Private Equity Investment in Ambulatory Surgery Centers

Rachel Linch

September 21, 2023

Effective January 16, 2024, Compliance Risk Analyzer has joined VMG Health. Learn more.

October 19, 2023

Written by Matthew Marconcini, CPA and Lukas Recio, CPA

In recent years, there has been a notable surge in hospitals and healthcare systems entering into joint ventures with private equity groups. This trend is driven by several different factors that reflect the ever-evolving landscape of the healthcare industry and it is expected to continue in the future.

Howard G. Berger, CEO and Board Chairman of RadNet, said, “Another one of our significant initiatives is expansion through hospital and health system joint ventures. In the past, we have stated that we see a path forward towards holding as much as 50% of our imaging centers in these partnerships.”

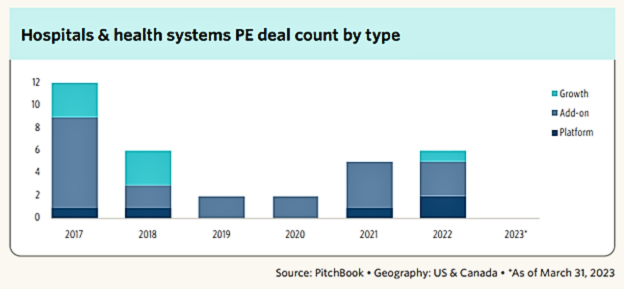

Additionally, based on the graph below, we can see there has been a continued increase from 2019 to 2022 in PE deal count for hospitals and health systems.

Firstly, the financial pressures faced by many healthcare providers have led them to seek external investments to bolster their resources. Private equity groups, with their substantial capital reserves, offer a lifeline to struggling hospitals, and enable them to invest in technology, infrastructure, and quality improvement initiatives.

Secondly, private equity firms bring expertise in business management and operational efficiency to the partnership. In an increasingly competitive healthcare environment, hospitals and health systems must find ways to streamline operations, reduce costs, and enhance patient care. Partnering with private equity allows healthcare organizations to tap into the financial and operational acumen of their partners which leads to more effective and efficient healthcare delivery. For instance, we have seen hospitals create joint ventures within their behavioral health operations because they want to keep the service but need to bring in a partner that has the financial resources and operational expertise to help turn it around. Another area where we have seen an increase in successful partnerships with private equity is hospitals looking for a better urgent care strategy. Private equity has the resources, financial backing, and expertise to bring in the right systems and people to create substantial value. Private equity firms help urgent care clinics standardize processes, consolidate overhead costs, and find new branch locations without saturating the market. This assistance helps relieve physicians from tasks that they are typically too busy to tackle.

Moreover, the shift towards value-based care models has necessitated investments in population health management and preventive care. Private equity investments can provide the necessary funds to develop and implement the necessary tools to accurately estimate the total cost of care with the goal of delivering better patient outcomes and increased cost savings in the long run.

Lastly, the COVID-19 pandemic exposed vulnerabilities in healthcare infrastructure and underscored the need for agile, resilient healthcare systems. Private equity partnerships can help healthcare providers strengthen their resilience, enhance their preparedness for future crises, and adapt to the rapidly changing healthcare landscape.

While there are many benefits hospitals are seeing by partnering with private equity groups, there are several areas, listed below, that need to be discussed between the parties as they consider this partnership:

In conclusion, the increasing collaboration between hospitals and health systems with private equity groups is a response to the multifaceted challenges and opportunities in the healthcare sector. These partnerships offer financial flexibility, operational expertise, and a pathway to innovation. All of these offerings are essential for healthcare organizations striving to provide high-quality care in a rapidly evolving marketplace. As healthcare continues to transform, such joint ventures are likely to remain a key strategy for hospitals looking to thrive in the years ahead.

Subscribe

to our blog