows but also highlights the importance of effective revenue cycle management, including timely billing and collection processes. Similarly, accounts payable under accrual accounting provide insights into a company’s obligations and upcoming cash outflows, lending toward robust vendor management and procurement practices. Healthcare entities must develop comprehensive systems for monitoring these working capital components to ensure they reflect the actual financial health and to make informed decisions regarding cash management, investment opportunities, and strategic planning. However, there must first be benchmark net working capital to compare future trends.

Under cash accounting, earnings may appear more volatile, as revenues and expenses are recorded only when cash transactions occur. However, accrual accounting captures economic events more accurately and consistently. Fluctuations in reported earnings can be caused by timing differences in revenue and expense recognition and can be particularly pronounced in the healthcare sector, where seasonal variations and payor reimbursement lags are common, causing revenue to be recognized in one period and the corresponding expenses in another on a cash basis of accounting.

For stakeholders and potential investors, understanding the sources and implications of this volatility is crucial for assessing the company’s true financial health. Cash-to-accrual conversions within a quality of earnings analysis help identify and normalize these fluctuations, providing a clearer picture of sustainable earnings and operational performance. By aligning revenue and expense recognition to an accrual basis, stakeholders can benefit from more reliable insights into the company’s financial trajectory, aiding better investment and management decisions. For healthcare entities, this detailed analysis is particularly vital, given the sector’s unique financial dynamics and regulatory landscape. The application of advanced analytical techniques, such as trend analysis and scenario modeling, can further enhance the understanding of earnings volatility and its impact on long-term financial planning and stability.

Converting from cash accounting to accrual accounting in a quality of earnings analysis offers several positive benefits. Accrual accounting provides a more accurate reflection of a company’s financial performance by matching revenues and expenses to the periods in which they are earned or incurred, offering a clearer picture of the company’s profitability over time. This enables stakeholders to make better-informed decisions regarding operational changes, investment, lending, or acquisition opportunities. Additionally, accrual accounting enhances comparability with industry peers and facilitates benchmarking analysis, as financial statements prepared under an accrual basis are inherently more standardized and comparable. Moreover, accrual accounting can uncover trends and patterns in revenue and expense behaviors, providing deeper insights into the company’s underlying financial health and operational efficiency. Overall, the conversion to accrual accounting strengthens the transparency, reliability, and credibility of earnings analysis, fostering trust among investors, creditors, and other stakeholders.

June 11, 2024

Written by Timothy Kent; Jordan Tussy, CVA; Molly Smith

GenesisCare, a prominent provider of cancer services worldwide, filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code on June 1, 2023, in the United States Bankruptcy Court for the Southern District of Texas (Case No. 23-90614). The Australian-based company, once valued at $5 billion and backed by private equity firm KKR, faced financial difficulties due to high debt levels and operational challenges.

Founded in 2004 by Dan Collins, GenesisCare (the “Company”) served Australian cancer patients until 2015, when the Company expanded to Europe via its purchase of eight cancer centers from Cancer Partners UK. During 2016, GenesisCare continued growing its European operations through the acquisitions of 17 centers in Spain from IMOncology and Oncosur Group.

In late 2019, GenesisCare made headlines with the acquisition of U.S.-based cancer provider 21st Century Oncology for $1.5 billion. Two years prior, 21st Century Oncology filed for bankruptcy because of declining reimbursement and “regulatory costs concerning electronic records and legal expenses.” At the time of acquisition by GenesisCare, 21st Century Oncology operated 294 locations, including 124 radiation oncology centers, with an estimated $230 million of earnings before interest, tax, and depreciation (EBITDA).

While rapidly expanding GenesisCare’s footprint, the 21st Century acquisition left the Company with significant levels of debt and a new operations base that was reemerging from bankruptcy. GenesisCare faced significant challenges in its effort to turnaround the U.S. operations, including an aging equipment base and IT system, operational inefficiencies, and increased competition. Prior to GenesisCare’s Chapter 11 filing, they reported approximately $2 billion of total debt on its balance sheet, largely associated with the 21st Century acquisition.

In March 2023, CEO and Founder Dan Collins stepped down, and three months later, the Company filed for bankruptcy on June 1, 2023.

Five months after its initial filing, GenesisCare announced the U.S. Bankruptcy Court for the Southern District of Texas confirmed the Company’s Chapter 11 Plan of Reorganization after receiving support from approximately 95% of voting creditors. The plan included significant deleveraging of GenesisCare’s balance sheet, with a reduction in total debt by approximately $1.7 billion.

On February 16, 2024, GenesisCare completed its reorganization process and emerged from Chapter 11. As part of its reorganization plan, GenesisCare will operate as four distinct businesses in the U.S., Australia, Spain, and the UK, with an independent governance structure and Board of Directors for each business. Furthermore, the businesses will be responsible for the strategies and performance of their market. The Company also received approximately $56 million of new capital infusion from investor groups to help support the growth of the remaining businesses. As a result of the restructuring plan, the Company is prepared to move forward well capitalized with a relatively low level of debt and a more focused operational strategy.

