- About Us

- Our Clients

- Services

- Insights

- Healthcare Sectors

- Ambulatory Surgery Centers

- Behavioral Health

- Dialysis

- Hospital-Based Medicine

- Hospitals

- Imaging & Radiology

- Laboratories

- Medical Device & Life Sciences

- Medical Transport

- Oncology

- Pharmacy

- Physician Practices

- Post-Acute Care

- Risk-Bearing Organizations & Health Plans

- Telehealth & Healthcare IT

- Urgent Care & Free Standing EDs

- Careers

- Contact Us

Valuing a Portfolio of Hospitals: Do Unprofitable Hospitals Add to Portfolio Value?

September 20, 2013

Unprofitable Hospital Valuation Influences

The most widely recognized metric for valuing a healthcare service enterprise with multiple facilities is the Enterprise Value / EBITDA metric. EV/EBITDA multiples of companies with a portfolio of facilities may not tell the full story of an enterprise’s value. Since non-profitable or break even facilities do not add to a portfolio company’s EBITDA– does this mean that these facilities do not have an additive effect on the company’s value?

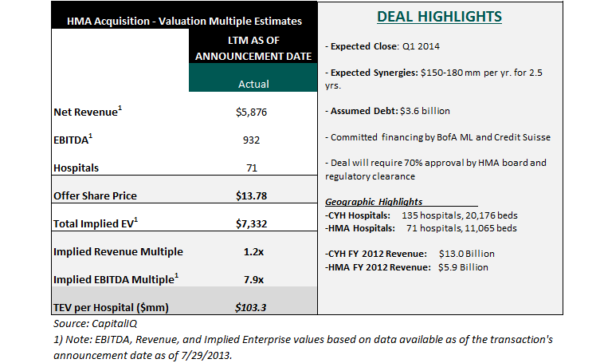

For example, let’s examine the recently announced acquisition of Health Management Associates by Community Health Systems. Based on publicly available data, the $7.3 billion deal implied a 7.9x EBITDA multiple, which translated to approximately $103.3 million per each of HMA’s 71 hospitals:

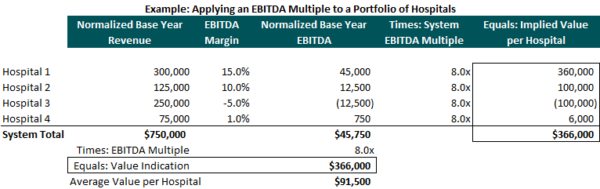

In an enterprise-level transaction of a health system, solely applying a comparable transaction multiple to a portfolio of hospitals’ consolidated EBITDA may undervalue break-even and negative cash flow hospitals held by the system. Let’s consider a separate hypothetical example:

As indicated above, the use of a single EBITDA multiple attributes negativity to hospital valuation with negative EBITDA. When the value indication is averaged across all four hospitals, we see that value from positive cash flow assets are attributed to negative cash flow assets, and vice versa. Therefore, it’s safe to assert that this “Robin Hood” approach of valuing a portfolio of assets can distort system value.

When valuing a portfolio of hospitals, the following should be considered by the valuation analyst:

Do Not Ignore Residual Fixed Asset Value of Negative or Break Even Cash Flow Hospitals – Hospitals with negative cash flow may have value under a modified book value approach. For a market approach, analysts should consider applying a revenue multiple or other valuation approaches to accurately capture the value of the portfolio of hospitals.

Individual Hospital Characteristics – Factors such as an individual hospital’s payor mix, volume trends, and local demographics may affect an individual hospital’s cash flow stream. These factors, along with a hospital’s recent profitability, should be considered in the value calculation.

Other Pricing / Value Metrics – Valuation professionals may want to consider evaluating other metrics or multiples, such as price per bed, per hospital, or revenue multiples, when valuing a portfolio of hospitals.

Categories:

Subscribe

to our blog