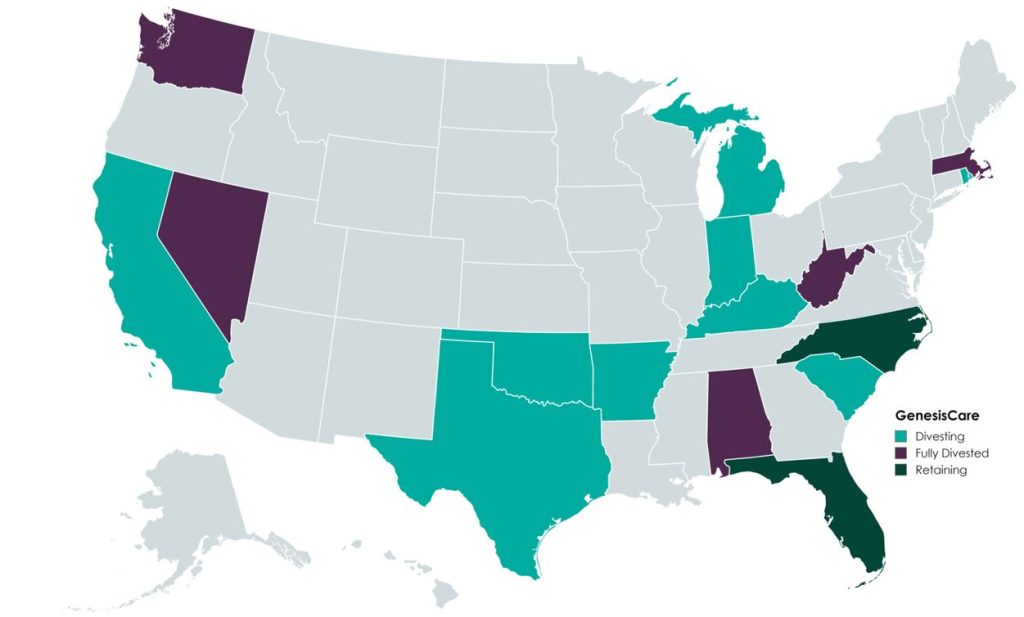

In the U.S., GenesisCare will retain practices in the “fast-growing markets” of Florida and North Carolina, which will continue to offer similar cancer care services (medical oncology, radiation oncology, surgery, and imaging). Currently, the Company operates 145 locations across the two states. GenesisCare has sold or is in the process of divesting its remaining assets across 14 states.

Newly appointed chief executive officer David Young said, “I am confident that our independently run businesses are strongly positioned to capture the exciting opportunities available to them in the markets they serve while never losing sight of our core goal: delivering better life outcomes to patients.”

A primary objective of GenesisCare’s restructuring plan was to divest all U.S.-based assets outside of North Carolina and Florida. This decision was part of its strategic plan to focus on core operations to ensure long-term sustainability.

According to bankruptcy filing documents, GenesisCare has divested 32 locations across 14 states. Assuming all of the transactions close at the defined purchase price in the transaction agreements, cash proceeds to GenesisCare would be approximately $113 million, with an implied equity value of approximately $131 million (see chart below). The assets have drawn interest from many different buyer types, including health systems, large oncology platforms, and practices. Dr. Shaden Marzouk, President of GenesisCare U.S., said, “The strong interest we received from a wide variety of buyers from across the U.S. is a reflection of what we have long known―that GenesisCare’s U.S. business benefits from an incredible team, a desirable footprint and a proven ability to care for patients.”

One notable transaction was OneOncology’s acquisition of two radiation oncology practices in South Carolina for $25.0 million (per the asset purchase agreement), expanding OneOncology’s service offerings in an existing market. CEO of OneOncology, Jeff Patton, MD, said, “For OneOncology, these are two great business assets that are really the only radiation facilities that are open in that market. It’s a market we were already in, so sometimes things match up well.” Specifically, OneOncology acquired a Myrtle Beach facility with three linear accelerators and a Conway Center with one.

California-based Sutter Health purchased five radiation oncology practices in Modesto, San Luis Obispo, Santa Cruz, Stockton, and Templeton, California. According to the purchase agreement, the total purchase price for these centers was $32 million. President and CEO of Sutter Health, Warner Thomas said, “We know how important it is for specialty services like cancer care to be offered close to home so patients can stay on track with their treatments. Keeping continued cancer care accessible in these communities was a driving force for Sutter to acquire these care centers.” Sutter also has certain capital investments in mind, including new radiation oncology equipment, technologies, and other support services.

Based on Kroll’s bankruptcy docket, there are medical and radiation oncology assets still available for sale, which could result in increased transaction activity with interest buyers, such as health systems, private equity–backed oncology platforms, and practice acquisitions. After successfully emerging from Chapter 11, GenesisCare is entering a new chapter, as emphasized by CEO David Young: “GenesisCare has achieved the goals it set out at the beginning of its restructuring process. We exit Chapter 11 with great businesses, each with a compelling future.” The Company’s focus on continuous growth is highlighted by the planned construction of three new radiation oncology centers in Australia, scheduled to open in 2024. With a more concentrated U.S. and global platform, GenesisCare has indicated that it is well positioned for future growth as a newly capitalized, low-debt entity committed to providing the highest level of care for its patients.

Patrick, A. (2024, February 18). GenesisCare emerges from bankruptcy, cuts deal with government. Australian Financial Review. Retrieved from https://www.afr.com/companies/healthcare-and-fitness/genesiscare-emerges-from-bankruptcy-cuts-deal-with-government-20240218-p5f5t5

Staff Writer. (2024). Amid major cancer care bankruptcy, oncology clinics sold. Oncology News Central. Retrieved from https://www.oncologynewscentral.com/article/amid-major-cancer-care-bankruptcy-oncology-clinics-sold

GenesisCare. (2024). GenesisCare’s reorganisation plan confirmed with overwhelming support from voting creditors. GenesisCare. Retrieved from https://www.genesiscare.com/au/news/genesiscare-reorganisation-plan-confirmed-with-overwhelming-support-from-voting-creditors

GenesisCare. (2024). GenesisCare completes reorganisation and emerges from Chapter 11. GenesisCare. Retrieved from https://www.genesiscare.com/au/news/genesiscare-completes-reorganisation-and-emerges-from-chapter-11

Patrick, A. (2019, December 13). Aussie cancer outfit makes first US move in $1.5b deal. Australian Financial Review. Retrieved from https://www.afr.com/companies/healthcare-and-fitness/aussie-cancer-outfit-makes-first-us-move-in-1-5b-deal-20191213-p53js7

Private Equity Stakeholder Project. (2024). Private equity healthcare bankruptcies are on the rise. Private Equity Stakeholder Project. Retrieved from https://pestakeholder.org/reports/private-equity-healthcare-bankruptcies-are-on-the-rise/

June 4, 2024

Written by Frank Fehribach, MAI, MRICS; Danny Cuellar

There was once a time when no one considered a lease as an asset. It was just an expense to be paid at the end of the month and ignored until the following month. Then ASC 842 came around in 2018 and operating leases became assets—right-of-use assets (ROUs), to be exact. ROU assets had to be put on the balance sheet and depreciated. Then they had to be tested for impairment. Now, for some firms that are downsizing their operations (or downsizing their physician practices), they must be impaired.

In the beginning, there was FAS 13, Accounting for Leases. For lessees, leases were either operating or capital leases. Operating leases were expensed and capital leases, if they passed the test, were put on the balance sheet. To be a capital lease, you had to meet one or more of the four criteria:

FAS 13, which came into effect in 1977, became known as ASC 840 under the codification of the accounting standards. ASC 840 would continue until it was replaced by ASC 842 in 2019 for public companies and 2021 for private companies. ASC 842 was developed over nearly a decade and released in 2016. The main difference between the ASC 840 and 842 was that all operating leases greater than 12 months in term would be recognized on the balance sheet as both an ROU asset and a liability. The Financial Accounting Standards Board had hoped this difference would increase transparency. It certainly had the effect of producing large lease guidance manuals from all the major accounting firms. It also produced a whole new category of assets that potentially need to be tested for impairment, and to be impaired if they failed.

Accounting firm guidance indicates that ROU assets are subject to ASC 360-10 impairment guidance applicable to long-lived assets. ROU assets must be assessed for potential impairment if there is an internal or external indicator, like the decision to vacate a leased space entirely or partially. However, vacating a leased space does not mean that it has been abandoned. Abandonment accounting would only apply if the space were vacated and not used at all (even for storage) without intent to sublease the space.

ASC Topic 360, Property, Plant, and Equipment was issued in August 2001. Because of ASC 842, former operating leases of more than one year are now long-lived assets. These leases are subject to the same asset impairment guidance in ASC 360 that applies to any other property, plant, and equipment assets. ASC 360-10-35-23 states, “For purposes of recognition and measurement of an impairment loss, a long-lived asset or assets shall be grouped with other assets and liabilities at the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities.”

An ROU asset has identifiable cash flows based on the lease payments. Testing is performed based on an undiscounted cash flow. During normal business operations, leased space is often vacated as operations are right-sized to the current business environment, creating a need to test for impairment. If the undiscounted cash flow is lower than the carrying amount of the asset, ASC 360 requires the owner of that ROU asset to reduce it to its fair value.

What is the fair value of an ROU asset that is no longer used for the purpose that it was created for through the lease? To answer this question, we must know what market participants would pay for this asset if offered on the market as of the trigger date. For an ROU asset, this would be a sublease and the present value of future sublease payments. Typically, there is a certain period to find a sublease tenant, and then the sublease tenant would occupy the space for the remainder of the primary term. Option periods, that before may have been included in the ROU asset, may be excluded because the landlord may not allow it, or the actual tenant may want to end the lease and not exercise an option. If option periods were included in the ROU asset value originally, the impairment amount would increase. Additionally, the discounting of the sublease payments is done at a market rate not an internal borrowing rate (IBR) used to establish the ROU asset value initially.

During a lease term, an organization’s operations in the leased space can be completely shut down or downsized. Typically, a completely vacated space will fail Step 1 of the testing, as there is no cashflow being generated for the lease space. For a partial vacancy, the Step 1 test becomes even more important, as part of the space is still being utilized. However, our experience is that a partially vacated space will still trigger the need to test for impairment. For a completely vacated lease, there is usually the assumption that the ROU asset must be impaired.

In this new world of ROU assets, health systems need to be wary of physician practice downsizing in a leased space. Downsizing in a leased space could and should trigger impairment testing and possibly adjustment to fair value. The transition to ASC 842 represents a significant shift toward greater transparency in lease accounting, as the new standards provide a clearer picture of an entity’s financial obligations, though they also require more complex accounting. VMG Health has extensive experience assisting health systems and physician practices with this financial reporting exercise.

May 29, 2024

Written by Isabella Rosman and Tim Spadaro, CFA, CPA/ABV

The following article was published by Becker’s Hospital Review.

Throughout VMG Health’s client base, we are privileged to work with many major players across the physician practices landscape—from solo practitioners and independent physician groups to large platform practices, private equity (PE)–backed physician practice rollups, and those affiliated with large health systems.

VMG Health has been engaged to assist clients in varying capacities associated with transactions, ranging from providing business valuations to financial due diligence (quality of earnings). This insight has provided important visibility into the buyer’s perspective. Further, our work has delved into the operations of practices, including coding and compliance, physician compensation, and strategy work. As a result, our experience offers us a unique glimpse into physician practices and the underlying transaction environment. From our experience, including anecdotal discussions with clients and operators in this space, we’ve outlined a few major headwinds and tailwinds facing physician practice transactions in 2024.

Reimbursement Pressure: Physician practices continue to face reimbursement pressure. In November 2023, the Centers for Medicare & Medicaid Services (CMS) issued its final rule announcing policy changes for Medicare payments under the Physician Fee Schedule (PFS) for 2024. Per CMS, overall payment rates under the PFS will be reduced by 1.25% in 2024, following a 2.0% decline in 2023. Although the overall impact on reimbursement varies across specialties, the rate cuts will continue to suppress margins and put pressure on physician practices. For more information on operational challenges and opportunities with physician practices, see VMG Health’s most recent Physician Alignment Tips & Trends Report.

Persistent Inflation: Wage inflation (largely driven by a tight labor market, an aging physician base, and recruiting challenges) and the rising costs of drug and medical supplies have been persistent. According to the government’s Medicare Economic Index (MEI), medical practice costs are expected to increase by 4.6% in FY 2024 on top of last year’s 3.8% increase. Without reimbursement keeping pace with increasing costs, many physician practices’ profit margins have contracted.

Many physician practices seek out a partner to help combat the daily pressures they face. Practices may benefit from operational synergies by consolidating with a larger organization, particularly if the larger organization has favorable reimbursement rates or anticipated cost savings from duplicate services (back-office employees, external accounting, etc.). In fact, many buy-side clients run a managed care or “black box” analysis to assess the potential rate lift and the resulting practice economics on a post-transaction basis to better inform themselves and their investment committees during diligence. Contact VMG Health’s Revenue Consulting & Analytics team to analyze the potential rate lift on your next deal.

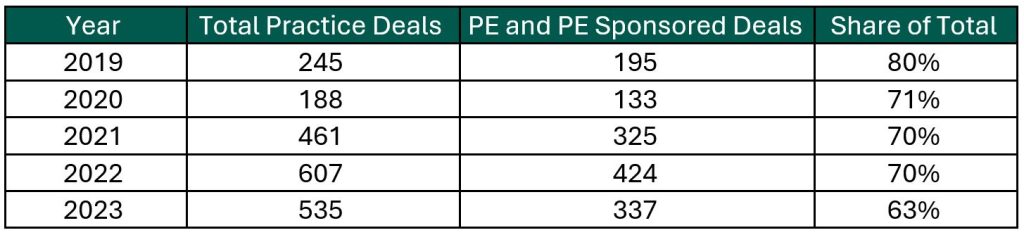

Record High Dry Powder: PE has been an active participant in the physician practice transaction space for many years, as evidenced by recent deal volume presented in the table below. Capital committed to PE funds but not yet deployed (dry powder) is presently at record highs for healthcare services. The current estimate of dry powder earmarked for healthcare services among U.S. headquartered PE managers is approximately $100 billion, according to Pitchbook’s Q4-2023 Healthcare Report. PE funds are regularly searching for a home to deploy this capital and physician practices are a common target.

Source: Irvin Levin, 2024 Health Care Services Acquisition Report

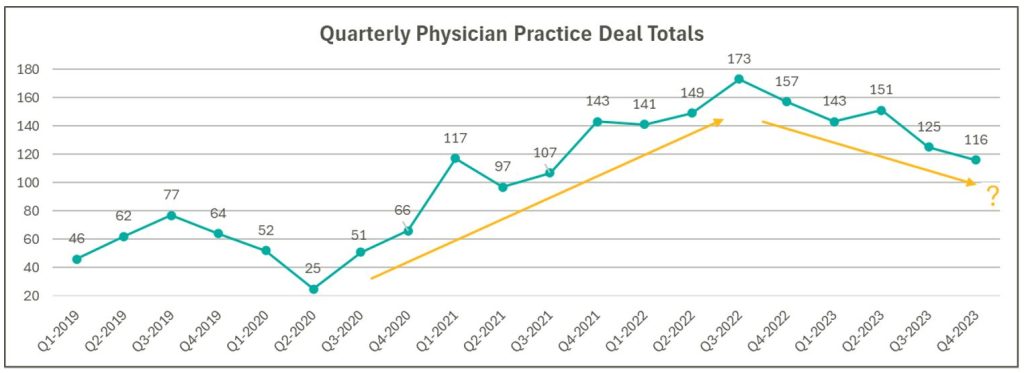

Source: Irvin Levin, Healthcare M&A Quarterly Reports

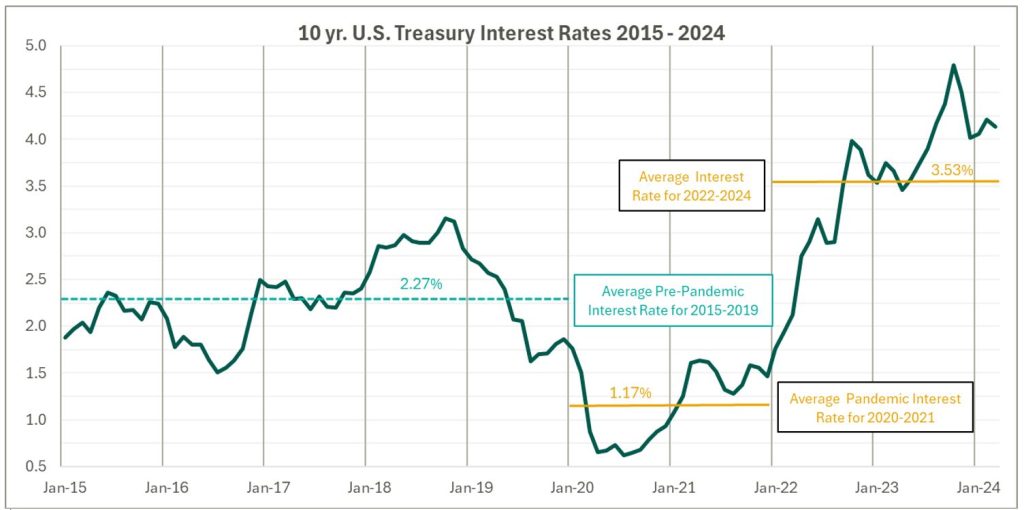

High Interest Rates: As the pandemic hit, fiscal stimulus and loosened monetary policy led to ultra-low interest rates relative to historical norms and spurred transaction activity. Interest rates began to materially rise throughout 2022, challenging overall transaction activity in the latter part of 2022 and during 2023 as access to capital tightened and the cost of capital increased. The below chart presents interest rates over the period as measured by the 10-year U.S. treasury.

Despite higher rates, transaction activity for physician practices has remained robust relative to pre-pandemic levels. However, there are signs that interest rates are having a lagged effect on deal volume considering the recent downward trend from Q3 2022 through Q4 2023 as observed in the above chart. While this does not necessarily mean that we should expect deal volume to revert to pre-pandemic levels, it does highlight that we have entered a new transaction environment. In this environment, the time to close deals lengthens as sellers digest lower valuation multiples and buyers increase scrutiny during due diligence given an uncertain future macroeconomic landscape. Contact VMG Health’s Financial Due Diligence team for details on how the changing tide is impacting the due diligence process.

At the start of 2024, interest rates remain elevated and volatile with an uncertain path to a normalized level, which continues to serve as a headwind for transaction activity. However, interest rates can change quickly, and the U.S. Federal Reserve has signaled that it will likely be appropriate to begin rate cuts at some point during 2024. Market participants have started anticipating rate cuts from this messaging, which could certainly serve as a tailwind throughout the remaining course of this year and into next.

Source: Federal Reserve 10 Year U.S. Treasury Market Data

Regulatory Transaction Oversight: Healthcare consumes a considerable amount of U.S. spending and is expected to continue increasing; CMS’ National Health Expenditure Accounts (NHEA) Healthcare projects healthcare spending to increase from approximately 18.3% of U.S. GDP in 2021 to 19.6% in 2031. Furthermore, it is an election year, with a current U.S. Presidential Administration keenly focused on the rising costs of healthcare. As a result, increased regulatory scrutiny has manifested itself over the ongoing consolidation across healthcare services, particularly within the physician practice space.

This heightened scrutiny is most recently evidenced by the Federal Trade Commission (FTC) suing U.S. Anesthesia Partners, Inc. (USAP), a prominent provider of anesthesia services in Texas, over an alleged “…anticompetitive acquisition spree to suppress competition and unfairly drive-up prices for anesthesiology services.” The FTC also hosted a workshop on March 5, 2024 to assess the public impact of private capital in healthcare. On that same day, the FTC, U.S. Department of Justice (DOJ) and U.S. Department of Health and Human Services (HHS) requested public comments on the effects of transactions involving PE, health systems, and payors on the healthcare providers and ancillary services space.

FTC Focus on Non-compete Agreements: It is not uncommon for physicians to a sign non-compete agreement upon joining a physician practice. The intent of a non-compete agreement, as well as the potential impact, are being hotly debated, with the FTC proposing a rule to ban non-compete clauses. A recent VMG article, Non-Compete Agreements: A Prevailing Quagmire provides details highlighting the arguments and broader implications of non-compete agreements and the proposed ban.

Overall interest in acquiring physician practices remains high, and we don’t expect that to change in the foreseeable future. The dynamics outlined above will likely dictate the path and volume of transactions throughout 2024 and beyond. To read more and stay informed as the year unfolds, please visit VMGHealth.com.

Centers for Medicare & Medicaid Services. Calendar Year (CY) 2024 Medicare Physician Fee Schedule Final Rule. Centers for Medicare & Medicaid Services website. Published November 2, 2023. https://www.cms.gov/newsroom/fact-sheets/calendar-year-cy-2024-medicare-physician-fee-schedule-final-rule

Centers for Medicare & Medicaid Services. CMS Finalizes Physician Payment Rule, Advances Health Equity. Centers for Medicare & Medicaid Services website. Published November 2, 2023. https://www.cms.gov/newsroom/press-releases/cms-finalizes-physician-payment-rule-advances-health-equity

Landi H. Physician groups decry finalized Medicare payment cuts as 2024 expenses rise. FierceHealthcare. Published November 3, 2023. https://www.fiercehealthcare.com/providers/physician-groups-decry-finalized-medicare-payment-cuts-2024-expenses-rise

American Medical Association. Only Cure for Medicare Payment Mess: Wholesale Reform. American Medical Association website. https://www.ama-assn.org/about/leadership/only-cure-medicare-payment-mess-wholesale-reform#:~:text=To%20put%20this%20into%20perspective,top%20of%20last%20year’s%203.8%25https://www.ama-assn.org/about/leadership/only-cure-medicare-payment-mess-wholesale-reform#:~:text=To%20put%20this%20into%20perspective,top%20of%20last%20year’s%203.8%25

VMG Health. 2023 Healthcare M&A Report. Published [publication date not provided]. https://vmghealth.com/2023-healthcare-ma-report/ https://vmghealth.com/2023-healthcare-ma-report/

PitchBook. Q4 2023 Healthcare Services Report. Published [publication date not provided]. https://pitchbook.com/news/reports/q4-2023-healthcare-services-report

Reuters. Fed’s Powell Set Election-Year Stage with Testimony on Rate Cuts, Inflation. Reuters website. Published March 6, 2024. https://www.reuters.com/markets/us/feds-powell-set-election-year-stage-with-testimony-rate-cuts-inflation-2024-03-06/

Centers for Medicare & Medicaid Services. National Health Expenditure Fact Sheet. Centers for Medicare & Medicaid Services website. Published [publication date not provided]. https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/nhe-fact-sheet

Federal Trade Commission. FTC Challenges Private Equity Firm’s Scheme to Suppress Competition in Anesthesiology Practices Across the United States. Federal Trade Commission website. Published September [publication date not provided], 2023. https://www.ftc.gov/news-events/news/press-releases/2023/09/ftc-challenges-private-equity-firms-scheme-suppress-competition-anesthesiology-practices-across

McDermott Will & Emery LLP. Top Takeaways: FTC Hosts Workshop, Solicits Public Comment on Private Equity in Healthcare. McDermott Will & Emery LLP website. Published [publication date not provided]. https://www.mwe.com/pdf/top-takeaways-ftc-hosts-workshop-solicits-public-comment-on-pe-in-healthcare/

Aguirre I. Non-Compete Agreements: A Prevailing Quagmire. VMG Health website. Published [publication date not provided]. https://vmghealth.com/thought-leadership/blog/non-compete-agreements-a-prevailing-quagmire/https://vmghealth.com/thought-leadership/blog/non-compete-agreements-a-prevailing-quagmire/https://vmghealth.com/thought-leadership/blog/non-compete-agreements-a-prevailing-quagmire/

May 20, 2024

Written by Grayson Terrell, CPA

The following article was published by Becker’s Hospital Review.

In today’s complex healthcare environment, mergers and acquisitions (M&A) are proving to be more challenging than ever, with heightened governmental regulations impacting both the operation of an entity and the purchase and sale of an entity.

To successfully navigate a transaction in the healthcare sector, it is paramount that buyers and sellers make informed decisions through all of the tools made available to them. For sellers, this can come in the form of understanding how their business operates, understanding inefficiencies and growth opportunities, and even understanding what their business is worth. For buyers, informed decision making relies heavily upon understanding the markets in which they are investing, including governmental regulations in some states that may impact their ability to invest and operate; understanding the key operating metrics of similar companies in similar industries; and ensuring that they are paying an appropriate amount for the business. This is especially important because, in healthcare transactions, the capital used to purchase is often provided by investors who are counting on timely positive returns.

Financial due diligence (FDD) is pivotal to the success of any healthcare transaction, as it requires detailed investigation and analysis of a company’s financial information and is used to validate a company’s true run-rate operating potential. With most healthcare M&A transactions, purchase price is based on a multiple of a company’s salable earnings before interest, taxes, depreciation, and amortization (EBITDA). As such, the buyer and seller must perform the appropriate financial due diligence procedures prior to executing a transaction. Below are five vital aspects of the financial due diligence process.

The Quality of Earnings (QofE) process consists of making adjustments to the entity’s reported financial statements to normalize EBITDA. The bulk of these adjustments involve adjusting or removing impacts of non-recurring and one-time items from earnings to arrive at an adjusted EBITDA figure that represents a more accurate view of the entity’s true cashflows. This process also gives the FDD team the opportunity to pose pointed questions related to the entity’s operations, finances, and accounting functions, highlighting key information that could negatively or positively impact adjusted earnings. Specific to healthcare transactions, some of the relevant areas of interest with respect to potential EBITDA adjustments are:

The Quality of Revenue (QofR) analysis may be the most important part of the FDD process when it comes to healthcare-related transactions, given the unique characteristics and nuances of healthcare revenue. During this process in many middle-market healthcare deals, the conversion of revenue from cash basis to accrual basis is a fundamental exercise with respect to the QofE analysis. The cash waterfall approach is the gold standard and therefore the most common method for accomplishing the cash-to-accrual conversion. With this method, detailed billing data is obtained from the entity’s revenue cycle management (RCM) system, which includes charges by date of service and payments by date of service and by date of payment. In this analysis, payments are adjusted back to their specific date of service (accrual basis), and outstanding collections on charges billed during the period under analysis are estimated based on historical collection patterns cut by payor, CPT code, or various other means.

Pro forma adjustments are forward-looking projections on certain aspects of the business, which are layered back in across the historical financial statements. These assumptions can help buyers understand potential areas of future direction and growth opportunities for the company; however, these adjustments should be thoroughly scrutinized during buy-side FDD procedures to ensure the adjusted EBITDA and purchase price are not over- or understated. These estimations tend to lean more in favor of the seller and are often a primary area of focus by the opposing buy-side FDD team. As such, a seller should understand all aspects of the business, especially as they relate to these forward-looking projections, and should be able to support the key inputs utilized to derive these pro forma adjustments. If properly supported, these adjustments often increase the sale price of the business enough to cover the cost of FDD procedures incurred by the seller, if not many times over. Some examples of commonly observed pro forma adjustments in healthcare related QofE reports include:

Another common analysis in FDD procedures is a Net Working Capital analysis, which is used to determine the working capital (current assets less current liabilities, excluding cash and debt) required to operate a business in the post-transaction environment. This subsection of FDD typically involves substantial negotiation between buyers and sellers when approaching the close of a deal, as both parties will view various inputs differently, often striving to set a working capital peg that is more favorable for themselves. As a miscalculation of this peg can cost a seller on a dollar-for-dollar basis if the agreed-upon level of net working capital is not met, it is imperative that management and their advisors are involved and knowledgeable on this calculation.

Most of the time, healthcare transactions occur on a cash-free, debt-free basis. Standard with any cash-basis business, many debt and debt-like items have the potential to be inaccurately reflected within a company’s balance sheet. As such, a Debt and Debt-Like Items analysis can assist buyers and sellers in understanding a company’s debts and liabilities as of the date of sale. These items can include potential tax-related exposures, outstanding litigation and legal settlements, deferred compensation, notes payable, and others.

In closing, FDD is a necessary step in ensuring that sellers have the keys to sell their businesses at the best possible price, and buyers can protect the money of their companies, firms, or investors by making a sound investment in the target company. This proactive approach creates trust between all parties and leads to more lucrative transactions for all.

May 9, 2024

Written by Grayson Terrell, CPA; Joe Scott, CPA; Lukas Recio, CPA; Wayne Prior, CPA; and the Baker Tilly team

The M&A healthcare industry presents a unique set of challenges, and it is important to have the proper M&A professionals involved to assist with identifying potential deal issues. In addition to financial due diligence experts, M&A tax professionals should assist with understanding and identifying the transactional tax consequences, as the identified tax issues may impact the overall deal structure or may be used to negotiate in the purchase agreement. During the M&A due diligence lifecycle, financial and tax due diligence teams must collaborate closely. This collaboration often uncovers synergies between their processes, enhancing completeness and efficiency. As their work is often completed first, the financial due diligence team may act as the first line of defense and can assist with identifying potential exposures earlier in the process. M&A tax advisors can assist with vetting and quantifying these exposures, which can assist with limiting the identified risks during the purchase negotiations. Tax considerations often influence the structure of a sale, determining whether it’s taxable or tax-free, whether assets or equity are bought, and whether taxable gains can be delayed through methods like earn-outs, installment sales, and debt.

The starting point for tax diligence is understanding the tax entity type of the target included in the transaction. Different tax issues may arise depending on how the entity is treated for tax purposes. The common tax entity types are:

S corporation:

Partnership:

C corporation:

Improper independent contractor classification (applicable to all tax entity types). While some employers misclassify their employees as independent contractors in error, others do it intentionally to avoid paying state and federal payroll taxes by passing that responsibility onto the employee. Employers found to have misclassified their employees are subject to payroll tax and penalties that could succeed to the buyer. During due diligence, it’s important to determine whether independent contractors should be considered full-time employees. A common healthcare tax due diligence issue is the misclassification of certified registered nurse anesthetists (CRNAs), doctors, and other healthcare professionals as independent contractors. It is important to request IRS Form 1099 and understand the services performed by the independent contractors. Depending on the time dedicated to the business, level of pay, direction from the employer, and several other factors, there may be contractors who could be misclassified, resulting in potential payroll tax exposures. The IRS provides a 20-factor test to help make that determination with considerations related to direction and control.

Unclaimed property (applicable to all entity types). Each state has an unclaimed property statute governing when and what types of property must be remitted to it. Examples of unclaimed property include uncashed or unclaimed refund checks, patient overpayments, insurance overpayments, payroll checks, or vendor checks. If unclaimed after a certain period (dormancy period), those checks must be turned over to the state. This is a common issue amongst healthcare providers, as there may be instances where a patient’s insurance covers more than what was originally estimated for an appointment or procedure, resulting in a patient overpayment. In a situation where a healthcare provider sees non-recurring patients, the patients are less likely to use a credit balance toward a future appointment. It is important to review the target’s accounts payable and accounts receivable aging schedules to determine whether there are any balances that give rise to an unclaimed property risk. Financial due diligence teams will likely have access to the target’s financials and can assist with pulling the documentation necessary to evaluate these potential risks. To avoid possible unclaimed property liability, buyers should determine whether the target is properly addressing its escheatable property.

Improper treatment of owner personal expenses (applicable to S and C corporations). Is the S corporation owner using a corporate account for any personal expenses? If so, these payments may be considered compensation and subject to payroll tax. If the employer’s share of payroll tax is unpaid, the buyer could be held liable for the amount owed after the acquisition, including interest and penalties. In parallel, if a C corporation shareholder is conducting similar activities, the IRS or state revenue service may classify these expenses as dividends, which are non-deductible for income tax purposes.

Unreasonable owner compensation (applicable to S and C corporations). Since an S corporation shareholder’s distributive share of income is not subject to self-employment or payroll tax, owners are often motivated to minimize their salary in favor of non-wage distributions. However, if the IRS determines an owner’s salary to be too low based on multiple factors—including profits, business activities, and the shareholder’s involvement in the business—non-wage distributions could be reclassified to wages subject to employment taxes. The buyer may be responsible for this tax if it isn’t resolved before the acquisition. Conversely, if a C corporation shareholder’s salary is too high relative to the available facts, the IRS or state revenue service may deem the compensation to be excessive and reclassify a portion to dividends.

Related-party transactions (applicable to all entity types). A related-party transaction takes place between two parties that hold a pre-existing connection prior to a transaction. There are many types of transactions that can be conducted between related parties, such as sales, asset transfers, leases, lending arrangements, guarantees, and allocations of common costs. These transactions can become problematic when an S corporation utilizes them as a vehicle to get extra cash out of the business. If a shareholder owns both Company A and Company B, and Company A pays the shareholder a below-market salary while also renting a building from Company B (an LLC taxed as flow-through) at inflated rates, it may be considered disguised compensation to avoid payroll taxes. It is important to request copies of the lease agreements and understand the fair market value of the square footage and rent of the property to determine a potential disguised compensation risk as it relates to related-party transactions. Problematic related-party transactions should be addressed during due diligence.

Cash vs. accrual accounting method (applicable to all entity types). The IRS prefers the accrual method, but if a company is on the cash basis of accounting for tax purposes, the buyer should determine whether they meet the requirements to continue using that method. The change in accounting method from cash to accrual may result in additional income that could be recognized in the post-closing period. By identifying the issue and quantifying the potential exposure, the buyer and seller can negotiate who will bear the tax on the additional income.

Pass-through entity tax (PTET) (applicable to S corporations and partnerships). In certain states, eligible S corporations can make PTET elections, whereby the entity is responsible for paying the shareholder’s share of tax at the entity level. States began enacting responses to state and local tax deduction limitation because of the 2017 Tax Cuts and Jobs Act (TCJA), which limited the allowable deduction for state and local taxes on an individual’s tax return to $10,000. The primary benefit is reduction of federal income taxes; however, use caution when evaluating whether benefit exists on state returns. PTET elections may shift the successor liability for state income taxes from the shareholder to the entity. Most of the elections are irrevocable. During due diligence, determine whether the company has made these elections for the states that have enacted these rules. Given the ever-changing PTET rules, companies should maintain a process to review company’s PTET elections.

20 Percent Deduction Under Section 199A (applicable to S corporations and partnerships). Section 199A was enacted as part of the TCJA and provides a deduction for qualified business income (QBI) from a qualified trade or business operated directly or through a pass-through entity. For healthcare providers, the application of Section 199A can be complex due to the nature of healthcare services being classified as a non-qualifying Specified Service Trade or Business (SSTB). However, certain healthcare-related businesses may qualify, such as a dermatology practice’s sales of skincare products or certain laboratories whose tests benefit the healthcare industry but aren’t independently viewed as health services. Additionally, while a doctor, nurse, or dentist is in the field of health, someone who merely endeavors to improve overall well-being, such as a personal trainer or the owner of a health club, is not in the field of health.

Built-in gains tax (applicable to S corporations). When a corporation has converted its status from C corporation to S corporation, or has acquired assets from a C corporation in a tax-free transaction and has a recognition event within five years, it may be subject to a corporate-level, “built-in gains” tax in addition to the tax imposed on its shareholders from the transaction. The buyer can leverage its knowledge of a potential, built-in-gains tax liability, as identified in the due diligence process, to negotiate with the seller such that the buyer would not inherit said liability.

Non-resident withholding (applicable to S corporations and partnerships). State and local governments are permitted to tax the income of their residents and the income of nonresidents if that income is derived from sources within their state or locality. It’s important to ensure that the S corporation or partnership complies with state and local income tax withholding regulations.

When it comes to healthcare acquisitions, it is important to consider the above items from a tax perspective. Financial and tax due diligence teams should work together to help buyers and sellers avoid tax liabilities, identify unrealized tax savings, and structure the transaction in a tax-efficient manner. Baker Tilly’s M&A tax team can assist in identifying the related risks and opportunities associated with healthcare acquisitions, all in an effort to maximize value. If you have any questions or would like additional information, please contact:

Michael O’Connor, Partner Emeritus: Michael.OConnor@bakertilly.com

Michael DeRose, Senior Manager: Michael.DeRose@bakertilly.com

Peter Dewan, Manager: Pete.Dewan@bakertilly.com

Kendra Nowak, Senior Associate: Kendra.Nowak@bakertilly.com

February 14, 2024

At VMG Health, we’re dedicated to sharing our knowledge. Our experts present at in-person conferences and virtual webinars to bring you the latest compliance, strategy, and transaction insight. Sit down with our in-house experts in this blog series, where we unpack the five key takeaways from our latest speaking engagements.

My portion of the presentation was about the valuation of academic healthcare brands. I talked through different valuation methodologies, which are the income cost and market approach, by discussing the specifics related to brand valuation. Additionally, I spoke about the key things to consider in a brand valuation or in a transaction involving a brand, like how to structure the payment—whether it’s through a variable or fixed license rate—and some of the pros and cons to different affiliation structures.

In academic brand valuations, the owners of the academic brands tend to think their brand is extremely valuable. However, from an actual fair market value transaction perspective, the value of that brand is based on the licensee’s return, even if the brand is powerful and may drive allocations higher. If the licensee can’t make a monetary return on it, there won’t be a huge value that they have to pay. Otherwise, they’d be negative.

Leaders can look for opportunities with this knowledge. Brands are not a common part of a joint venture arrangement. Adding a health system’s brand to a joint venture may result in an additional return or credit for something that the system is contributing to the joint venture. Historically, leaders may not have valued brands, but they can.

The blog, Healthcare Brand Valuation: Purpose, Strategy, and FMV Implications, is a great supplemental resource for those looking to learn more about incorporating brand in healthcare transactions. Additionally, another article is coming to the VMG Health website soon, and it will focus on brand valuation. Watch our site for that upcoming content.

Brands can and should be considered, and possibly included, in healthcare transactions.

Our team serves as the single source for your valuation, strategic, and compliance needs. If you would like to learn more about VMG Health, get in touch with our experts, subscribe to our newsletter, and follow us on LinkedIn.

Authors